Money flows in and out of DeFi ecosystems like the changing of the tide. In 2021 fifteen different blockchains exceeded one billion us dollars in total value locked. The early adopters who stay ahead of the money flow tend to make the highest returns. Aurora looks set to become another billion dollar DeFi ecosystem. This article explores the tech, the $800m grants program, the most recent opportunities and how to yield farm on Aurora and Trisolaris.

Layer Zero

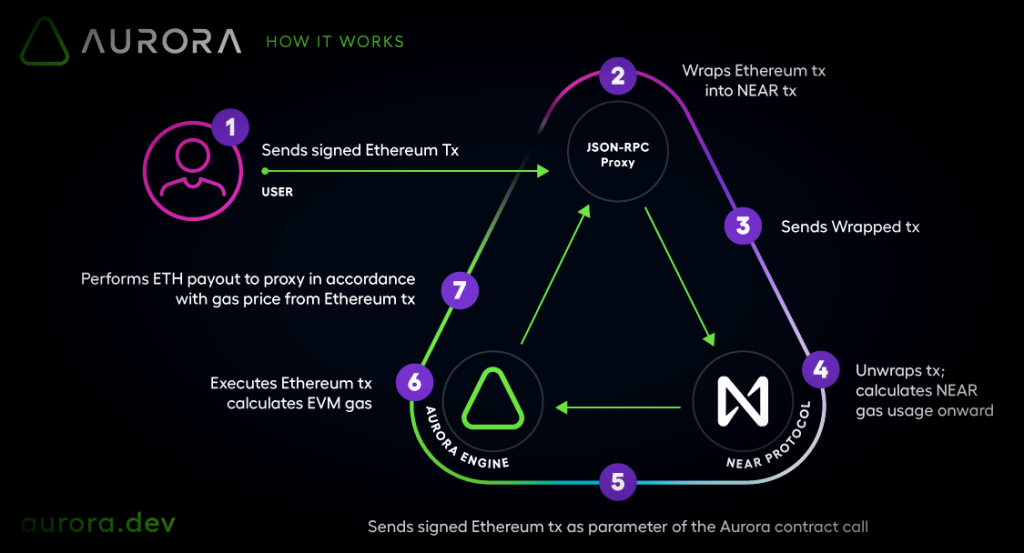

Aurora runs on Near Protocol and has been developed by the same core team. Near Protocol is a layer zero proof of stake network that aims to be a community controlled cloud incentivise developers to build layer 1 chains on top of it.

Aurora has some incredible performance stats that we will look at later. These are made possible due to Near Protocol’s sharding technology known as Nightingale. Sharding splits the network data into fragments and distributes it in a way so that each node doesn’t need to manage the entire network history.

Near Protocol has a native token called NEAR however this might not be the best way to gain exposure to the growth of Aurora for a few reasons

- VC’s have already purchased around 350m of the 1b Near tokens in early stage funding rounds at a discounted rate and are sitting on unrealised gains.

- Aurora uses ETH for transaction fees which are so low it’s negligible. Unusual that they wouldn’t use the NEAR or AURORA token.

- Supply inflates 5% each year, with 90% going to node operators with the rest going to a treasury fund.

Having said that if Aurora takes off it’s likely to be very good for Near Protocol and the NEAR token valuation. It’s also potentially interesting as a long term holding because even if Aurora underwhelms there is the potential to launch something else on the Near network in the future.

One of the things I really like about Near Protocol is the professionalism of everything they do. From the carbon neutral certifications to the branding and presentation. It’s the kind of thing that wouldn’t put off a institutional trad-fi investor.

Aurora EVM

Aurora is Ethereum virtual machine (EVM) compatible making it easy to deploy contracts and protocols from other EVM chains like Ethereum, BSC, Polygon and Avalanche C-Chain. Developers can simply fork open source code and deploy it to Aurora.

The benefit of this is that we know there will be a lot of protocols and platforms launching both new and cross-chain versions of existing products. One drawback of EVM chains is that because it’s so easy to deploy code there are also going to be a lot of scams and rug pulls.

Aurora has block times of just over one second and transaction confirmation times of around 2 seconds. This is exceptionally quick and if it works at high loads it will compete with any high performance blockchain out there. Transactions are currently free but I assume that will change as soon as they experience a DoS attack but even once the fees are turned on transactions will only cost around $0.01 USD.

The team has also deployed a Rainbow Bridge which facilitates trustless cross chain transfers of ERC20 tokens between Ethereum and Aurora.

