This article explores the different types of business model as well as looking at what makes a good business model and some common online business models.

- The 10 Business Model Categories

- The 10 Types Of Business Model Explained [Video]

- Breakdown of a Business Model

- What Makes a Great Business Model?

- Types of Online Business Model

The 10 Business Model Categories

| Model | Description | Examples |

|---|---|---|

| 🛒Distribution | Bridging the gap between manufacturer and consumers | Retailers, Dropshipping |

| ⚡Utilities | Providing core infrastructure | Electricity, Mobile Networks |

| ⛏Natural Resources | Extract natural resources such as oil, metals & wood | Oil Industry, Glencore |

| 📺Media | Create, organise & publish information | Facebook, Newspapers |

| 🔧Manufacturing | Taking raw materials or components and adding value | Dell, Tesla |

| 📱Software | Develop and monetise software | SaaS, Freemium games |

| 👩🏼🤝🧑🏼Human Resources | Provide expertise or man power | Accountants, Uber |

| 🏠Real Estate | Flip or lease land or buildings | Hotels, WeWork |

| 💸Financials | Providing financial services | Banks, DeFi |

| 🍻Entertainment | Fulfil consumer need to be entertained | Pubs, Casinos |

Most businesses will fit comfortably into one of these 11 categories however some may bridge two or more such as online casinos that are fundamentally software but build their business based on entertainment.

