Celestia is one of the most widely used scaling solutions for projects that need high throughput, cheap transactions on a dedicated decentralized public blockchain.

The aim is for “developers to deploy their own blockchain as easy as deploying a new smart contract”

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Celestia at time of writing. Do your own research, not investment advice.

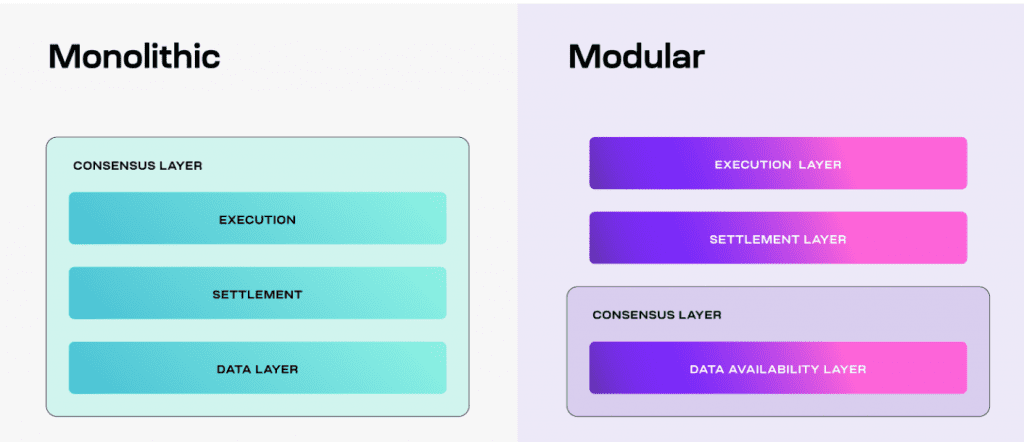

What Is A Modular Blockchain?

Modular blockchains are designed to improve scalability, flexibility and interoperability. In a modular blockchain, tasks are distributed among specialized nodes, rather than concentrated in a singular system. This modularity allows for greater customization and scalability, creating a more efficient platform for developers to build their own appChains. An appChain is a dedicated blockchain specifically deployed for the use of a single application.

Modular blockchains divide tasks such as transaction processing, dispute resolution, transaction ordering and data availability into separate specialized tasks. Celestia focuses on consensus and data availability rather than execution, users deploy their own execution clients such as EVMs (Ethereum virtual machines).

Modular blockchains like Celestia are not restricted to a single execution environment, enabling developers to build applications and chains according to their preference and needs.

Despite the increase in complexity, Celestia keeps user costs low by relying on a technique called “data availability sampling“. I think of data availability sampling as a random check on a small part of a data set to determine it’s validity.

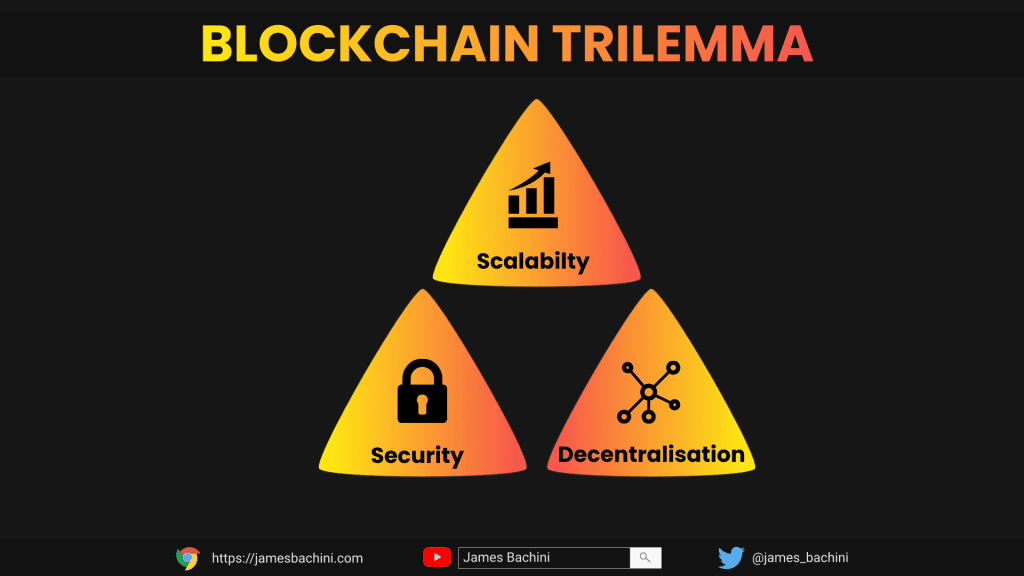

Modular blockchains are designed to tackle the blockchain trilema and improve scalability without compromising the security or decentralization of a system.

