VEGA is a dedicated appChain built for decentralized derivatives such as futures and options contracts.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to VEGA at time of writing. Do your own research, not investment advice.

Vega is a infrastructure layer that acts as the foundation for the creation of various derivative products and trading platforms. By running a dedicated appChain traders are able to execute orders at high speed and low costs.

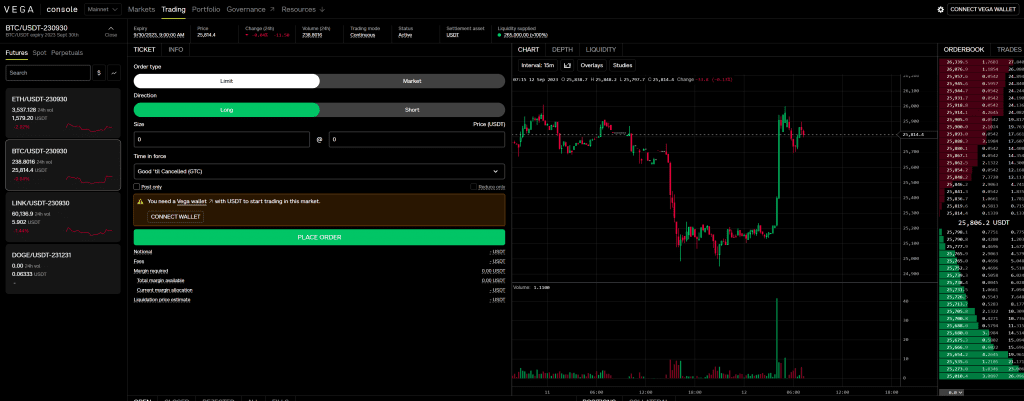

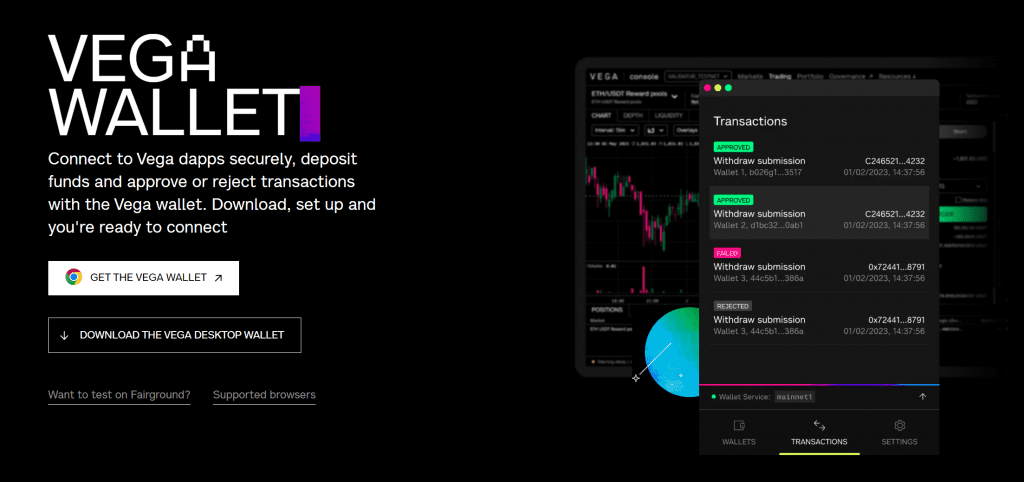

There is currently an in-house trading console, browser wallet and alpha mainnet release.

To solve the liquidity issue we have talked about previously Vega uses a incentivization scheme to attract market makers. The native Vega token is used as an incentive, currency to execute trades and to establish network consensus.

The permissionless market creation is somewhat questionable as it needs to be approved by the Vega community. The community allocations of the Vega token are not clear due to “detailed information about actual and currently planned emissions of all types is not currently published”*.

Traders can bridge funds directly from Ethereum to VEGA using ERC20 tokens. They will then need to download the dedicated VEGA browser wallet.

At time of writing there are four futures markets for:

- Bitcoin

- Ethereum

- Link

- Doge

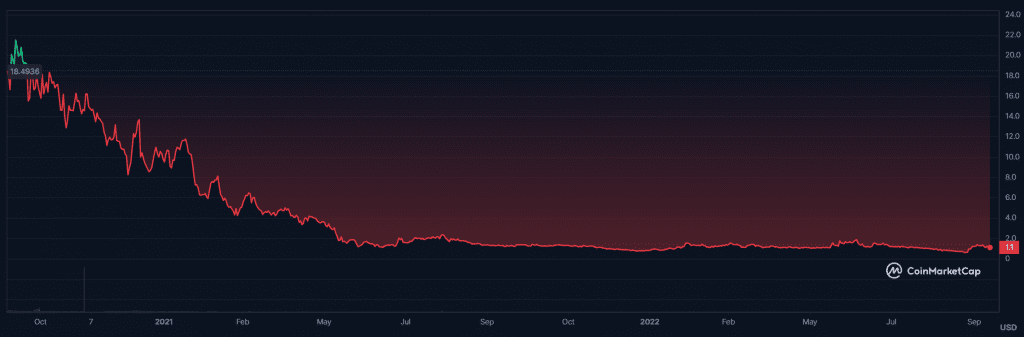

Vega was launched in 2019 and raised $43m in a coinlist token sale in 2021. They are also backed by some prestigious VCs

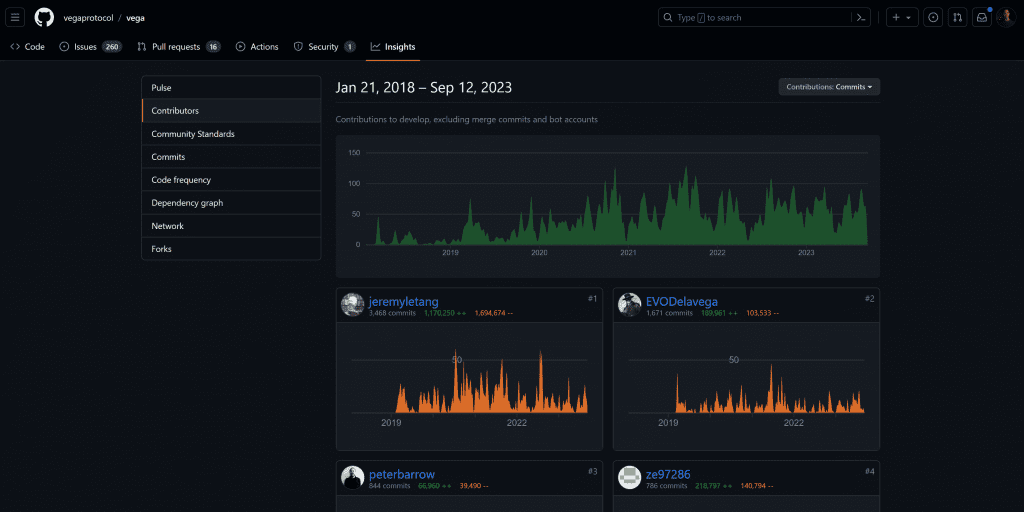

Since then it’s been actively and consistently developed which we can see from the Github insights.

The ambiguity around the token allocations is concerning and the token has been down only since launch.

It’s another project where they are probably struggling to find users and traders to kick start the flywheel in a bear market. Another one to watch in this mini series of DeFi trading protocols.

If you want to get the latest research posts direct to your inbox once a week, subscribe to The Blockchain Sector at: https://bachini.substack.com