In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets.

DyDx took this concept and packaged it in to a decentralized trading platform. With over a billion dollars in daily volume it’s long overdue a deep dive in to DyDx.

- DyDx Introduction

- Trading Volumes & Adoption

- Decentralized Trading Competitors

- How Decentralised Is DyDx?

- DyDx Demo Ropsten Testnet

- Depositing Funds & Getting Started

- DYDX Token & Tokenomics

- The Future Of Trading On L2’s

DyDx Introduction

DyDx is a decentralized exchange that primarily runs on a layer 2 scaling solution called Starkware. This provides fast, zero cost transactions for placing bids into an orderbook when trading.

The platform enables leveraged trading on Bitcoin, Ethereum and various altcoins with 10-20x leverage.

The DYDX token is a governance token which was originally airdropped with allocations to team and high profile investors as well. The developers aim to completely decentralize the platform by the end of 2022.

Trading Volumes & Adoption

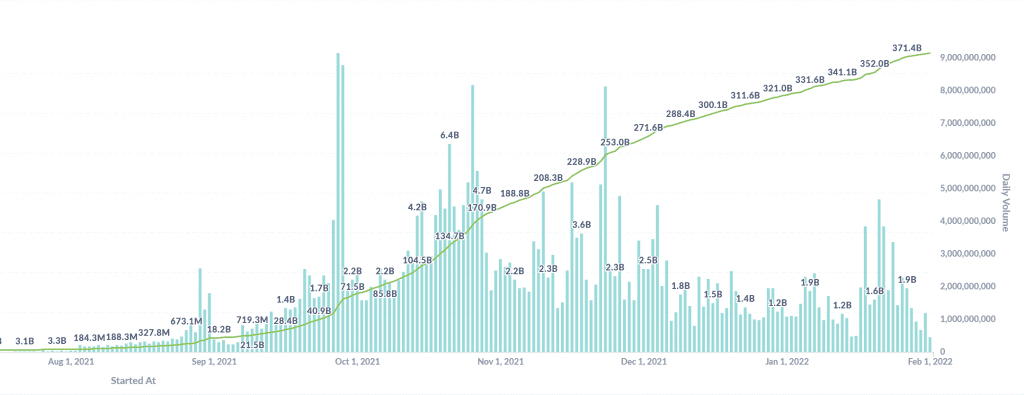

There is currently $1.2 billion USD in daily trading volume, down from from the average in the later part of 2021.

Note that trading is currently incentivised through the distribution of the DYDX token to traders based on trading volume. This somewhat clouds the real adoption and makes it hard to gauge.

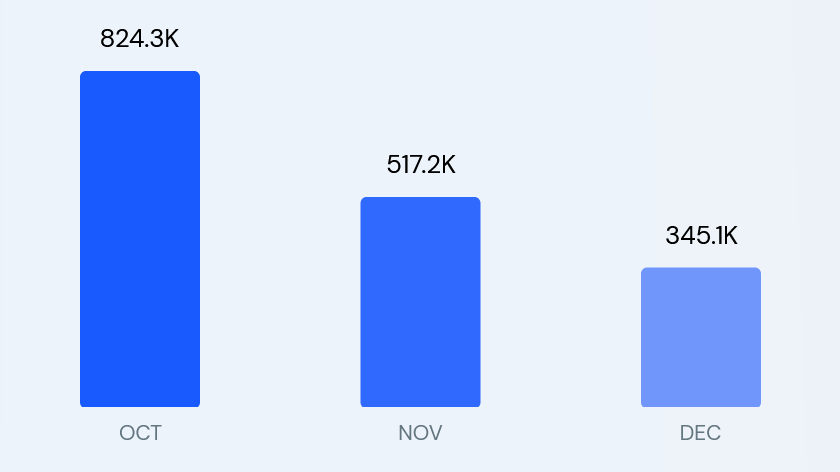

One interesting stat we can look at is the website visitor count estimates on Similarweb.

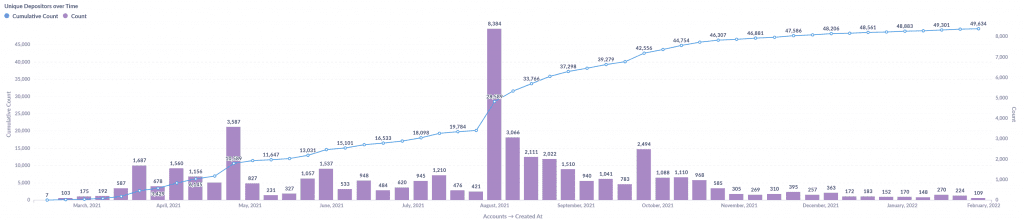

The markets haven’t been favourable for attracting new traders to leveraged trading of digital assets the last few months and we can see that in the unique depositor stats as well.

