Resonate Finance is building a protocol for the creation and sale of yield futures. In this article we will look at what yield futures are, how they can benefit a projects tokenomics & why investors might find them attractive. This post isn’t sponsored and I currently have no stake in Resonate Finance or Revest at time of writing.

- Resonate Finance Video

- What Are Yield Futures

- Resonate Built On Revest NFT Tech

- Tokenomic Effects

- Project Partnerships

- Aggregator & Marketplace

Resonate Finance Video

What Are Yield Futures

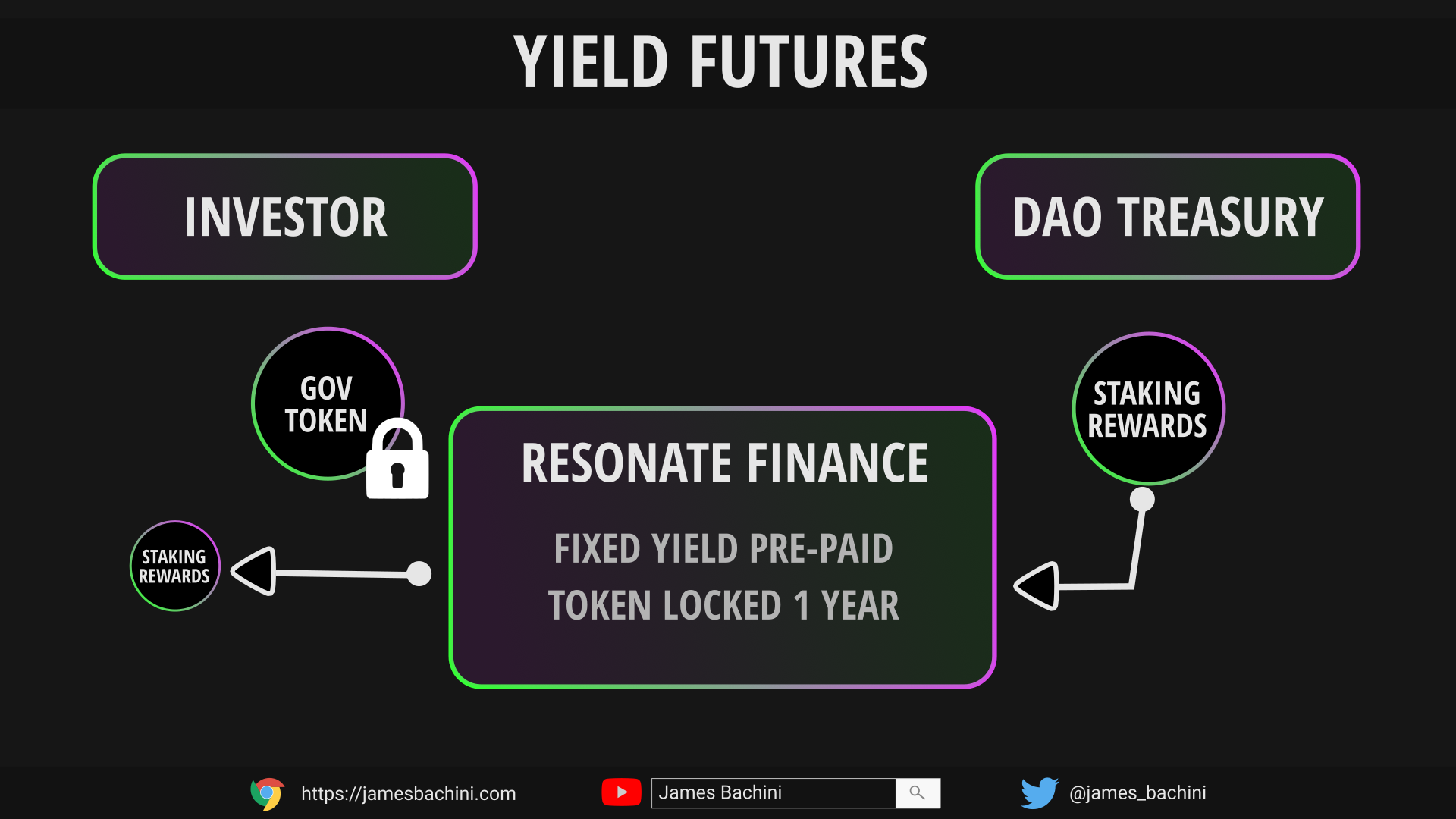

Yield futures provide an incentive to lock tokens for a fixed APR return. The yield is pre-paid at the time of the lockup. For example a investor would provide $100 worth of governance tokens at a fixed APR of 12%. The $12 of reward tokens which may be additional governance tokens or stablecoins are given to the investor straight away. They can then use this yield as they see fit while the collateral is staked for the lock up period.

