Imagine a financial system where your loans automatically pay themselves off, interest-free and without the need for monthly repayments. Alchemix is a synthetic asset protocol run by community DAO.

This is a write up of my research notes and is not sponsored in any way. I currently at time of writing have no stake in Alchemix or it’s tokenised products.

How Alchemix Works

The protocol allows users to access advances on various yield farming strategies through a synthetic token.

- alETH – synthetic Ether

- alUSD – synthetic stablecoin

These tokens represents the future yield generated by deposited collateral.

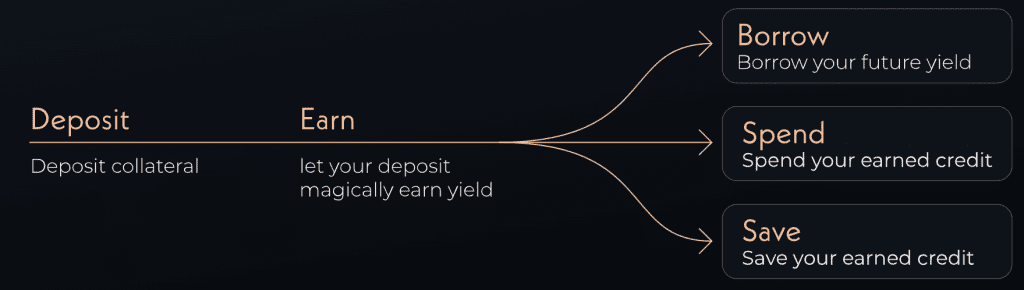

A user will deposit collateral into a Alchemix yield farming strategy of their choice. They can then borrow up to 50% of the locked collateral in one of the synthetic assets. These synthetic assets can be traded on decentralized exchanges at market rates. The original deposit earns a yield which is then used to pay off the loan. The user can either wait for the yield to completely pay off the loan or pay it back earlier to withdraw the collateral.

This allows for efficient tax planning as USD borrowed against ETH collateral may be susceptible to capital gains tax in some jurisdictions.

ALCX Governance Token

The ALCX token serves as the backbone of the Alchemix ecosystem, providing voting rights, incentivizing participation and facilitating the protocol’s sustainable growth. The Alchemix DAO supports the growth of the Alchemix ecosystem and the Ethereum community as a whole.

| Market Cap | $28,661,769 |

| Total value locked (TVL) | $68,786,338 |

| Circulating supply | 1,830,590.54 ALCX |

| Total supply | 2,147,832.51 ALCX |

| Fully diluted valuation | $33,628,864 |

A $33m FDV seems reasonable for a DeFi protocol which has the potential to capture as significant amount of TVL if they achieve product market fit. The risk for users is in the internal economics of the synthetic tokens and of course smart contract risk which will weigh heavy on the growth metrics.

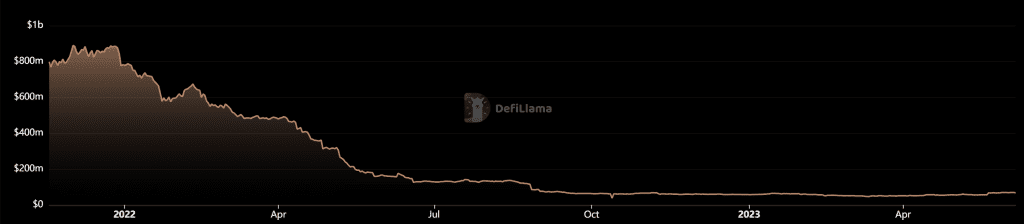

TVL is down from it’s peak in late 2021 where it reached over $850m. Regaining momentum and new users will be key if the project is to establish itself as a viable option for borrowing USD on ETH collateral.

Alchemix Finance offers a compelling product in the DeFi space, a unique blend of self-repaying loans, yield farming, and synthetic assets. If they can get the marketing right and attract the right type of users in the next bull run then the ALCX token price will reflect the TVL growth and future prospects of the protocol.