Ricsson Ngo took inspiration from Uniswap and set out to build a permissionless money market. The idea evolved into Timeswap which recently launched on Arbitrum. In this article I’ll write up my own notes and internal research on the protocol. Note this is not a sponsored post and I don’t currently hold any stake in Timeswap.

Update January 2024

I took another look at Timeswap following an integration for a client. Notes below.

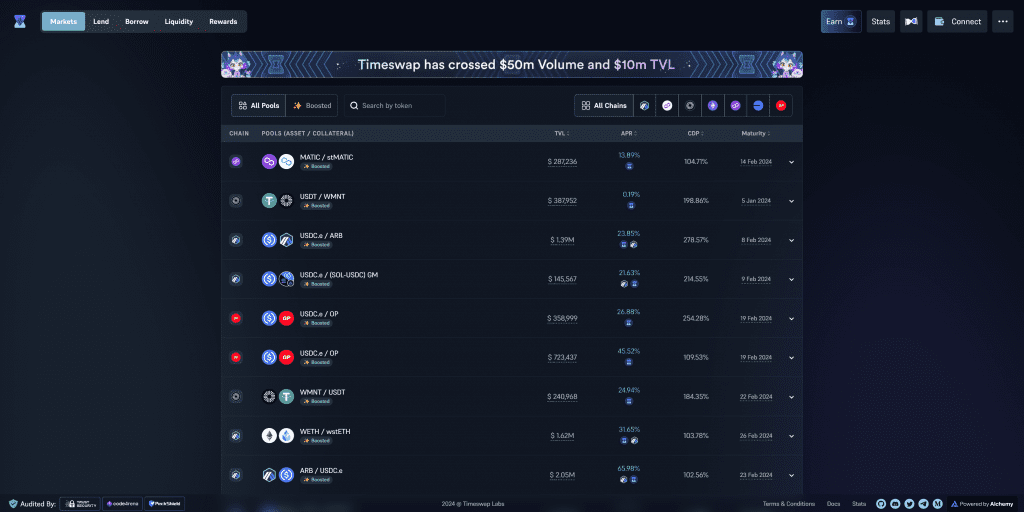

Timeswap is a borrowing and lending platform like Aave but instead of requiring permission for assets to be listed as collateral it enables any party to set up a liquidity pool which is used as a money market.

For example a protocol can deposit USDC to a pool which specifies their governance token as collateral. This then allows users to come in and deposit the governance token and borrow the USDC (up to around 75% of the collateral value).

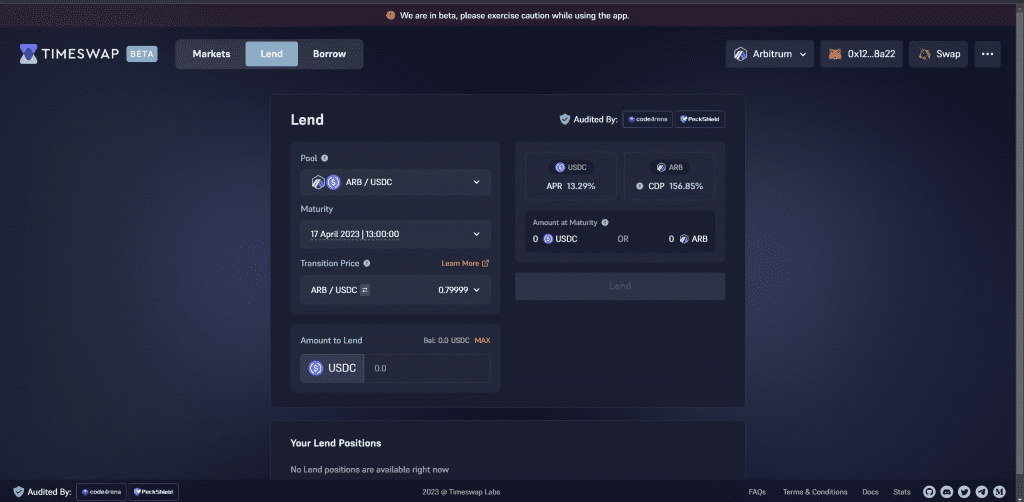

Borrowers pay a fixed rate APR which is set at the time of the transaction. This rate fluctuates for future borrowers based on the amount of USDC left in the pool.

