An epic battle is currently breaking out between a rapidly growing Reddit community Wallstreetbets vs Hedge Funds.

For those who don’t know Wallstreetbets is a subreddit which is dedicated to proudly “treating the stock market as a casino”. It is generally not safe for work and describes itself as 4Chan with a Bloomberg terminal.

https://www.reddit.com/r/wallstreetbets/

Now last year one user, with a name I can’t print, found out that a lot of hedge funds had short sold Gamestop, a struggling retailer of video games.

The short interest was huge, over 100% which means more shares had been sold in the company through derivatives than actually exist. He buys a large amount of call options and starts posting about it on /r/wallstreetbets.

A series of events created some momentum including:

- New board member Ryan Cohen, founder of Chewy

- A pivot towards building their online presence

- Sony & Microsoft announce their next gen consoles will have disc drives

The stock was trading below $5 in August and starts to rise to around $18 at the beginning of 2021.

As the share price starts to go up the hedge funds that shorted it start to lose money.

A short is when someone borrows shares and sells them to buy back later. It’s basically a bet on the stock price going down. A short squeeze is when the price goes up and the shorters lose money and have to buy back shares to cover their positions pushing the price higher.

Then things go from bad to worse for the hedge funds. Wallstreetbets users start piling in buying stocks and call options adding fuel to the fire.

One particularly exposed hedge fund, Melvin Capital had previously boasted about shorting Tesla, Elon pipes up with a single tweet gamestonks and everything goes into ludicrous mode.

The problem is the hedge funds sold so much stock there isn’t enough sellers for them to buy it back at a reasonable price quick enough to cover their position.

This is known as days to cover and is basically a stat for the amount of shorts divided by the daily volume of shares traded.

The share price goes through the roof and is trading at over $100.

It’s suggested that Melvin Capital has now lost more money on paper than it has on it’s balance sheet. The worlds largest market maker Citadel provides a 2 billion dollar bailout taking. Citadel is said to be involved in 1/5 of all US stock trades. They also has large influence on the brokers where they purchase order-flow including Robinhood.

Then on Thursday 29th January things started to get a bit weird.

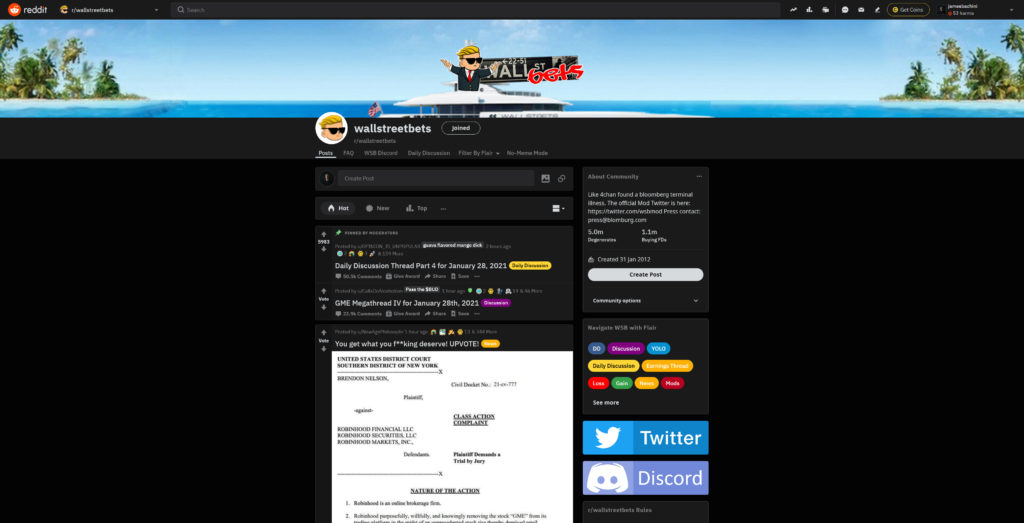

Robinhood, Interactive Brokers and Ameritrade all block the purchase of Gamestop shares. They are still allowing users to sell them and close positions but not purchase. You can imagine how the wallstreetbets users reacted, many of whom use Robinhood as their broker.

