This article looks at the future of crypto index funds running on DeFi and in particular the Set Protocol and Index Coop. Crypto index funds known as sets provide a single token which represents a managed or fixed fund of digital assets.

- Index Funds in TradFi and DeFi

- Creating A Crypto Index Fund Video

- Set Protocol v2

- TokenSets Website

- Yield Farming With Index Coop

- Popular TokenSet Index Funds

- Creating A Set On Polygon

- Asset Management For Set Owners

- Set Protocol Team & Traction Analysis

- Solidity Code Review

- Conclusion | Future Of Crypto Index Funds

Index Funds in TradFi and DeFi

In traditional finance index funds are the most common investment vehicle for passive investing. Over $8 trillion USD has been allocated to various index ETF’s with the SPDR S&P 500 ETF Trust holding $0.4T alone. These funds charge low fees on high volume and it’s big business for the operators.

In DeFi we haven’t seen the same rush towards passive investing that we’ve seen in traditional markets. I think that some of the reason for this is the acceptance that it’s hard to beat the SP500 while in crypto most traders/hodlers/investors have had outsized gains by simply investing early in the latest and greatest projects.

The point is that it’s far easier to outperform Bitcoin in crypto markets than it is to outperform the SP500 in traditional markets. This will likely change over the next decade as the market matures, institutions come in and the inefficiencies are ironed out.

Bitcoin has grown in to a serious asset class in it’s own right and who knows what it’s USD valuation will be in 10 or 20 years time. The higher it goes up, the more money comes into the markets and it’s expected this will have a dampening effect on the volatility. By the time BTC gets to $1 million the biggest opportunity for independent retail traders and investors will be gone.

Markets will become harder to trade and it will turn into a zero sum game where money flows from retail to the more sophisticated quants and institutions. When crypto markets are up only everyone can make money, when they go sideways it’s much harder to take profits from other market participants.

At some point along this maturation curve passive investing should become more appealing for crypto investors looking for set and forget strategies. Enter crypto index funds…

Creating A Crypto Index Fund Video

Set Protocol v2

Set Protocol is a tokenised asset management system for building crypto index funds. Assets within a set or TokenSet are held in a decentralised smart contract on either the Ethereum or Polygon blockchain. A user can buy a token which represents the set giving them exposure to all the underlying assets held within the contract.

Independent asset managers can create their own token sets and rebalance them according to their own strategies. Most ERC20 tokens that are traded on Uniswap and Sushiswap can be added to a set. This opens up the potential for asset managers to add value and charge fees for allocating funds to the best performing digital assets.

Once a set has been created it can be traded via an ERC20 compatible token.

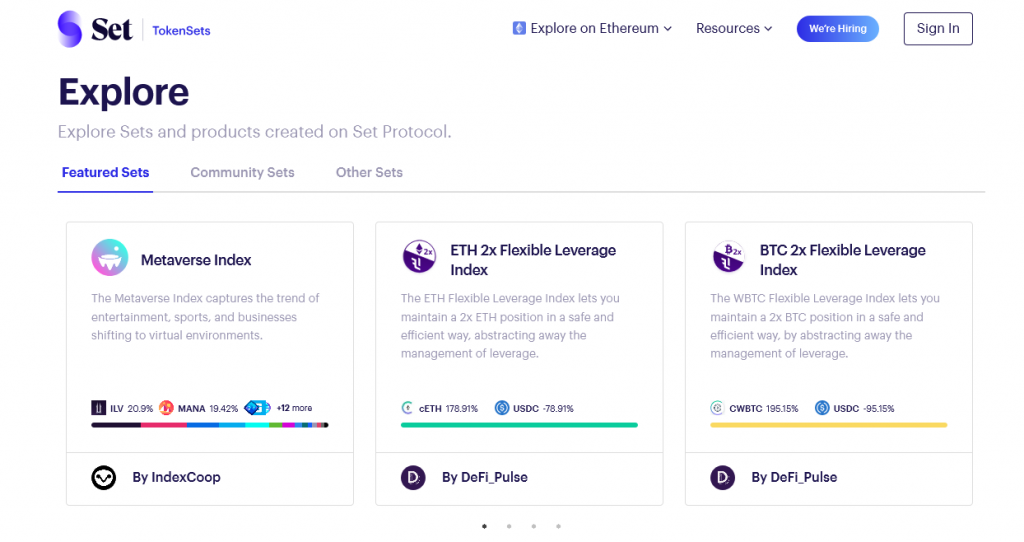

TokenSets Website

The TokenSets website at https://www.tokensets.com is a platform built by the Set Protocol team. It provides a user interface meaning anyone can create a set without any coding knowledge.

