April 2021

-

Uniswap V3 Trading Bot 🦄

In this tutorial I’ll be explaining how I built Uniswap v3 trading bot in preparation for arbitrage opportunities. We will be looking at why Uniswap v3 is important and how concentrated liquidity pools provide new features such as range orders. I’ll then show how I built and tested the trading bot prior to Uniswap v3…

-

Twitter Trading Bot | Elon + DOGE = Profit

In this article I’ll share how I built a Twitter trading bot to trade a cryptocurrency called DOGE every time Elon Musk tweeted something mentioning it. I’ll be using NodeJS to query the Twitter API and then executing trades on FTX. Building A Twitter Trading Bot Video James On YouTube The “Elon Effect” Opportunity Anything…

-

Sharpe Ratio Explained | How To Calculate Risk Adjusted Returns

In this article we look at how to calculate risk adjusted returns using the sharpe ratio. We look at some modern examples which you can try using the share ratio calculator. Sharpe Ratio Calculator This calculator uses the simplified Sharpe ratio as discussed here. Possibilities Success Chances: % Return: $ Break Even Chances: % Return:…

-

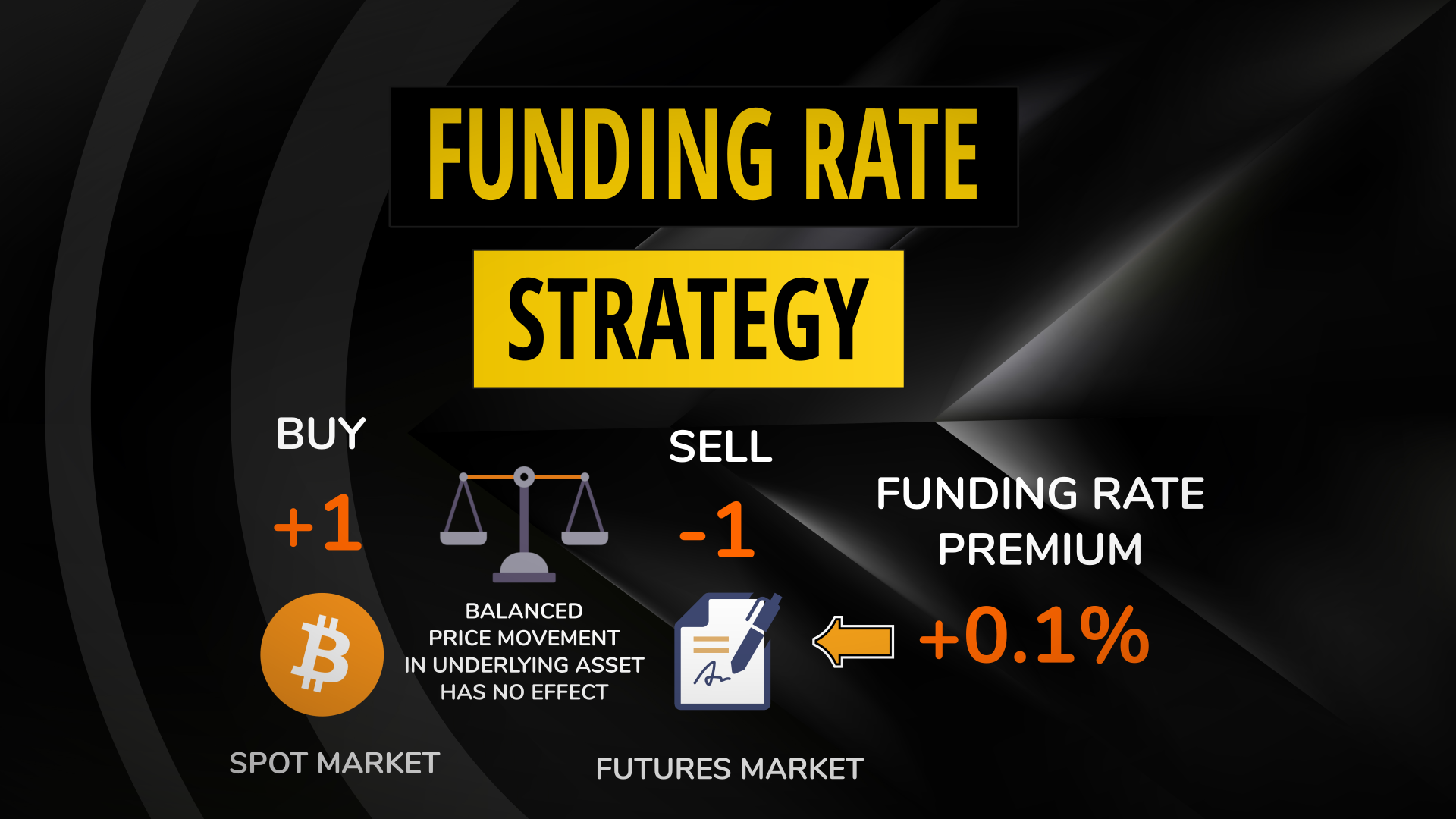

Futures Funding Rate Strategy | Using Binance & FTX To Arbitrage Funding Rates

In this article I’ll be executing a cash and carry trade purchasing a crypto asset on spot markets and short selling a futures contract for the same asset to collect funding rate fees. Understanding Futures Contracts A futures contract tracks the price of an underlying asset. It allows active traders to take out a long…