In this article I’ll be executing a cash and carry trade purchasing a crypto asset on spot markets and short selling a futures contract for the same asset to collect funding rate fees.

- Understanding Futures Contracts

- Funding Rate Compounded Returns

- Futures Funding Rate Strategy

- Risk, Reward & Longevity

- Automating The Futures Strategy

- Conclusion

Understanding Futures Contracts

A futures contract tracks the price of an underlying asset. It allows active traders to take out a long position (betting the asset will go up) or a short position (betting it will go down).

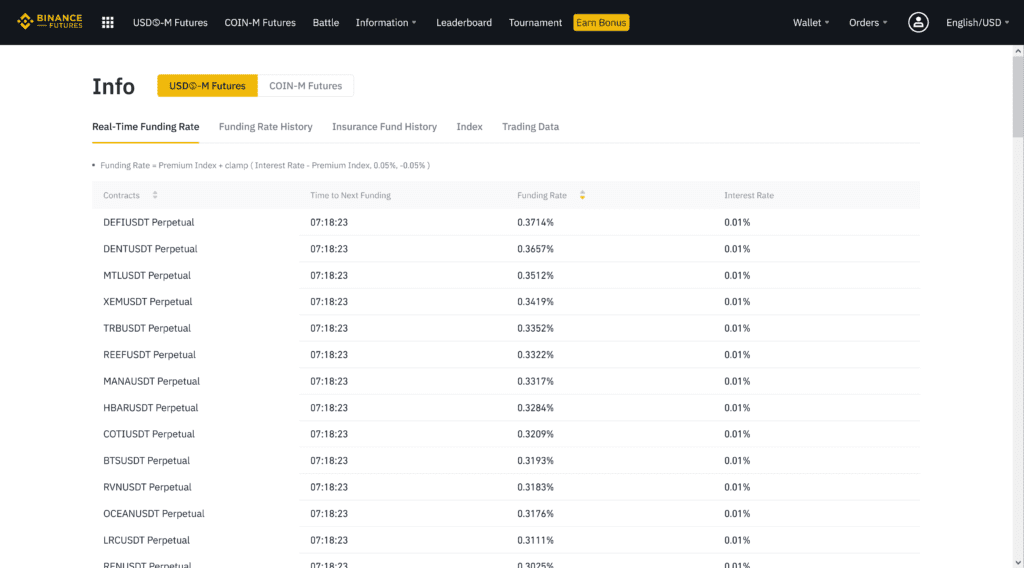

When more traders are long than short the longs will pay the shorts a funding rate fee to balance the contract and anchor the price to the underlying asset. Funding rates on crypto assets are currently at very high levels because we are in a bull market and most traders are betting on further gains.

Funding rates on Binance are collected every hour and we can see that some crypto assets have reached more than 1% a day. Essentially anyone who is short on the DEFI-USDT contract will be collecting 0.3714% every eight hours to hold that position.

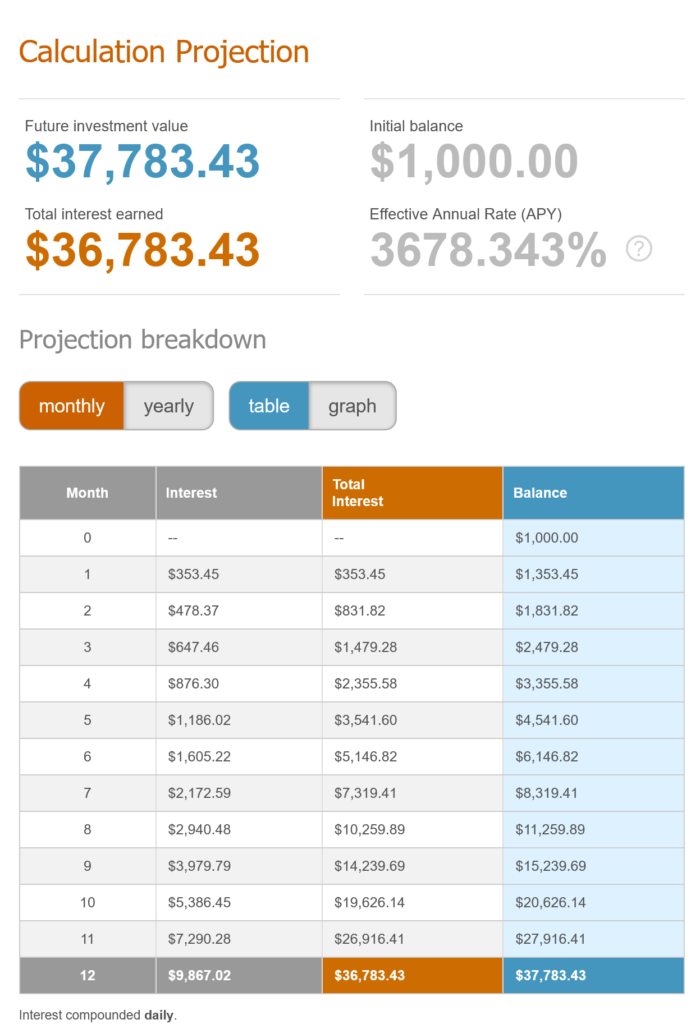

Funding Rate Compounded Returns

Now 1% doesn’t sound like a lot but when this is compounded daily it results in a 3678% APY. If this opportunity lasts a year (which is somewhat unlikely at these unsustainable levels).