Note that DyDx is currently unavailable in the United States due to regulatory concerns. If they open up US markets then it could greatly increase the platforms reach and adoption.

Decentralized Trading Competitors

The competition that DyDx faces comes from three different areas:-

- Automated market makers like Uniswap

- Centralized exchanges such as FTX

- Decentralized competitors like GMX

Let’s look at each of these competitors individually.

DyDx vs Uniswap

The technology is quite different because Uniswap uses liquidity pools which contain a pair of assets to swap one for the other. DyDx uses order books where traders place limit orders on what they are willing to buy/sell an asset for. Another trader can come along and agree that price with a market order or place another limit order in the book increasing the liquidity within the order book as more orders build up.

While anyone can setup a liquidity pool on Uniswap for any asset DyDx only has 28 markets for the largest, most traded digital assets. This is targeting different users including market makers who already trade on centralized exchanges, discretionary traders making bets on Bitcoin, Ethereum & a few altcoins going up or down and delta neutral traders who want to set up a hedged position to collect the funding rate on DyDx’s perpetual futures contracts.

DyDx vs FTX

FTX has a better user experience and higher volumes. Trading on DyDx means there will be less liquidity in the order books which could be an issue for larger discretionary traders. The main benefit is the lack of counterparty risk as the USDC collateral is held within a smart contract rather than by a corporation such as with centralized exchanges.

Email signup is optional and traders can setup a DyDx account with just a wallet address which may appeal to some traders who value privacy.

DyDx vs GMX

GMX is perhaps DyDx’s closest competitor in terms of decentralised orderbook futures trading platforms. GMX has already launched on a couple of chains in Avalanche and Arbitrum. It will be interesting to see if they will expand further across various alternate layer 1 and layer 2 blockchains or if this will spread liquidity too thin.

Combined daily volume on GMX is currently $72 million USD so in terms of trading volumes it’s got a lot of catching up to do.

How Decentralised Is DyDx?

Decentralization is linear and a consistent challenge for developers rather than a binary 1 or 0. Currently DyDx operates on centralized web servers with trading running on a questionably decentralized layer 2 in Starkware. There was some controversly last year when an AWS outage took down the protocol completely.

Starkware are 3rd party developers that provide an application specific layer 2 scaling called StarkEx. This technology is based on ZK-STARK rollups which prove the network state on Ethereum layer 1.

The centralized aspect of the exchange is centred on DyDx Trading Inc, a US firm which has taken venture capital from a number of prestigious firms including the following:

DyDx has raised $87 million USD in three funding rounds.

The developers aim by the end of 2022 to build towards a “open-source, community-governed and fully decentralized exchange”.

DyDx Demo Ropsten Testnet

For DyDx to compete with centralized exchanges it is going to need to further decentralize it’s protocol while providing a better trading experience.

This is no mean feat as FTX and Binance are working towards the same goal of perfecting how a trading platform should be without the same restrictions caused through decentralized infrastructure.

The best way to check out the current UX on DyDx is to take a look at the testnet demo here:

https://trade.stage.dydx.exchange/portfolio/overview

This is on the Ropsten testnet so you’ll need to set the network to Ropsten in Metamask. This provides a play money, no risk demonstration of how DyDx works.

Depositing Funds & Getting Started

To trade for real we need to deposit collateral to the platform from the Ethereum mainnet. Collateral is held in USDC but a user can deposit a number of different currencies which will be converted on receipt. The current transaction fee for a deposit is around $100 USD.

Once we have collateral in our account we can go to the trade tab and choose a market. There are 28 markets in total with the bulk of the open interest and trading volumes on Bitcoin and Ethereum.

We have the option to place different order types including:-

- Limit Orders (passive adding liquidity)

- Market Orders (aggressive taking liquidity)

- Stop Limit (sell when risk level reached)

- Trailing Stop (dynamic stop limit that follows price)

- Take Profit Limit (sell when profit target is reached)

Learn more about order types here: Limit orders vs Market orders

Because we are carrying out transactions on the StarkEx Layer 2 we don’t pay the same gas fees to make trades that we would if this was on Ethereum mainnet.

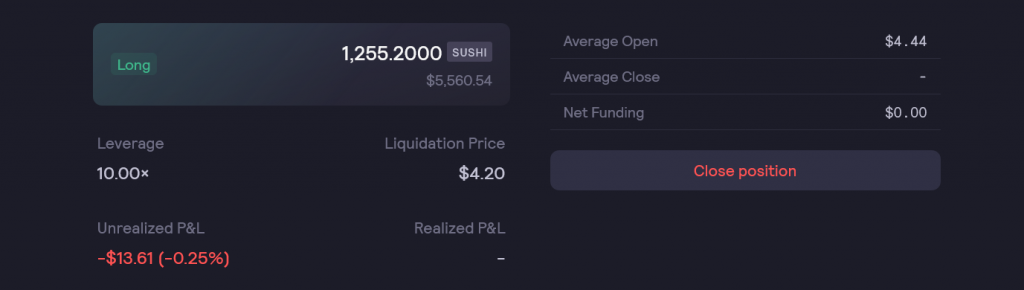

Once an order is filled it gets added to our positions tab

We can close the position which executes a market order or use limit orders to sell our longs or buy back our shorts.