Robinhood then raises margin requirements and liquidates some of their users positions selling them against their will. Some screenshots were posted of liquidations at the absolute bottom of the daily candle. The price was driven down by blocking anyone buying then Robinhood liquidates positions at the lowest possible price.

Was Citadel pulling the strings here? If Melvin Capital goes pop are they exposed?

It’s not just Wallstreetbets crying foul play, politicians start to get involved in the saga too.

Some of the biggest Wall Street firms are opening themselves up to litigation with what is blatant unethical market manipulation. It’s suggested the fall out from this and knock on effects could be the most devastating since the fall of Lehman brothers in 2008.

When you buy a stock there is an unlimited upside but the downside is fixed because you can only lose what you put in. The problem with shorting a stock is that it flips this and there is unlimited downside. In theory the price can keep appreciating and you can lose an infinite amount.

On Friday 29th January a large amount of call options expire and there currently isn’t enough liquidity. Short interest is still over 100% and the stock is flying, currently over $200. The big question is will Wallstreetbets users and anyone else that’s jumped on the trend sell and at what price?

So I did what any sensible spectator would do in this situation, picked up some popcorn & YOLO’d in. At this point it’s not a financial investment it’s a donation to the cause. There’s zero chance I’m going to make any financial gains but at least I’ll be able to tell my Grand kids about this one day.

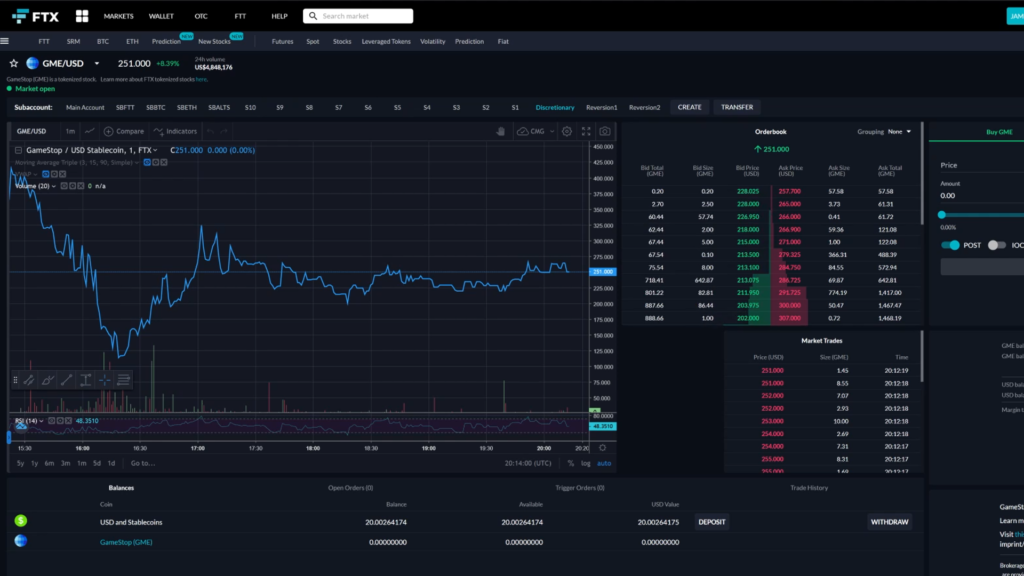

I went on FTX and opened up a small margin position on GME/USD. I know I’ll never profit from it because… I’m not selling. It can get liquidated as and when the wallstreetbets users see fit.

I love a good underdog story and this has brightened up a cold wintery lockdown.

To those taking on Wall Street, good luck to you.

If you’ve enjoyed these resources could you help share this content on social media and send it to anyone who you think might appreciate it.

Thank you.