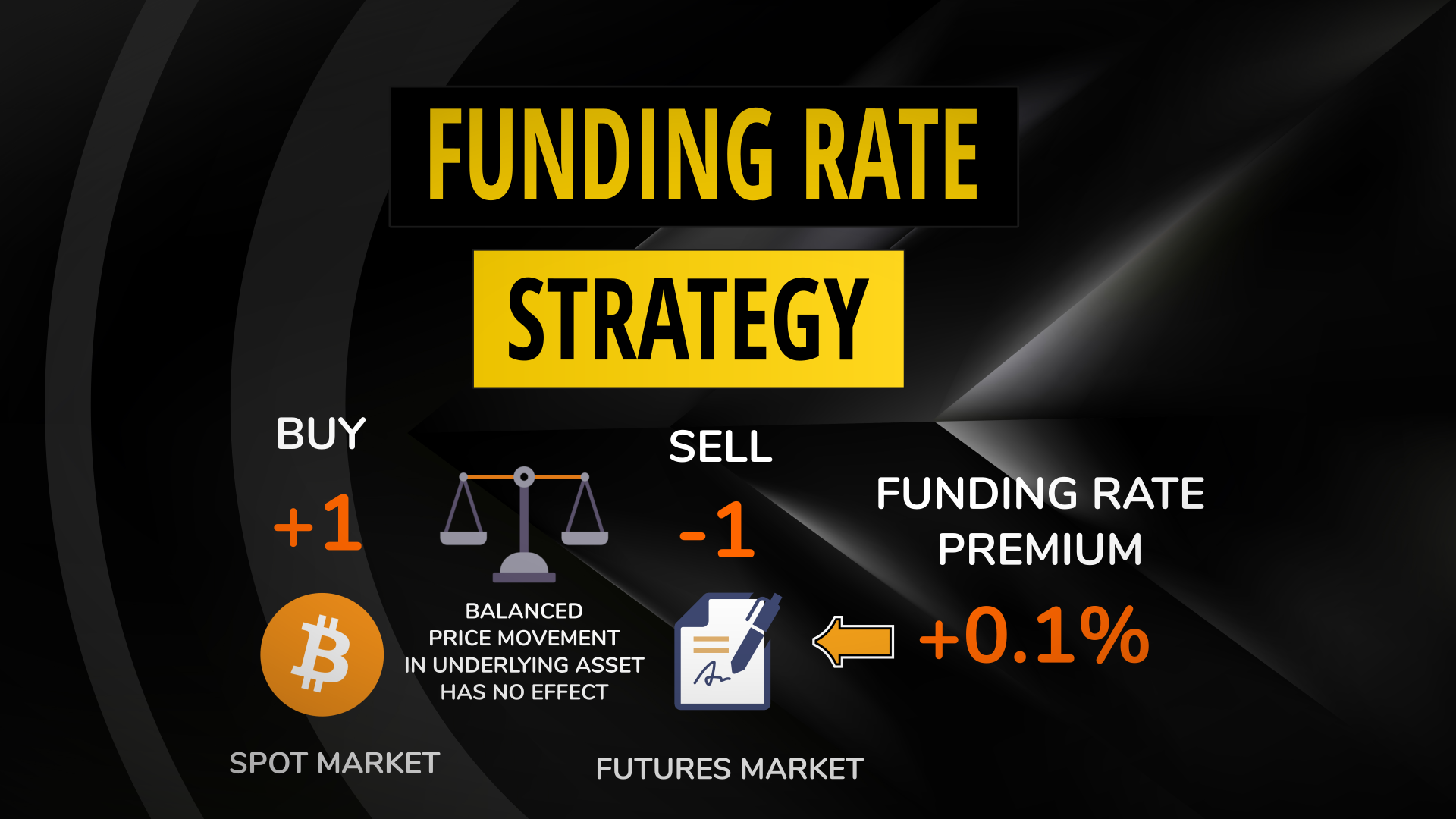

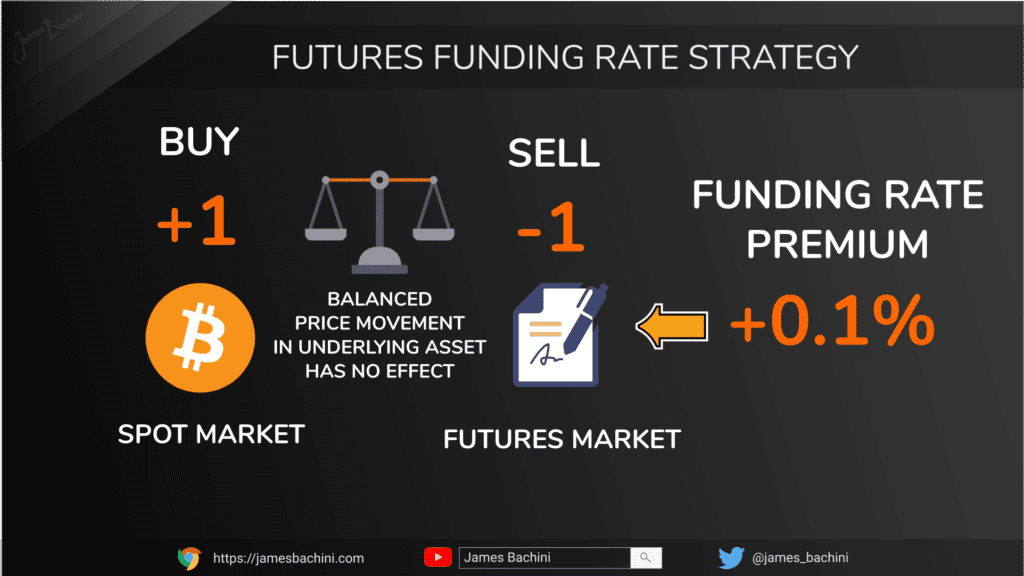

But the catch is that if the underlying asset goes up in price by more than 1% a day then it will lose money. This is why it’s necessary to hedge the position by buying the same amount of the crypto asset on spot markets.

So for example purchase 1 BTC on spot markets and short sell 1 BTC-PERP futures contract to collect the funding rate fee. This will hedge the position so that if Bitcoin goes up or down it doesn’t matter and the two positions will balance each other out.

If we are not using leverage then we will need to split our capital in half to do this reducing the strategies returns if you calculate in the cost of capital required to hedge the position.

Update 8th May 2021 The funding rates have already dropped back with the highest rate currently on sushi-usdt at 0.0653% / 8hrs. It’s still not bad by any means but the chances of the rates we saw previously being sustained for a whole year are almost zero making annual APY figures irrelevant for the most part. A few people have pointed out that quarterly futures provide a more sustainable fixed rate of return compared to perps and it’s an easier trade to manage. I’ll do another post on this in the future with some experimentation on execution strategies.

Let’s look at how to execute the futures funding rate strategy in a video demo.

Futures Funding Rate Strategy

Risk, Reward & Longevity

The futures funding rate strategy is delta neutral meaning the risk is managed by hedging the position. There is still the risk of having funds on a centralised exchange and the risk of getting hacked etc. There is also the opportunity cost, essentially we are placing our funds in USD when everyone else is betting on the crypto market going up. Anyone based outside of the US will also have Forex risk if they base performance on local currencies.

The funding rates are at very high levels because we are in a bull market. Realistically these returns are unsustainable and at some point the euphoria in crypto markets will decline and the funding rates will come down with it. If there is a sharp drop in the price of a crypto asset it can also stop out and liquidate long traders bringing the funding rate down sharply with it. If things turn too bearish then the funding rate may go negative and the position will start losing money at which point it would need to be closed ASAP.

