Squared ETH or Squeeth is a perpetual options protocol that provides unlimited upside leverage with no liquidations on long positions.

Squeeth isn’t just a tool for traders, it can be used as a hedge for liquidity providers on Uniswap and it can provide a funding rate yield in sideways markets.

This article starts at the basics with how convexity works and goes on to focus on how this new product can be used by traders, investors and developers. The explainer video provides a quick overview and if you are interested in emerging DeFi technologies consider subscribing to the channel.

- Explainer Video

- Convexity

- Why Long Squeeth?

- Why Short Squeeth?

- Funding and oSQTH

- Uniswap v3 Hedge

- Automated Strategies

- Opyn Finance

- Conclusion

Explainer Video

Convexity

Most investors have linear returns from their positions. If I buy $100 of Bitcoin on exchange and the price goes up 10% we end up with $110. Financial instruments like options can provide convex exposure to asset price movements.

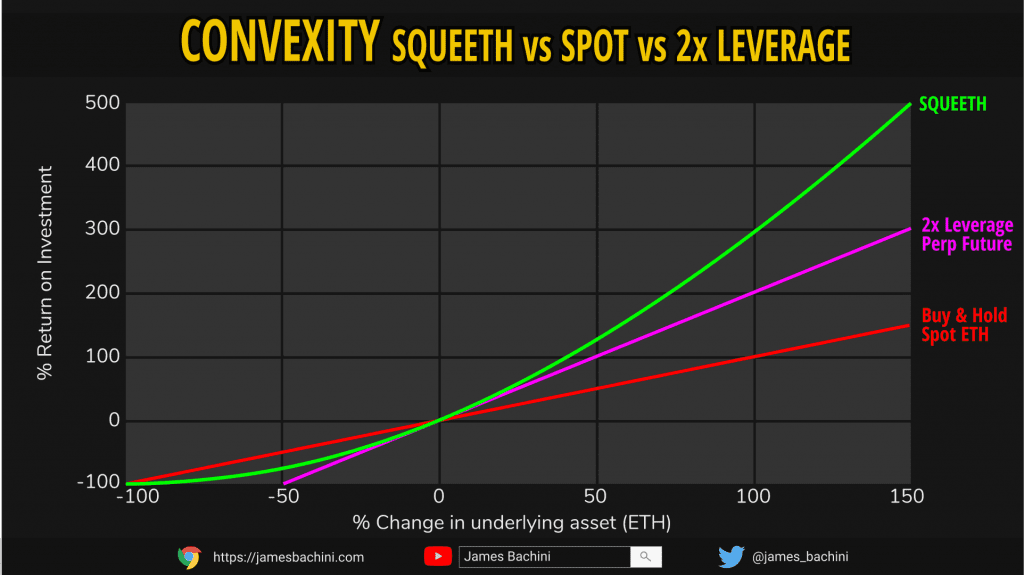

The following chart compares returns of Squeeth vs a buy and hold ETH strategy vs a 2x leveraged long position such as a perpetual futures contract on FTX.

The curviture of the green line is what is known as convexity. In options markets gamma is used as a measure of convexity in relation to the underlying asset.

Compared to a 2x long position there is less downside and greater upside. Too good to be true? Yes of course there is no free lunch and if the market goes sideways then funding rates will be higher on convex instruments which eats in to returns.

Why Long Squeeth?

To take out a long position a trader can purchase oSQTH on Uniswap. This is an ERC20 token which tracks the price of Squeeth minus a funding premium.

Squeeth provides huge returns over short time frames when markets are in up only mode and Ethereum is putting in massive candles. Traders can potentially increase their returns and avoid the risk of liquidation because there are no liquidations on long positions.

The main concern for anyone looking to go long and purchase Squeeth is the funding mechanism which depreciates the value of their holding over time. Due to the upside benefits Squeeth will almost always have positive funding which means that longs pay shorts for exposure. Over time this can erode returns which is why this type of product shouldn’t be used for long-term investing.

Why Short Squeeth?

To short squeeth a trader needs to deposit 200% collateral in Ethereum to mint oSQTH. This balances their position so that price changes in ETH are balanced and cancel each other out, leaving only squared changes in ETH price and funding revenues.

This basically means that you aren’t shorting Ethereum so much as you are shorting volatility. The best time to short squeeth would be when a trader expects the market to go sideways. This means their position doesn’t change and they just collect the funding.

Funding and oSQTH

Because this is DeFi it would be difficult to take a funding payment directly every 8 hours like with futures on centralised exchanges. Instead the funding premium is derived from the index price of where ETH² should trade at in theory and where the oSQTH token is trading at.

