Coinbase has come under criticism for insider trading which has led them to open up about what tokens they are considering listing in the future. In this article we will look at the opportunity this brings alongside an analysis of all 50 projects. We will end by looking at how we can identify and track digital wallets which may have insider information.

- Insider Trading & Transparency

- Emerging Opportunities [Video]

- Ethereum Tokens Under Review

- Solana Tokens Under Review

- Identifying Insider Wallets

- Tracking Wallet Transactions

- Conclusion

Insider Trading & Transparency

In this blog post Coinbase announced it will announce the tokens that are currently in review for a listing on the exchange in Q2 2022.

https://blog.coinbase.com/increasing-transparency-for-new-asset-listings-on-coinbase-e06f2edb095e

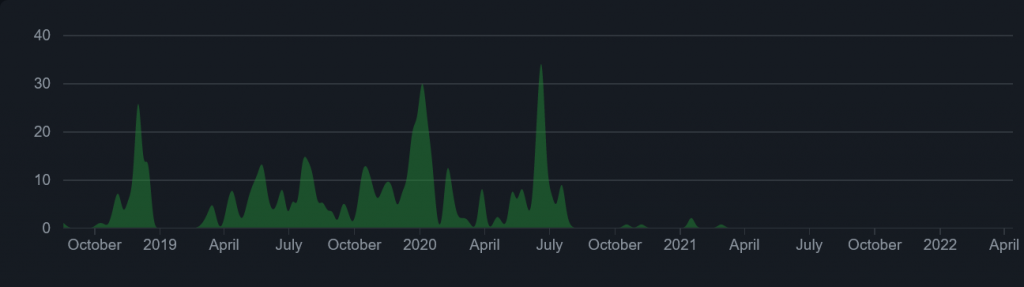

This has come after much criticism of insider trading and the listing of some projects which haven’t done well. When a project gets listed on Coinbase the token price will usually appreciate significantly. The lower market cap the token the more it will pump on announcement listing. This has provided a good market opportunity for systems traders over the last few years. It’s also widely believed that information is leaked and trading takes place before the official announcement. While this could be from opportunistic employees working at Coinbase it could also be from things like API/blog information leaks.

Emerging Opportunities

This provides a unique opportunity where Coinbase has provided a list of all the emerging projects they are considering in the space.

Some of these are very new and have market caps below $10m at time of the announcement meaning there’s the potential for traders and investors to take early positions. While there is now formal endorsement of these projects Coinbase does have a team of analysts who’s job it is to Alongside the “under review assets” list we now have a list of token addresses which we can use alongside known insider trading wallet addresses and the flow of funds from these addresses to more accurately predict what and when Coinbase will listing next.

Ethereum Tokens Under Review

Over the past few days I’ve been going through each project doing a quick analysis. Some that I’ve found more interesting I’ve done a deeper dive into while others I’ve meerly glanced over to get an idea of what the project is doing.

Aleph.im ($ALEPH)

Market Cap: $53m

Aleph provides off-chain services such as digital storage and identity verification. The project was founded in 2018 and aims to bridge Web2 technologies in to the Web3 space.

Arcblock ($ABT)

Market Cap: $16m

A decentralized dev environment that includes a blockchain framework, runtime and an ecosystem for building dApps.

BiFi ($BIFI)

Market Cap: $107m

A project I’ve looked at a number of times and have considered allocating capital to in the past but never pulled the trigger on. Beefy Finance is a yield aggregator which auto-compounds returns for yield farmers across multiple blockchains. https://beefy.finance/

Big Data Protocol ($BDP)

Market Cap: $5m

A very low market cap protocol which aims to provide a marketplace for commercially valuable datasets. Fully diluted market cap is $10m on this project.

Binance USD ($BUSD)

Market Cap: Lots

This should be familiar, it’s Binance’s stablecoin which is used widely for inter exchange transfers and on Binance Smart Chain. Would make sense for Coinbase to list it making it easier for users to transfer funds between Binance and Coinbase.

BitDAO ($BIT)

Market Cap: 684m

BitDAO probably has the most impressive list of VC backers in the space with names such as Peter Theil, Jump Capital, Founders Fund and Pantera all involved. My understanding of BitDAO is that it aims to become the incubator of Web3 providing early seed and angel funding to new projects in the space in exchange for future token allocations. I think this is one of the most likely candidates for listing due to the size and backing of the project alongside the mandatory compliance with regulations.

Botto ($BOTTO)

Market Cap: $5m

Another super low market cap project which has seen a big pump since the announcement. Currently not listed on any centralized exchanges although there is a BOTTO/WETH market on Uniswap. Each week 350 pieces of art are presented to the public, token holders vote on which pieces they like which trains the machine learning algorithm to create better art and NFTs. Each week the piece with the most votes gets minted into an NFT and listed on SuperRare. Proceeds of the auction are returned to Botto token holders.

