One of the most recognized techniques for investing is dollar cost averaging. A process where you invest equal amounts over set periods i.e. $100/month. A less well known strategy is value averaging which when compared across multiple markets and time frames is more effective.

In this article I discuss the concept of value averaging, the benefits of this approach over dollar cost averaging, some inherent challenges and how it would work for a novice investor starting during the peak of a bull market.

- What Is Value Averaging

- The Uber Driver Problem

- DCA vs Value Averaging Compared

- Taking It Further & Alternatives

What Is Value Averaging

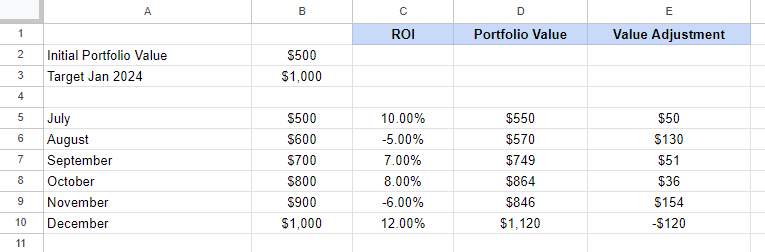

Value averaging involves adjusting the amount you invest each period to meet a specific target. This target is increased by a set amount each period, so you could set a 1% per month target and invest monthly for example. The investment value is then adjusted to ensure that the portfolio’s value meets this target. If your actual portfolio value exceeds the target, you invest less or even sell some assets. If your portfolio value is below the target, you invest more.

Planning a value averaging investment enables you to determine a specific target for your portfolio value at a singular point in the future and work backwards to figure out how to make that happen.

Therefore during a bear market you would purchase more assets and during a bull market you’d be purchasing less or even selling assets.

In this simplified example we start with a portfolio of $500 that we want to turn in to $1k by the end of the year. The ROI represents our monthly returns which we top up using the value adjustment. On good months we top up less and on bad months we top up more. By the final month we are actually selling assets to rebalance the portfolio back to the target amount.

The Uber Driver Problem

The problem with investment markets and particularly cryptocurrency, where I mainly focus, is that the vast majority of market participants invest at the worse possible time.

The “cab chatter curse” is real, if you hear Uber drivers talking about crypto you should be very concerned. Every bull market I get friends and family ask me for an opinion about buying Cardano. When the market goes parabolic it attracts retail investors who fomo in at the worse possible time.

When the markets correct this leaves those same investors with losses and crypto is a scam again…

Rather than fomo in at the height of a bull market or when crypto seems exciting, most market participants would be better off setting up a long-term investment plan. The most simple of these is a DCA strategy which can be automated on apps like Coinbase. However this market agnostic strategy perhaps leaves some chips on the table when compared to a value averaging strategy.

DCA vs Value Averaging Compared

Why would one prefer value averaging over the standard dollar cost averaging strategy?

Dollar cost averaging involves investing a set amount over regular intervals, irrespective of market fluctuations. This mitigates the risk of making a large investment at the wrong time.

Value averaging provides several benefits over dollar cost averaging:

- Greater potential for increased returns By adjusting your investments to purchase more when prices are lower and less when prices are higher, value averaging can potentially yield greater returns over the long term.

- Reduced risk Value averaging can reduce your investment’s volatility. If the market’s on an uptrend, value averaging eases potential overexposure by cutting back on the investment. Conversely, in a downturn, it systematically capitalizes on lower prices.

- Financial Planning Targets Value averaging can ensure that an investor hits specific target or benchmark, something which dollar cost averaging cannot assure.

Value averaging in the domain of crypto investing isn’t without challenges. Cryptocurrencies are notoriously volatile, which can make value averaging a highly reactive process which requires a lot of commitment when markets inevitably set on fire.

Value averaging may not be practical for investors with limited capital. This strategy requires that you have additional funds on hand to invest when your portfolio value drops below the target. In crypto markets a 30% crash can happen overnight, how committed are you to making up that shortfall?

Value averaging also requires constant attention and financial management. It can require investors to sometimes buy and sell investments, rebalancing portfolios and is all together a more complex and time consuming undertaking.

Taking It Further & Alternatives

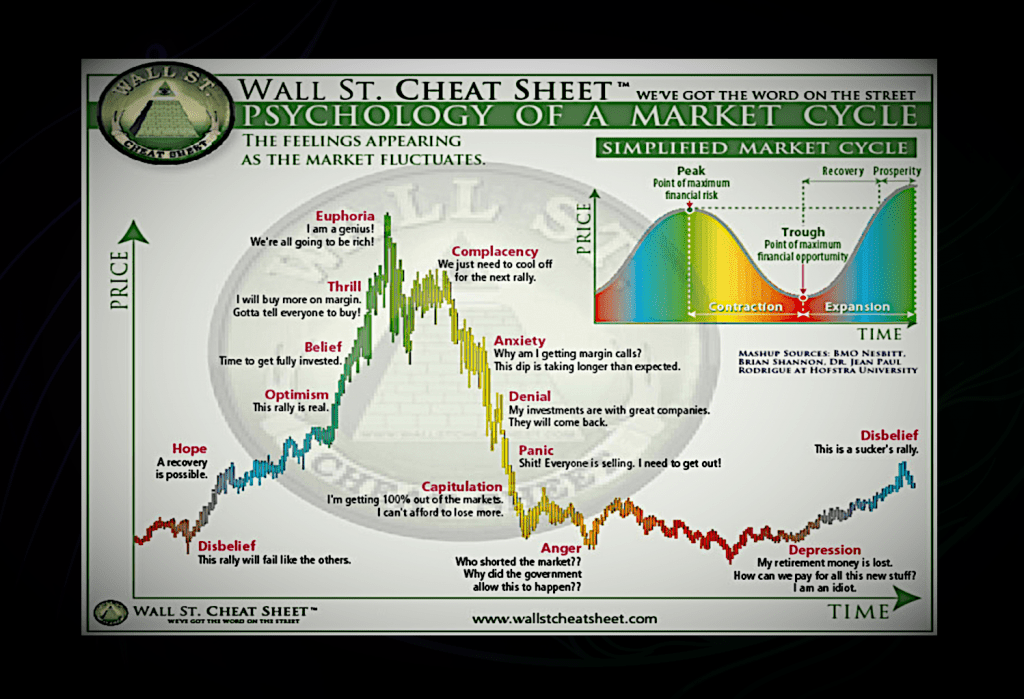

For investors entering a new market I think value averaging is a superior strategy to DCA. It requires strict financial management and a basic understanding of market cycles and human behaviours.

For those committed to closely monitoring and managing their investments there are ways to take this further.

Crypto markets are notoriously volatile, with wide swings as Mr Market goes fully bipolar and decides to sell off or bid up on any given narrative. As an investor you can take advantage of that by studying market cycles and allocating capital when everyone else is too afraid to.

You could use high time frame moving averages to plot a course of fair value and only allocate capital when price falls below a target buy price below that fair value.

You could monitor sentiment on Google Trends, Crypto Twitter, Influencer Intolerability and a whole host of other metrics to gauge where we are in a market cycle.

The point is there is a lot you can do to improve on an over simplified dollar cost averaging strategy. If DCA outperforms 90% of market participants then a basic understanding of cycles and some careful planning will put you in the top 5%, hopefully outperforming the vast majority of investors, traders, hedge funds, prop trading firms propped up by fraudulent exchanges and other smart money market participants.

As with any form of investment strategy, due diligence, market understanding and risk management are of utmost importance. This post is for education and entertainment purposes only, not a financial advisor and you’d be better off on WallStBets for financial advice.