Curve finance recently launched their own stablecoin crvUSD. I was lucky enough to meet one of the developers working on crvUSD at ethDenver and have been impressed with the product and how it has been rolled out.

It is an algorithmic stablecoin with massive potential backed by one of the biggest names in DeFi, let’s dive in.

This is a write up of my internal research notes, this is not a sponsored post however I do have an allocation to Curve via convex finance in my personal portfolio which could create bias. Do your own research, not investment advice.

- What Makes crvUSD Different?

- Minting crvUSD

- Strategies & Opportunities For crvUSD

- Impact For Curve Finance

What Makes crvUSD Different?

Most overcollateralized stablecoins have a simple product where you deposit an asset like ETH and can mint up to 66% of the dollar value in a stablecoin. This acts like a loan that you can pay back at any time and reclaim the original collateral. If the value of ETH drops so that your collateral is worth less than say 90% of the loan it opens it up to 3rd parties to liquidate the position. You keep the stablecoin but lose the underlying collateral.

This is simple but perhaps not optimal as participants risk getting liquidated when using volatile digital assets which often experience wide price swings. Curve came up with the idea for a soft liquidation where if the collateral value decreases it get’s sold off gradually to reduce the risk of ruin.

When your collateral enters soft liquidation, it means that the value of your collateral has fallen below a certain threshold. In this mode, certain restrictions are applied to your position

- You are not allowed to withdraw the collateral

- You can’t add more collateral to your position but you can add crvUSD

- Collateral gets swapped into crvUSD gradually as price moves against the position

If the price of your collateral continues to drop sharply and reaches a more critical level, your position will undergo hard-liquidation. At this stage your position will be liquidated and all your collateral will be sold off to repay the outstanding debt.

The soft liquidation is executed using bands where the collateral is divided into tranches a bit like concentrated liquidity in Uniswap. Each band represents a specific range of prices for the asset used as collateral. The purpose of these bands is to optimise the risk of liquidation for each portion of collateral.

As price moves down through the bands collateral gets sold off on the Curve AMM for crvUSD by MEV bots. If price moves back up the reverse happens and your collateral is repurchased using crvUSD all be it at a likely loss.

There’s more information on the mathematics of how these bands are optimised in the whitepaper here: https://github.com/curvefi/curve-stablecoin/blob/master/doc/curve-stablecoin.pdf

The variable borrow rate (currently 9-10%) is also used to incentivise the maintenance of the peg to the US dollar. When positions are in soft liquidation the rate can fall creating incentives for market participants to borrow. In contrast to this an increasing rate incentivises existing borrowers to buy crvUSD and repay their loans.

A concept known as peg keepers is also used to help maintain the peg. Peg Keepers are smart contracts which enables arbitrageurs to mint or burn crvUSD based on market demand relative to a 3rd party stablecoin. Currently their are 4 peg keeper pools for USDC, UDST, USDP & TUSD.

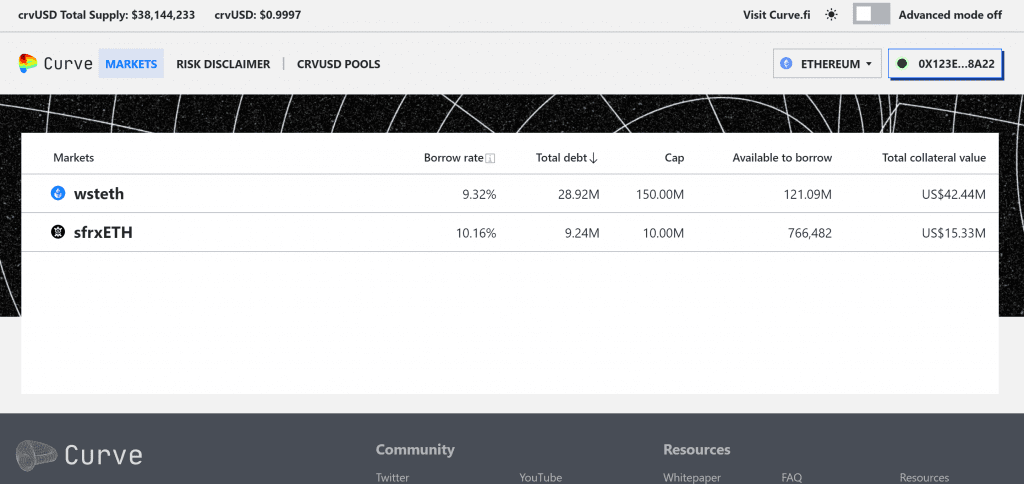

Minting crvUSD

Curve have once again pushed the boundaries of user interface design with their cutting edge web3 platform. I joke but I actually love it.

