Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice.

Update 2023-08-10: Rebalanced my LBR position buying more at @ $1.22

Ever since I submitted usETH as a hackathon entry in the summer of 2022 I have been interested in the potential for a decentralized algorithmic stablecoin backed by a staked Ethereum position.

Lybra Finance looks like a better, more sustainable version of what I envisioned at the time and still think has a lot of potential.

How Lybra Finance Works

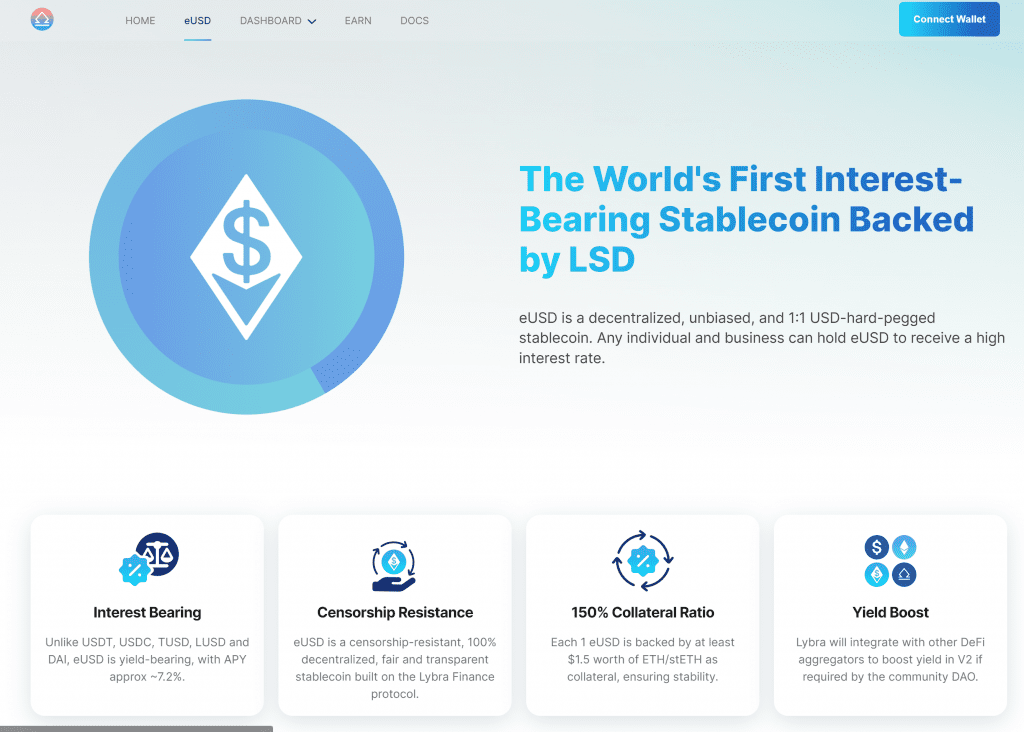

A user will deposit stETH or ETH to the protocol which enables them to borrow/mint eUSD at a collateralisation ratio of 150% so you can mint $66 eUSD for every $100 of ETH deposited.

Any ETH in the contract is staked using stETH by Lido Finance, rETH by Rocket Pool and bETH by Binance which earns staking rewards at around 4% a year currently.

These rewards are used to pay a yield on the eUSD stablecoin. So no interest is earned on ETH deposits but it is earned on eUSD holdings.

Because of the collateralisation ratio and distribution of the LBR governance token this provides a competitive APY for stablecoin holdings which is quoted on the website at around 7.2%.

Users can only mint new eUSD when demand is strong and price exceeds 1 USD. They can then sell the newly minted eUSD on a decentralized exchange (DEX). This increases the market supply of eUSD and lowers its price back to 1 USD.

