For founders looking to raise capital there are a number of options which we will explore in this article.

Private Round

A private round is where a founder will outreach and pitch their concept to investors in the space. For raises under $100k angel investors can provide initial funding to get a project started. For larger raises VC’s and crypto native funds are more suited to large rounds.

Private rounds are often completed using SAFT’s which are a simple agreement for future tokens. This is a written contract which outlines terms and allocations, see a saft example here:

Angel Investors

Angel investors are wealthy individuals who invest in early stage projects. Angel investors typically have a personal connection to the founders or the project and they are often willing to take on more risk than VC firms.

If you know someone who invests large amounts in the industry or is looking to then consider sending them a deck. You can also find angel investors on various websites and groups setup to channel deal flow to the individuals looking to deploy capital in relevant sectors or geographic locations.

Venture Capital

Venture capital in the blockchain sector generally comes from crypto native firms with a remit to invest in early stage projects. VC’s invest in teams as much as the idea so if you have a team with strong credentials you will likely find it easier to raise.

In venture capital there are different stages of funding that a company may go through as it grows. The amount of money raised, the type of investors involved and the goals of the company vary depending on the round.

- Series A is the first major round of funding for a company. It is typically used to help the company build out and launch its product or service, hire its initial team and begin marketing.

- Series B is the second major round of funding for a company. It is typically used to help a project scale by expanding its team and entering new markets.

- Series C and beyond are generally reserved for high value raises ($10m+). To reach this stage a project will need to have already gained some traction and proven it’s potential.

Public Round

A public round is when the founders raise capital from anyone and everyone openly offering tokens or products for sale. There are legal issues regarding token sales and regulatory requirements in certain jurisdictions so be sure to get legal advice before undertaking anything that could be considered a securities offering.

Governance Token Sales

Governance tokens are generally ERC20 tokens which represent voting rights or a claim on treasury assets derived from a protocols fee generation.

There are a number of ways to carry out a token sale. In 2017 there was a boom in ICO’s where tokens are offered via a smart contract for sale. Today we often see similar mechanisms labelled as TGE’s (token generation events). An alternative mechanism is a fair launch scenario where tokens are made available by adding them as liquidity on a decentralized exchange.

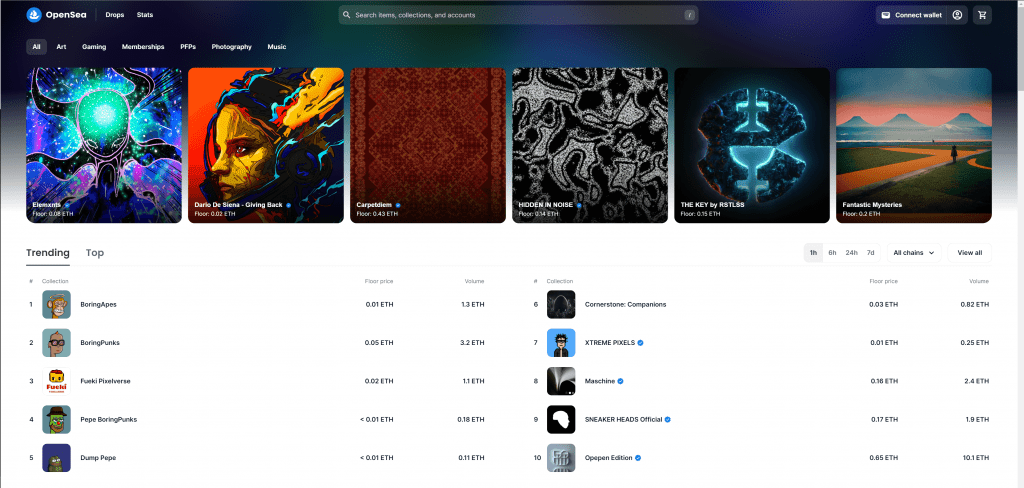

Digital Products

For projects that aren’t well suited to governance tokens there is the possibility to raise capital through the sale of digital asset products. One example could be a founder who sells NFT’s on OpenSea to raise seed capital for his project.

Through creativity and engaging a community, founders have the ability to create products that have perceived value which can be realised to raise funds.

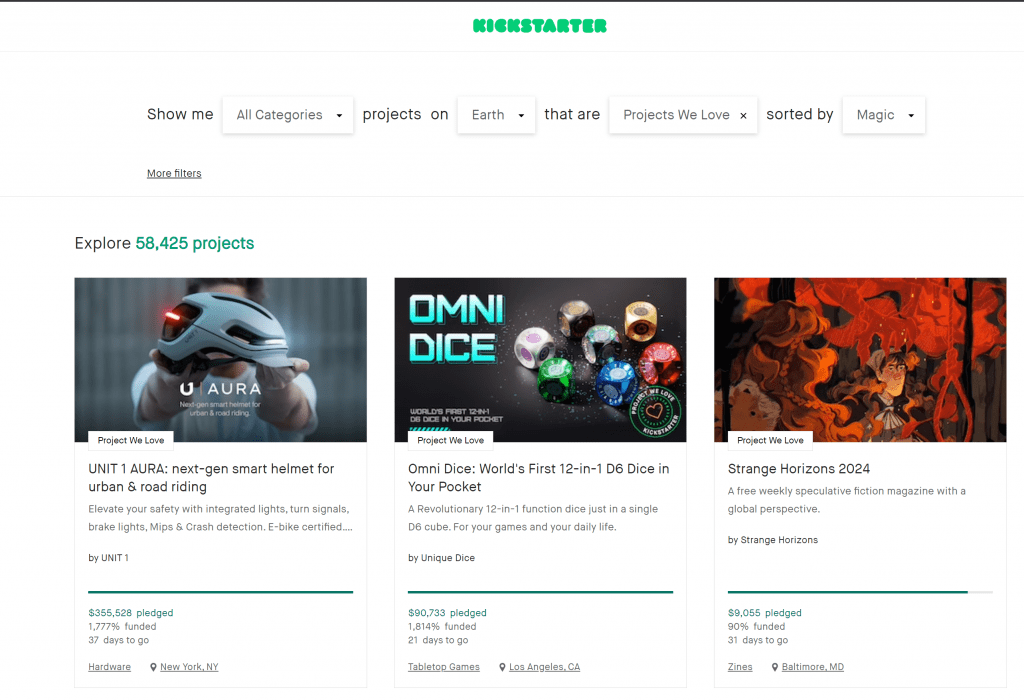

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow individuals to raise money from the general public. Crowdfunding can be a good option for crypto projects that have a large community of supporters.

The platforms have all the tech and legal requirements in place which offers founders some peace of mind and speed of execution. Crowdfunding is hit and miss and a lot will depend on your presentation and marketing of the pitch.

There is no right or wrong way to raise capital but for many projects they will use multiple avenues. It’s quite common for projects in crypto to raise capital via a private round with VC’s prior to completing a public funding round and then finally launching a token on a DEX.

I can speak from experience that bootstrapping a project without adequate funding isn’t much fun. If you can successfully raise capital by finding investors that share your vision it can reduce a lot of the barriers to success.