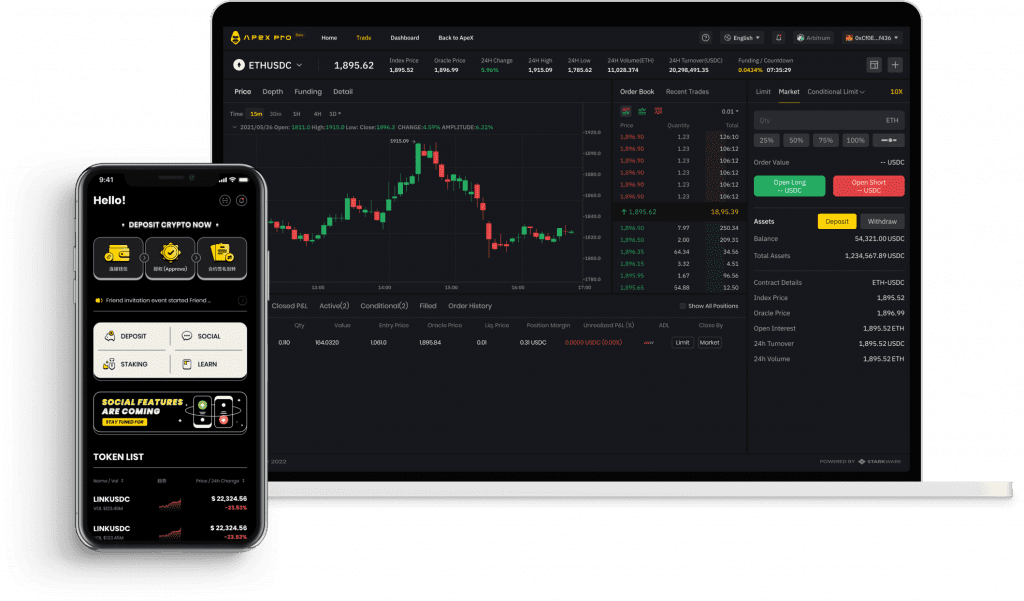

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice.

What Is ApeX Pro?

ApeX Pro uses a central limit order book (CLOB) model similar to centralized exchanges. This is where bids and asks are placed by buyers and sellers for a set price and volume that they are willing to trade at. The order book matches buyers with sellers when prices are met.

To date Uniswap’s automated market maker model has reigned supreme in DeFi trading but this is optimized for Ethereum mainnet where transaction fees are high.

ApeX Pro uses StarkEx & Validium, Layer 2 scalability solutions, to provide faster transaction processing and negligible gas fees. This provides the computation and data storage for the exchange offering users non-custodial trading.

StarkEx & Validium

StarkEx is a Layer 2 scaling solution developed by StarkWare. It uses STARK proofs (Zero-Knowledge Scalable Transparent ARgument of Knowledge), a form of cryptographic proof, to validate a large batch of transactions off-chain before committing them to the Ethereum mainnet. This approach allows StarkEx to significantly increase the scalability of decentralized applications while minimizing on-chain computation and storage requirements, resulting in drastically reduced gas fees for users.

StarkEx accomplishes this by moving the majority of transactions and computation off-chain while still maintaining on-chain security. This is achieved through the use of mathematical proofs that can validate large amounts of data with a small proof. The small proof is then sent to the main chain to be verified. This process allows for a high level of scalability while maintaining a high level of security.

Validium, is another scaling solution that uses ZK-STARKs, similar to StarkEx. However, the key difference lies in the approach to data availability. Unlike StarkEx, which opts for on-chain data availability, Validium uses off-chain data storage. This means that, while the computations are verified on-chain, the data itself is stored off-chain and provided by a separate data availability layer.

The trade-off here is between increased scalability and trustlessness. By storing data off-chain, Validium can potentially scale better than solutions with on-chain data availability. However, it requires users to place more trust in the data providers, as any disruption or manipulation of the data availability layer could affect the reliability of transactions.

Orderbook vs AMM

In this newsletter I recently wrote about how I think decentralized exchanges will evolve as Ethereum 2.0 scales up and on-chain data becomes more efficient.

https://bachini.substack.com/p/evolution-of-crypto-exchanges

tl;dr Orderbooks are going to take over from AMMs when transactional cost comes down and Ethereum users move to either L2 rollups, appChains or enshrined rollups.

APEX & BANA Tokenomics

ApeX Pro has two main tokens that the protocol is built around.

APEX

- APEX is the token that underpins the ApeX Protocol infrastructure.

- The total supply is 1,000,000,000 tokens.

- It not only allows holders to be a part of the protocol’s governance but they can also gain from staking activities.

- Tokens can be acquired at a discounted rate via bonding, but they’re held in a 15-day lock-up period before being released to users.

- They can be staked through different methods, either via trading on DEX platforms, providing liquidity to the eAMM pool or specifially partaking in APEX staking.

BANA

- BANA is essentially a reward token under Apex Pro.

- It was minted from locking in 25,000,000 APEX, providing a total supply of 25,000,000,000 BANA at a redeem rate of 0.001.

- It can be converted back into APEX after a lock-up period based on the amount burnt in the Buy & Burn Pool.

- The token supply of BANA can be potentially increased, but this needs to be approved by APEX holders through governance.

- Users gain BANA from weekly trade-to-earn events, taking into account the fees, USCD balance, completion of user tasks and BANA-USDC LP Token during a calculated period with the Cobb-Douglas function.

