Earlier this year Radiant Capital launched Radiant v2, an omnichain lending protocol. This is a write up of my internal research notes, this is not a sponsored post and I have no allocation at time of writing in Radiant or RDNT.

Radiant is a DeFi platform that allows users to lend and borrow digital assets across multiple blockchains.

With the launch of v2 they migrated the RDNT token to the LayerZero OFT (Omnichain Fungible Token) format, making cross-chain fee sharing more seamless and enable quicker launches on additional chains.

“Radiant is positioning itself to be the go-to money market and source for cross-chain liquidity across all of DeFi — while driving Real Yield via organic economic activity and protocol fees”

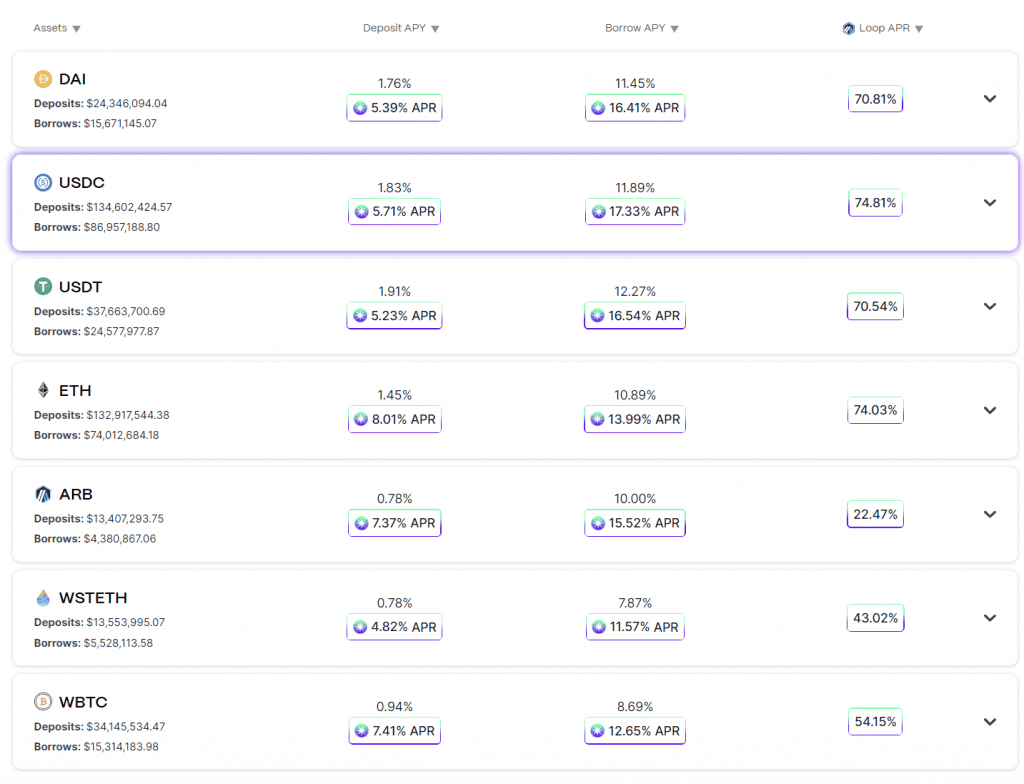

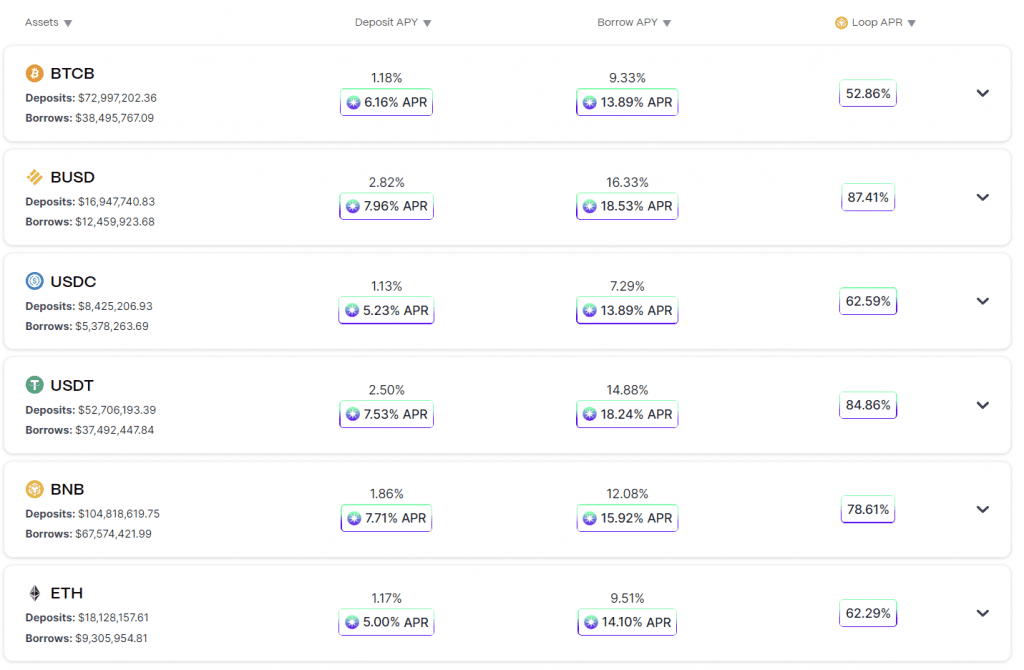

The protocol has significant liquidity on both Arbitrum ($390m) and BNBchain ($274m) and I expect there is room for horizontal expansion to other chains.

Radiant Assets on Arbitrum

Radiant Assets on BNBchain

RDNT v2 Token

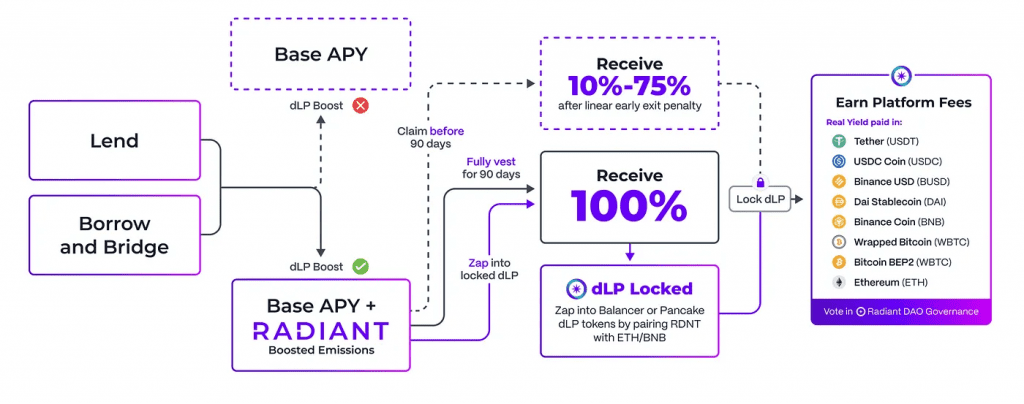

To earn platform fees depositors need to lend funds and also lock Radiant liquidity tokens. The Radiant Dow voted to require a 5% ratio between Radiant liquidity tokens and deposits to unlock emissions. This means that for every $100 of deposits in the protocol, the user needs to lock $5 of liquidity tokens to unlock emissions.