Aurora also has a native governance token with a 1 billion supply distributed as follows. Utility cases for the token aren’t obvious as transaction fees are paid in ETH. Probably staking incentives (further inflating supply) and potentially fees from Rainbow Bridge could create some demand on exchange.

Somewhere in the region of 250 million tokens are locked in a vesting program for VC’s and team members. This includes 2 year unlocking schedule from 18th November 2021.

- 25% unlocked after 6 months

- 12.5% after 9, 12, 15, 18, 21 and 24 months

Aurora is compatible with standard Ethereum tooling such as Metamask, truffle, hardhat etc.

$800m Incentives

We saw last summer with Avalanche how effective incentives can play in launching an alternate layer one blockchain. Incentives attract the initial liquidity that gets the DeFi flywheel turning and starts things in motion to grow TVL, user numbers and developer interest.

There’s an active development program with milestone grants available and applications in the following areas:

The best place to start for developers is: https://aurora.dev/start

Opportunities

The first thing I’d suggest doing is trying out the bridge using the Ethereum Ropsten test network. If you need some free testnet tokens then visit Paradigm’s excellent faucet here. This provides an easy way to get acquainted with the bridge before we look at investment and yield farming opportunities.

Staking of the AURORA token is due to go live in Q1 this year.

However I think it will be the VC’s that walk away with the biggest gains on NEAR and AURORA and the risk/reward isn’t as good as some ecosystem plays.

In past L1 rotations we’ve seen ecosystem tokens like JOE and CAKE outperform in the early stages of network adoption. Here is the current Aurora ecosystem listed on DeFillama: https://defillama.com/chain/Aurora

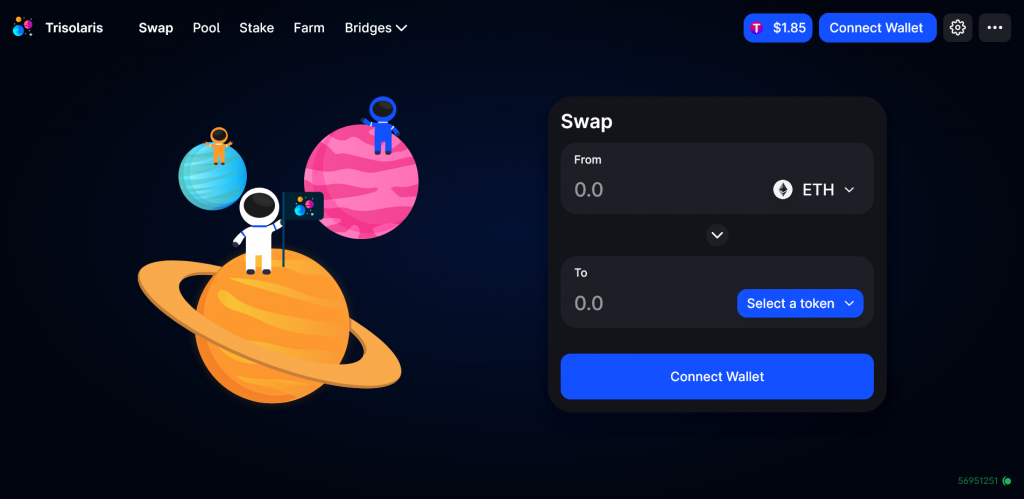

Investors generally want to own the best in class assets due to the long-term tendency in tech to trend towards monopolies or dualopolies. In crypto money tends to flow to lower market cap altcoins in bull markets and then returns to market leaders in bear cycles where investors have the highest convictions. For these reasons we will be focusing on Trisolaris which is the leading DEX. I’ll also cover Nearpad which is a launchpad project because this will provide early access to projects where both risk and reward are at their highest.

Trisolaris

Trisolaris is a pretty standard automated market maker based on Uni v2. There’s a native TRI token which has single sided staking rewards currently at 36% APR.

TRI Tokeomics

TRI has a fixed supply of 500 million.

Distribution is set at 70% to liquidity providers with an emittance schedule set for 3 years, 15% to treasury funds and 15% to the team with a 1 month cliff and 12 month vesting.