Connect a wallet and you can build, buy an sell sets from within a web browser.

Token sets are broken down into 3 types:

- Robo Sets – passive sets that follow hard coded parameters

- Social Sets – actively managed funds aimed at copy trading social influencers

- Portfolios – newly added set type for portfolios of digital assets

Yield Farming With Index Coop

Index Coop is a subsidiary of the Set Protocol which was created to incentivise adoption. It functions as an independent decentralised asset manager controlled by a DAO. I tend to think of Set Protocol as the infrastructure provider and Index Coop manages the fund itself.

The INDEX token provides a voting and governance mechanism for the decentralised asset manager. INDEX is distributed via liquidity mining incentives. Currently there are 3 pools:

- Uniswap V3 DPI-ETH Liquidity Program

- DPI Liquidity Program

- MVI Liquidity Program

More details on the latest pools can be found here: https://www.indexcoop.com/liquidity-mining

This opens up various possibilities for yield farming such as purchasing the DPI (DeFi Pulse Index) set token and providing liquidity against the ETH pair on Uniswap then staking the LP tokens to earn INDEX tokens as well. There would likely be some impermanent loss but I’d expect DPI and ETH to be somewhat correlated as DeFi blue chips and ETH tend to move together over the mid-long term.

Popular TokenSet Index Funds

Here are the most popular set protocol crypto index funds as of November 2021.

| Product | TVL | Description |

|---|---|---|

| ETH 2x Flexible Leverage Index | $209,828,211 | 2x Leveraged long position on Ethereum |

| DeFi Pulse Index | $195,467,609 | DeFi Pulse index of market cap weighted DeFi tokens |

| Metaverse Index | $37,653,837 | Index Coop set focused on metaverse tokens |

| BTC 2x Flexible Leverage Index | $20,178,199 | 2x Leveraged long position on Bitcoin |

| Sushi DAO House | $9,571,531 | Conservative actively managed portfolio by Sushi DAO |

| Bankless BED Index | $5,949,695 | 33% BTC, 33% ETH, 33% DPI (DeFi Pulse Index) |

Some of these are really compelling and I think the Bankless BED index isn’t too far away from my own crypto portfolio with the exception of a yield bearing stablecoin allocation.

