This DeFi analysis report for Raft Finance follows up on my analysis and investment in Lybra Finance. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Raft or the R stablecoin. Do your own research, not investment advice.

How Raft Works

Raft is a DeFi protocol that enables users to borrow and lend assets using their staked Ethereum position (Lido Finance’s stETH) as collateral.

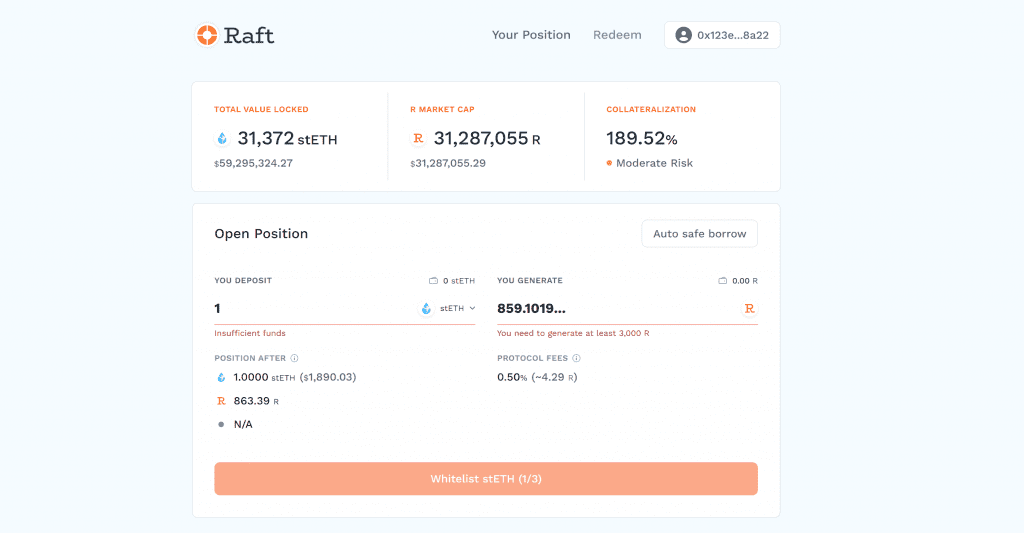

To participate in borrowing on Raft Finance users must deposit wstETH with a collateralization ratio of at least 120% for each R (the native stablecoin of Raft). This ensures that there is sufficient collateral to cover the borrowed amount and maintain the stability of the protocol.

Note there is a minimum debt requirement for borrowers, which is set at $3,000 R.

Users get to keep the staking rewards which accumulate in their collateral position but pay a borrowing rate and fee on the R stablecoin.

Calculating The Borrowing Rate & FEE

The Base Rate is determined based on the borrowing and redemption frequency of R. The Borrowing Spread is a hardcoded to range between 0% (minimum) and 1% (maximum). The Borrowing Rate itself is the sum of the Base Rate and the Borrowing Spread, with a cap set at 5%.

When borrowers take out a loan on Raft Finance, they are subject to a Borrowing Fee. The Borrowing Fee is calculated by multiplying the borrowed amount by the Borrowing Rate. For example, if the fee rate is 0.05% and a user borrows $10,000 R, they will be charged a fee of $5 R. As a result, the total debt will amount to $10,005 R.

Returning borrowed R tokens to Raft is a straightforward process. When borrowers repay their debt, the R tokens are immediately burnt. There are three methods of returning minted R:

- Repayment Borrowers can repay their own borrowed R tokens in Raft and receive their wstETH collateral back. Partial or full repayments are possible, but it’s crucial to ensure that the resulting debt balance does not fall below the minimum requirement. Successful repayment not only improves the collateral ratio of the borrower’s position but also increases the available collateral that can be withdrawn.

- Redemption The redemption mechanism ensures stablecoin holders can redeem R tokens from the protocol’s borrowers at any time. The redemption process involves using the redeemed R tokens to pay off a portion of each existing position’s debt. The amount of debt repaid is proportionally distributed among positions based on their collateral amounts.

- Liquidation Liquidations serve as a safeguard to ensure that each R token is always backed by at least 1 USD worth of wstETH. An account becomes eligible for liquidation when its collateral falls below the Minimum Collateralization Ratio.

The liquidation process begins when a 3rd party MEV liquidator initiates a smart contract call. The liquidator pays off the borrower’s debt and, in return, receives the collateral and a liquidator reward.

The R Stablecoin

R is the stablecoin which uses a combination of hard peg and soft peg mechanisms to maintain its peg value of 1 USD.

The hard peg mechanism relies on arbitrage opportunities to maintain the stablecoin price aligned with its stETH backing assets and always within the price band of 1 USD to 1.10 USD. This is done through two mechanisms: redemptions and over-collateralization.

- Redemptions allow R stablecoin holders to redeem it for the equivalent value in wstETH collateral. Whenever a user redeems their R tokens, these tokens get burned by a smart contract, reducing the R circulating supply and increasing its price. This implies that redeeming R tokens for wstETH is economically convenient only when R trades below 1 USD.

- Over-collateralization creates an upper boundary for the R price, which is 1.20 USD. Users can deposit 1.20 USD worth of wstETH, mint 1 R, and sell it on the open market for more than 1.20 USD to lock in a riskless profit when the R price exceeds this level.

The soft peg mechanism relies on the ability of a stablecoin design to incentivize users to act based on the expectation that the peg will be kept in the future. This is done by creating a Schelling point to which the system tends to return after temporary deviations.

