Mean Finance is a DeFi protocol that enables users to dollar cost average (DCA) into a position for an ERC-20 token.

In this article we will look at why dollar cost averaging is useful and how Mean Finance works.

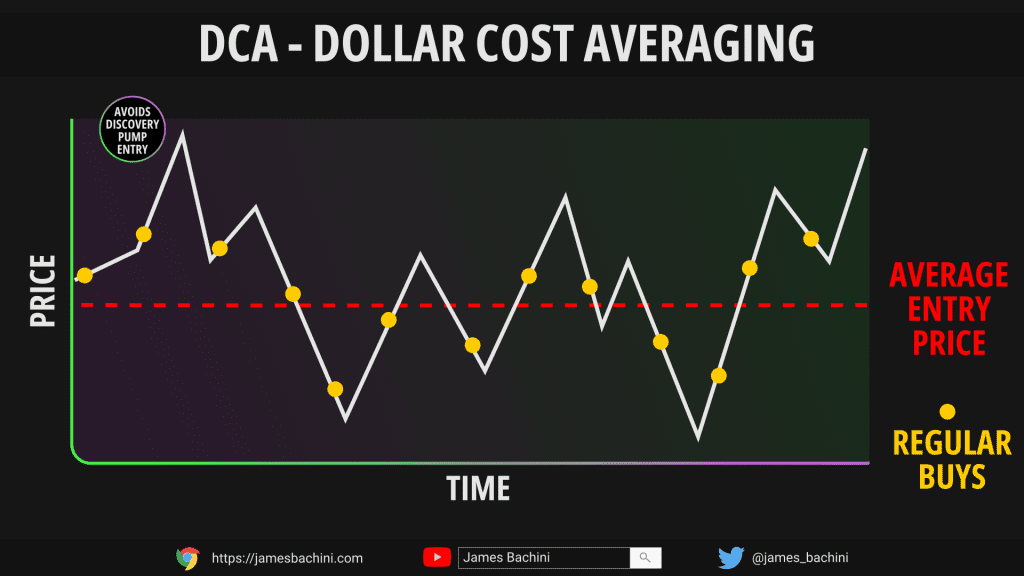

Why Dollar Cost Average

Dollar cost averaging is an investment strategy that simply breaks a entry into equally weighted regular buys over a period of time. You could for example buy $100 of Bitcoin every month to get an average price over the course of the year.

The idea is that if Bitcoin goes up then you are in profit, if it goes down it lowers your average entry cost. Another benefit is that it reduces the risk of buying into an asset during the initial discovery pump when a lot of market participants are finding out about it and also allocating capital.

Most people “discover crypto” at the peak of a bull market when everyone is talking about it and it’s obvious that past market participants have made a lot of money. This is unfortunately the point of maximum financial risk for the asset. DCA’ing over a long enough time period i.e. 4 year market cycle somewhat mitigates that risk.

The same mechanics work in the altcoin markets where narratives and attention shifts on a much lower timeframe.

Mean finance provides a mechanism for dollar cost averaging into ERC20 tokens using an automated DeFi platform.

How Mean Finance Works

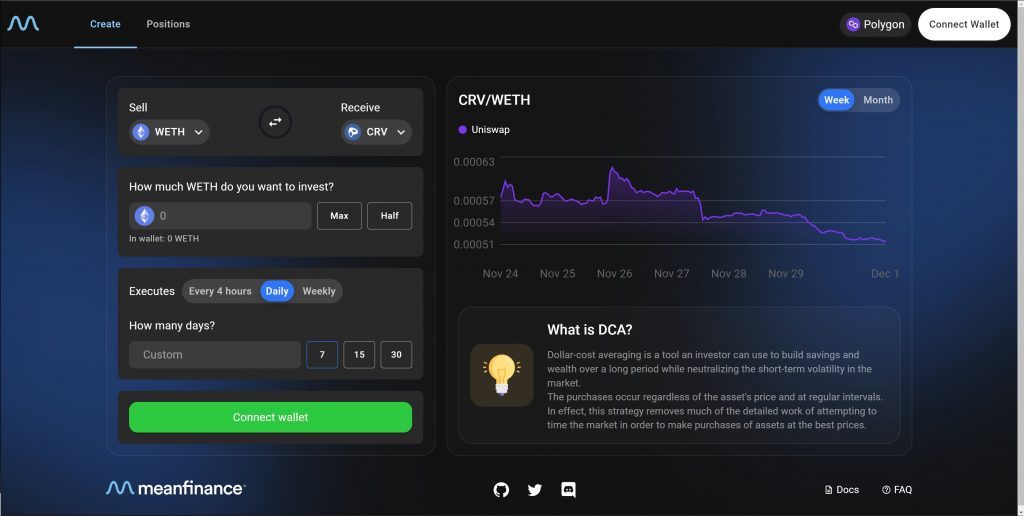

Mean Finance enables a user to deposit funds which are used to purchase the target token at regular intervals.

The user interface looks familiar with a similar layout to Uniswap plus the added option to execute over 4 hour, daily or weekly periods.

In the background the funds are wrapped into a ERC721 NFT which holds the base asset and the target token. Each period a equal amount of the base asset is made available for 3rd parties (arbitrage/MEV bots) to create the transaction and earn a fee.

For the end user this means they can set up a dollar cost averaging strategy in a single transaction and the rest will be taken care of automatically in the background. At any point they can close the position burning the NFT and withdrawing the underlying funds.

Fees & Incentives

3rd party “swappers” (arbitrage/MEV bots) are incentivized to execute transactions through two mechanisms. A 0.6% transaction fee which is double the standard rate on most DeX’s and through an arbitrage opportunity.

The swappers get a 75% of the transaction fee earning them 0.45% off the capital value of the order. This covers the transaction fee and the DeX fees that the swapper needs to pay in order to execute the transaction.

Price discovery within the smart contracts is provided by an oracle which updates all the token prices. If this price falls out of line with the fair value on external DeX’s then there may be more or less opportunity for arbitrage by the bots monitoring the protocol.

There will be one daily transaction per asset pair (for the daily period) across the entire protocol rather than each individual users position getting filled at different times. This means you can wait up to 1 full time period for the first DCA execution if you just missed the previous days transaction when setting up your position.

Flexible NFT Positions

The NFT tokens which represent the dollar cost averaged position are somewhat flexible adding interesting dynamics to the protocol.

It’s possible to add permissions for other wallet addresses to add/withdraw funds to the underlying collateral. There is also the option to transfer or sell the NFT position via the standard ERC721 function.

A couple of negatives before we wrap this up.

- Not all ERC-20 tokens are compatible and the team need to onboard assets and set up oracles meaning that you might not find the very latest token releases on the platform.

- Mean Finance is not deployed on mainnet where you would expect the most value to be in terms of offsetting transaction fees. Currently it is available on Polygon, Arbitrum and Optimsim.

Conclusion

Mean Finance is a good example of a protocol which provides a useful service and collects fees in return. On each transaction 0.15% is going to the treasury which provides real returns as part of a viable business model.

I think that the team may find it difficult to grow given the current market conditions but when sentiment shifts its certainly a platform to keep an eye on.

In theory a user could create an automated DeFi strategy to buy into a position using Mean Finance and then exit via a one-sided liquidity position on Uniswap V3. So you get an average price in and then earn fees as the target token moves towards your price target.

It wont be long before we see another #altszn and this is a tool that could be used to capitalize and build positions in the current bear market.