Chrono.tech ($TIME)

Market Cap: $47m

Not to be confused with the Wonderland TIME token Chrono.tech provides human resources services using blockchain to “streamline access to work and payments”. The Australian based blockchain company was founded in 2016 suggesting they may be struggling for traction.

https://chrono.tech | https://laborx.com | https://paymentx.io

Coin98 ($C98)

Market Cap: $298m

Coin98 offers an “All in one DeFi hub” including cross-chain swaps, wallet, token issuance, venture fund, staking, among other services. The C98 token has a fully diluted market cap of $1.6B which is considerable. To realise this I think it will be critical to find specific applications that appeal to market participants to gain a strong user base which is yet to be seen.

DappRadar ($RADAR)

Market Cap: $14m*

FDV on this $248m and it looks like the circulating supply is in negotiation with CoinMarketCap which suggests it should be taken with a pinch of salt. dAppRadar is a popular site that provides listings for DeFi, NFT’s, GameFi projects. I’ve used it in the past for research purposes but commercially it aims to become “The Worlds dApp Store”.

DEXTools ($DEXT)

Market Cap: $30m

A widely used tool for checking token prices and other onchain analytics. The DEXT token is used to enable premium membership services such as a trading bot and price/wallet alerts. Current pricing structure incentivises holding the token rather than repeat purchases which creates demand but limits upside potential. A strong project but perhaps not a speculative token.

DFX Finance ($DFX)

Market Cap: $7m

An automated market maker built for stablecoin pairs using a oracle price feed to provide less slippage. The bonding curve shifts in line with a price feed supplied by an oracle. Interesting project but they are going up against one of the biggest players in the space in Curve which will be hard to compete against. That said there’s a proven market for stablecoin liquidity.

DFX and Curve are similar in that they are DEXes trading crypto and stablecoins, the USP for DFX though is that they only handle “exotic” 1:1 fiat backed stablecoins (i.e non USD focussed) such as the new EUROC (including the only EUROC/USDC liquidity pool for the euroc release), XSGD (singapore dollar), CADC (Canadian dollar) etc. where as curve focuses on USD variants only e.g USDT

Dope Wars Paper ($PAPER)

Market Cap: $15m

Love the style but would Coinbase really list a project called dope wars? The paper token is the ERC20 in game currency for the dope wars game. The whole project is governed and created by a DAO and has a retro theme reminding me of the old Commodore 64 games.

Drep ($DREP)

Market Cap: $43m

Drep is an EVM compatible blockchain. I couldn’t find much information but believe the launch of DREP-chain mainnet is due in Q2 this year. One anomaly is the lack of recent development which would either suggest the project has a development issue or they’ve moved the repository.

There is a Binance listing already in place https://www.binance.com/en/trade/DREP_USDT

A lot of potential for alternative layer 1 blockchains and at this market cap and with ample liquidity via Binance it’s one to keep an eye on.

Elastos ($ELA)

Market Cap: $63m

Elastos aims to provide a network for dApps to run as an alternative to centralised internet services. The p2p network can be accessed via applications on mobile and desktop. Founded in 2000, but pivoted to a blockchain project in 2017 there is an evident lack of traction and growth unfortunately.

Gemini USD ($GUSD)

Market Cap: lots

Gemini is the Winklevoss twins exchange and integrating GUSD will make it easier to transfer assets between the two US based regulated exchanges.

Honey ($HNY)

Market Cap: $191m

Hive is a DeFi protocol that combines an NFT marketplace and minter with an ERC20 HNY token distribution. The platform has a nice UX and the protocol is built on Polygon.

Hopr Token ($HOPR)

Market Cap: $31m

A data privacy focused project. I struggled to understand how it worked, so straight from the site “The HOPR protocol provides network-level and metadata privacy for every kind of data exchange. A mixnet protects the identity of both sender and recipient by routing data via multiple intermediate relay hops that mix traffic.”

Index Cooperative ($INDEX)

Market Cap: $115m

One we have looked at and experimented with before https://jamesbachini.com/crypto-index-funds/

Index Coop enables tokens sets which act like managed funds for collections of digital assets. Independent fund managers can earn fees when investors allocate capital to the fund. I still think this could have a lot of potential to impact the same kind of market as eToro’s copy trading. New product released recently that’s gained some traction in icETH.

