As Ethereum moves to a proof of work network it opens up the possibility to stake our assets to gain a yield. We can do this by running our own validator node on the network… or we can use a liquid staking platform. In this lido staking tutorial I’m going to look at the LIDO platform which has $4.3B USD worth of ETH staked accounting for 59% of the entire network. LIDO has also expanded into Terra and Solana ecosystems and we’ll be looking at these too.

- What is Liquid Staking

- Staking SOL on LIDO [VIDEO]

- The Lido Platform

- LIDO Wallet Integrations

- Staking Alternatives

- LDO Governance Token

- Conclusion

What is Liquid Staking

In a proof of stake network staked funds must be bonded to a validator node. This sounds complex and to set it up is somewhat challenging for users that just want a yield on their assets. Liquid staking provides a simple alternative with web platform where users can stake their funds and receive a staked version of their asset in return. For example when you stake ETH on LIDO you get stETH back. This is important because stETH can be traded, it can be used as collateral on some DeFi protocols and it can be transferred between accounts like any other token.

stETH tokens are pegged 1:1 with Ethereum and stETH balances are updated daily. So if you stake 1 ETH you will receive 1 stETH in return on week 1. By week 2 you will see your balance of stETH increase in your wallet as staking rewards are distributed automatically across the network.

The current APR’s on LIDO at time of writing are:-

| Ethereum (ETH) | Terra (LUNA) | Solana (SOL) |

|---|---|---|

| 4.2% APR | 3.4% APR | 5.8% APR |

Staking SOL on LIDO Video

The Lido Platform

The LIDO web platform can be found here.

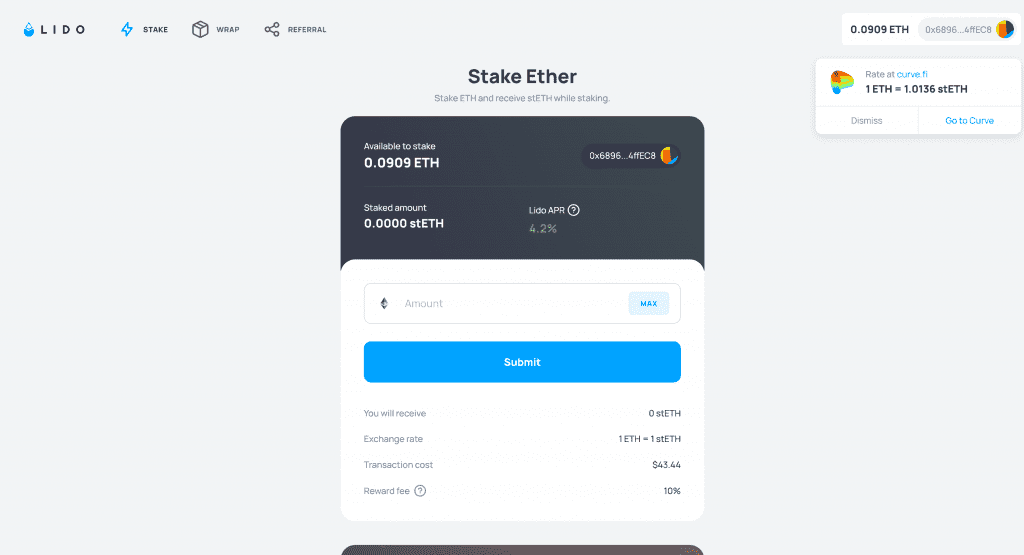

You can see from the above screenshot that stETH is currently around 1% below it’s peg on Curve Finance. This means it would be more efficient to purchase stETH on curve that stake on LIDO at 1:1 return.