The 10 Types Of Business Model Explained

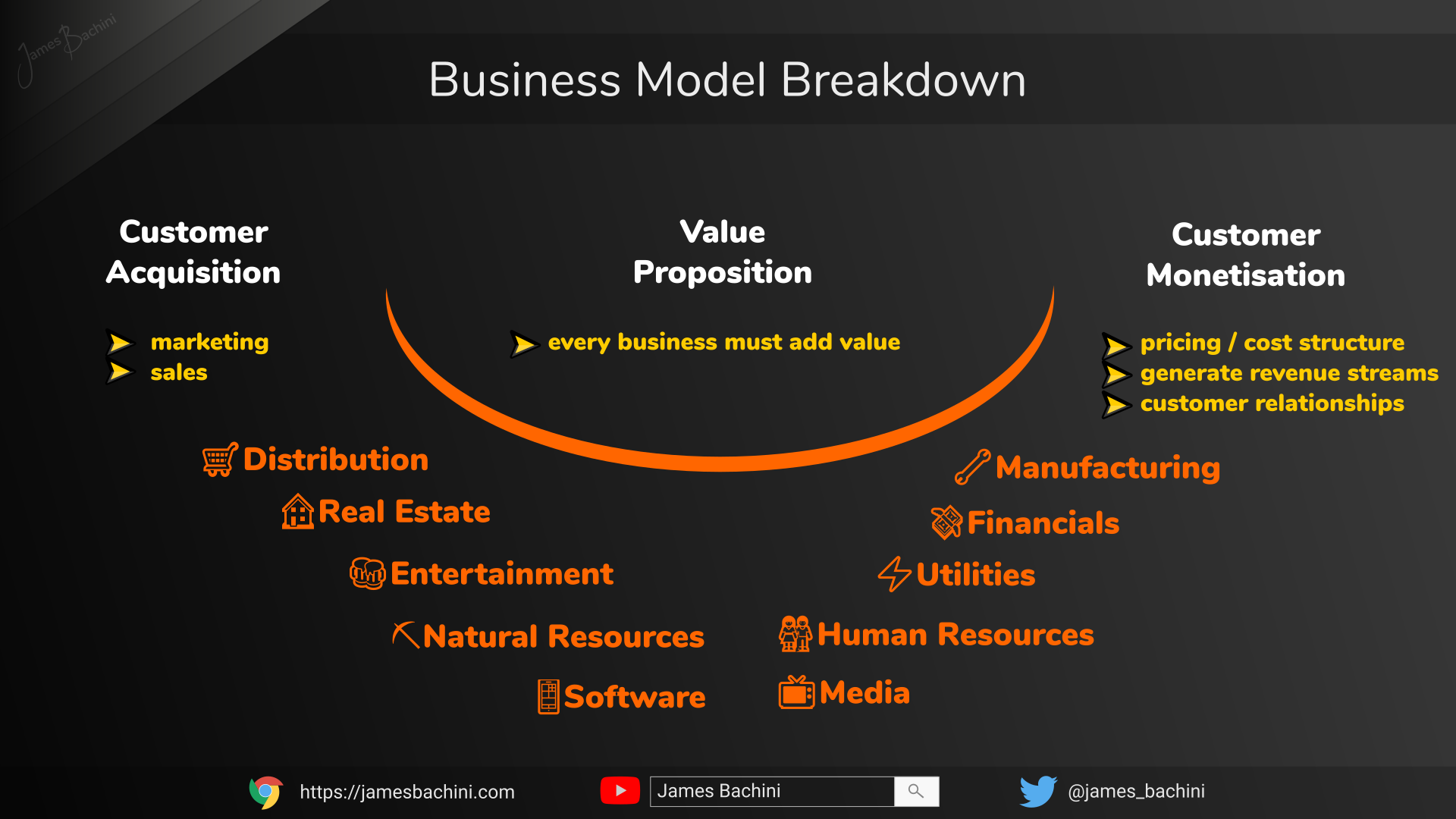

Breakdown of a Business Model

Every type of business model can be broken down to a core value proposition. Lifetime value of a customer needs to be greater than customer acquisition costs for the business model to be profitable.

Businesses acquire customers through marketing and sales. They add perceived value through their business model enabling customer monetisation.

What Makes a Great Business Model?

The above describes every business model but what sets apart really great business models from average ones.

Operating Margins

The more perceived value a company can create the better profit margins will be. Higher margins means more funds for customer acquisition and growth strategies enabling the company to grow and scale faster.

Competition kills margins as perceived value is deteriorated when customer choice is expanded. If you have 50 mins to spare, legendary VC Peter Thiel done a talk for Y Combinator on why competition is for losers here.

Customer Acquisition

A great business will have a reliable way to find new customers. This could be through performance marketing, network effects or a talented sales team.

Companies that add thin value or operate at low margins are particularly sensitive to customer acquisition costs which can stall growth.

Never rely on “build it and they will come” work out how much it costs to acquire a customer so you can ensure they come.

My favourite method of customer acquisition is online marketing.

Revenue Streams

Great businesses generate great revenues. This can be through the sale of products and services, rebilled subscription services or the sale of resources such as digital ad space.

Some businesses can excel on a one sale per customer basis but most will find that generating consistent revenues from existing customers leads to higher LTV (lifetime value).

Product/Market Fit

Businesses that have a product that customers really want tend to be able to create more perceived value, generate higher margins and grow faster.

Nothing in business is as important as having a market for a company’s products or services. It is much harder to create a new market than to disrupt an existing one. Companies that improve efficiencies in large markets tend to grow fast and profitably.

Scalability

For a business to grow it needs to scale operationally. Some businesses scale much better than others. Online businesses in particular tend to be able to expand across global markets quickly.

Businesses can scale vertically where they will increase market share in their current operating markets or horizontally where they move into new markets.

Scaling fast can often require funding in the form of angel investors, venture capitalists, business loans or for the largest companies an initial public offering (IPO).

Types of Online Business Model

Here are some common types of online business model:-

- SaaS – Software as a service

- Dropshipping – Selling products and delivering directly from manufacturer

- Print on Demand – POD, printing custom t-shirts, mugs etc.

- Affiliate Marketing – Generating leads and revenues for merchants through affiliate marketing

- Advertising – Creating content and monetising through digital ads

- Info Products – eBooks, online courses

- Subscription Services – Charge a monthly fee for premium products

- Freemium Apps – Generate revenues through in-app purchases

- Flipping – Buying something and selling at a markup

- Data Licensing – Selling data via an API