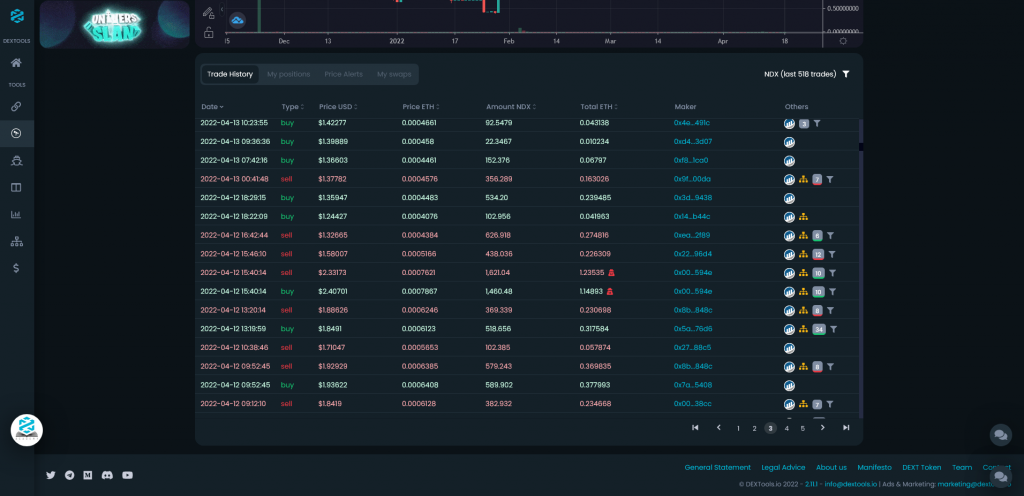

Indexed Finance ($NDX)

Market Cap: $1m

Prior to the Coinbase announcement this project would have had a market cap of about $500k. Similar to IndexCoop in that they provide token sets or funds of digital assets. You can allocate capital to a basket of digital assets in one go without buying each one and rebalancing etc. Indexed Finance uses a passively managed approach and their most popular product is the “Degen Fund” which currently holds $6m AUM.

They also offer staking incentives where you can stake your funds to gain an allocation of the NDX governance token. My biggest concern is the lack of ongoing activity with no updates to the github repos in the last month and only a couple of twitter posts put out.

Jupiter ($JUP)

Market Cap: $15m

Jupiter is a privacy focused blockchain with “military grade encryption”. They have released some interesting products such as decentralized git, a social messenger and a NFT marketplace called Leda.

Kromatika ($KROM)

Market Cap: $8m

My understanding is that Kromatika uses Chainlink as an oracle service to execute a Uniswap trade in a way that avoids front running bots. The user pays a fixed fee to execute the trade avoiding swap fees and slippage. Roadmap mentions CEX listing in Q2.

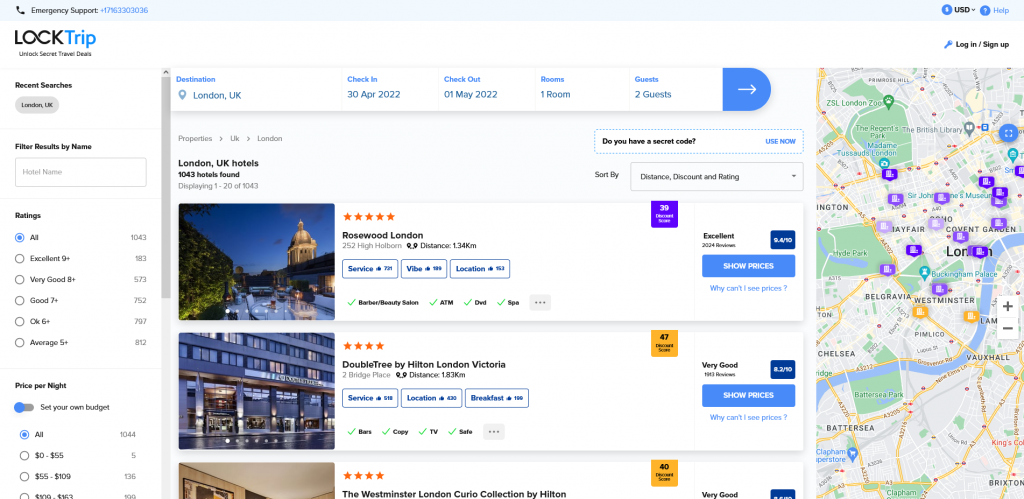

LockTrip ($LOC)

Market Cap: $30m

A blockchain based travel portal founded in 2017 which cuts out the middlemen to offer up to 60% discount when booking hotels.

This feels like one of the first real world products on the list. The website is highly optimised and well put together. There is also a planned launch for a NFT matrix which uses NFT contracts to streamline the booking process for hotel rooms. Each room is allocated a NFT for each night which provides a digital token and access. This is probably how it will work in the future and a user just scans an app at reception or on the door to check in.

The LOC token accrues value through a buy back & burn mechanism where 3% of transaction fees are used to purchase the token on exchange. Only negative point is a lack of traction, I couldn’t get similarweb data for the site because there weren’t enough monthly visitors.

