The following guide provides everything you need to know to successfully raise capital for your startup. Startup funding doesn’t need to be complicated, investors are actively looking to deploy capital into new ideas and businesses.

- Where To Raise Capital [Video]

- Creating A Pitch Deck

- Meeting & Pitching To Investors

- Negotiations, Equity & Contracts

Where To Raise Capital

There are a number of options for startups to raise capital and get funded. Which route you choose depends largely on the amount of funds required and how the business will appeal to retail and institutional investors.

Crowdfunding Platforms

Crowdfunding platforms offer a modern way to connect investors and startups through an online marketplace for investments and new products.

A startup will usually create a listing for their business or product which will be published on the crowdfunding website. Investors will periodically check through the listings to see if anything meets their investment criteria.

Consumer focused crowdfunding platforms take this a step further by enabling startups to pre-sell their innovative products direct to end users.

Consumer Focused Crowdfunding Platforms

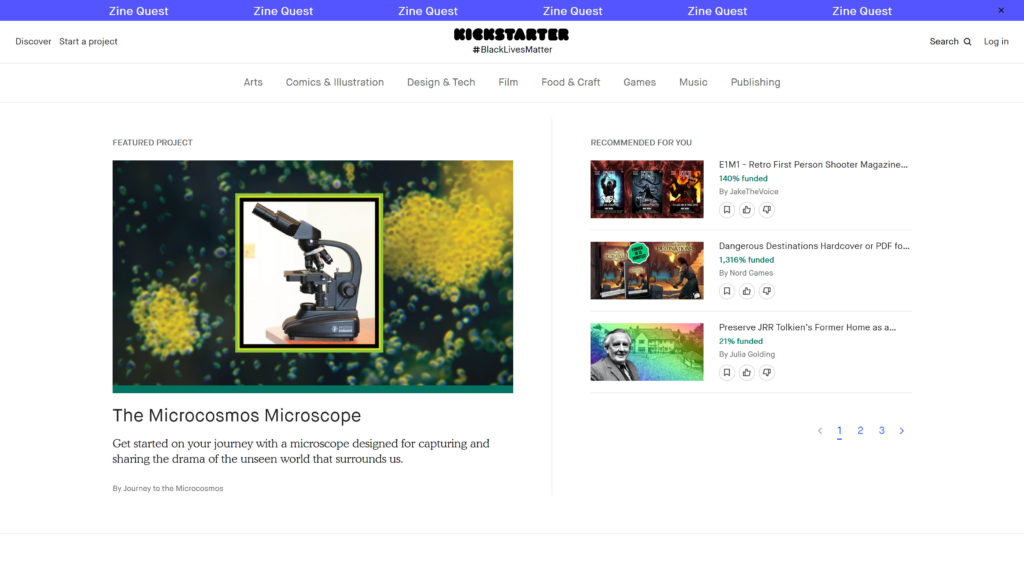

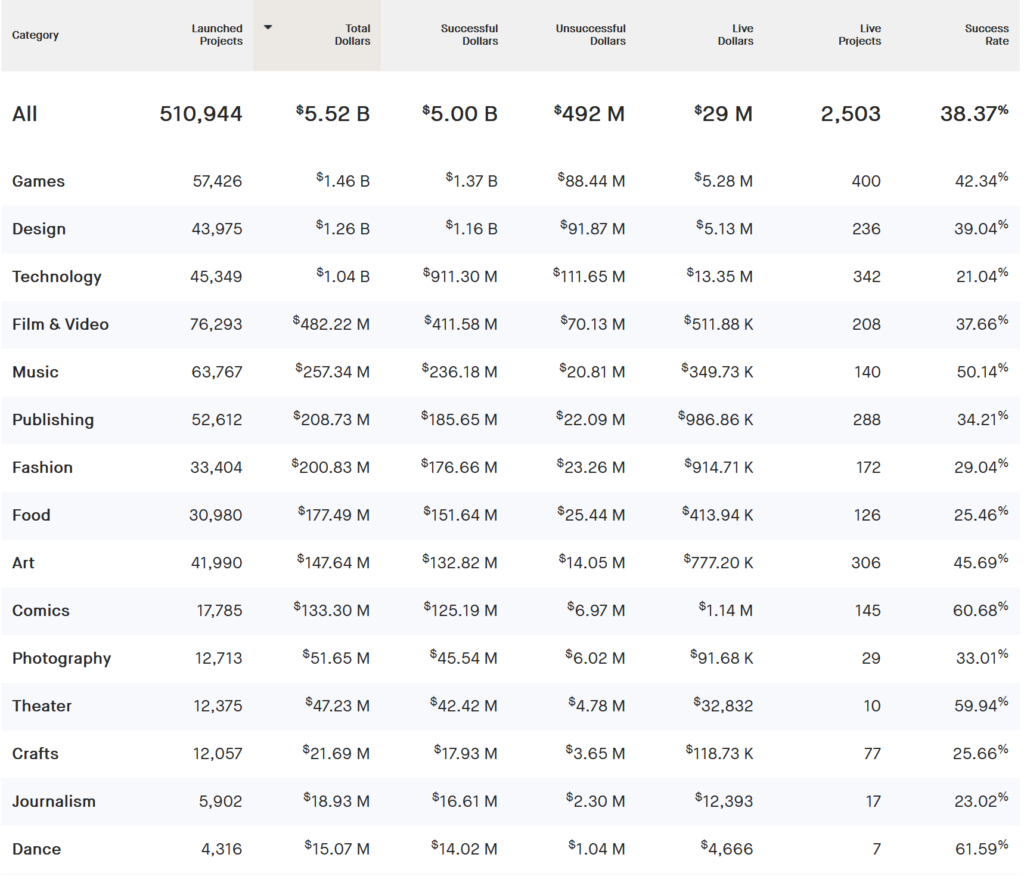

Kickstarter is the market leader in this field. Their website has raised over $5 billion USD for startup founders.