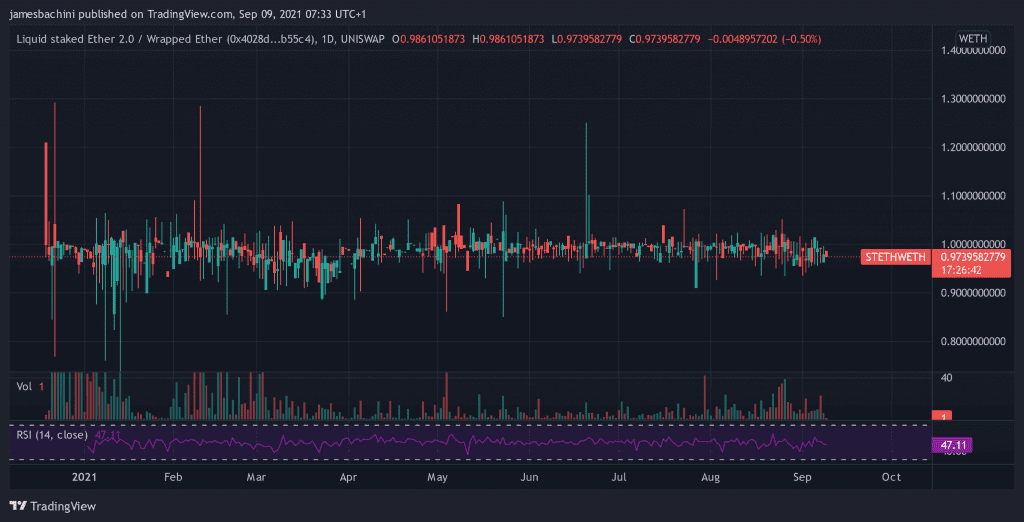

We can see from the TradingView chart for stETH/WETH on Uniswap that it gets out of line quite regularly. This is mainly due to the inability to unstake stETH until Ethereum 2.0 goes live (estimated Q1 2022). Anyone who wants to convert stETH back to ETH before then needs to use an exchange at market value. I don’t think there’s much liquidity on Uniswap for this pool and Curve is the main market.

If the current market value of stETH is above 1 ETH then it makes sense to stake using the LIDO platform. If it’s below 1 ETH then it may well be more optimal to trade it on a decentralized exchange such as Curve or Uniswap. This mechanism and arbitrage opportunity is what keeps the token pegged 1:1 to ETH eventually.

Steps To Stake On LIDO

- To stake tokens we will need a digital wallet. For ETH/LUNA I recommend Metamask and for SOL I recommend Phantom.

- Connect the wallet to the web platform at here.

- Select network and enter the amount you wish to stake.

- Approve the transaction and wait for network confirmation (30 seconds max).

- To see the token in your wallet you may need to add the token contract address.

(Metamask will prompt to “add stETH token”) - Sit back and wait for staking rewards to come in and your token balance to increase.

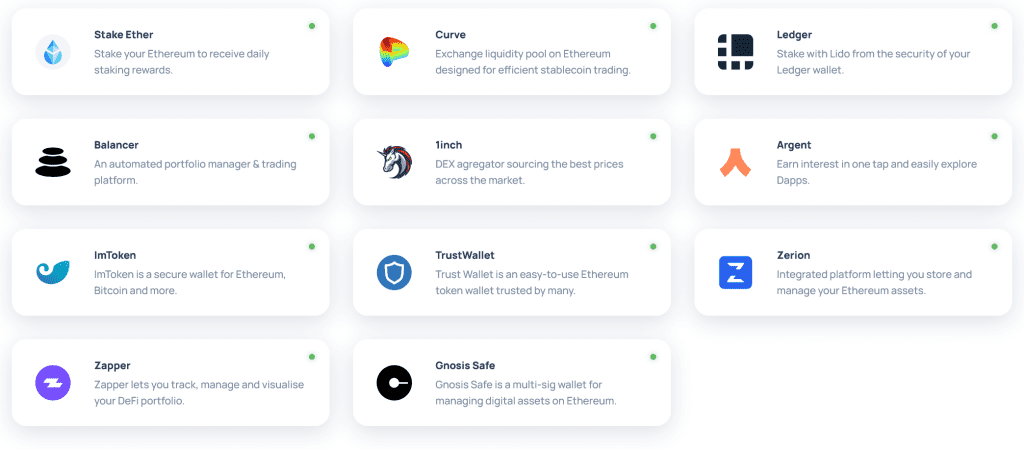

LIDO Wallet Integrations

Many digital wallets and DeFi platforms now have LIDO staking built into the platform itself.

If you have funds on a ledger hardware wallet for example you can use LIDO directly from within the Ledger Live app.