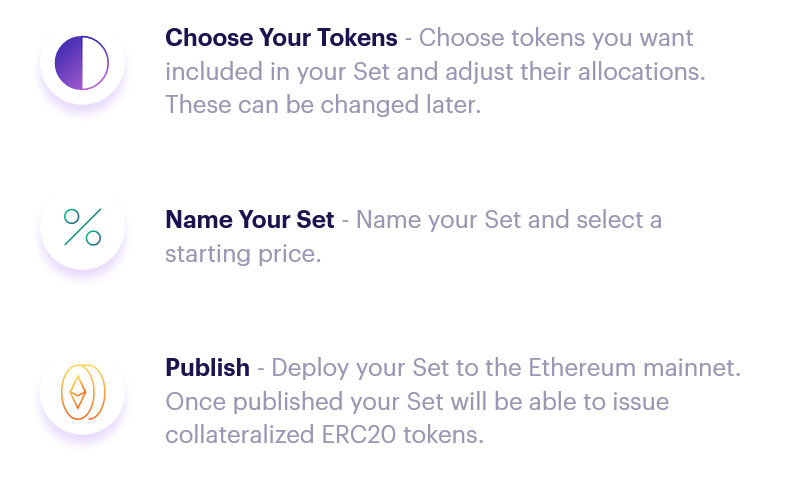

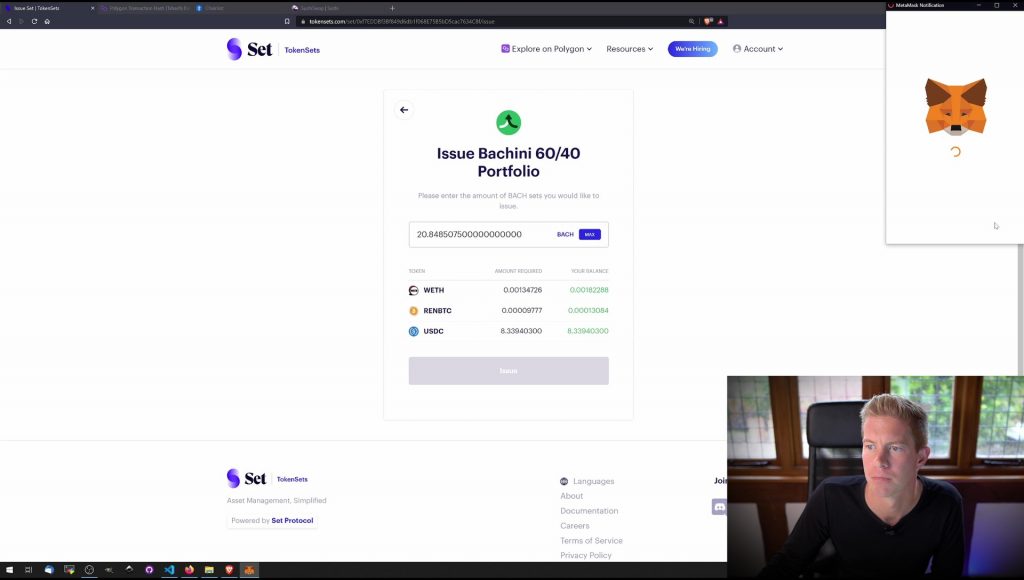

Creating A Set On Polygon

The first step is to setup metamask and add Polygon as an alternative network.

Then we need some MATIC tokens in the wallet which can be purchased from Binance or FTX. These are the native tokens for the Polygon network and will be used to pay transaction fees.

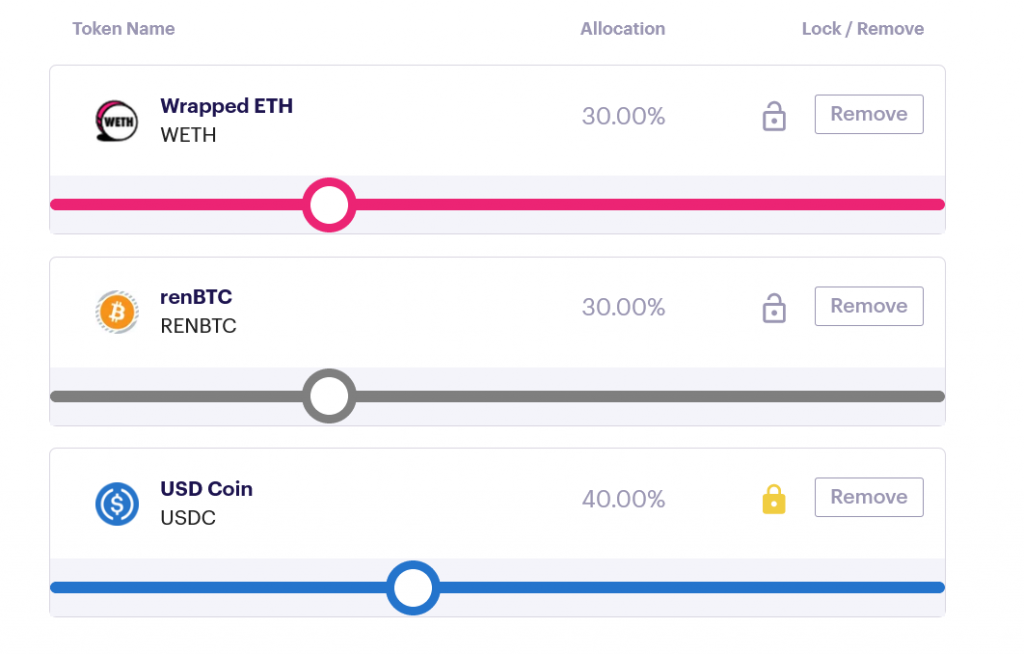

There are 3 stages to setting up your Set Protocol index fund:

The first step is to choose tokens and set the allocation percentages. Note that we are using wrapped Ethereum and renBTC for exposure to the native assets.

Note that publishing a set on Ethereum L1 is expensive in Gas due to the need to deploy contracts as part of the process. Fortunately there is also an option to deploy on Polygon (Matic) which has much lower transaction fees.

Once published we can add tokens to the set contract so that it holds value and issue set tokens which are ERC20 compaitble to represent those holdings.

