The latest development in the Curve Wars is the establishment of a new player. Conic Finance is gaining traction and becoming a significant player in the stable swap ecosystem.

This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Conic Finance products. Do your own research, not investment advice.

Update 2023-08-14, following hacks on Conic and Curve, the governance token $CNC dropped to $2.18 and I have taken a position.

What Is An OmniPool?

An omnipool is like a bucket where different types of assets can be stored. When you deposit an asset into an Omnipool, it automatically distributes it across different Curve pools based on pre-set weights.

For example you can deposit USDC to the pool and it will provide exposure to all of these different assets and your position will earn the yield from trading fees.

Conic Finance’s omnipools allow individuals to deposit a single asset which gets spread across a whole spectrum of Curve pools. The weightings of which pool get the most allocation is set by DAO vote.

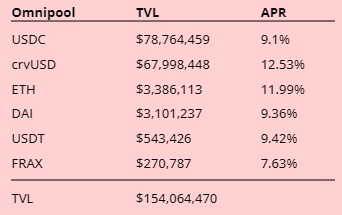

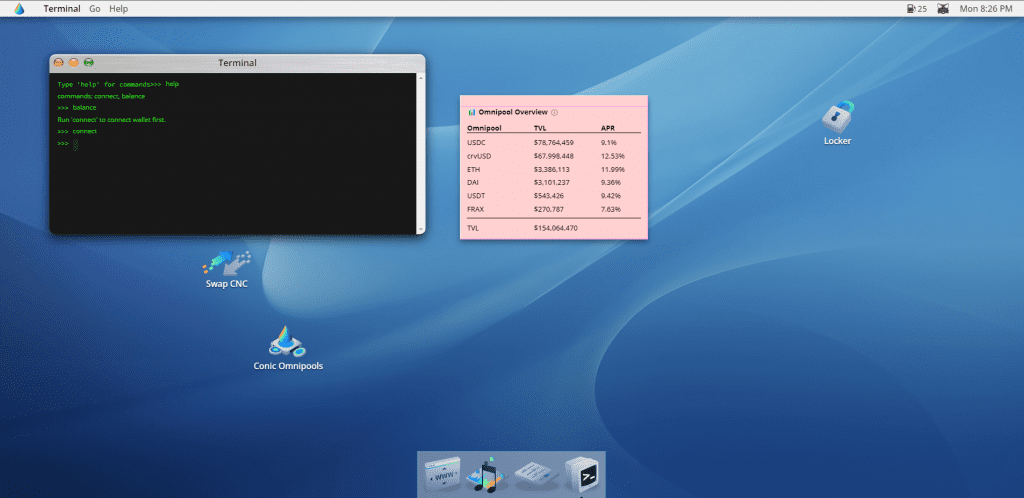

The Frontend In All It’s Glory

Let’s take a moment to appreciate this frontend which was clearly designed by boomers for boomers and heavily inspired by Curve’s 1990’s style.

Diversified Curve Yield

Conic Finance offers investors an avenue to diversify their yield exposure across multiple Curve pools using a single asset. Your asset is not restricted to yield returns from one Curve pool, but instead, gains exposure to multiple Curve pools.

There is value in diversification both to reduce the risk of ruin posed by a potential depeg of any single asset and in the avoidance of yield underperformance from any single pool.

This yield diversification is regulated by specific liquidity allocation weights, dictating the share of Omnipool’s total liquidity dedicated to each Curve pool. These weightings are valuable because increased liquidity is valuable to stablecoin projects. CNC, Conic’s native token, is allocated to liquidity providers who stake their Omnipool LP tokens or provide liquidity during a rebalance period.

Conic empowers LPs with a democratic system where every fortnight, a liquidity allocation vote is conducted. Any holder of the vlCNC token can participate in these votes to decide the liquidity allocation weight updates across all Curve pools connected to an Omnipool. Following the voting period, a rebalancing session ensues along with an additional distribution of CNC tokens to depositors. This mechanism maintains a balanced weight allocation within the ecosystem.

The CNC Token

| Token Price | $5.17 |

| Circulating Supply | 5.6m |

| Total Supply | 10m |

| Market Cap | $29m |

| Fully diluted valuation | $51.7m |

The distribution of CNC supply is as follows:

- 10% airdrop to vlCVX holders

- 30% for community raise

- 44% for liquidity providers

- 19% is designated for rebalance initiatives

- 25% for stakers of Omnipool LP tokens.

- 6% goes to the treasury

- 10% is for AMM stakers (CNC/ETH Curve factory pool)

Locking the CNC token can yield vote-locked CNC (vlCNC). The longer the CNC is locked, the more vlCNC a holder will receive. With vlCNC, holders can participate in bi-weekly votes on liquidity allocation, addition of new assets, whitelisting/blacklisting of curve pools and proposing changes to the protocol.

The DAO treasury originally received 6% of the total CNC supply, with 5% on a 1 year vesting schedule and 1% fully vested at launch to seed the Curve CNC/ETH pool. 10% was designated for an airdrop to vlCVX holders, with unclaimed amounts after 6 months retaken by the treasury.

Conic’s Omnipools have the ability to levy a fee on the total CRV and CVX earned. Future platform fees can potentially be distributed to vlCNC holders following a DAO vote. This is not enabled at this time, likely due to securities laws, but could add significant value to token holders in the future.

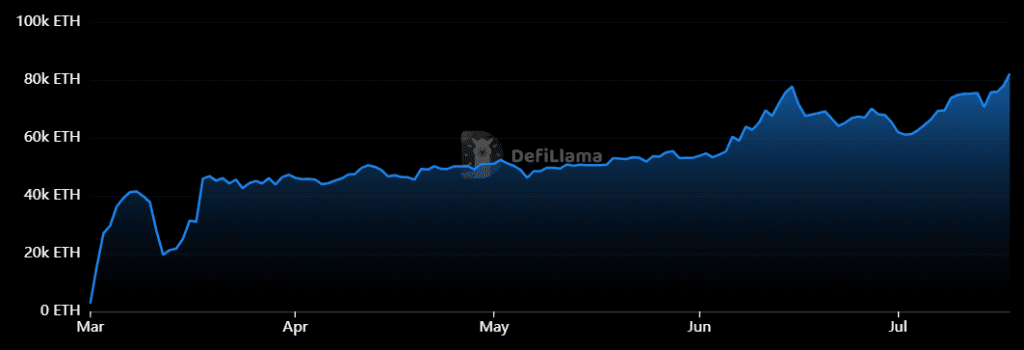

The project is steadily gaining TVL since launch with more than $150m currently locked.

Conic Finance represents a significant innovation in the Curve ecosystem, with its unique approach to incentivizing liquidity provision and protocol governance. As the Curve Wars evolve the fight for liquidity, as protocols strive to maintain the peg of their digital asset products, competition only becomes fiercer.

In this progressing landscape, there are plenty of opportunities for investors and developers alike. As new protocols emerge, offering novel solutions and compelling incentives to users, there are openings to participate in the growth of these platforms. Whether it’s by providing liquidity, participating in governance, or developing new solutions, the evolution of the Curve Wars presents many possibilities.