The current incentivised pools with their allocation percentages are:

- wNEAR-TRI 22%

- wNEAR-ETH 11%

- wNEAR-USDC 11%

- wNEAR-USDT 11%

- USDC-USDT 10%

- wNEAR-WBTC 11%

- AURORA-ETH 2%

- TRI-AURORA 7%

- wNEAR-LUNA 1%

- wNEAR-UST 1%

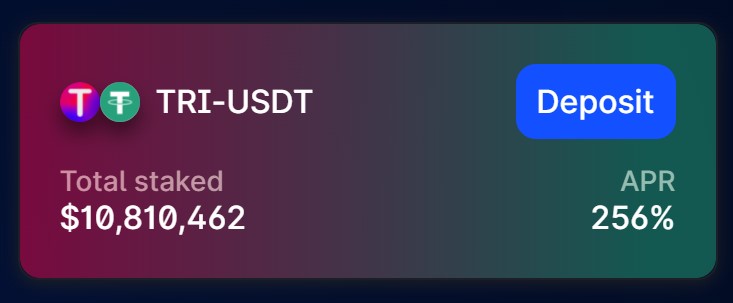

- TRI-USDT 13%

The two that jump out at me here for yield farming are the stable pool USDC/USDT which will likely be popular. Also the wNEAR/TRI which is wrapped NEAR governance token. I’d expect these to move somewhat in line which would reduce impermanent loss.

Perhaps a strong yield farming strategy worth considering if you are heavy stablecoins right now is to deploy an allocation in the USDC/USDT pool to earn TRI and then stake the TRI for an additional 36% APR or in a TRI-USDT pool which currently has a 250%+ APR. If TRI appreciates or maintains its value then the upside potential is exceptionally high and the downside risk is mainly in opportunity cost and smart contract risk.

I’ve made a video which covers this strategy below: Trialis Yield Farming On Aurora

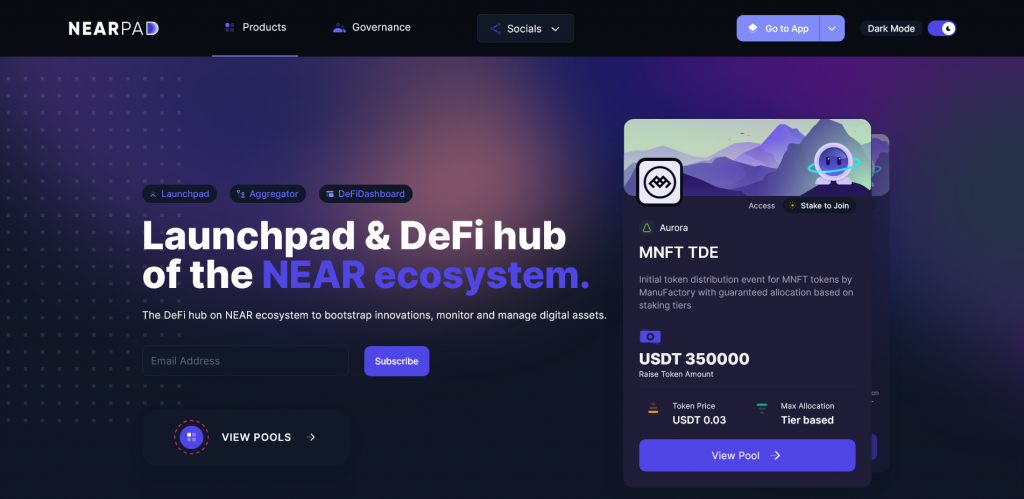

NearPad

Nearpad is a launchpad which acts as an IDO platform for new projects, a bit like kickstarter for crypto. We’ve seen lucrative launches on other alt layer 1 ecosystems with launchpads like SolStarter and PolkStarter.

Currently there’s only one project launching MNFT and this wasn’t within my area of expertise but I think this site is worth bookmarking and coming back to in a few weeks to a few months time to see what is happening.

Yield Farming

There are some good yield farming opportunities right now on Trisolaris with incentivised liquidity pools through the distribution of the TRI token. Here is a video in which I talk about Aurora and demonstrate bridging tokens, providing liquidity and then staking LP tokens.

Note there are always risk with DeFi protocols and it’s important to do you own research. I wrote a bit about a framework for assessing DeFi risk here: https://jamesbachini.com/defi-risk/

Conclusion

Near Protocol has a strong team, plenty of funding and a good product which has proven demand in Aurora. The potential growth of this ecosystem will likely create opportunities and risks for investors and traders. Currently I think that working on Trisolaris is compelling and provides the best risk to reward for the ecosystem.

The TRI token is a farm token however so staking to keep up with supply is essential and it is likely to devalue over a long time frame. Timing will be critical and not easy to get right. Allocating capital early to earn TRI tokens which can be staked or compounded back in to the pool is in my opinion the most +EV play in the Aurora ecosystem right now.