Kickstarter is built around projects and each project must have a clearly defined goal. Project founders provide unique rewards for their backers, often tiered based on investment level.

In practice consumers view Kickstarter as an online store for the next generation of gadgets. The 20m backers tend to have a geeky, early adopter profile and products that appeal to that demographic do well.

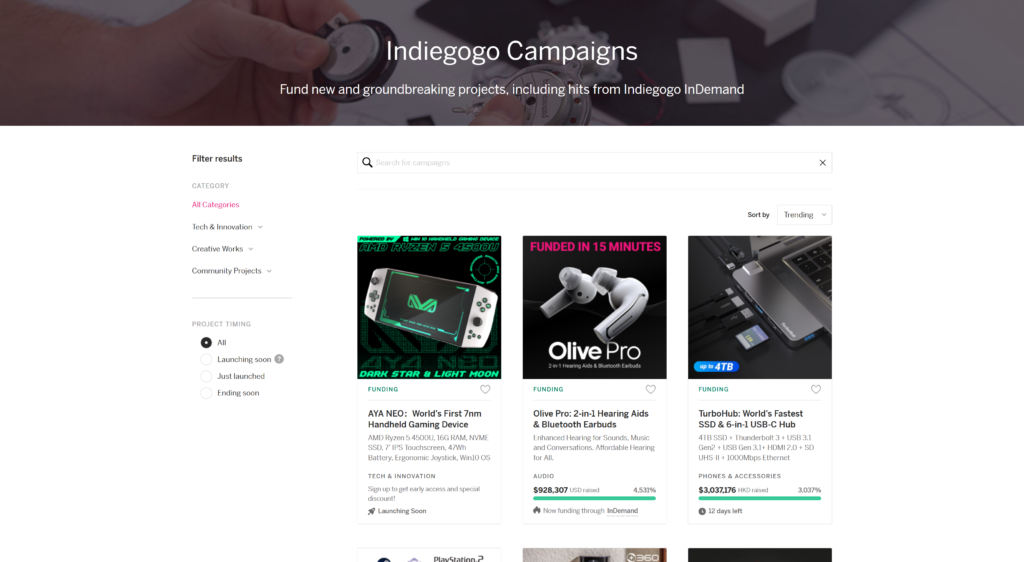

Indiegogo provides a more hands on approach than Kickstarter. You’ll get to speak to a rep who can advise on the crowdfunding campaign. They have tools to help founders identify backer demographics and also provide post-funding support.

Indiegogo get’s about half as much internet traffic as Kickstarter but there is still over 10m visitors per month according to Similarweb.

Investor Focused Crowdfunding Platforms

Investor focused crowdfunding platforms focus on high net worth individuals who generally allocate a small amount of their net worth to funding startups.

Investor focused platforms generally offer equity in exchange for funding.

Seedrs is an online directory of investment opportunities. It’s mainly for UK startups looking to raise between £100k to a few million.

I’ve spoken to the guys at Seedrs in the past and always found them to be professional and helpful.

