Trading DeFi Futures products on decentralized exchanges such as GMX and DyDx has never been easier. The user experience is getting close to on par with centralized exchanges. Liquidity however, not so much…

In this article we will look at how DeFi futures work, the market opportunity for decentralized futures exchanges and the two most popular DeFi futures markets.

What Are DeFi Futures

In cryptocurrency markets futures contracts trade at around 10x the volume of spot markets. So for every 1 Bitcoin bought and sold there will be 10 futures contracts traded.

Futures contracts offer a number of benefits over spot markets such as the ability to go long and short on a digital asset. A user can put down collateral such as a USD stablecoin and take a leveraged position.

Leverage works by multiplying the amount of assets you can trade. So if you deposit $100 to an exchange that has 10x leverage. You can go long or short to the value of $1000 in futures contracts. You can essentially purchase or short sell $1000 of assets. However leverage brings about risks, if the price moves <10% against your position at 10x leverage you will get liquidated and lose all your collateral.

Note that you can’t withdraw spot assets from futures markets. The contract acts as a digital agreement between holders on both the long and short sides to settle at some point in the future. In crypto markets we tend to use perpetual futures contracts which have no fixed settlement dates.

PERPs – How Perpetual Futures Work

Unlike traditional futures contracts that have a specified expiration/settlement date, perpetual contracts allow traders to hold their positions indefinitely. These came to popularity with the rise of Bitmex around 2017 and have been popular on centralized exchanges ever since.

To keep the contract in line with the market price of the underlying asset, perpetual contracts use a funding rate. This funding rate is paid by one side of the contract to the other side periodically. The funding rate is calculated based on the difference between the current price of the underlying asset and the price at which the perpetual contract is trading.

If the perpetual contract is trading at a premium to the current market price of the underlying asset, long positions pay short positions. Conversely, if the perpetual contract is trading at a discount to the current market price of the underlying asset, short positions pay long positions. The funding rate mechanism helps the futures contract maintain it’s peg to the underlying asset.

The Post FTX Battle

Since the collapse of FTX in 2022 a market opportunity has appeared for a decentralized exchange. Sam Bankman-Fried trading off customer deposits at Alameda was perhaps the biggest advert for self-custody of trading assets and the transparency of DeFi.

There will always be demand for leverage and trading products but the demand increases multitudes in bull markets. When crypto markets do their thing exchanges get busy and struggle with the sheer volume of users wanting to trade digital assets.

There is currently a battle for liquidity and attention from two DeFi futures markets as they look to become market leaders before the next bull run. It seems likely that in the next leg of the market cycle we will see a huge increase in adoption of decentralized futures trading and that will bring with it opportunities in terms of arbitrage, funding rates and governance tokens.

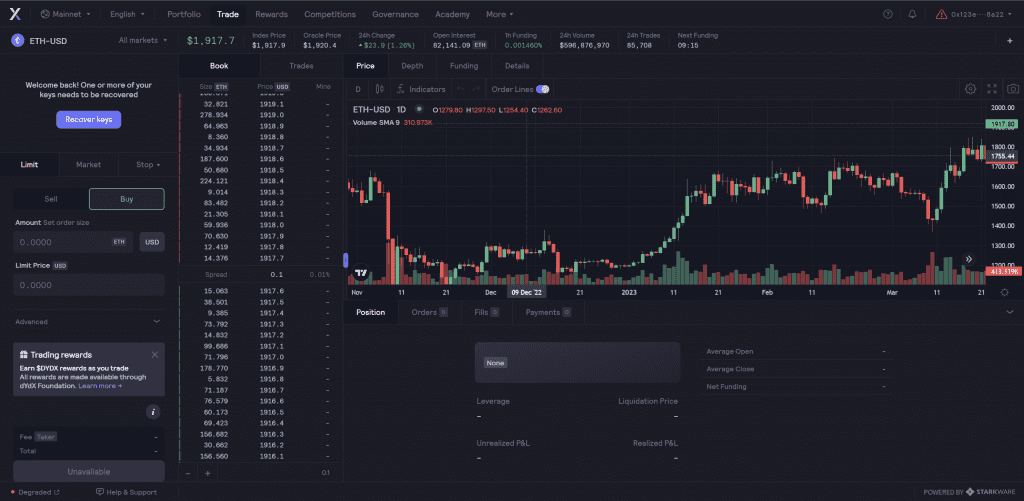

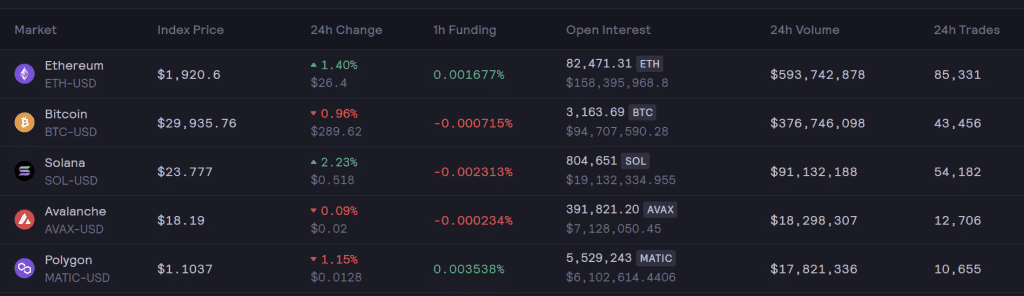

dYdX Analysis

dYdX is a decentralized futures exchange focused built on Starkware’s StarkEx scalability engine using zero-knowledge rollup technology with zkSTARKS, allowing for increased scalability of the network. The technology receives proofs, while validating a batch of transactions off-chain. These proofs are then sent back to the blockchain, where they are verified by a smart contract.