LIDO is the leading protocol for ETH staking and I’d expect to see more integrations and networks go live in the future as they expand their offerings.

Staking Alternatives

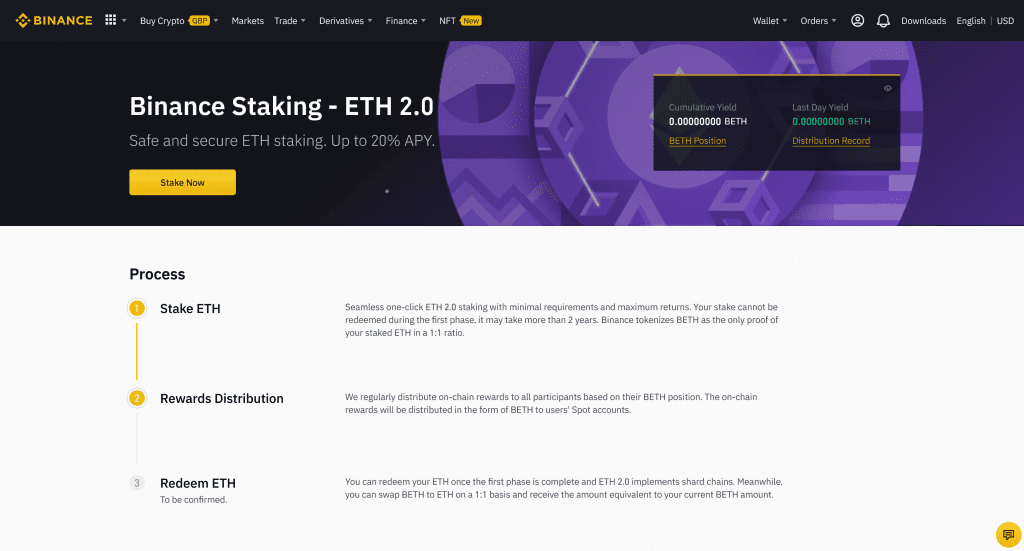

LIDO isn’t the only platform that provides staking. A popular option is to stake via Binance Earn.

On Binance ETH is swapped for BETH which is pegged and distributed in a similar way to stETH. You can do this from the comfort, or discomfort depending on your perspective, of a centralized exchange.

The other alternative that is worth considering is running your own validator node. This would require 32 ETH minimum funds and the technical ability to setup a server and deploy a node. The main benefits are that there are no fees or 3rd parties to rely on giving complete control over the staking process.

There’s more information about setting up and running a validator node here: https://launchpad.ethereum.org

Staking Risks

When running a independent validator node there is the risk of slashing if the validator node isn’t run correctly. However slashing is targeted more at manipulative users hacking the protocol rather than at validator nodes that don’t have the latest updates.

With centralized options like Binance there is the risk of regulatory interference, seized funds or hacked wallets. The risk of loss of funds from any of these events seems small considering past events.

With LIDO I feel the biggest risk is smart contract vulnerabilities. That’s not in any way a criticism against the developers or code quality. Whenever there is code on-chain it opens up the risk of unforeseeable bugs and vulnerabilities. To date I don’t think there have been any discovered and the code has been audited by numerous 3rd parties.

LDO Governance Token

Full disclosure: I recently allocated a small percentage of my portfolio (1% of digital assets) to a position in LDO.

My initial interest in LIDO was partly due to gaining a yield on my ETH holdings which currently represents my biggest holding but also to look at the governance token as an investment in itself.

The LDO token is currently ranked 350th on CoinMarketCap and I think there is plenty of room for growth in terms of TVL, market cap and token price.

The Bullish Argument

- ETH2.0 staking is likely to become big business as institutional investors will understand a yield bearing asset*.

- Lots of room for growth by adding new networks like the recent addition of Solana.

- First move advantage and network effects as stETH is accepted across DeFi lego bricks as collateral.

- LIDO DAO is a hard target for regulators to influence

- TVL growth, large addressable market in the future

The Bearish Argument

- No token utility outside of governance voting

- Circulating supply <3% of total supply.

- A lot of tokens vested to early investors and team released linearly from Jan 2022.

