GameFi utilises digital assets such as cryptocurrency tokens and NFT’s to create internal economies within games. In this article I look at how tokenomics can be designed to create sustainable business models for gamers, investors and developers.

- GameFi 1.0 Play2Earn

- Should Everyone Earn?

- Self-Development Retention

- Speculators Will Speculate

- The Search For The Next Axie

GameFi 1.0 Play2Earn

Growing up I played computer games on consoles where you would buy a cartridge or disk in a shop, take it home and load the game. Game developers earned revenues based on their sales and gamers moved from game to game as there was little updates or post-purchase development.

In 2009 Farmville launched alongside many other games with a Free2Play model and built on top of Facebook incorporating social aspects which allowed it to grow very fast. Developers made money on the sale of in-game items where users would level up or accelerate through the game by making credit card purchases.

In the bear market of 2018 Axie Infinity launched but it wasn’t until late 2021 that the game really took off with it’s Play2Earn model attracting hundreds of thousands of players and creating a $10B market cap for the AXIE token.

To realise their earnings players needed to sell the AXIE token for a base asset which could then be unloaded via a crypto off-ramp. This created a lot of selling pressure despite game developers efforts to encourage players to hold their earnings in AXIE. The constant selling pressure combined with a market downturn for the entire crypto sector caused prices and valuations to decrease further. At it’s peak AXIE was trading for $160 USD and today it trades for below $20.

Should Everyone Earn?

Play2Earn games in their current format are unsustainable. In any stable economy their needs to be value created and distributed. AXIE succeeded in creating huge amounts of value and attracting capital in-flows as investors, traders and speculators pumped up the token price. The issue was that they can’t sustainably continue giving out free money without causing depreciation of that money.

The same goes for and digital asset no matter if it’s a ERC20 token or NFT, if it’s easily earned it will be easily sold.

Now let’s look at a game which has proved hugely successful for over a hundred years both offline and online. In poker the top 2-3 players at a table of 9 will make money from the worse players at the table. At low stakes it’s relatively easy to compete and make small amounts of money. As soon as you start to move up the stakes it gets more difficult as you face regs (regular players) that are playing as their full time job.

While this could be criticised as gambling not gaming it provides a beacon of hope for a sustainable in-game economy.

If the top 10% of players make money and the top 1% maybe earns enough to make a living from playing the game then where does that money come from? In poker it is provided by worse players bluffing off their chips. However gambling is prohibited on most gaming platforms and a upfront cost for new players would put the game at a disadvantage to free2play models.

One options is to use sales proceeds to buy and mint an initial balance of tokens for new users. Good games can still charge a price for the game itself. If a game would normally cost $15 then potentially it could be priced at $25 instead and include $10 of in-game tokens. This would mean all players have an initial balance and it could create $10 of token buying pressure for each new player. A certain percentage of bad players would buy more tokens when their balance hits zero or they want to level up through the game. The best players will see their balances increase as they compete in a fair and balanced economy.

Let’s look at a simple example of how this might work.

Euro Soccer Manager 2023

Two smart contracts:-

- ERC20 In-Game Currency Token $FM

- ERC1155 NFT’s For Footballers, Teams, Kits etc.

All new players who buy the game start with an initial balance of $FM tokens minted from the contract. $10 of the sale price is used to buy back $FM tokens on exchange and burn creating balanced buying pressure.

Players are essentially team managers and use the $FM tokens to buy Footballer NFT’s and build a team to compete in a league competition. The top teams from each league win $FM rewards and move up to the next league where there are bigger prizes and more potential earnings.

At any point a player can sell their footballer NFT’s for $FM and then sell that for a USD stablecoin on exchange.

Self-Development Retention

Financial incentives can attract players to a game but it should be based on skill. The top players that have devoted time to learning the game and its nuances should earn the most. New entrants and lower skilled players should be incentivised not through immediate earning (as in Play2Earn) but the future possibilities.

Humans are competitive creators and we generally overestimate our own abilities*. This causes an effect seen often at the golf course where people will back themselves even if their chances and the odds don’t make sense.

There is an addictive quality to self-improvement and I often find myself attracted to the challenge of getting better at a game

By creating an in-game economy where the best players are rewarded it creates a challenge for new entrants and worse players. This challenge in itself is valuable because it can keep players interested adding to the retention and stickiness of a game.