MATH ($MATH)

Market Cap: $34m

The MATH token acts as a utility token for the MATH mobile wallets. These are cross chain digital asset wallets which can hold ERC20s and NFTs. The wallet has 1.6m users according to the site but the Android listing states 10,000+ installs. Impressive backers:

Monavale ($MONA)

Market Cap: $4m

There is also a MONA coin which is a separate project. Monavale which I believe has rebranded to DIGITALAX is an ecosystem built around web3 fashion. Founded by Emma-Jane MacKinnon-Lee the project bridges real world products with web3 digital assets. A lot of the products look like they are print on demand and a baseball hat costs $80. Outside my area of expertise.

https://www.digitalax.xyz/marketplace

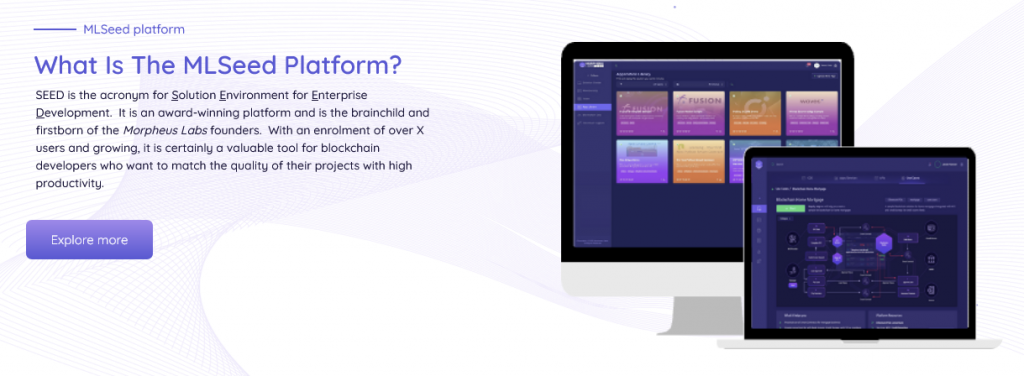

Morpheus Labs ($MITX)

Market Cap: $14m

Enterprise focused blockchain development platform.

mStable Governance Token: Meta ($MTA)

Market Cap: $7m

mStable have been around some time and at one point I had an allocation to the MTA token. They created a decentralised stablecoin mUSD and have now expanded to a wrapped Bitcoin product mBTC. The team has also launched a savings protocol offering ~5% APR return on the $mUSD stablecoin. Never really took off or offered enough to attract large inflows and TVL, this would still be my concern as to where growth will come from.

Muse ($MUSE)

Market Cap: $7m

Muse is the governance token for NFT20 which is a NFT liquidity protocol. When a NFT is deposited into one of the NFT20 pools 100 MUSE tokens are minted, 5% of those tokens goes to the NFT20 protocol and distributed to $MUSE token holders.

This is something that I expected to take off more than it has so far. Liquidity is a major issue with NFT’s because you need a specific buyer for each piece. It’s like selling a house or car and it takes time and may even be difficult to find buyers in bear markets. NFT20 and NFTX are both well positioned to grow with the NFT industry as it matures and become important infrastructure components if they can find product market fit.

Nest Protocol ($NEST)

Market Cap: $53m

A decentralized oracle service. Coinbase is listed in their Ecology section. Competing with Chainlink which is in itself competing with emerging technologies such as Uniswaps TWAP functionality. Oracles play a critical role in getting real world date on-chain. The value of this oracle data vs in house data provision is debatable but a more decentralised method could be valuable to some projects.

Opacity ($OPCT)

Market Cap: $16m

Decentralised encrypted file storage. My understanding is the client generates a private key which is used to encrypt data provided to a p2p network of nodes. The data is not distributed openly like with IPFS but the client can download the data at a later date and decrypt it with their key. There is also a method to create a shareable link if you want to make the data available to 3rd parties. 10GB of free storage if you want to experiment.

OpenDAO ($SOS)

Market Cap: $145m

OpenDAO made waves across the industry when they airdropped the SOS token. Since then the team has focused on building out a DEX, Bridge and lending protocol for SOS Chain. Not much going on in the Github repositories and perhaps the focus has moved on for both the community and developers.