As the APR goes up this incentivizes 3rd party lenders to add USDC to the pool to collect the interest rate, creating a dynamic market place for borrowing and lending.

Each pool has a fixed term, usually 2-3 months and there is no liquidation risk for borrowers until the end of the term. If collateral value is lower than the borrow amount at maturity then the position is liquidated and lenders receive the lower valued collateral.

The transition price of a pool is the price level at which borrowers are expected to pay back their loans. If price finishes above this level the borrower will sell the asset and pay back the loan to take back the underlying higher valued collateral. If price is below the transition price at the end of the term the borrower will keep the borrowed asset and the collateral will be released to the lender.

In practice this allows DeFi protocols, memecoins and any other project with an ERC20 token to introduce leverage to their system. If a user can borrow USDC they can buy more of the governance token with it and repeat the process leveraging up the position.

Each pool is isolated, much like liquidity pools on a DEX like Uniswap so there is no existential risk if one of the assets fails or depegs.

Timeswap is currently operational on multiple blockchain networks including Ethereum, Arbitrum, Mantle, Polygon PoS, Polygon zkEVM and Base. The project has been audited by code4rena and peckshield.

Pools can be boosted which means they are incentivized either by the project setting up the pool or by Timeswap themselves with a future distribution of the currently unreleased TIME Token.

An interesting project to keep an eye on as they seem to be gaining traction and product market fit in the space.

How Timeswap Works

Timeswap is a decentralized AMM (automated market maker) based money market protocol that allows users to manage their ERC20 tokens over a fixed period. The platform functions as both a zero liquidation money market and an options market.

The platform at https://app.timeswap.io is easy to use and the UX will be familiar and intuitive for anyone with some DeFi experience.

The Timeswap protocol utilizes a unique constant sum options specification and a duration weighted constant product automated market maker similar to the Uniswap.

It is a non-liquidation fixed term lending and borrowing protocol, which is fundamentally an option implementation under the hood. Timeswap utilizes a proprietary mechanism to value its options, assumably based on the black scholes model.

How Financial Options Work

To understand how Timeless works we need a basic understand of financial options. There are two types, call options and put options. A call option gives the buyer the right but not obligation to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

When an option is in-the-money, it means that the option has intrinsic value. For a call option to be in-the-money, the market price of the underlying asset must be above the strike price. For a put option to be in-the-money, the market price of the underlying asset must be below the strike price.

On the other hand, when an option is out-of-the-money, it means that the option has no intrinsic value. For a call option to be out-of-the-money, the market price of the underlying asset must be below the strike price. For a put option to be out-of-the-money, the market price of the underlying asset must be above the strike price.

Timeswap Loans

Timeswap operates on a constant sum model inspired by Uniswap’s constant product equation for price discovery. It offers fixed income style non-liquidatable loans, where no borrower is ever liquidated and has the option to either repay their debt or default before maturity.

If a borrower defaults, their collateral is forfeited and distributed to the lenders, whereas lenders receive full interest payments when all borrowers repay or get insurance in the event of borrowers deciding to default.

Every Timeswap loan can be compared to an option-based design, where the borrower buys a put option on selling their collateral to the lenders at maturity in asset terms at a fixed strike price

In a USDC-ETH pool if ETH is available cheaper on Timeswap arbitrageurs will withdraw all ETH completely with USDC and pocket the price difference, leaving only USDC in the pool. The underlying logic for having only one asset at all times in the pool stems from rebalancing. It is expected that only either ETH or USDC (whichever has a cheaper value) exists in the USDC-ETH pool at all times.

