Uniswap recently announced they are developing an RFQ (request for quote) system that will change the way we swap digital assets. In this article we will look at RFQ in crypto and how it works.

How RFQ Works

RFQ works when a buyer invites sellers to bid on specific amount of an asset. The buyer then uses these bids to determine the best available price and service level. The sellers use automated, programmatic response software to quote at their fair value price. This method, popularly utilized in traditional finance, offers a customer centric model that equips market participants with a flexible mechanism for trading financial instruments.

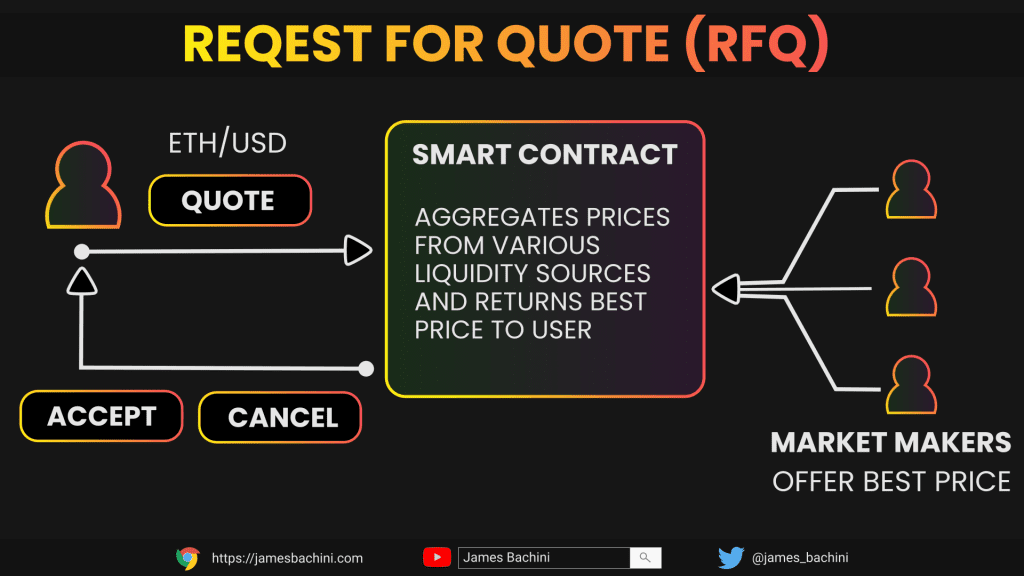

Understanding the RFQ Process

The RFQ process typically begins with the customer clicking a “Quote” button. This will send a request to the RFQ system which will then distribute it to market makers. They respond with quotes which are aggregated and the leading offer is sent back to the customer. The customer will then usually have 15 seconds to accept, cancel or requote.

If the seller accepts their quotation the transaction goes through and the assets are exchanged.

Advantages of RFQ Systems

In traditional finance RFQ is widely used for consumer facing frontends because of it’s simplicity and efficient backend mechanics.

RFQ systems promote competitive pricing and fair market dynamics. Since quotes are sought from multiple sellers, the prices quoted tend to be competitive, offering the buyer a fair deal. MEV is also less of an issue as the RFQ system can’t get sandwich attacked.

RFQ user interfaces are elegantly simple and lack the complexity of a traditional orderbook exchange. The customer does not need to worry about order types or fill rates, they simply click a button, get a quote and accept or deny.

RFQ systems can provide greater liquidity for large orders because they tap into the OTC desk systems where market makers are likely able to execute large trades without slippage compared to your average user. When dealing with complex or less liquid instruments a market maker can often provide a competitive quotation because they can access liquidity across multiple exchanges and chains.

RFQ in Crypto

The first RFQ platform to gain traction in crypto was CowSwap, which despite it’s name, was an innovative platform that combined an RFQ system with a DEX aggregator.

Uniswap clearly saw the promise in such a system and is building Uniswap X to venture in to the RFQ ecosystem. Uniswap X is a permissionless Dutch auction protocol which aims to aggregate liquidity sources for better prices. It will offer gas free swaps, protection against MEV (Maximal Extractable Value) and eliminate costs for failed transactions.

The protocol will run on a dedicated X appChain and outsource routing complexity to 3rd party fillers. Users will still need to approve spend of the token, then sign an off-chain order which will initiate the RFQ.

Over time I expect we will see more RFQ systems in crypto and we will go through a consolidation phase where liquidity is aggregated. Rather than using a single exchange, users will interact with a consumer focused application which completes swaps via RFQ backends.

I would be interested to see someone come up with an RFQ system for perpetual futures contracts. If you had the right market makers in place this could be an extremely compelling product to simplify trading with leverage on DeFi.