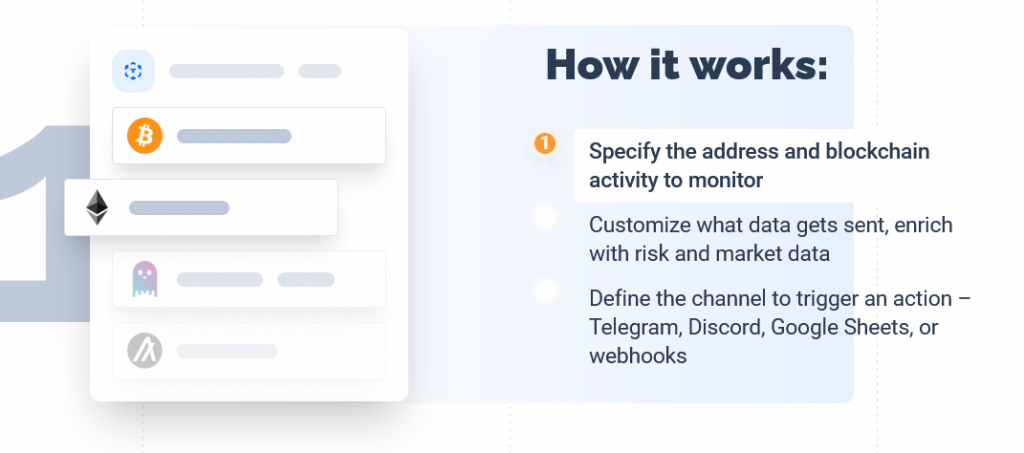

PARSIQ ($PRQ)

Market Cap: $43m

ParisIQ aims to build the IFTT (if this then this) for the blockchain sector. A SaaS platform making on-chain analytics and monitor more accessible with no code solutions.

PolkaFoundry ($PKF)

Market Cap: $16m

An EVM compatible blockchain built on top of Polkadot. Polkafoundry markets itself as a developer hub for builders in Web3 with particular focus on DeFi and NFTs. The platform enables cross chain transactions and has a launchpad for new projects.

Polychain Monsters ($PMON)

Market Cap: $14m

Founded in March 2021 Polychain monsters is a NFT trading game built on Polkadot. The PMON token is used to open booster packs which burns 40% of the tokens. Unfortunately NFT’s didn’t take off in the same way on Polkadot as it has on other blockchain such as Ethereum, Polygon and Solana.

https://polychainmonsters.com/

RAC ($RAC)

Market Cap: $3m

RAC is the personal project of grammy winning artist Andre Allen Anjos. The RAC token aims to connect the community looking to decentralise music production and distribution. Unclear how value accrues for token holders.

https://zora.co/rac | https://rac.fm

SelfKey ($KEY)

Market Cap: $43m

SelfKey aims to provide a digital identity wallet which connects a user to the metaverse. The platform integrates a KYC (Know your customer) product alongside storing digital assets and personal data.

StackOS ($STACK)

Market Cap: $23m

A no-code cross-chain enterprise development platform. StackOS app store provides access to the decentralised cloud network which hosts the dApps. The stack token is a governance and staking token for the network. Standard “clusters” provide cloud computing with 99.4% guaranteed uptime which can host docker images.

Definitely one of the more professional and substantial projects on this list. Decentralised application hosting hasn’t really taken off yet but it could become big business in the future if there is demand from consumers and developers. Would you use StackOS over proven centralised services such as AWS or GCN?

StaFi ($FIS)

Market Cap: $39m

StaFi is a liquid staking protocol which is often confused with Rocketpool because both use the same rETH ticker for staked Ethereum. StaFi provides a staked assets such as rETH, rBNB, rSOL, rMATIC and rDOT. Users who want to run validator nodes need to apply for approval which suggests some level of current centralisation. Fully diluted market cap is $74m which is very low compared to competitors in the same sector.

StaFi has been live since 2020 and hasn’t been able to gain the same traction as the likes of Lido Finance. StaFi has $60m TVL compared to $17B held in Lido’s liquid staking protocol. This perhaps raises some questions about how they will be able to compete going forwards.

Strike ($STRK)

Market Cap: $129m

Strike is an over-collateralised lending platform with $68m in TVL. Lending pools allow users to deposit ETH and receive sETH as a liquid token receipt for their share of the pool. Over time the borrowing fees are returned to the pool increasing the value of sETH relative to ETH. The STRK token was released in fair distribution without VC or founder allocations. There is also a smart contract audit from Certik, exchange listings at Kucoin among others and a developer API/SDK.

Student Coin ($STC)

Market Cap: $26m

A token development platform that aims to make it easy for users to deploy and manage their own digital assets. The STC terminal is the core product which offers token minting, there is also a digital wallet, staking platform for the STC token and an online educational academy.