What Does It Cost & Who Pays?

Celestia uses a fee structure where users submit data blobs in “blob transactions”. This transaction includes two parts:

- The data blob itself

- A transaction fee, which covers processing

Much like on mainnet, transactions with higher fees take priority in the system, but there’s no minimum fee required by the protocol. Nodes running transactions in the system use locally configured gas price thresholds that form part of the processing criteria.

In Celestia, gas refunds do not apply and users should ensure their set gas limit is accurate for the transaction. A function named GasToConsume() is available to calculate the total gas for all blobs in a transaction.

There are four ways a blob transaction can be submitted.

- A Celestia consensus node

- A Celestia light node

- GRPC to a consenus node

- JSON RPC to a consensus node

EVM AppChain For Solidity Devs

Celestia is compatible with the following rollups:

- Rollkit – for Cosmos SDK replacing tendermint

- OP stack – built by the Optimism team

- Sovereign SDK – zero knowledge virutal machine

- Dymersion – an IBC-enabled RollApp

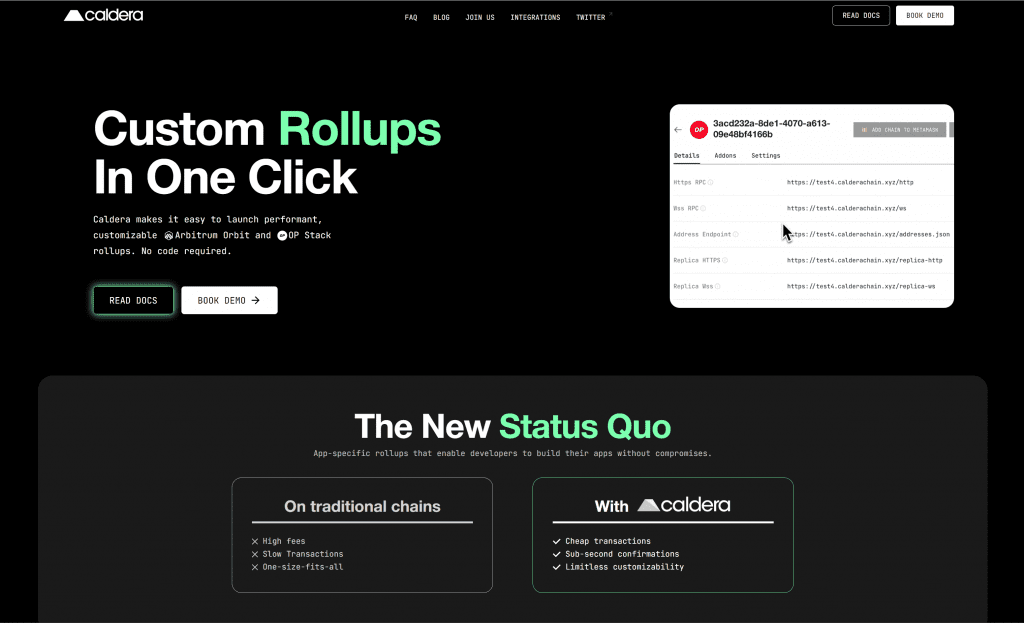

There is also Caldera which offers customizable Arbitrum Orbit and OP Stack (which uses Celestia under the hood) rollups at the click of a button. Caldera also includes a native two way digital asset bridge.

The potential here is for developers to create EVM blockchains with confirmation times below 1 second and negligible gas fees.

The downside of deploying smart contract code to an AppChain is that there are no existing assets or DeFi protocols to integrate with. You can’t build on the lego bricks of DeFi because you have the entire chain all to yourself.

For certain applications that require fast, cheap transactions but interoperability isn’t a concern, this is like living in the future.