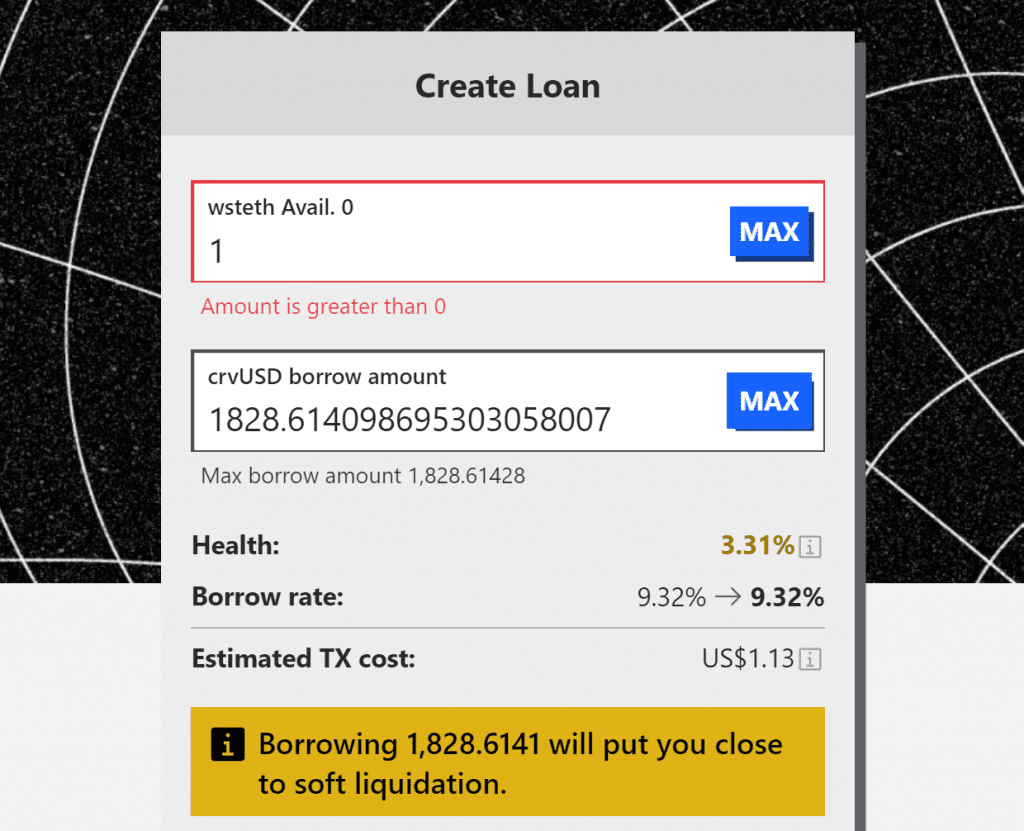

A user can deposit a staked ethereum token, for example wrapped stETH from Lido Finance and mint crvUSD.

Note that you can borrow a very high value relative to the collateral.

This screenshot was take when ETH was trading at $1886 USD. A small price move and it would start soft liquidating.

Note that the bands at which you deploy capital are adjustable and you can fine tune them in advanced mode.

Strategies & Opportunities For crvUSD

The sensible thing with any collateralized debt position is to borrow a small amount on top of enough collateral so that it can never get liquidated. Manage that position so that you are not at risk of losing the collateral.

I think crvUSD is setup and marketed as a passive set and forget loan which encourages users to take on risk while entrusting their collateral to a algorithmic liquidation process.

There are a number of opportunities that crvUSD can be used for:

- Leveraging up a position, deposit 100 wstETH, borrow dollar value of percentage and use it to buy more wstETH, repeat until you have desired leverage.

- Extract stablecoins to pay for expenses while still holding exposure to crypto assets. Many individuals and organisations in the space do this to cover costs without drawing down their portfolios.

- Avoid capital gains tax in some jurisdictions where loans are not taxed in the same way that withdrawals would be. Seek legal/accounting advice on this one.

The one issue with collateralized debt positions is timing your entry. In an ideal world you would sell of your digital assets at a market top getting the best US dollar price for them. If you take out a CDP at this same time it will almost certainly get liquidated as the market falls from the market top.

Taking out a position at a market bottom isn’t optimal either as you get a lower USD value on your assets. For users with idle funds in stables, it can be an opportunity to deploy capital to a leveraged staked Ethereum position. This is the best case scenario but timing market bottoms is difficult and terrifying.

Arbitrage Trading crvUSD

Take a look at this video published by Curve about arbitrage trading crvUSD using vyper.

Impact For Curve Finance

Curve have created a compelling product that offers benefits over what is currently available in the marketplace. Most users don’t want to have to actively manage their positions every time the market dips. By creating a soft liquidation mechanism it reduces some of that risk by automating some of the rebalancing functions that a user would normally have to undertake.

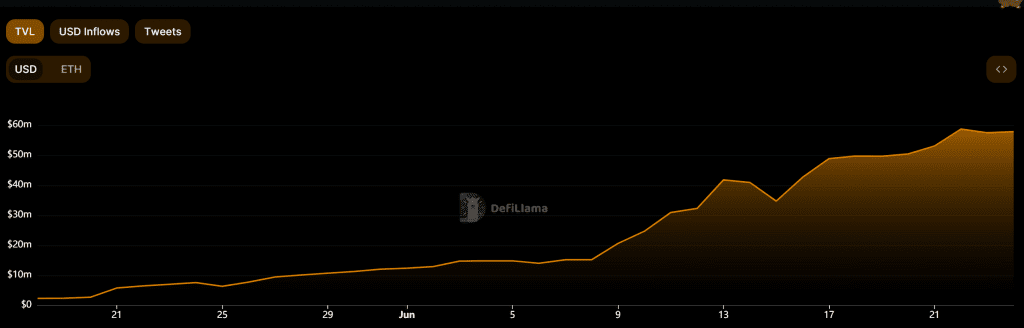

Curve is a DeFi giant specialising in stablecoin and stable asset pools. They are well positioned to create a stablecoin and also benefit form it’s success. I wouldn’t bet against crvUSD becoming the largest algorithmic stablecoin by TVL over the coming years.