For the investor this provides a guaranteed yield on their holdings at a fixed term offering convenience and the opportunity to lock in a rate. For the DAO treasury or DeFi project it provides a cost effective way to create demand for their token products.

Resonate Built On Revest NFT Tech

Resonate Finance are currently developing a yield futures platform which is due to launch Wednesday 5th October 2022.

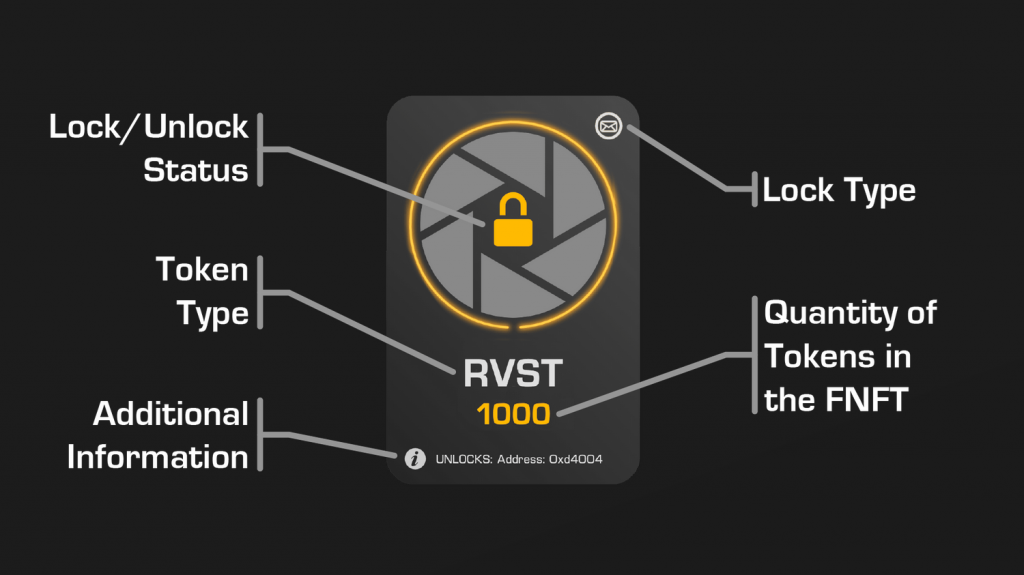

The team developing Resonate are building on top of an existing project that they developed called Revest which creates smart vaults in the form of NFT’s.

Resonate charges protocol fees which are split between both projects with the majority of the weighting going to Resonate Finance token holders.

The Resonate contracts are built around the ERC4626 tokenized vault standards. DeFi protocols that conform to this standard can be integrated easily while others may need a wrapper created.

There is an OpenZeppelin library for ERC4626 here: https://github.com/OpenZeppelin/openzeppelin-contracts/blob/master/contracts/token/ERC20/extensions/ERC4626.sol

Tokenomic Effects

Why would a DAO or project prepay yield to investors using Resonate Finance?

For well funded DAO’s there is little downside. They have funds available to prepay the yield payments and it creates demand for their governance token and locks it up so it can’t be dumped on exchange.