- Platforms like Ledger/Zapper could eventually release their own protocols

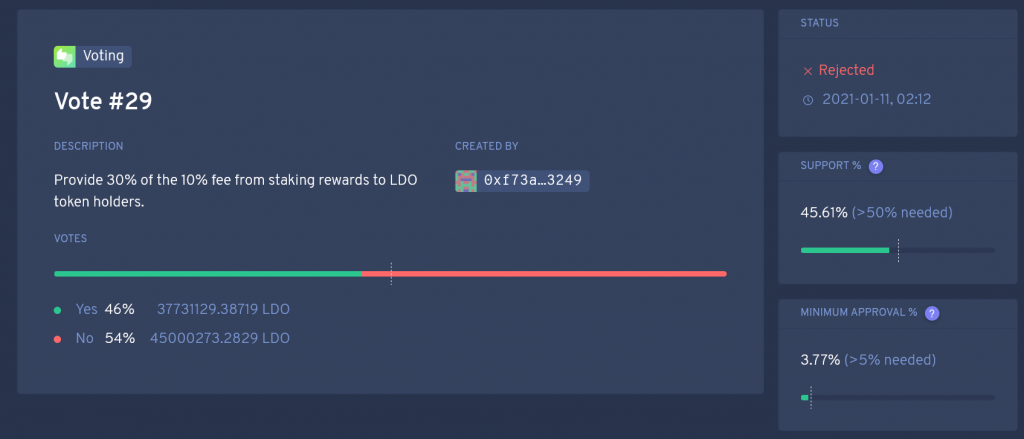

LIDO charges a 10% fee on staked profits. This fee is split between node operators, the DAO, and a coverage fund to insure against slashing penalties. There was already a vote in January on the DAO to provide 30% of the fees to LDO holders which got narrowly rejected.

My thesis is that this protocol is adding a lot of value and the funds will eventually be used to benefit LDO holders. As a back of napkin calculation.

Network Fee Generation = $6.2B TVL * (5% APR) * 10% = $31m this year

I’d expect TVL to grow more than 100% year on year. Staking rewards could be reduced as it becomes more popular but I’d expect most layer ones to be between 3-10% in the long term.

Current market cap is $128m due to vested tokens not being counted. Fully diluted market cap is $5.2B but this includes things like DAO treasury tokens which accounts for 36% of the supply. Even at $5.2B this market cap would only place the project at 30th in CoinMarketCap between Tezos & Cosmos.

The founders and team allocation is large too at 35% of total supply although this can be seen through rose tinted glasses as an alignment of interests with investors.

Between now and the linear vesting unlock which starts December 17th 2021 there is some increase in supply due to liquidity provider incentives and other DAO initiatives. What happens to the remaining supply once they start to get unlocked will likely make or break the tokenomics.

ETH2.0 is due to launch either later 2021 or early 2022. News and Crypto Twitter attention is going to be focused on the Ethereum upgrade to proof of stake. LIDO is in a good position to potentially benefit from this in terms of increasing TVL, brand awareness and token valuation. Delays and negative news flow could impact LIDO heavily as it increases the lock up period for stETH holders.

LDO is currently low liquidity and not listed on any centralized exchanges. The leading market place currently is Sushiswap which has a LDO/WETH pool with $16m in liquidity. Exchange listings and futures markets seem likely at some point and this could benefit liquidity and valuations.

Conclusion

LIDO provides a user friendly platform for staking layer one native assets. The protocol is growing horizontally and vertically as it moves into new ecosystems at the same time as expanding TVL in existing ones.

For investors with a HODL strategy staking provides an opportunity to gain a yield on their holdings. In the future this could evolve into a “passive income” narrative for retail investors and a “bonds v2.0” narrative for institutions.

LIDO is the market leader and best in class when it comes to staking platforms. There first mover advantage, brand awareness and 3rd party integrations across digital wallets and DeFi protocols provides a moat and competitive advantage.

The LDO token is an interesting governance token which lacks utility and liquidity… currently.

Hopefully this LIDO staking tutorial has been of interest and helps further understanding of the current and future staking opportunities on Ethereum, Terra and Solana.