A normalisation factor is used to adjust down the debt for minters. The value of this debt is calculated as follows

Value of debt in ETH = Original debt value * Normalization factor * Current ETH priceBecause of this funding premium holding oSQTH is going to depreciate in value over time if the price of ETH stays constant. A similar effect can be found in options markets and is known as time decay or theta. The opposite is also true for minters (shorters) who’s position will appreciate in value over time if the price of ETH stays constant.

Uniswap v3 Hedge

One interesting use case for this is that it can be used in combination with perpetual futures to hedge concentrated liquidity positions on Uniswap v3.

When providing liquidity if the price moves outside of the range then all our assets are converted to the depreciating asset.

So if you were providing liquidity for the USDC-ETH pair on Uniswap v3 and your range was between $3000-4000. If price rose quickly to $5,000 then you would end up with all USDC sold at rate between $3-4k. There’s an opportunity cost here which can be hedged with the help of Squeeth’s convex returns.

Simply put a concentrated liquidity position is a bet against volatility and long squeeth is a bet for increased volatility.

Automated Strategies

The Roadamp for release is Squeeth to be launched today January 10th 2022. Then on the 24th January we should see the first automated strategy release (The Crab 🦀). This will be on Ethereum mainnet initially with plans to branch out to layer 2’s in February/March. There are also Bull/Bear strategies planned with dates to be advised.

The crab strategy is a short vol position that rebalances back to 2x collateral every day and if the position drops below a safety threshold of 1.5x.

It will automate some of the work in managing the position independently and should provide strong returns in sideways markets.

The bull/bear strategies will likely be popular, especially when released on layer 2’s as this will open it up to more discretionary traders with lower gas fees on transactions.

Opyn Finance

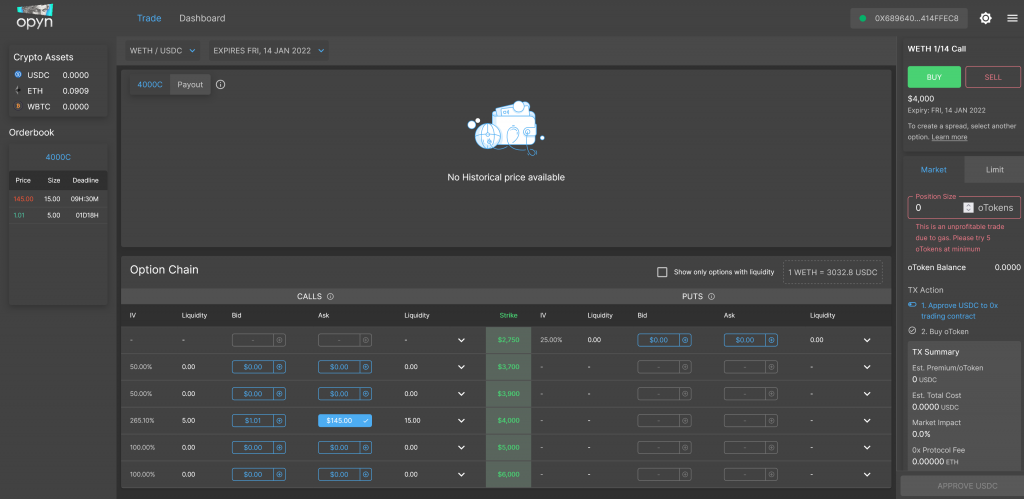

Squeeth was created by the team behind options protocol Opyn

Opyn Finanace on Github has some interesting Solidity repos for things like perpetual vaults and liquidation bots.

Solidity developers could also potentially use the funding premium as an on-chain metric for expected volatility in the markets or it could be used as part of a larger sentiment check.

Conclusion

Opyn has created an interesting new product in Squeeth. It will be interesting to see how much traction the launch on mainnet gets because the gas fees are going to be quite expensive for short term trades.

The long positions should appeal to day traders and swing traders that want to use DeFi trading protocols. However the gas fees are going to mean it’s only really viable for large position sizes. This is potentially quite a small niche of DeFi whales that want to take out short term speculative bets on the upside.

The short positions are probably more useful and interesting to long term investors with a neutral expectation of future price action. There is also the potential for more complex strategies to be built on top of this to do some for of leveraged yield farming based on the funding rate revenues.

The product is certainly something unparalleled and new to the market and kudos to Opyn for pushing the boundaries of what is possible in decentralised finance.