GameFi doesn’t make sense for games that are pure skill. For example I don’t want to play chess for money because it’s too skills based and the marginally best player will almost always win. There needs to be an element of luck to a game that creates variance for it to be attractive.

Speculators Will Speculate

The reason why Axie grew to a $10B market cap wasn’t because of the players it was because investors and traders speculated on the token. It was the best in class digital asset to gain exposure to the new and emerging GameFi sector.

Some of the largest crypto-native funds are currently looking for similar opportunities and see GameFi as the next big thing which will introduce a new wave of users to cryptocurrency over the next decade. Some of the smartest people in the industry are actively looking to deploy capital in this space.

However that isn’t easy because there hasn’t been sustainable business models to invest in.

GameFi 2.0 promises a new wave of long-term economies built around in-game digital assets. Investment can be useful to game developers who may use capital to bootstrap early funding, create additional buying pressure for tokens, to fund future developments extending a games life cycle and to financially incentivise players improving retention.

Earlier this week I went through a list of new and emerging projects in the crypto sector. Nearly half of these projects were related to GameFi with most being a screenshot, roadmap and “Game Coming Soon” token or NFT.

Is it any wonder why many traditional game developers are cynical about digital assets when there are so many scams and cringe projects in the industry currently. This will change over time and winners will emerge, perhaps Axie was the first but there will be more games that successfully integrate digital assets.

The Search For The Next Axie

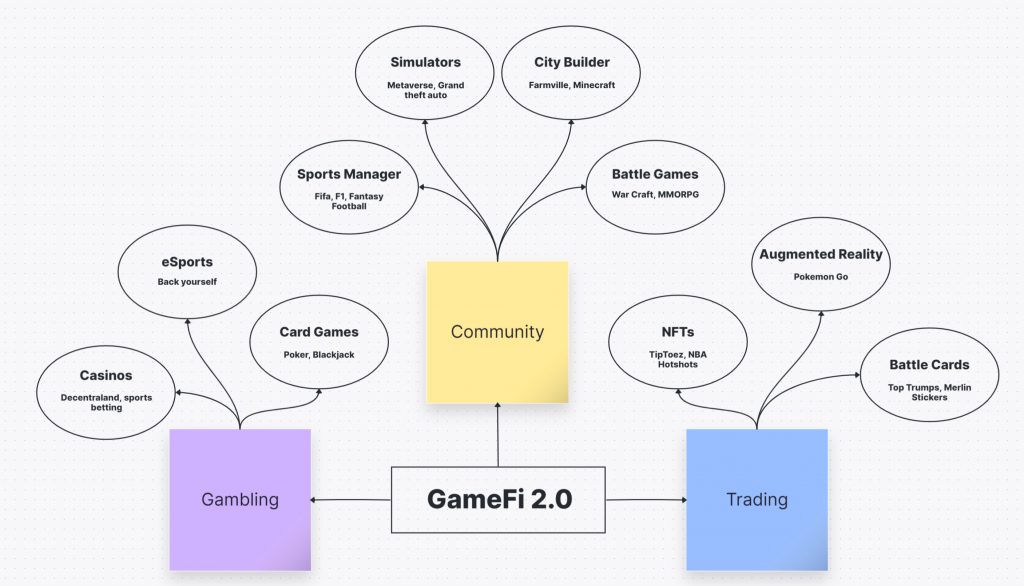

Here’s a brainstorm of the games that I think make sense for GameFi 2.0 and where I think we might see emerging projects with long term potential.

The next big hit in the GameFi sector may come from any one of these sub-sectors or it may incorporate multiple different features of community, gambling and trading to build something new and interesting.

Perhaps the Metaverse or Zuckerverse will open up new areas where digital assets can be utilised. Screen time per capita is increasing and digital economies will emerge in the places where we spend our time. GameFi 2.0 could well be the next big thing, not just in crypto or gaming but in tech generally to introduce digital assets to the masses as we extend up the adoption curve. It needs sustainable, fair, value accruing tokenomics and business models to make it work.

If you want to look further in to GameFi and individual projects one of the best resources I found was this currated docs sheet: https://docs.google.com/spreadsheets/d/1zizXKqmnex5YjbXD6c4k_VaQjr6ky0CL2TjK217kEmw/edit#gid=1153823974

I hope this examination of the GameFi sector has been of interest.