If the eUSD price falls below 1 USD, users can no longer mint new eUSD drying up supply. Existing borrowers have the opportunity to purchase eUSD at a discounted rate on the market. They can then redeem it within the Lybra Protocol for $1 worth of ETH/stETH. As users buy up the undervalued eUSD, demand increases, driving the price back up to 1 USD.

LBR Governance Token

The LBR governance token provides voting rights to the Lybra DAO.

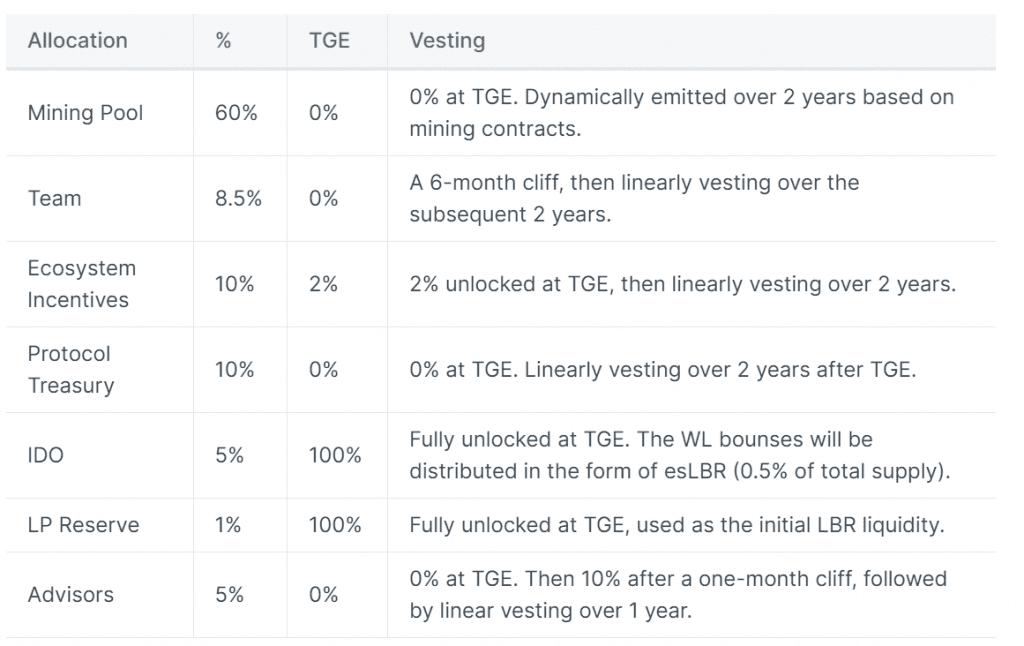

| Total Supply | 100 million |

| Circulating Supply | 7 million |

| Price @ 23-06-21 | $1.73 |

| Market Cap | $12 million |

| FDV | $173 million |

Token allocations are largely distributed to the mining pool. Interestingly there doesn’t seem to be any private funding round or VC interest. Mining rewards are distributed in esLBR which has a linear escrow period of 30 days. There is also some form of fee distribution which is somewhat unclear:

“esLBR holders receive a varied percentage of yield boost depending on the lock-up length. Details TBD.” & “100% of LSD Distribution Service Fee will be distributed to esLBR holders.”

The protocol is live on Ethereum mainnet and the code includes LayerZero OFT implementation with the plan to launch on Arbitrum and presumably other L2’s on the roadmap.