When a position is closed the profit or loss is realized and remaining collateral can be withdrawn back to an Ethereum mainnet wallet.

One key thing to note is that margin maintenance requirements are much higher on DyDx than on centralized exchanges. The liquidation price is just over 5% off the open price at 10x leverage. This provides the leeway for 3rd party liquidator bots to come in and liquidate any positions if they go offside. It’s a major negative factor compared to centralized exchanges.

The same order above which will be liquidated at $4.20 would be liquidated at $4.12 on FTX at the same 10x leverage.

DYDX Token & Tokenomics

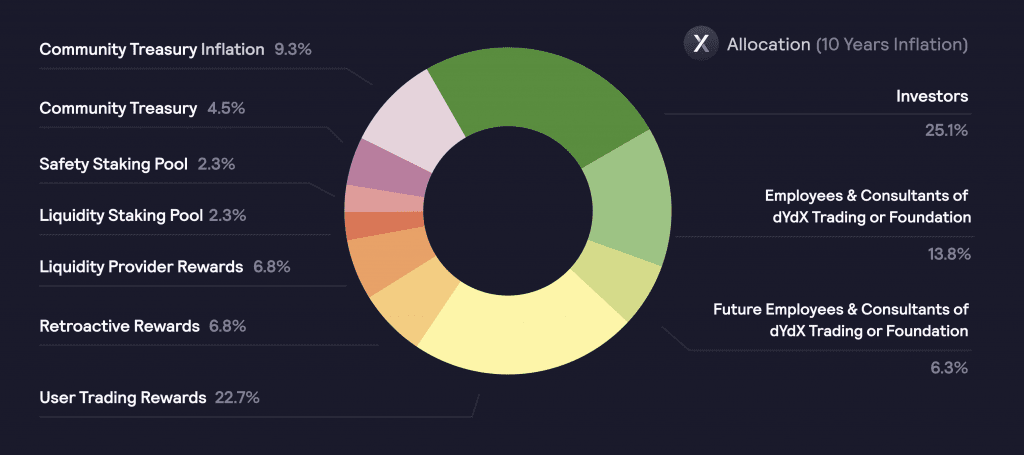

The DyDx token is being allocated as follows:-

- 22.7% Trading Rewards

- 6.8% Retroactive Rewards

- 25.1% VC Funding & Investors

- 20.1% Team & Advisors

- 9.3% Community Treasury Inflation

- 4.6% Staking Pool

- 4.5% Community Treasury

The VC’s obviously purchased the token at a significant discount and are sitting on unrealized gains.

DyDx holders will participate in governance and it has been suggested will also receive future trading fees from the platform.

Max supply: 1 billion tokens

Circulating supply: 65.5 million tokens

Fully diluted market cap: $6 billion USD at current price of ~$6

The unlock schedule is due to kick in 18 months after launch date of August 3rd, 2021, at 15:00:00 UTC with 30% of the tokens becoming available then and another 40% on top of that being unlocked in the following 6 months. The remaining 30% will be more evenly distributed over the next 3 years.

Might be worth making a note in the diary for February 3rd 2023 as there could be a few early VC investors looking for liquidity on that day.

There is also unusually a caveat in the docs about future inflation “Beginning on July 14th, 2026 at 15:00:00 UTC, dYdX governance can decide the maximum supply of new tokens to be minted, up to the maximum inflation rate of 2% per year at each mint. Only one mint is possible in a given 365 day period. All newly issued tokens will be allocated by governance and will vest immediately. These newly issued tokens can then be sent to any address specified.”

The Future Of Trading On L2’s

It’s clear that DyDx is the market leader in it’s niche. The issue is that niche is still relatively specialized and decentralized trading hasn’t caught on with the masses yet. The trading volumes paint a pretty picture but I suspect that without the incentivised trading there would be relatively little real volume going through compared to centralized exchanges.

I feel we are still waiting on a decentralized trading product which is 10x better than FTX. Perhaps something that provides a central platform or portal with leverage, bridging across multiple blockchains and liquidity providers.

While the unlock schedule is a concern for this time next year the DyDx token could perform well if the narrative shifts towards redirecting trading fees to holders and taking on the big centralized exchanges.

There is an opportunity for developers around the same time of Q1 2023 with the Surge update to Ethereum 2.0 which will make truly decentralised layer 2 technology much more efficient. There is the potential for a project to come along and disrupt the way we currently trade digital assets.

That may be DyDx as it evolves to find product market fit or it may be something new entirely.