Crowdcube is another UK based crowdfunding platform similar to Seedrs. They have institutional funds to deploy alongside the retail investors that discover businesses on their site.

Crunchbase is an American based website that acts as a discovery platform for investors. If you wanted to find out what new apps there are in a certain niche then you can pull up a list of recent projects and their investments using crunchbase. It’s used a lot by VC’s and angel investors to find new projects and get an overview of a sector.

Government Grants & Tax Relief

I only really have experience of government support in the UK so if you are raising funds elsewhere it’s probably worth skipping to the next section.

There is a list of government finance and support schemes available to startups and SME’s here:

https://www.gov.uk/business-finance-support

These are often regionally based and there’s going to be a lot of paperwork and red tape associated with releasing public funding.

One of the most successful and popular grant programmes is Innovate UK’s Open Grant.

https://apply-for-innovation-funding.service.gov.uk/competition/762/overview

The government also offers tax relief for investment and innovation.

R&D Tax Relief

Businesses can get a 33% refund on R&D spend. Most tech startups will be able to benefit from this as R&D can be on a broad range of innovative technologies.

SEIS | Seed Enterprise Investment Scheme

The SEIS programme offers both income tax and capital gains tax relief to investors in small businesses and startups. If you are raising capital in the UK you’ll get asked at some point if you are SEIS or EIS registered. EIS is a similar program for larger or more established enterprises.

It’s relatively easy to apply and takes between one to three months to get approval. It’s definitely something that’s worth doing if you are planning to raise capital further down the road.

Friends & Family

I have mixed feelings about this. While friends and family is probably the low hanging fruit in terms of ease of accessing capital it can have a long term negative impact.

As a startup founder there is a lot of pressure on you already to succeed. Statistically most don’t and you have to be aware of the chances of failure and what that will feel like. If your business is failing then there’s enough weight on your shoulders without taking Mum and Dad’s life savings down with you.

If your friends and family are uber rich and don’t mind losing the money then that is one thing. If a loss would negatively impact their lives then look at other ways to fund your ambitions.

Bank Loans, P2P Lending & Credit

The benefit of starting a business with a bank loan or P2P lending platform is that you don’t dilute the equity in the business from the outset. Founders can effectively borrow money from various sources with the promise to pay it back at a later date or in instalments.

The catch is that most banks have vast experience in startup funding and know the risks associated. They will normally ask for the founder to provide collateral for the loan. This is often in the form of real estate and the loan will be secured against your home.

The danger is if you can’t meet the repayments then the bank could reposes your home and you lose everything.

Many loans will follow a VAR, a variable rate of interest which could fluctuate in the future. Interest rates are historically low at the moment which makes borrowing money cheap. In the future we could see interest rates increase to combat inflation which would lead to higher monthly payments on borrowed capital putting pressure on many businesses cash flows.

If you have a high street bank account then this is a good place to start as you’ll have a credit history with that organisation.

FundingCircle is a market leader in the space. They offer unsecured loans of up to £500,000 to small businesses. FundingCircle works a little bit like Seedrs in that they connect retail investors with entrepreneurs rather than deploying their own money.

The UK government also provides a business loan scheme specifically for startups: https://www.gov.uk/apply-start-up-loan

VC’s, Accelerators & Angel Investors

Venture capital firms developed out of the tech startup scene in Silicon Valley. Many have grown in to billion dollar companies in their own right and have helped build some of the worlds most successful startups.

VC’s are usually looking for disruptive startups with high growth potential. They invest in moonshots and founders that have a chance of creating industry leading businesses.

Many venture capital firms will also provide a network of support for their startups. The benefits of landing a big VC deal go far beyond the initial capital injection.

Some of the most famous venture capital firms include:

Incubators and accelerators provide a more hands on approach to funding and nurturing startups. Someone from the incubator will act as a mentor providing direction, contacts and business tools to develop.

Incubators will usually ask for applications over a period of time then review and pick the startups with the most potential. They will then provide some funding and their services in exchange for equity.

There are a number of incubators which are currently accepting applications.

Ycombinator – You only have to look at the businesses that have gone through Ycombinators incubator to appreciate their success rate. They invest $125k USD in to very early stage startups. Ycombinator is very integrated into the Silicon Valley venture capital networks which can benefit future funding rounds.

TechStars – Provide a 3 month programme which is aimed at “helping entrepreneurs succeed”. Since starting in 2006 they have funded 2000 projects with a combined market cap of $30b.