There’s also the potential to use leverage on both spot and futures trades to increase the returns but this adds to the complexity and risk associated with liquidation.

For large amounts there is also a liquidity risk of being able to get in and out of positions with minimal slippage. The highest rates are usually for index fund contracts like DEFIUSDT we looked at earlier which is harder to hedge because it tracks a basket of goods or for low liquidity markets. This actually benefits traders with smaller amounts of capital because they can get in and out of positions in low liquidity markets much easier and with less slippage than large funds and crypto whales.

Automating The Futures Strategy

One issue I found with this strategy is that the funding rates fluctuate for different assets on an daily basis. The crypto asset with the highest funding rate will change based on what the price action is doing at that time and how traders are positioning themselves. I was having to manually switch assets regularly which wasn’t as passive as I would like. I ended up building a bot to automate the strategy using NodeJS and the exchange API’s. The code I used isn’t suitable for public release but here are the details if you want to do something similar:-

There is an API call on both Binance and FTX to get the funding rate for futures contracts.

Binance – https://binance-docs.github.io/apidocs/futures/en/#get-funding-rate-history

/fapi/v1/premiumIndex

returns response.lastFundingRateFTX – https://docs.ftx.com/#get-funding-rates

/funding_rates

returns response.result.rateFrom this you can select an asset based on the funding rate and minimum volume requirements. I rotated through a list of pre-approved assets at set times per day.

I’d recommend scaling in and out of positions gradually building a position towards the time when the funding rate is collected. A limit order can be used on the spot market and then an event can be fired when filled to execute the futures short using a market order. The fees are greater on the market order but it minimises risk of the market moving while only having one side of the position open.

Conclusion

There is so much opportunity in the blockchain sector right now. It’s possible to gain exceptional returns without taking on excessive risk. For me it provides a way to take a small amount of profits out of the markets and put those funds to use.

The exceptional 1000%+ APY returns might not last forever but while the opportunity is there I think it’s a great strategy.