I’ve previously discussed Eigenlayer and how restaking works but let’s look at what this will look like for the majority of users. Liquid Restaking Tokens are the equivalent of stETH for restaking where users can deposit assets to gain exposure to yield from restaking using a simple ERC20 token.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to restaking governance tokens at time of writing. Do your own research, not investment advice.

EigenLayer introduced a novel concept in the PoS landscape, actively validated services or AVS’s. By enabling the restaking of liquid staking tokens, EigenLayer allowed users to secure AVS’s, extending Ethereum’s security model to a broader range of applications. This restaking mechanism not only provided enhanced security for various distributed systems but also opened up new yield opportunities for stakers.

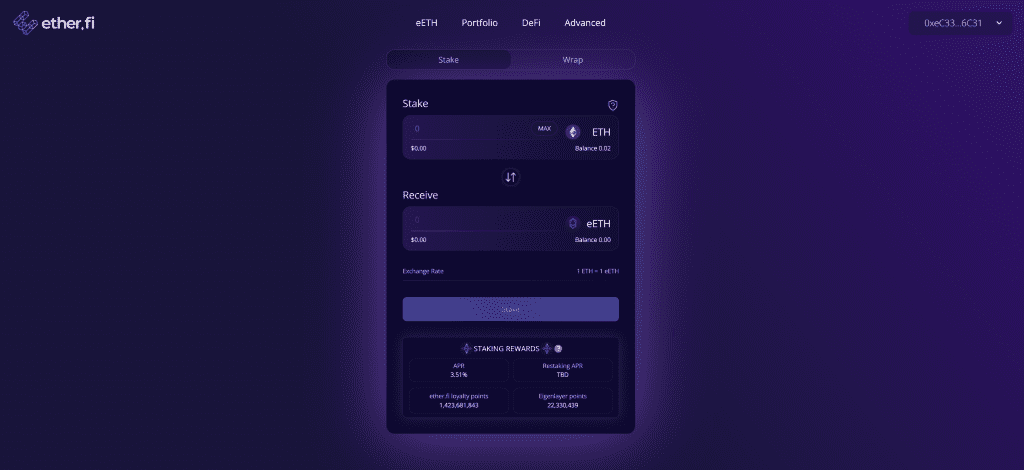

For end users however these complexities will be obfuscated behind a familiar frontend.

Building upon the concept of LSTs, LRTs provide liquidity to these restaked positions. Users who stake their ETH on platforms like EigenLayer receive additional yield from AVSs, and LRTs represent these positions, offering a liquid form of restaked assets.

Liquid restaking tokens provide a compelling value proposition, to get yield on top of the staking rewards already paid out to Ethereum stakers.

This technology is still emerging, Eigenlayer and many restaking projects aren’t yet fully live. There is increased risk at the very early stages of a protocol’s life cycle and restaking adds another layer of risk on top of a volatile asset, staking and liquid staking counterparty risks.

There is going to be an EigenLayer airdrop in 2024 and it could be the biggest airdrop of all time and valued in the billions USD. This is going to “create a wealth effect” and potentially spur a new narrative around liquid restaking projects in the space.

Some projects I’ll be looking at in more detail in future posts include ether.fi, KelpDAO, Restake Finance and Renzo. Right now some of these projects are using a points system to imply future governance token airdrops in return for you to deposit tokens and boost their TVL stats. Some chance Lido enters the market or integrates this internally which will take a significant market share but there is no public discussion of this currently.

Liquid Restaking Tokens represent a significant innovation in the Ethereum and DeFi ecosystems, offering new avenues for yield generation and liquidity. They also introduce complex layers of risk that must be carefully considered before depositing your hard earned ETH.