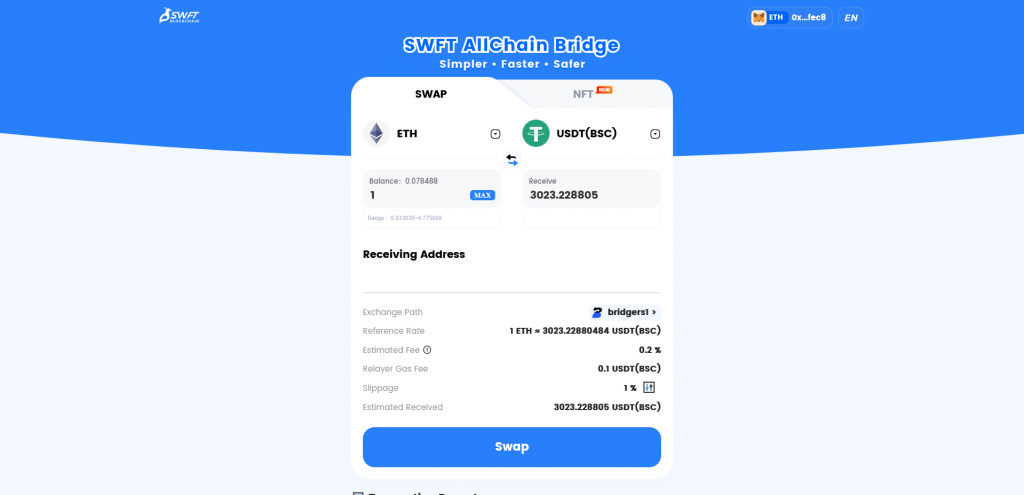

SwftCoin ($SWFTC)

Market Cap: $10m

SWFT provides a cross-chain bridge with 35,000 trading pairs across multiple blockchains. The first thing that struck me about this project is the sheer number of blockchains that it’s possible to transfer assets between.

- ETH, BSC, HECO, Arbitrum, POLYGON, Polkadot, OEC, TT, CELO, TRON, Fantom, AVAX-C, Terra, BTC, XDC, XRP, CRU, EOS, ORC, BNB, Avalanche, KSM, IOST

The SWFTC token provides discounts up to 50% on trading fees which brings them down to 10 basis points on some trades. Transaction times are quoted as usually within 3 minutes. There is also a NFT bridge which has just launched enabling select NFT projects to be wrapped across different blockchains. The biggest negative with this project is a lack of transparency about how it works. The Github repository links off to Google documents detailing how to use the API but doesn’t actually include any code.

I believe SWFT AllChain Bridge is a centralised service that works by a single entity/server receiving deposits and sending out transactions via the different blockchains. There’s nothing inherently wrong with that which makes it worse than using a centralised exchange. The product looks good, is competitively priced and could pick up traction quickly if the team can build trust and traction in the space. My biggest concern would be security and having large volumes of transactions routed through a centralised service will make it a target for hackers.

Sylo ($SYLO)

Market Cap: $12m

Sylo is a communications network where any wallet can sign transactions to communicate with another wallet address. Outside of direct coms users can unlock privileges and permission by signing transactions using their existing wallets. The SYLO token has a liquidity mining program with ETH/SYLO and WBTC/SYLO pairs on Uniswap. Founded in 2017 and $1.7m in TVL.

TE-Food ($TONE)

Market Cap: $15m

A farm-table traceability solution for food transparency. Launched in 2016 and now serves 6000 business customers. The TONE token acts as a license to use the TE-Food platform.

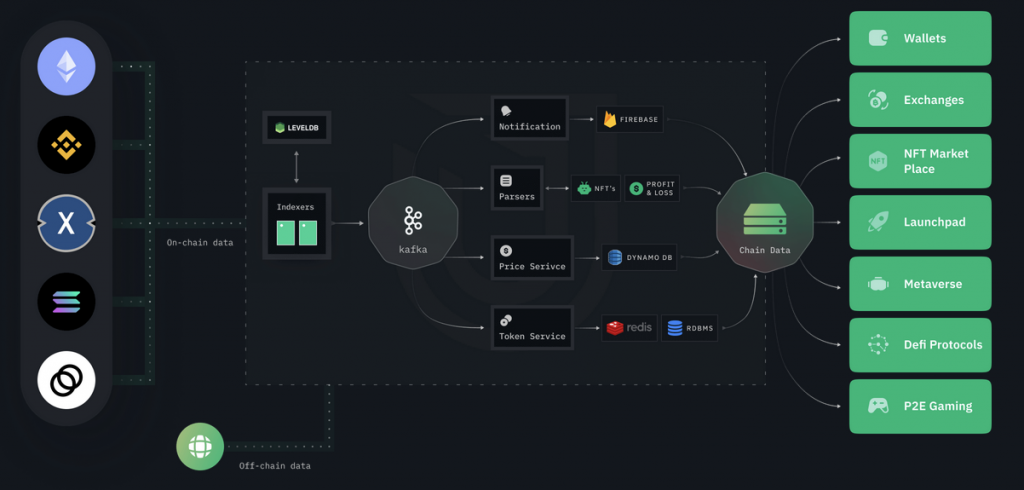

UnMarshal ($MARSH)

Market Cap: $2m

Unmarshal takes cross-chain blockchain data and packages it making it more accessible and useful for developers. The data is obtained via a decentralised network of nodes that are incentivised by the MARSH token.

