Overcollateralized lending has emerged as a cornerstone in the decentralised finance ecosystem, providing a secure and efficient way for users to borrow and lend digital assets.

Blend Capital leverages this mechanism on Stellar’s Soroban smart contract platform, introducing a robust protocol for overcollateralized lending and borrowing.

This article delves into how overcollateralized lending works, explores Blend Capital’s integration with Stellar Soroban, and provides insights into lending and borrowing funds on Blend, as well as the BLND tokenomics.

- How Overcollateralized lending works

- Blend Capital on Stellar Soroban

- Lending Funds on Blend

- Borrowing Funds on Blend

- BLND Tokenomics

- Building on Blend

How Overcollateralized lending works

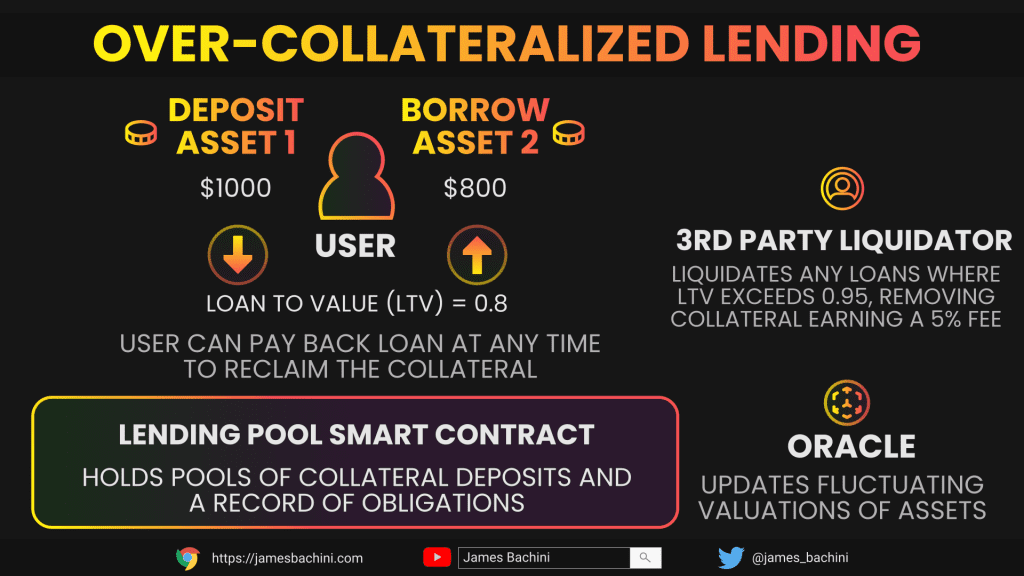

Overcollateralized lending involves borrowers providing collateral that exceeds the value of the loan they wish to obtain. This surplus collateral acts as a safety net for lenders, ensuring that they can recover their funds even if the borrower defaults. The process enhances security within lending markets by mitigating the risks associated with price volatility and borrower insolvency.

In practice, a borrower deposits assets into a smart contract as collateral. The value of this collateral is typically higher than the loan amount, calculated using specific collateral and liability factors. If the value of the collateral falls below a certain threshold due to market fluctuations, the borrower’s position may be liquidated to protect the lender’s interests.

Blend Capital on Stellar Soroban

Blend Capital operates on Stellar’s Soroban smart contract platform, utilising its infrastructure to offer overcollateralized lending services. Soroban provides an environment for smart contracts, enabling Blend Capital to deliver a decentralised, non-custodial, and censorship-resistant protocol.

By building on Soroban, Blend Capital ensures that its lending pools are immutable and operate without reliance on central intermediaries. This decentralisation enhances trust and security, as users retain control over their funds and interact directly with the protocol’s smart contracts.

Lending Funds on Blend

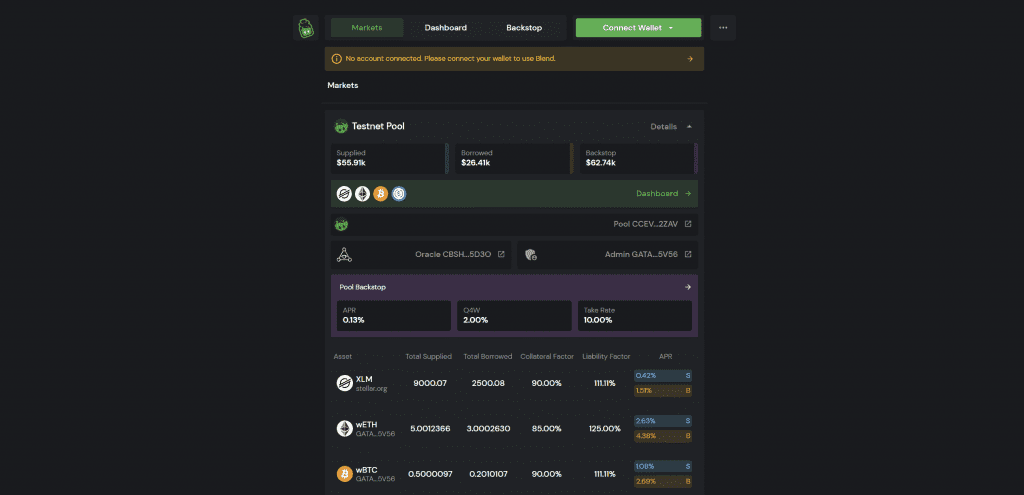

Lenders on Blend can supply assets to lending pools, earning interest from borrowers who utilise these funds. The process is straightforward:

- Asset Supply Lenders deposit Stellar-based assets into a chosen lending pool that supports the asset they wish to lend.