Native Timeswap Tokens

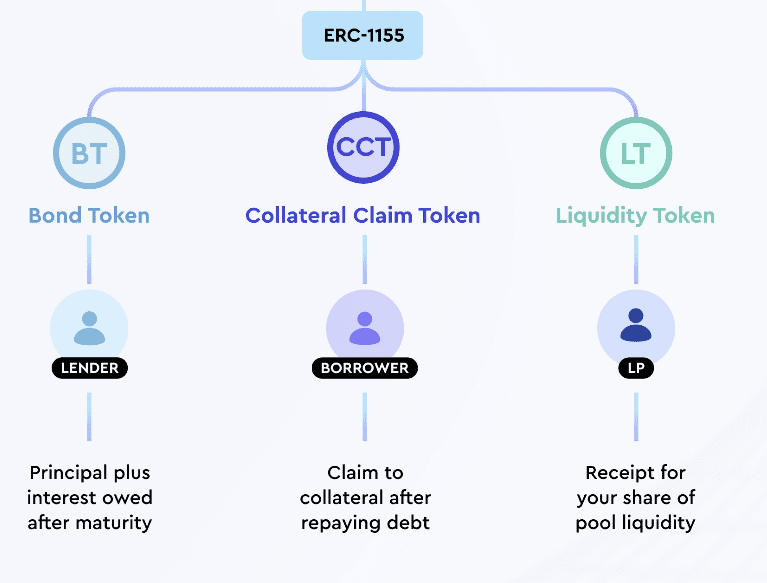

Timeswap offers 3 types of native tokens based on the ERC1155 contract:

- Collateral Claim Tokens (CCT) are minted for borrowers against their locked collateral. These tokens can only be burned before maturity, and their value becomes zero after maturity. Borrowers receive CCT tokens as a claim for their locked collateral after repaying the debt. There are separate CCT tokens for each collateral asset used in the pool.

- Bond Tokens (BT) are minted for lenders against their claim for principal and yield. These tokens can be burned before maturity with a small penalty on the yield to provide an early exit for lenders. Holding 1 CCT and 1 Bond token simultaneously is equivalent to having a neutral position (equal lend and borrow positions).

- Liquidity Tokens (LT) are minted to liquidity providers (LPs) as a claim to their portion of assets in the pool. LPs receive LT tokens in exchange for providing liquidity to the pool. These tokens allow LPs to claim to the existing liquidity, which includes the assets in the Principal pool and the collateral locked in the Collateral Pool. LPs can burn their LT tokens anytime before maturity with a penalty for an early exit.

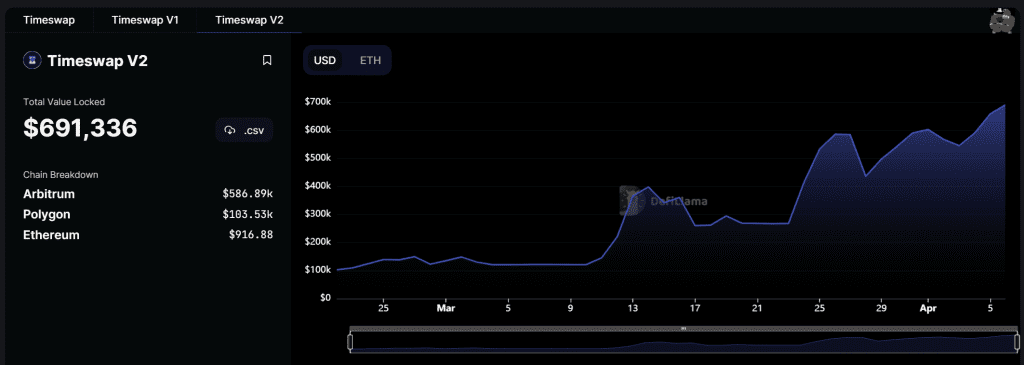

Timeswap V2

Timeswap V2 was developed in 2022 and provides several major changes which makes it 4-5x more capital efficient according to the team.

- The first is the ability to flexibly exit from positions, allowing repaid loans to be added back to the pool instead of remaining idle.

- Bidirectional pools have been introduced, combining $USDC-$ETH and $ETH-$USDC into a unified liquidity pool.

- The new version requires overcollateralized positions, minimizing LP risk, and reducing value absorbed by arbs.

- The introduction of transition price provides a simplified UX. Borrowers and lenders can enter a pool that best fits their risk-reward profile based on transition price.

- Single-sided liquidity has been introduced, which gives LPs the option to provide liquidity for one side of the pool.

- The complexity of native tokens has been reduced from 6 different tokens to 3, enabling the development of flexible exits and reduced code complexity, thus gas efficiency.

These changes increase capital utilization and efficiency, decrease borrowing interests and slippage, and reduce LP risk.

Conclusion

Timeswap is a novel protocol bringing AMM simplicity to lending and options markets in decentralized finance. It allows users to lend tokens into the pool to earn a fixed income or borrow/leverage tokens against other tokens, without liquidation risk.

The launch of v2 improved capital efficiencies and horizontal scaling on Arbitrum has led to an increase in TVL. The project is still small enough to have significant upside potential if and when they release a native governance token.