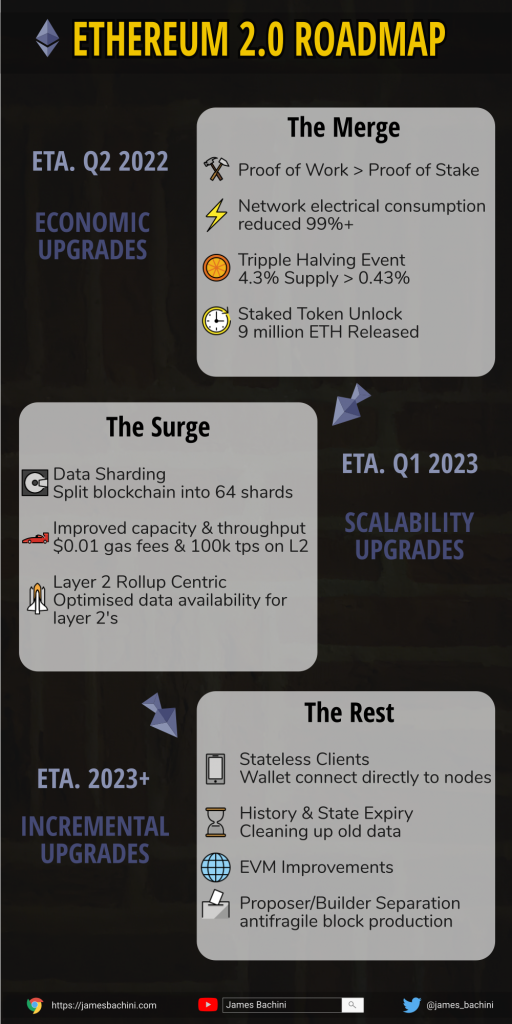

Ethereum 2.0 is the biggest update that the crypto sector has ever seen. A series of rollouts will include a migration to proof of stake, sharding and the highly anticipated triple halving event. This article will discuss the roadmap for these rollouts, what changes each update will implement and the possible effects.

- Ethereum 2.0 Roadmap Video

- The Merge – ETA. Q2 2022

- The Surge ETA. Q1 2023

- The Verge, Purge & Splurge ETA. 2023+

- Ethereum v2 Conclusion & Infographic

Ethereum 2.0 Roadmap Video

The Merge – ETA. Q3 2022

The merge is the next stage of Ethereum 2.0 upgrades which involves an overhaul of the consensus mechanism and tokenomics. The best guess from Ethereum core developers is currently September 2022.

In late 2021 we saw EIP-1559 implemented which started the path towards deflationary ETH with the burning of gas fees. The Merge is the next stage where supply distribution will decrease dramatically and staked tokens get unlocked.

This is likely to be a highly volatile period for the price of ETH on exchange. The entire blockchain sector will be focused on the rollout and the “ultrasound money” narrative. Post merge a huge amount of tokens will get unlocked and there is the potential that this could cause a supply shock on exchange.

The combination of improved long-term tokenomics from the triple halving event and short-term supply shock of the staking unlock makes this a highly complex and difficult market situation to model.

Proof of Stake

Currently Ethereum is using a proof of work algorithm similar to Bitcoins. Huge facilities packed full of mining hardware search for hashes which secure the network and block rewards. The environmental concerns over proof of work consensus has been discussed previously and more so in the mainstream press in the last year. The merge will reduce network electrical consumption to <1% of the current usage.

Ethereum 2.0’s beacon chain is a proof of stake network which relies on stakers to deposit a large amount of ETH to vote on the correct block validations. Bad actors have their staked ETH slashed which ensures a anti-fragile blockchain network.

If you are currently using liquid staking protocols like LIDO to get a yield on your ETH then you already have funds deposited indirectly on the beacon chain.

The merge will migrate users from the existing Ethereum mainnet to Ethereum 2.0’s beacon chain. At this time users will need to adjust their metamask settings or there may be an automated update to connect to the new network which is similar to a hard fork.

Funds, state history and protocol application data will all be migrated automatically.

The Triple Halving Event

The migration to proof of stake will redirect block rewards from mining facilities to long term holders of Ethereum’s native token.

At this time block rewards will be cut from 12800Eth to 1280Eth per day. This will mean annual inflation of Eth will be cut from 4.3% annually to 0.43% which is going to be considerably less than amount of Eth burnt from gas fees.

Eth will become a deflationary asset meaning that it’s supply goes down over time making it more scarse.

When discussing the price of Eth we normally denominate in USD, which in contrast is an inflationary asset with expanding supply. Inflation of USD and deflation of ETH over a long enough period, should cause the laws of supply and demand to increase the price of ETH relative to the USD.