If you are considering joining an accelerator then do your due diligence and make sure the people and culture that you’re going to be working with suits your business.

Angel investors are usually high net worth individuals that seek out early stage startups to invest in. There are plenty of angel investor networks that will either specialise in a particular field or geographic region.

In Cambridge alone we have Cambridge Angels and Cambridge Capital Group. You’ll likely be able to find networks of angel investors local to you with a quick Google search.

Angel investors are often start up veterans who have either started their own business or been around the startup scene for some time. They can be a valuable resource and can act as a mentor or board member for the startup as well.

Self Funding & Bootstrapping

This would always be my default first option. If you have a revenue generating business then growth should be achievable without taking on debt or giving away equity unnecessarily.

There are some exceptions when operating in new or competitive niches where there is a winner takes all environment for the market leader and growth comes first before all else.

If you are able to bootstrap your startup then it rightly or wrongly takes away some of the pressures off. When you give away equity you are essentially giving someone else a say in how to run your business. When you take on debt you are creating a future liability that can weigh down a business.

There are a number of ways to increase cash flow without taking on debt such as encouraging annual prepay billing or agreeing favourable terms with suppliers.

Jason Fried @ Basecamp is an advocate of self-funding. In his book “It doesn’t have to be crazy at work” he talks about the risks of taking on VC capital and the external pressures that this causes.

Creating A Pitch Deck

A pitchdeck is usually a pdf or externally hosted slideshow type document which serves as an introduction to a startup for investors.

Angels and VC’s will literally go through hundreds of these so an idea needs to stand out, be timely to a investors interests or clearly demonstrate early stage growth and traction.

Here is a suggested layout for a pitchdeck:-

- Logo & Value Proposition

- Problem & Solution

- Business Model & Opportunity

- Meet The Team / Experience

- Technology & Explainers

- Growth & Traction

- Call To Action & Contact Details

Here are some example pitchdecks:

Once you’ve created a beautiful pitch deck you need to get it out to investors.

Here is a list of VC contact details that I’ve used in the past for a fintech/blockchain project. You’ll notice that there is a column for previous investments and that’s because I personalised the email to show I had done some research on their firm.

You’ll probably want to create your own list of VC’s and Angel investors in your sector and record correspondence and progress with each.

Meeting & Pitching To Investors

I think it’s fair to say that this is an area that most startup founders don’t relish. New platforms like crowdfunding have removed the need to meet investors face to face completely. However if you are looking to raise large amounts then there’s no getting around the need to pitch your business. At some point everybody that ever started a business had to pitch for one reason or another so it is worth getting some practice in.

The first thing to remember is that investors are beneath their rugged exteriors actually human and appreciate being treated as such. This isn’t going to be dragons den and you aren’t going to get shot down or laughed at for TV’s sake.

When meeting investors be confident but not overly salesy. Express why you are enthusiastic about an idea and seek to get their feedback. These are smart people that understand industry sectors and the risks involved in early stage startups. They may be able to provide insights and a broader opinion on a project even if they aren’t willing to offer capital.

Setting meetings and pitching is a numbers game and the more a founder does it the better they’ll get and the more chance they will have of finding a match.

Negotiations, Equity & Contracts

Negotiations will start based on the amount you want to raise and the equity on offer. Investors will want to gain the most equity for the smallest price and entrepreneurs will want to give away the least amount of equity at the highest price.

The term valuation is used a lot in negotiations. If a startup is offering 10% equity in exchange for $200k then they will need to justify a $2m valuation for their business.

At this stage the founder will need to form a corporation if they haven’t done so already. In the UK this is in the form of a limited liability company. This is easy to do and just requires an online form to be filled in.

There are different types of shares and equity and it’s worth reading up on these prior to negotiating terms so you have an idea of the terminology and requirements that they’ll be expecting. In the UK there are class A and class B shares and investors will usually negate that their shares are class A. In the US I believe there is a similar situation with preferential shares.

Either the founder or the investor will suggest a contract template to use for the deal. This may be a founders agreement or shareholders agreement. It forms the legal basis for the future of the business and all parties should read and understand what is in that document.

Anything contentious should be adjusted to suit both parties and funds wont be distributed until the terms are agreed.

I hope that helps early stage startup founders get some financial support.

If you are interested in learning more about online business then check out the free digital marketing course.

If you’ve enjoyed these resources could you help share this content on social media and send it to anyone who you think might benefit from it.

Thank you.