Wrapped Ampleforth ($WAMPL)

Market Cap: $79m

AMPL is an algorithmic stablecoin that uses a rebasing mechanism to maintain it’s loose peg to the USD. Once a day the token will rebase if the price is outside of the $0.96-$1.06 range. This means that the amount of AMPL in your wallet fluctuates rather than the price of the token. These supply adjustments are made proportionately for all holders.

Solana Tokens Under Review

Apricot Finance ($APT)

Market Cap: ???

Apricot Finance is a lending protocol and leveraged yield farming platform. The X-Farm product offers substantial returns on leveraged positions such as 77%APR on SOL-USDT via Orca. $150m in TVL deposited as collateral on the platform.

Bitspawn ($SPWN)

Market Cap: $2m

Bispawn is a Esports platform that connects gamers with sponsors and advertisers. The SPWN token enables a marketplace for competitive events and community rewards. Recently expanding into the NFT space with their SPWNGODS drop.

Green Satoshi Token ($GST)

Market Cap: $16m

GST tokens are earned via the step tracking game STEPN. This is a Web3 play to earn lifestyle application which distributes rewards based on distances run and carbon offsets. Users mint NFT sneakers and then walk, jog or run to earn GST which enables them to level up or mint new NFT sneakers.

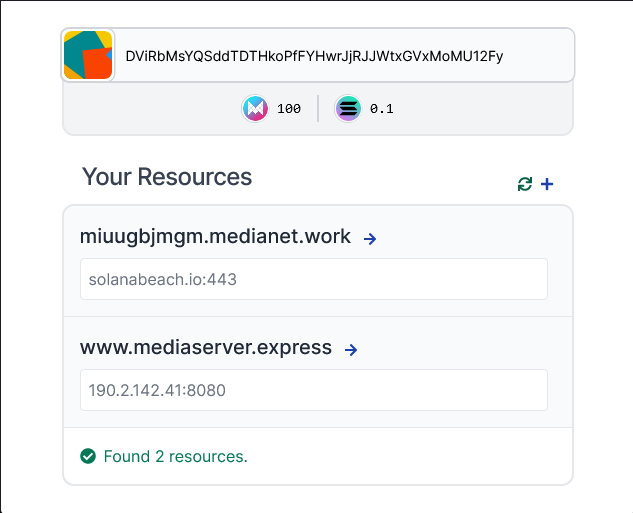

Media Network ($MEDIA)

Market Cap: ???

Media network is a decentralised content delivery network that runs on a p2p network. Anonymous users can deploy content across the censorship resistant network. Nodes known as Media Edges are incentivised via the MEDIA token.

Realy ($REAL)

Market Cap: $20m

Realy is developing a virtual city metaverse based on the unreal graphics engine. The REAL token will act as the base layer currency and will be distributed via the treasury and play-to-earn incentives. Land can be purchased or leased via NFT’s. Strong VC backing from the usual names in the Solana ecosystem such as Multicoin, Alameda & 3AC.

Identifying Insider Wallets

To start we need to identify the token contract addresses which Coinbase has kindly listed in their press release.

I suggest looking at some of the lower market cap projects that don’t have centralised exchange listings as this makes it easier to track on chain transactions via DEX purchases.

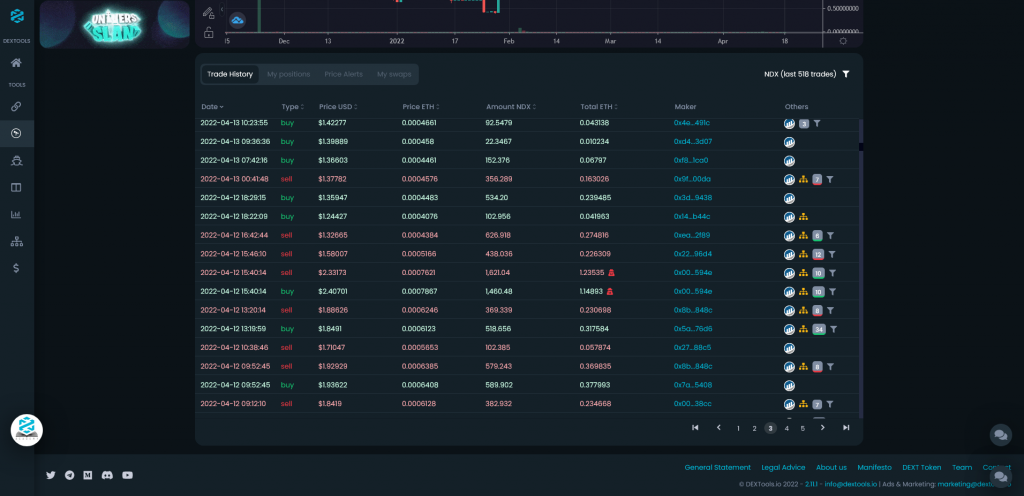

If we post the token contract address for NDX (0x86772b1409b61c639eaac9ba0acfbb6e238e5f83) into DexTools and select the most transacted liquidity pool we get the following:

https://www.dextools.io/app/ether/pair-explorer/0x9dfad1b7102d46b1b197b90095b5c4e9f5845bba