Less than 10% of the ETH total supply is currently staked on the beacon chain. This means that stakers can get around 5% APY returns on their holdings. This return on investment is likely to appeal to traditional finance hedge funds and investment firms.

If Ethereum ever came close to flipping Bitcoin’s market cap to become the largest digital asset it would accelerate the institutional adoption of Ethereum staking. Even if this never happens the negative yields in traditional finance combined with inflation in fiat currencies creates a perfect storm for migration to DeFi and the Ethereum 2.0 staking yield machine.

Over the long term the distribution to stakers is likely to have less negative selling pressure as well because they are more likely to reinvest the ETH block rewards rather than sell it for electricity like miners need to do.

The merge is about making ETH deflationary and directing block rewards to investors rather than miners.

Staking Unlock

Currently there are around 9m ETH staked on the beacon chain which all get unlocked during the merge. This has a current market value of $30 billion dollars.

From the Ethereum docs “A few features, such as the ability to withdraw staked ETH, will have to wait a little longer after the merge is complete. Plans include a post-merge cleanup upgrade to address these features, which is expected to happen very soon after the merge is completed”

Around 2m ETH was staked in January 2021 when ETH was trading at around $1000. Those investors are sitting on 300%+ gains even before their staking rewards.

It seems likely that a proportion of the unlocked funds are going to end up on exchange to realise some profits and buy real world things.

How much is debatable and will there be a buyer for those funds or will it cause the price to drop? It’s very hard to tell without the framework of where we are in the market cycle at the time.

If there’s a influx of institutional money and prices are going up and the merge goes well; then those funds could get bought up pretty quick by traditional finance firms looking to get into crypto. Microstrategy alone has purchased $3.5 billion in Bitcoin, if a sovereign wealth fund wanted to make an allocation then this might be the opportunity.

In contrast if markets decline and there is a negative bearish sentiment then those unlocked funds could create a rush to sell and market capitulation which will likely be the opportunity of a lifetime for anyone with capital to deploy. If (in the unlikely event) Eth went back below $100 for example what would happen to DeFi governance tokens, blue chip NFT’s and Alt Layer 1’s?

So price prediction somewhere between $100 and $20k then #helpful. The point is that there is going to be a lot of market dynamics going on and it’s going to create greed, fear and volatility in the markets at a greater level than we have seen in some time.

The merge will not have any direct impact on scalability or gas fees. The technical improvements required to solve these issues are solved in the next upgrade.

The Surge ETA. Q1 2023

If the merge is an economic upgrade for Ethereum then the Surge is the technical upgrade that we have all be waiting for.

Ethereum 2.0 will introduce data sharding to increase network capacity. Additional capacity means less competition for transactional space and lower gas fees.

However I think our days of using Ethereum layer ones to swap tokens and mint NFT’s are probably numbered. Eventually it will still become a chain of proofs and end users will execute transactions on highly efficient layer two rollups.

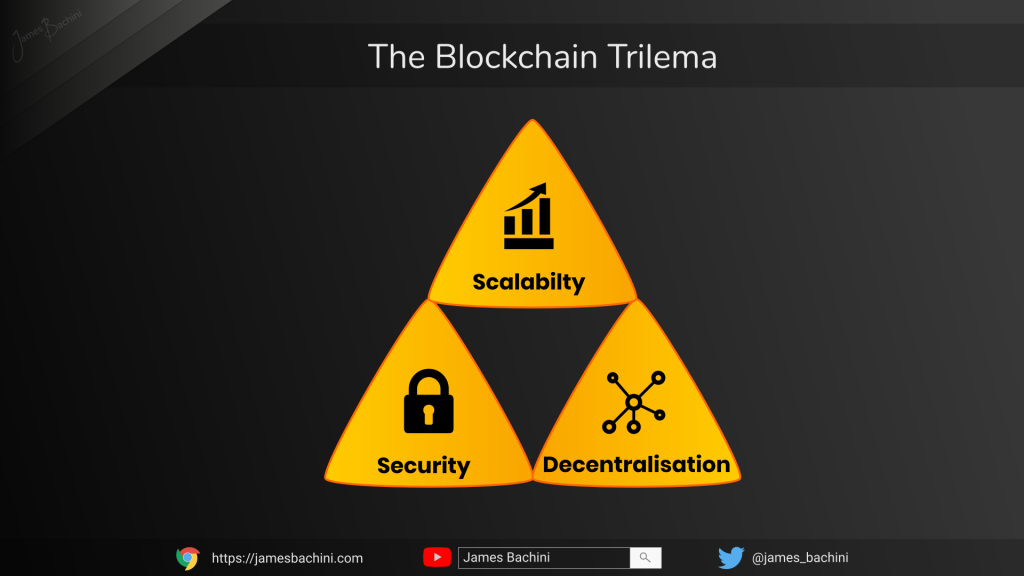

It is fundamentally impossible to have everyone interact with the same blockchain without compromising on decentralisation. Therefore Ethereum 2.0 will become a chain of sub-chains and the technology rolled out in the surge is designed to facilitate that shift.