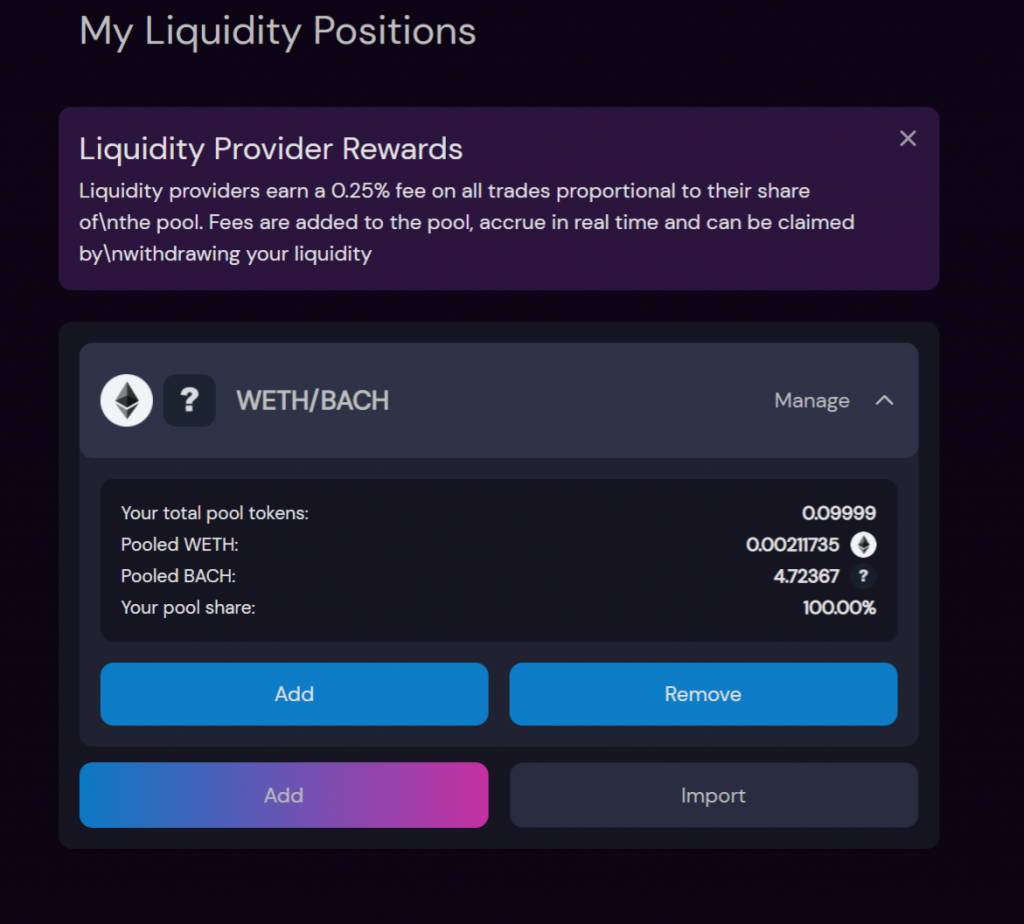

We can then provide the token for the set as liquidity on a DEX such as SushiSwap.

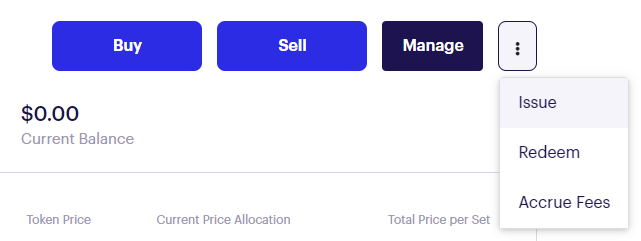

Asset Management For Set Owners

Managing a set takes place on the TokenSets management portal. If you select your set and have the owner wallet connected you’ll see a manage button. Once in the management portal users need to enable different modules to enable functionality such as issuing new tokens and setting fees.

Fees are known as streaming fees and are paid out to set managers. The fee structure is calculated linearly at a percentage of the set balance over a period of time.

The issuance module provides a method to buy, sell, issue and redeem set tokens.

