MUX is a decentralized trading platform offering slippage free trades and 100x leverage.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to MUX at time of writing. Do your own research, not investment advice.

The first thing that jumps out about MUX is the number of markets available. There are 46 crypto markets, 17 forex markets and 2 commodity markets for gold and silver.

It’s also available across 5 different blockchains:

- Arbitrum

- Optimism

- BNBchain

- Fantom

- Avalanche

They achieve this without fragmenting liquidity by having a central pool of capital that traders trade against called MUXLP.

The MUX Aggregator

The MUX Aggregator combines GMX liquidity with native MUXLP liquidity to efficiently route trades on the backend. A trade may be placed through GMX but with leverage boosted using the MUXLP mechanism.

The aggregator also provides cross-chain liquidity aggregation which means MUX can scale rapidly to new EVM blockchains without needing to bootstrap each one individually.

Let’s look at an example where a trader opens a $10,000 position at 100x leverage on the MUX Aggregator using $100 of collateral. GMX offers 50x leverage on the same asset so the MUXLP will supply the additional $100 margin to create the GMX position.

Price data is fed to the contracts via a “dark oracle”, this is an interesting concept I hadn’t come across before. It’s basically a private oracle which does not supply data outside of it’s on-chain transactions to prevent frontrunning. In practice I assume this is a centralized server taking price feeds from various sources and aggregating them into a batch transaction. Centralization is a potential security risk and an attacker accessing this server could manipulate pricing to drain the MUXLP liquidity.

Funding & Traction

MUX have a star studded cast of venture capital firms backing the protocol.

It’s stated that they are not focusing on crypto native traders but trying to build a product that attracts traders from tradfi markets. Given current market conditions in the blockchain sector this seems like a smart move.

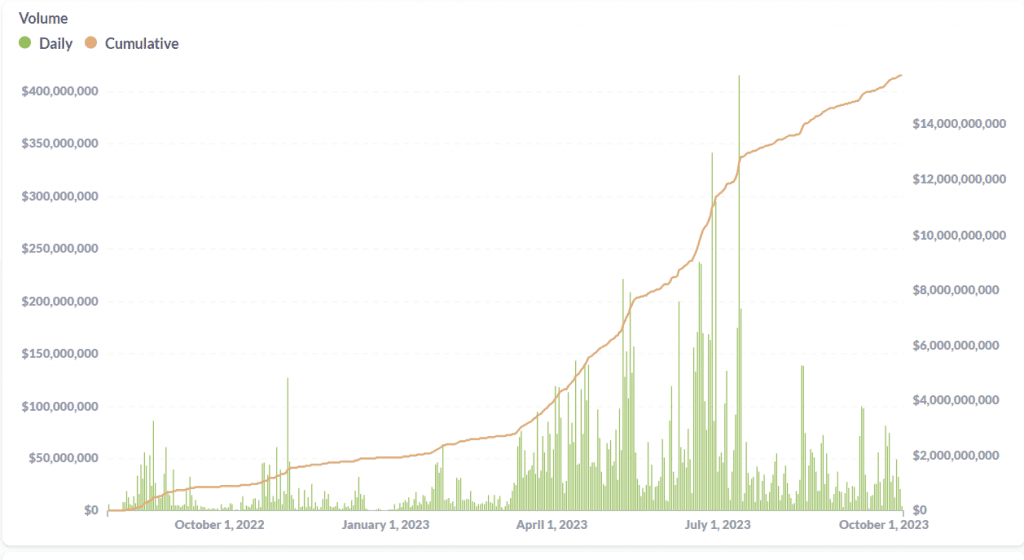

MUX protocol is currently doing around $20m trading volume per day and this is down slightly from its peak earlier in the year. Given market conditions and anti-wash-trading initiatives this is still impressive.

Almost all the trading volume is on Arbitrum and Bitcoin, Ethereum and the Arb token make up 90% of the volume across markets. The forex and commodity side makes up less than 3% of trading volume currently.