- Interest Earnings As borrowers draw from these pools, lenders earn interest proportional to their contribution. The interest rates are demand-based, fluctuating with the utilisation ratio of the pool.

- Withdrawal Flexibility Lenders can withdraw their assets and accrued interest at any time, provided the pool has sufficient liquidity. The protocol’s reactive interest rate mechanism ensures high utilisation rates incentivise additional liquidity.

Lenders also have the opportunity to earn BLND token emissions if the pool is within the reward zone and allocations are set for lenders.

Borrowing Funds on Blend

Borrowers can access funds from Blend by overcollateralizing their loans:

- Collateral Deposit Borrowers deposit collateral into a lending pool, ensuring it meets the required collateral factor (CF) relative to the desired loan amount.

- Loan Acquisition They can then borrow assets up to their calculated borrow limit, which is determined by the value of their collateral and the pool’s liability factor (LF).

- Interest Accrual Interest on the borrowed amount accrues automatically and is added to the borrower’s liability balance.

- Repayment and Flexibility Borrowers can repay their loans and interest at any time. Maintaining the required collateral ratio is crucial to avoid liquidation.

Borrowers may also receive BLND token emissions under the same conditions as lenders, enhancing the incentive to participate in the protocol.

BLND Tokenomics

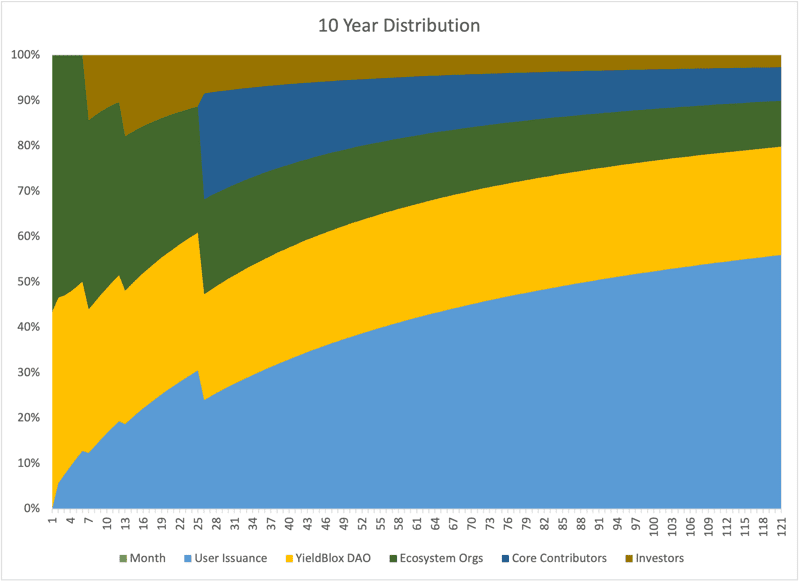

The BLND token is integral to Blend Capital’s ecosystem, serving both utility and governance functions. Upon its launch, 49 million BLND tokens were emitted, and the protocol continues to emit 1 BLND per second to its users. The initial distribution of tokens was strategically allocated to key stakeholders such as the YieldBlox DAO, ecosystem organisations, core contributors, and investors. This distribution came with various lock-up periods to ensure long-term commitment and stability within the system.

Users can earn BLND tokens by lending or borrowing on Blend, particularly when engaging with pools that fall within the reward zone. Those who deposit in the backstop module, providing insurance for lending pools by contributing BLND

80:20 liquidity pool shares, are also rewarded with BLND emissions. This offers an additional incentive to support the health and liquidity of the protocol.

The backstop module serves as a crucial mechanism to safeguard against bad debt in the lending pools. Backstop depositors earn a portion of the interest paid by borrowers, in addition to receiving BLND emissions, further incentivising users to contribute to the security of the system. In this way, the BLND token plays a central role not only in driving participation but also in maintaining the overall stability and efficiency of the Blend Capital protocol.

Building on Blend

Blend Capital’s smart contracts are fully open-sourced, providing developers with the flexibility to build on top of the protocol and create custom lending markets or applications. Developers can access the contracts and contribute to the project through the official GitHub repository at Blend Capital GitHub.

For developers looking to build on Blend, the repository includes key contract code and examples. One such example is the test case written in Rust, which demonstrates how to deposit and borrow against collateral. You can find this example in the test_wasm_happy_path.rs file within the Blend smart contract suite.

A key function for depositing collateral is on line 47 of the test file, where the following code is used to submit a request to supply collateral:

let result = pool_fixture.pool.submit(

&merry,

&merry,

&merry,

&vec![

&fixture.env,

Request {

request_type: RequestType::SupplyCollateral as u32,

address: stable.address.clone(),

amount,

},

],

);In this code snippet, the pool.submit() function is called to deposit collateral into a lending pool. Here’s a breakdown of what is happening here:

pool.submit()is the function call that interacts with the lending pool, submitting a request on behalf of the user to deposit collateral.- The three

&merryparameters represent the address of the lender. - The

&vec![]argument contains the necessary environment (fixture.env) and the actual request to deposit collateral. The request object specifies the type of transaction (RequestType::SupplyCollateral), the asset being used as collateral (stable.address.clone()), and theamountof the asset to be deposited.

Blend Capital offers efficient, and decentralised overcollateralized lending and borrowing services. By understanding the mechanics of overcollateralized lending, engaging with Blend’s lending pools, and participating in the BLND token economy, users can effectively leverage the opportunities presented by this innovative protocol.