Set Protocol Team & Traction Analysis

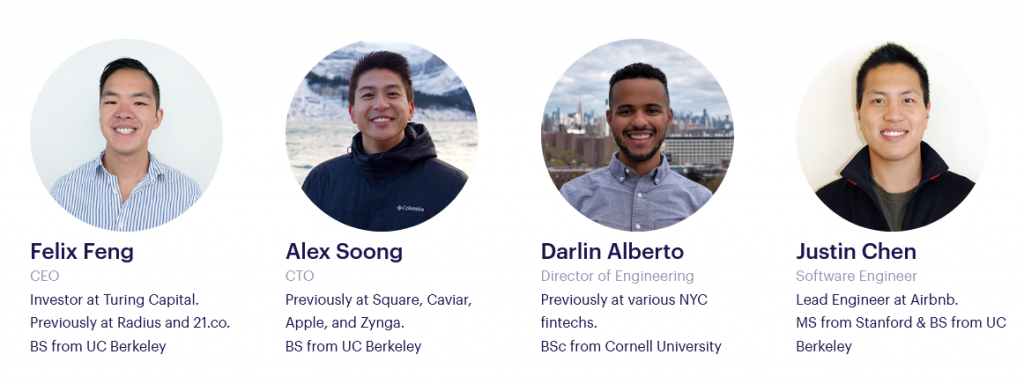

The Set Protocol team is headed by Felix Feng out of San Francisco

They are currently hiring which is a good sign of expected future expansion. Also of note is that Anthony Sassano of The Daily Gwei is listed as a advisor.

There is a Bankless interview with Felix here: https://www.youtube.com/watch?v=ewliK70l57M

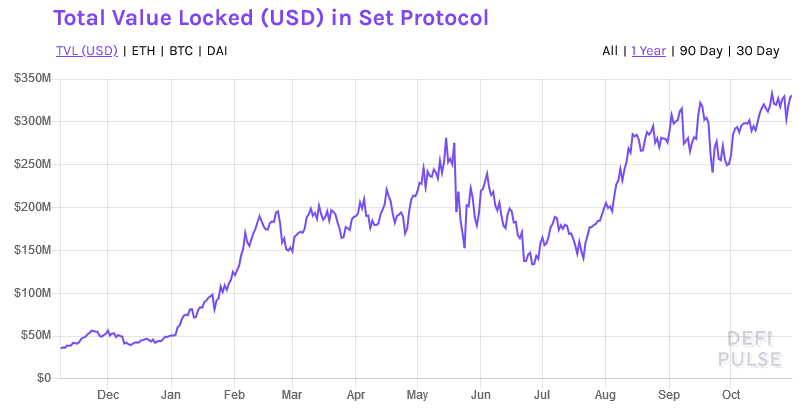

The project has been going since 2017 and is only now starting to see major gains in traction as DeFi has expanded in the last year. TVL (total value locked) is growing steadily, roughly following the rise and fall of crypto markets in general.

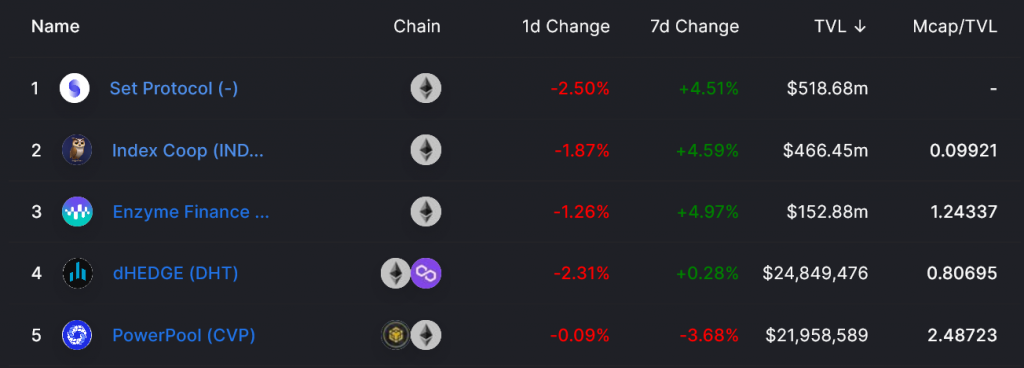

They have a first mover advantage and significantly greater market share over any competition. It’s hard to argue that they aren’t best in class/niche in terms of gaining adoption.

Solidity Code Review

The code is open sourced and the interesting stuff is here: https://github.com/SetProtocol/set-protocol-v2/tree/master/contracts

There was a security audit carried out in 2020 by OpenZeppelin among others and there is a bug bounty program run in house and detailed in the readme.