The biggest challenge to overcome is the trading fees which stack up when compared to competing centralized exchanges. There is a position fee which is currently discounted to 0.06%, a funding premium which to long ETH equates to 40% APY, and then there are the protocol fees from GMX or other liquidity sources that the aggregator taps into.

MUX Tokenomics

The MUX protocol utilizes four distinct tokens: MCB, MUX, veMUX and MUXLP. Each token serves unique functions within the protocol:

- MCB is the main token of the protocol. Users can lock MCB over a period from 2 weeks to 4 years to gain veMUX, which enables them to earn protocol income and MUX rewards.

- MUX is a non-transferable reward token. Users can earn MUX by holding veMUX or staking MUXLP. The initial supply for MUX is 1,000,000 with a daily emission of 1,000. MUX can be used in two ways, it can be staked to earn veMUX or it can be vested into MCB over one year.

- veMUX is the governance token of the MUX protocol. It provides voting power for protocol governance. Users receive veMUX after locking MCB and/or MUX. veMUX holders vote on governance initiatives and also earn protocol income and MUX rewards.

- MUXLP is the protocol’s liquidity provider token. Users can purchase MUXLP tokens with certain permitted assets and then stake them to earn protocol income and MUX rewards. There’s no supply cap for MUXLP tokens. They are minted when buy orders are filled and burnt when sold.

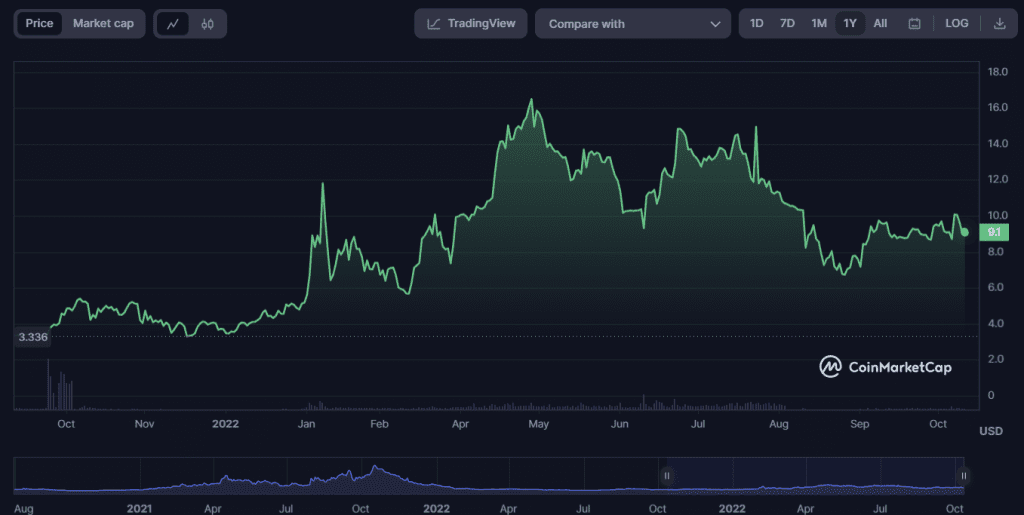

From an investment thesis MCB is the token that is most compelling and it’s been performing well, up 170% over the last year.

| Token Price Oct 2023 | $9.07 |

| Circulating Supply | 3.8m |

| Total Supply | 10m |

| Fully diluted valuation | $90m |

I couldn’t find any information in the docs or on 3rd party sites about the terms at which the VC’s participated in the early funding rounds or any form of unlock colander.

Out of all the decentralized leverage trading platforms I’ve looked at recently (I think there might be more devs building dex’s than there are traders using them), this is one of the ones that seems to have some traction and usage. My main concern is over the moat that they have in terms of liquidity. Because they are aggregating liquidity from 3rd party exchanges like GMX they are paying their fees and then adding fees on top which increases the cost of trading.

With enough volume I expect they would be able to optimize their contracts to balance off longs and shorts internally and reduce the cost of execution over the long term. If this is possible and they can bring more of the liquidity in-house to reduce trading fees and make them more transparent it could create a very compelling product.