Data Sharding

The Ethereum blockchain will be split into 64 shards. This will help spread the load, reducing network congestion and lowering gas fees.

The current implementation is for data only and doesn’t distribute computational power.

Sharding will reduce the amount of data required to run a node to a point where it could be set up on an average laptop.

Layer Two Rollups

A layer 2 roll up is a separate blockchain that proves it’s integrity by validating data back to a layer 1.

We have already seen optimistic rollups in use on Ethereum since summer 2021 when Optimism and Arbitrum were released. These shipped without a native token or strong economic incentive to encourage adoption. Neither layer two has gained significant traction to date with Arbitrum being the marginal winner in this field.

In the last week we’ve seen Binance introduce withdrawals direct to Arbitrum which is a big step forwards. It means that users can now get funds in to the network much easier and it’s a show of support from Binance for layer two technologies.

Perhaps the most anticipated layer two event is ZKSync’s token launch. Ethereum founder Vitalik Buterin has suggested that ZK rollups will win over optimistic roll ups in the long run and ZKSync is the most highly regarded project in this field. After the Surge update the transaction fees should be around $0.01 USD and the network will run at 20,000 transactions per second

ZKsync is a commercial project run by Matter Labs and backed by some prestigious VC’s. They state in their docs that a token is imminent although there are no details on a potential airdrop. The token is likely to be used primarily to incentivise network adoption and with it being fully EVM compatible we should see an expansive DeFi ecosystem emerge with plenty of opportunities for yield farmers.

ZKsync’s code base is also open source and free from licensing issues. It seems likely that a successful launch will encourage more projects to fork and build with the technology.

Sharding when combined with layer two technologies will provide greater capacities in the order of magnitude necessary for mainstream adoption of DeFi. It’s estimated that when completely rolled out Ethereum layer 2’s should have a combined transactional throughput of 100,000 transactions per second.

This is the end goal that will provide a scalable foundation for DeFi to expand in to.

The Verge, Purge & Splurge ETA. 2023+

The next three stages of development I feel are so far in the future that they are liable to change considerably before they get rolled out. These will put the finishing touches on the Ethereum 2.0 network and provide incremental improvements.

Stateless Clients

Currently users connect their digital wallets to the Ethereum network via an RPC provider such as Infura that relays signed transactions to a node on the Ethereum network.

Stateless clients introduce the possibility of removing the RPC provider. It will reduce the hardware requirements to run a node to a point where a digital wallet mobile application can be a node on the network relaying it’s own transactions.

This will increase the number of network nodes (all be it firewalled) and removing a single point of failure in the popular RPC relayers.

History & State Expiry

As the blockchain grows it will become harder and harder to store all the data. It will eventually become beneficial to have some kind of compression or archiving functionality of data that isn’t required for every day running of a node.

It’s been suggested that this is a long way off and may be one of the final improvements which will help efficiency and make it easier to manage the ever expanding blockchain data set.

EVM Improvements

There are discussions over various improvements to the Ethereum Virtual Machine which will likely get rolled out during these updates.

EVM Object Format – Improvements to the structuring of on-chain bytecode making it easier to introduce new features.

EVM Bigint Arithmetic – Improvements to the computation and calculation efficiencies of large numbers

Over time there will be ongoing upgrades to the EVM and Solidity compilers.

Proposer/Builder Separation

There is a possibility that large entities gain too much control over the block production across multiple layer two chains.

PBS aims to solve this by adding a block producer selection process. This will further democratise the block production and improve decentralisation.

ETH v2 Conclusion

Ethereum is finally going through it’s evolution to a multilayered blockchain that is capable of handling mass adoption. The “end game” as Vitalik puts it will have layer 2’s executing 100,000 transactions per second with costs around $0.01.

This will enable the further appreciation of Eth as an asset and the merge this year will greatly improve the long term tokenomics. The second stage upgrade will focus on sharding and provide the throughput required to scale Ethereum 2.0 for years to come.

This is the foundational layer that I and other blockchain developers want to build on.