For instance, when R trades above 1 USD, existing borrowers are not incentivized to repay their positions. In contrast, prospective users could take advantage by borrowing and selling R on the open market. The same reasoning applies when R trades below 1 USD: borrowers are incentivized to repay their debts, and prospective R holders buy R on the open market and redeem it.

Raft also seeks to establish deep liquidity across numerous market pairs to reinforce R’s soft peg to $1. By leveraging a combination of decentralized automated market makers (AMMs) and centralized exchange market-making strategies, the protocol aims to create a robust liquidity foundation.

| Trading Pair | Exchange | Liquidity |

|---|---|---|

| R / DAI | Balancer v2 | $43.24M |

| R / wstETH | Balancer v2 | $8.98M |

| R / wstETH | Maverick | $964.51k |

| R / USDC | Uniswap v3 | $500.69k |

A liquidity committee plays a pivotal role in maintaining the peg by managing and deploying incentives across different pools. This dedicated committee ensures that the protocol adapts to the ever-changing market conditions and optimally allocates incentives to foster liquidity and maintain R’s stability.

Governance

Currently there is no governance token in place and the team control the liquidity committee role through a mutlisig.

Raft’s current governance model is designed to be efficient, transparent and minimalist all be it centralized with plans to decentralize. The contracts are designed where possible to be permissionless and immutable. Key parameters can be updated with the 3/5 multisig controlled by a combination of Raft and partner VC’s.

The scope of governance is intentionally limited to three main areas:

- Appointment of the Liquidity Committee

- Treasury fund expenditure

- Setting protocol fees

In the future, Raft plans to transition to a more participatory governance model likely built around an ERC20 RAFT governance token allowing users to contribute to the direction of the protocol. This might be one to watch if there is a TGE or tokensale event at some point in the future.

Conclusion

Raft Finance works slightly differently to Lybra Finance in that the collateral rewards remain in the collateral rather than offered to stablecoin holders. There are pros and cons to this but one negative is you don’t get the same yield bearing sustainable stablecoin which is a valuable product in itself.

I think it will be more difficult for the R team to integrate R throughout the DeFi ecosystem with 3rd party partnerships and collateral approvals.

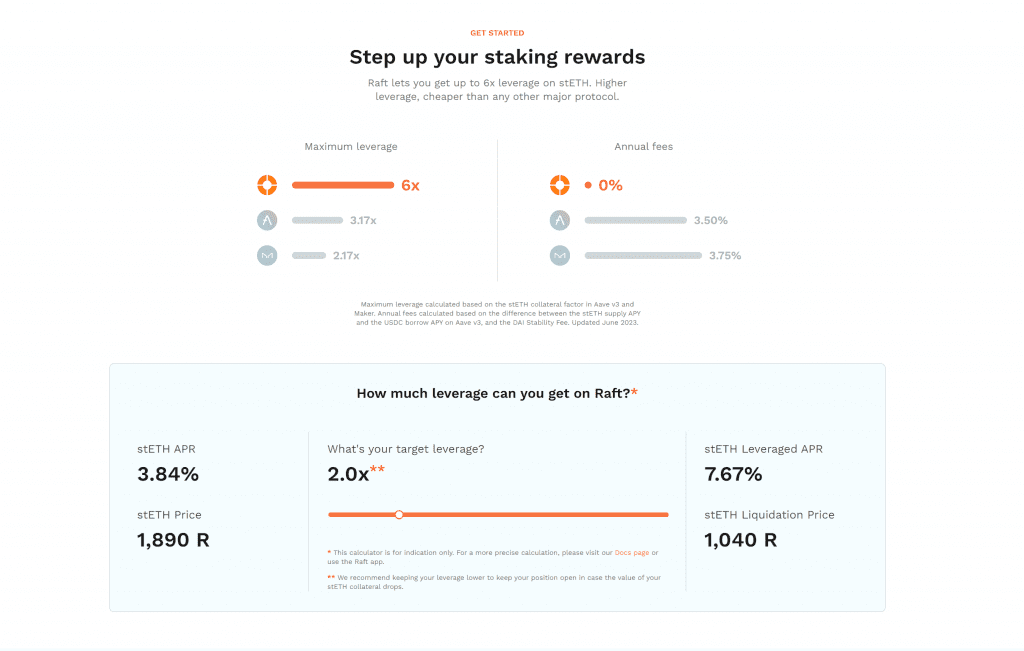

One thing they have done really well is create a one click leverage system to depost stETH -> borrow R -> buy stETH -> repeat

This is obviously a high risk strategy but they have made it as easy as possible for users to execute a semi-complex leveraged position.

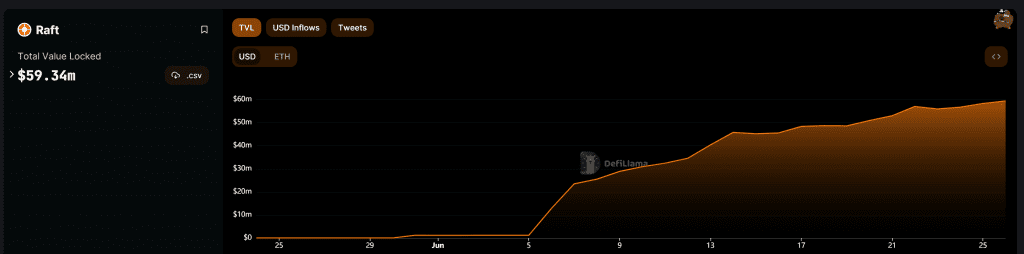

The project is growing and gaining steady traction with TVL sitting just below $60m currently.

One to watch, especially in regards to a future potential RAFT governance token which could be used to incentivise growth.