The first thing that strikes me about the code base is that there’s a huge amount of original code in there. There’s modules to interact with various protocols which are interesting in themselves such as this one which uses Aave lending to build leveraged products: https://github.com/SetProtocol/set-protocol-v2/blob/master/contracts/protocol/modules/AaveLeverageModule.sol

There’s a thorough suite of unit tests with the module above having 4000 lines of test code alone.

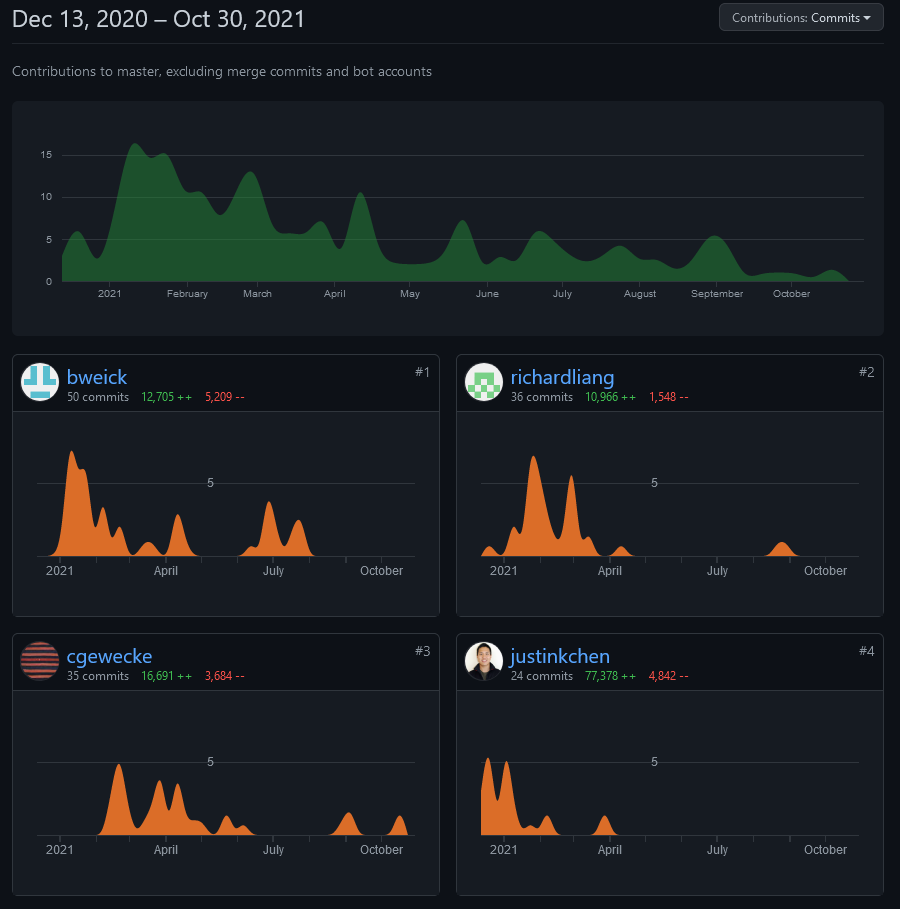

Development work on the Set Protocol V2 seems to have slowed which might be a sign of maturity. There are another 29 repositories managed by the same team for things like the UI, a javascript framework, Index Coop contracts and strategies.

The code base is massive, expansive and the work of a strong team over multiple years. This isn’t a project which forked and launched but a lot of work has gone into creating something unique and interesting. With that much original smart contract code the potential for vulnerabilities is significant.

For developers working with Set Protocol there is a npm repository which includes the contracts and hardhat artifacts.

Conclusion | Future Of Crypto Index Funds

Index funds play such a large part in traditional finance markets that I think it’s only a matter of time before they start to play a significant part in crypto markets.

As markets mature and DeFi adoption grows there’s going to be an expanding market for passive investing. Index funds run by networks like the Index Coop could play an important role in onboarding and enriching the next generation of DeFi users.

There is potential to expand the capabilities of decentralised social trading and passive index funds to include yield farming and staking opportunities. At which point the attractiveness of these products will only grow. When the returns from passive investing start to outperform independent traders it may reach a tipping point and grow on the narrative of “beating x% of active crypto traders” much like traditional finance index funds have in the past.

Set Protocol and Index Coop are well positioned as market leaders in the sector to take advantage of this opportunity.