The platform supports margin trading, with isolated margin allowing users to assign particular funds in the account as part of a trade, while cross-margin utilizes all the assets a trader keeps on the platform. The exchange currently offers a maximum of 25x leverage on perpetual futures contracts for 32 assets.

The founder and CEO of dYdX is Antonio Juliano, who first entered the crypto space in 2015 upon getting a job as a software engineer at Coinbase. As a Princeton University graduate with a degree in computer science, Antonio embarked on his entrepreneurial journey and founded dYdX in early 2017.

dYdX introduces retroactive mining benefits, allowing the platform to show appreciation to historical users and incentivize them to trade on layer 2 protocol.

The TVL has dropped since peaking in October 2021. The DYDX governance token has a market cap of $385m but a fully diluted market cap of $2468m

GMX Analysis

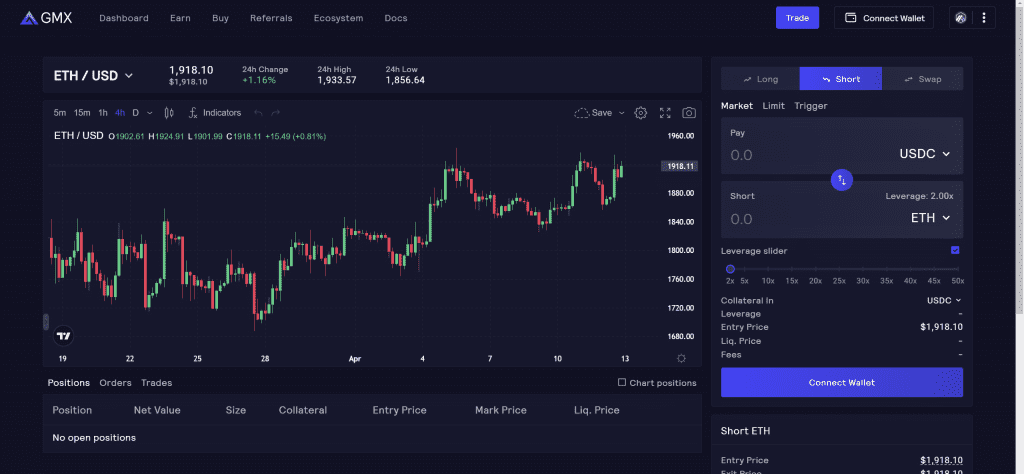

GMX is a decentralized exchange that allows users to do spot swaps and trade perpetual futures with up to 50x leverage while allowing users to have custody of assets in their cryptocurrency wallet. With low swap fees, zero-slippage trades, and limit orders, GMX is looking to provide its users with a better and more efficient trading experience.

The GMX protocol achieves zero-slippage through a multi-asset liquidity pool called GLP. The pool consists of 50-55% stablecoins, 25% ETH, 20% BTC, and around 5-10% other altcoins. Liquidity providers add liquidity when they mint GMX Liquidity Provider Tokens (GLP), in exchange for which they receive 70% of fees generated on the blockchain and no impermanent loss. The GLP pool acts as a counterparty for trades in a similar way to Synthetix.

GMX is multichain with most of the liquidity on Arbitrum. It utilizes price oracles such as Chainlink to get accurate price data for assets and liquidate positions accordingly.

The GMX token is the protocol’s utility and governance token. It has a market cap of $670m and a fully diluted market cap of $700m. Token holders can stake their tokens and earn three types of rewards.

- Stakers are eligible for 30% of all generated protocol fees distributed to all GMX token stakers

- Stakers earn esGMX (escrowed GMX) tokens, which can be staked to earn further rewards or vested. If a token holder vests these tokens, they are converted back to GMX tokens over 12 months

- GMX stakers earn Multiplier Points that help boost yield and reward long-term users, helping further decentralized ownership on the platform

Trading On DeFi

Today their just isn’t much liquidity on DeFi futures exchanges compared to centralized exchanges such as Binance. There are fewer assets to trade and executing large orders on low liquidity altcoins just isn’t possible.

This needs to change before DeFi futures exchanges have their moment. Users want 100x leverage, permissionless decentralized execution and all the latest and greatest altcoins.

The issue with getting more risky assets onto an exchange like GMX is that it puts the GLP liquidity pool at risk. In order to solve this issue, DeFi futures exchanges need to find a way to increase liquidity while also maintaining the security of the platform. One possible solution could be to incentivize market makers to facilitate larger trades. Essentially we have the user experience of FTX in a DeFi protocol but now we need the equivalent of Alameda to provide liquidity for all markets.

DeFi futures exchanges have the potential to revolutionize the way that traders interact with the financial markets. However, in order to achieve their full potential, these platforms need to address the challenge of getting liquidity and more assets on the platform.

Out of the two platforms I looked at GMX seems to be the clear frontrunner in terms of trading technology and also as a potential investment. I believe that currently more people are invested in GMX/GLP than there are actually trading on the platform. Perhaps GMX or dYdX can mature into the decentralized futures exchange that we want and need in this industry or perhaps something new altogether comes along and simplifies things in the same way Uniswap disrupted spot markets.