DeX Evolution

We haven’t seen widespread adoption of perpetual futures trading within DeFi ecosystems to date. This may be because DeFi leveraged trading presents several unique challenges:

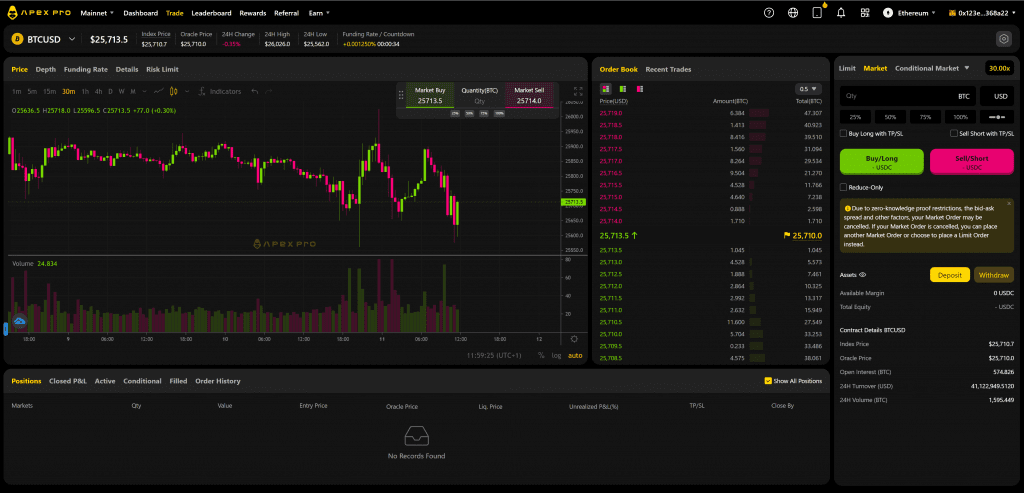

- User Experience (UX): The DeFi user experience has often been complex, expensive and unintuitive, making it challenging for some users. Centralized platforms have simpler interfaces that are more efficient because they aren’t reliant on distributed networks for data transfer.

- Liquidity: DeFi markets often lack the full range of assets found on centralized exchanges, limiting the scope of trades that can be executed. Most DeFi trading avenues currently suffer from poor liquidity, this leads to high slippage costs and difficulties in getting in and out of trades.

The ecosystem is rapidly evolving and numerous projects are aiming to offer leveraged trading offerings on DeFi. Platforms like dYdX and GMX are at the forefront of this expansion but have yet to find real product market fit.

With Layer 2 scaling solutions, we’re seeing significant improvements in transaction speed and reduced gas costs, which is going to solve the user experience side of the problem.

When a “killer trading dApp” takes off it could attract enough users in a short space of time to attract market makers and sophisticated market participants somewhat solving the liquidity issue.

If ApeX Pro or another competitor can solve this they will create a 10x better product than centralized exchanges because of:

- Self-custody of Assets DeFi allows users to maintain control of their assets during the entire trading process. This could greatly reduce the risk of FTX style meltdowns with centralized platforms.

- Interoperability and Composability DeFi’s open-source nature allows for seamless integration between platforms. This makes it possible to transfer assets and execute more complex financial strategies efficiently.

- Accessibility: DeFi leveraged trading could provide all traders, regardless of their country of origin or socio-economic background, the opportunity to participate in complex financial activities typically reserved for professional traders or fund managers in traditional finance. Perhaps a double edged sword and ethically questionable but there is a strong benefit to financial inclusion.

Conclusion

ApeX Pro provides a decentralized solution for permissionless trading of perpetual futures contracts. This will be a trillion dollar industry one day in my opinion as active traders move to decentralized finance.

ByBit are one of the largest centralized exchanges and likely have some competitive advantages in terms of market maker relationships to bootstrap liquidity and offer a better user experience.

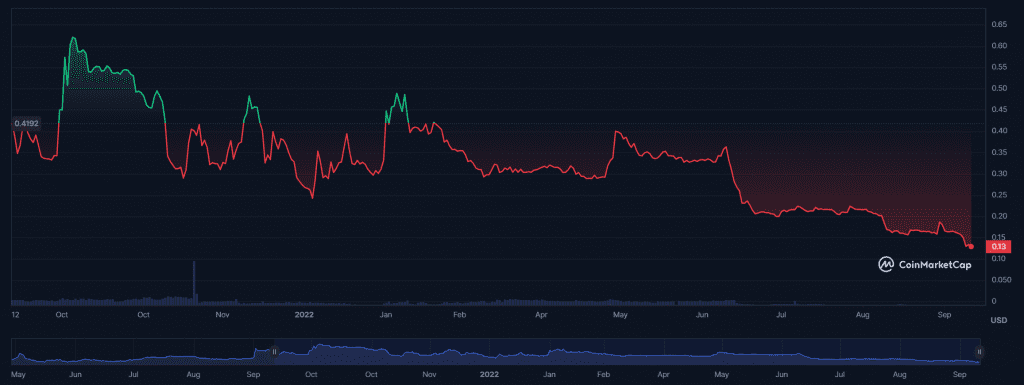

The tokenomics are interesting but the APEX token specifically has been underperforming (like many other altcoins in a bear market).

I think it is one of a handful of DeFi trading venues that is worth keeping an eye on over the next few years. At some point this is going to become a massive sector within DeFi and at this time there is no clear winner.

I’ll be looking at more decentralized trading protocols over the coming weeks so sign up for the newsletter if you want to stay updated: https://bachini.substack.com