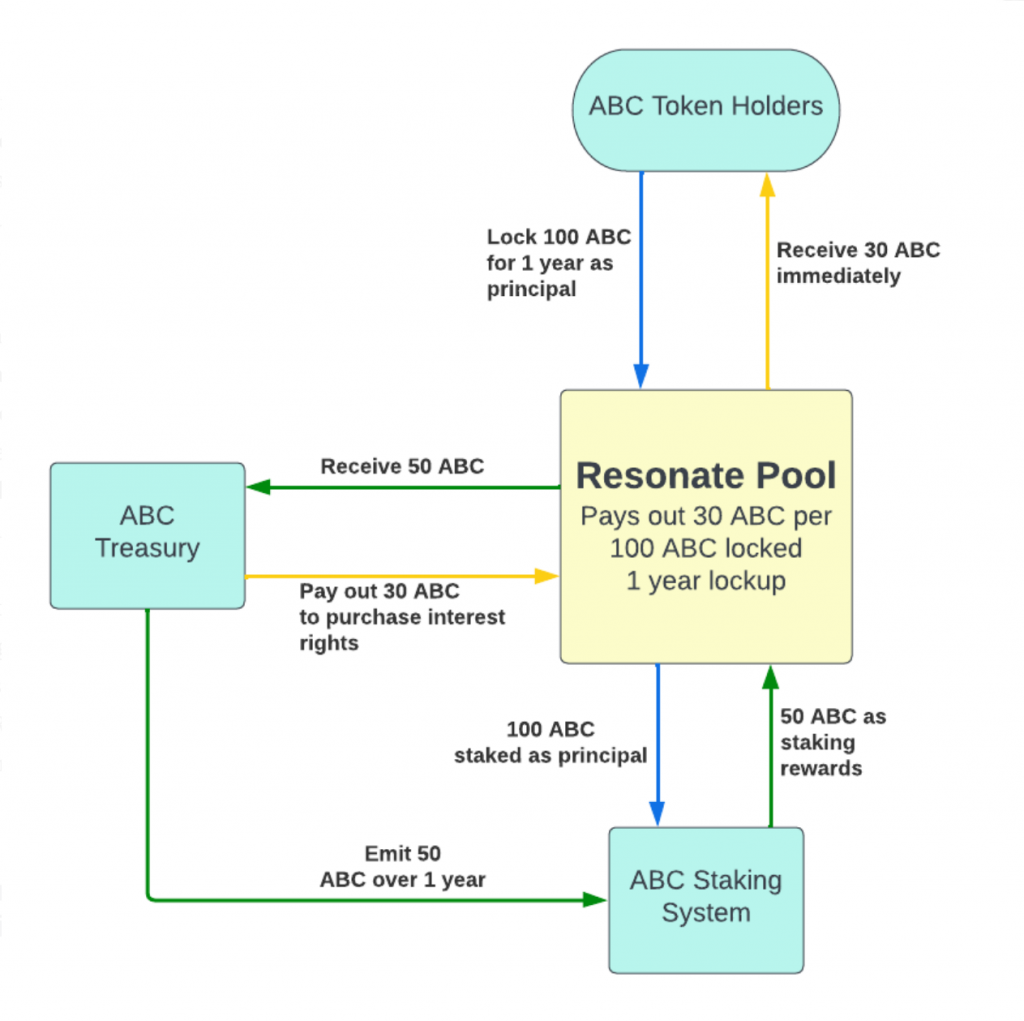

The staking rewards over the year period are usually 1-2% higher than the prepaid amount assuming they stay stable so there is some upside available for the DAO as well. Let’s look at an example to clarify this.

DAO partners with Resonate and provides 100,000 governance tokens valued at $1 each in prepaid yield as staking rewards for their governance token. They set a rate of 10% knowing that staking rewards on their protocol are 12%.

Investors will lock up 1 million tokens to get the prepaid yield creating demand on exchange. Those governance tokens are staked earning 120,000 gov tokens over the one year period. After one year the funds are released back to the investor and the DAO makes a 20,000 gov token profit on their yield futures strategy.

The key thing here isn’t the profit but the capital efficiency at which a DAO can incentivise demand for their token products while creating no selling pressure for a one year period.

Project Partnerships

Resonate Finance have one of the most active and professional biz dev/sales teams I’ve seen in the blockchain sector. For a pre-launch startup they have a team of six sales people who are onboarding partners to offer yield futures.

Partnerships already announced include Spiritswap, Beefy Finance & Optimism and at launch there are going to be in the region of 30 vaults to choose from.

Aggregator & Marketplace

Resonate Finance’s success will hinge on their ability to generate an audience. If partners can tap into an existing pool of investors who are actively looking for yield bearing products then there is a lot of value in the protocol. The end goal should be to become the one-stop shop for fixed term yield futures which are aggregated via the Resonate platform.

The market timing isn’t ideal but the team isn’t new to the industry and when markets sentiment shifts there will be demand for yield farming products as investors turn risk on.