Tracking Wallet Transactions

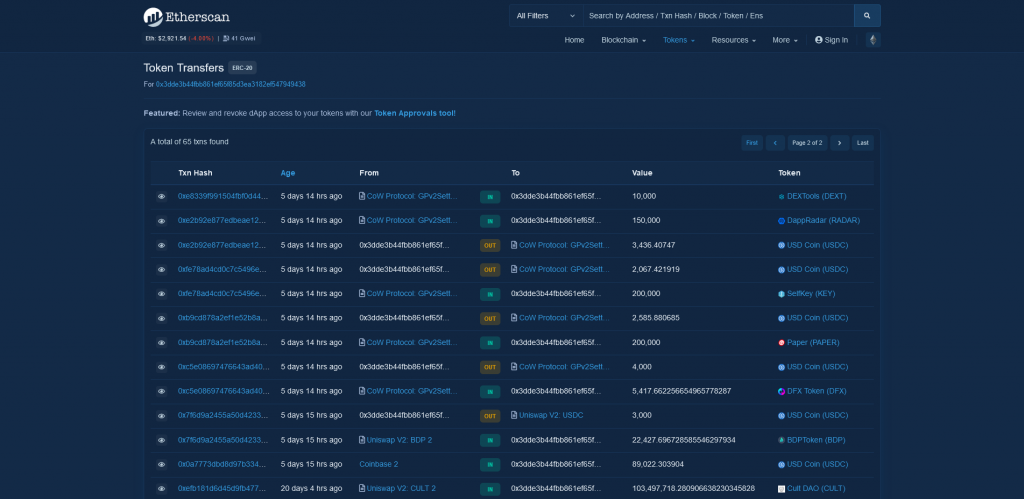

Once we have some wallets of interest we want to set them up on an alert based system. There are a number of pre-built tools for this or you can custom build something using a web3 library such as Ethers.js

Here is a simple example that just uses the transaction count for an address to pop a message when there’s a new transaction. You could connect this to any API you want for notifications.

const { ethers } = require("ethers");

const provider = new ethers.providers.getDefaultProvider();

const targetAddress = `0x3dde3b44fbb861ef65f85d3ea3182ef547949438`;

const init = async () => {

let initialCount = await provider.getTransactionCount(targetAddress);

console.log(`Initial TX Count for ${targetAddress} = ${initialCount}`);

setInterval(async () => {

const txCount = await provider.getTransactionCount(targetAddress);

if (txCount !== initialCount) {

initialCount = txCount;

console.log(`NEW TX: https://etherscan.io/tokentxns?a=${targetAddress}`);

}

}, 60000);

}

init();

Conclusion

The Coinbase under-review list contained some surprising projects. A lot on the list I would find uninvestable because they have little traction and utility in the space and seem unlikely to ever find product market fit with their current offerings. There are a number of projects with market caps less than $10m and it seems unlikely that these would be suitable for a listing on such a major exchange as opening them up to a wider audience could likely cause a pump and dump type affect on the token price.

The projects that I thought were most interesting and worth keeping an eye on were:-

- BiFi – Beefy finance yield aggregator

- BitDAO – DAO fund, probably the most likely to get listed

- Botto – Unlikely to get listed but interesting community concept.

- IndexCoop – Managed funds of digital assets

- StaFi – Huge potential in liquid staking markets this year

- SwftCoin – Centralized but convenient cross chain bridge

However this doesn’t necessary coincide with the projects that I think are most likely to get listed next on Coinbase. For this I think the Coinbase team will be looking for more established projects which are sustainable and unlikely to cause embarrassing price action in the long term. The projects I believe are most likely to get listed are:-

- BitDAO

- Nest Protocol

- SelfKey

A big question remains as to why this list doesn’t include some of the major projects that are established and doing business in the DeFi and NFT space. Likely security regulations comes in to this as Coinbase is a US regulated exchange and can’t be seen to do business with anything that provides returns to token holders.

I hope that you’ve found this Coinbase “under review” listing analysis useful. The expansion of blockchain technology is the biggest opportunity I’ve ever seen and I’m focusing on exploring, learning, investing and trading in these markets. I’ll also try and share as much as possible along the way so subscribe to my YouTube channel and connect with me on Twitter.