Lybra Finance Investment Thesis

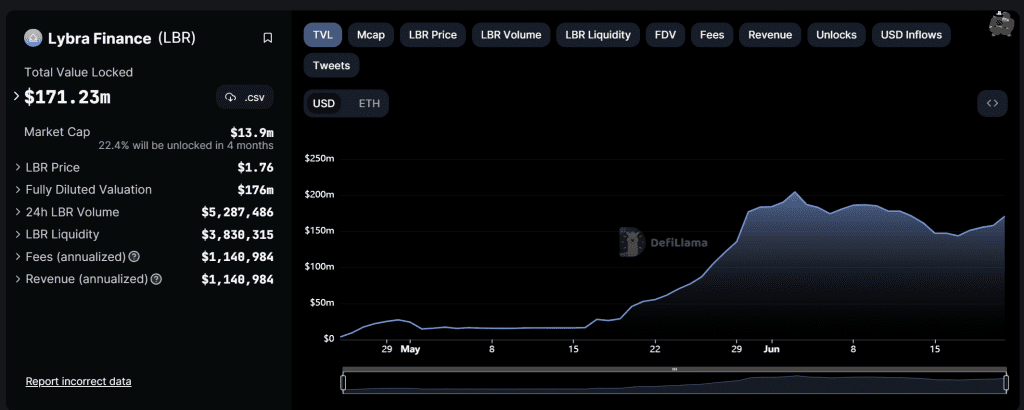

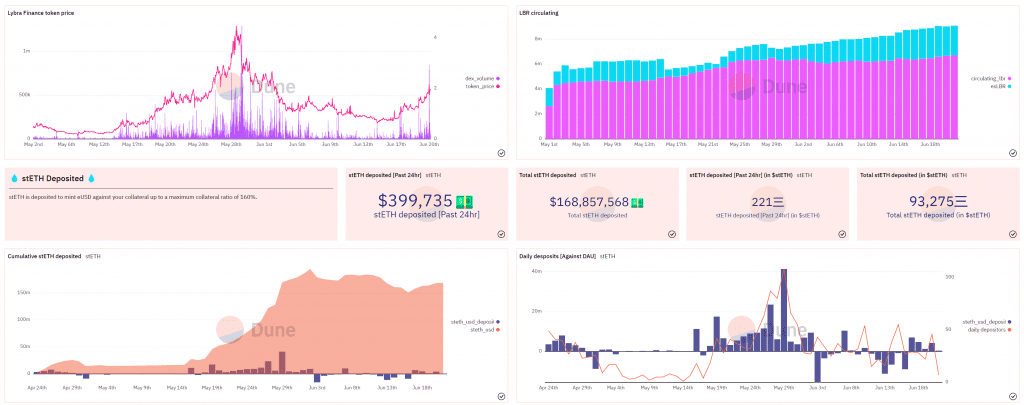

The project launched in late April so it is still early days but there is $171m in TVL already which peaked at the start of June.

The LBR token was minted on May 1st so the six month team cliff will open up some supply of tokens around November 1st, although I haven’t double checked the timestamps.

The team supply is insignificant relative to the mining rewards which is currently between 54,618 to 126,277 daily and mainly distributed to the eUSD loan pool*.

One concern is around the potential for a DeFi hack. There is a security audit by Solidity.finance but they didn’t find anything significant. A $100k bug bounty on immunefi is a bit more reassuring but there is risk to be aware of.

There is a very nice Dune Analytics board by @DeFiMochi here: https://dune.com/defimochi/lybra-finance

Currently Lybra is significantly ahead of its competitors offering similar products based on TVL.

| Project | Market Share | TVL |

|---|---|---|

| Lybra | 34.749% | $168.68m |

| IETH | 11.743% | $57.00m |

| crvUSD (curve) | 11.092% | $53.84m |

| Raft | 10.969% | $53.24m |

| Pendle | 10.874% | $52.78m |

There is significant potential for growth in TVL on mainnet but also from the imminent roll out to cross chain ecosystems.

Luna proved product market fit for a interest bearing stablecoin and Lyra Finance offers a more sustainable and safe design of that system.

With a market cap of $12m I think there is significant upside to the LBR token and this is one of the first projects I’ve found for a while which has investment potential.

It is a farm token so there is going to be significant selling pressure from the eUSD loan pool but overall the tokenomics are favourable for a speculative high risk allocation.

Bare in mind I have a bias because this is a field that I have a particular interest towards, do your own research, not investment advice.

For more information see the official site at https://lybra.finance