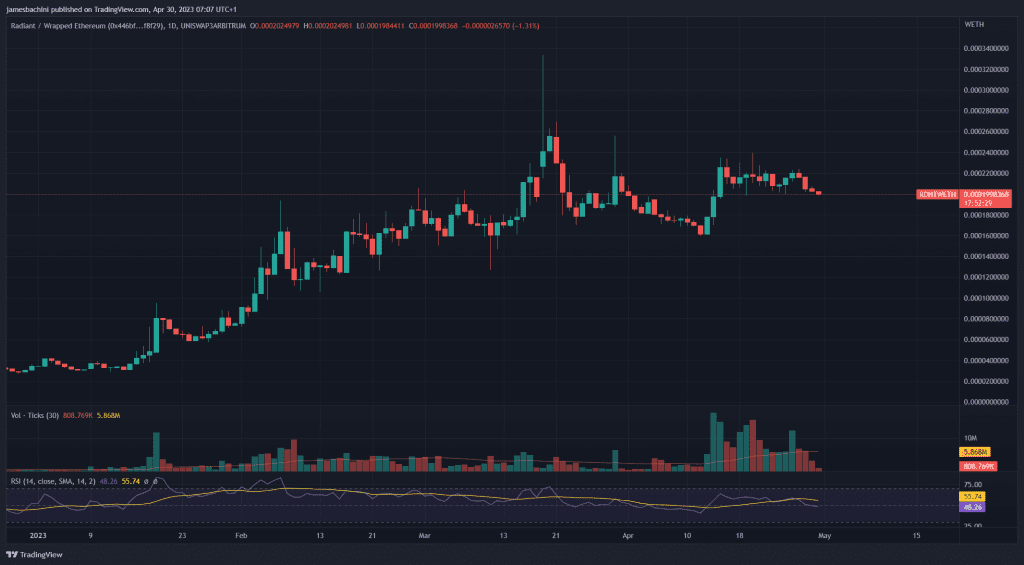

This increases the utility for the RDNT token which has been doing well so far this year. This chart shows the Uniswap pool for RDNT/WETH on Arbitrum.

Emissions are accrued through liquidations and interests from borrowers. The rewards are made up of Blue Chip assets such as Bitcoin, Ethereum, and stable coins. Radiant has already raked in millions through platform fees. 60% of the fees are divided up among DLP lockers, 25% to the base fee for lenders, and 15% to the DAO.

There was no presale or private sale to VC firms, the project has been bootstrapped by the team.

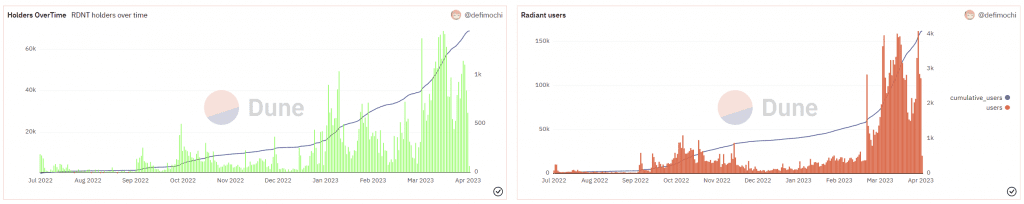

There are some interesting stats on the RDNT protocol, pools and fees on Dune: https://dune.com/defimochi/radiant-capital

RDNT holders and platform users increasing over time.

Radiant Governance

Radiant Governance is built on a decentralized autonomous organization (DAO) that is governed by community members who lock RDNT. RDNT token holders have the power to submit proposals, vote on proposals and bring those to fruition.

A legal entity called Supernova Holdings will serve the Radiant DAO as a foundation by implementing the proposals from the DAO.

A council is composed of three members, appointed by a vote of locked RDNT token holders. The council serves a twelve month term and there is an annual vote to appoint members. The council controls the multisig DAO wallet, attends weekly meetings, votes on RFPs and attends community events.

Conclusion

Cross chain borrowing and lending is going to be a significant industry in the future. Radiant has gained significant traction on Arbitrum and BNBchain, with the potential to expand its product to additional layer 2’s and alt L1’s in the future.

The RDNT token is used by lenders to secure a share of platform fees and emissions. If the team can grow TVL it should increase demand for the RDNT token and bring additional value to the project.

The governance is well thought out to protect the developers who bootstrapped the project from scratch with no VC funding. They have created a valuable protocol which is well positioned for an expanding omnichain future.