February 2022

-

3 Yield Farming Stablecoin Strategies

Yield farming stablecoin strategies provide high returns on low volatility digital assets. In this article I explore three ways to generate yield on USD stablecoin holdings. For an introduction on what stablecoins are and the different stablecoins compared see this article: https://jamesbachini.com/stablecoins/ Note that stablecoin farming strategies are changing all the time and this article…

-

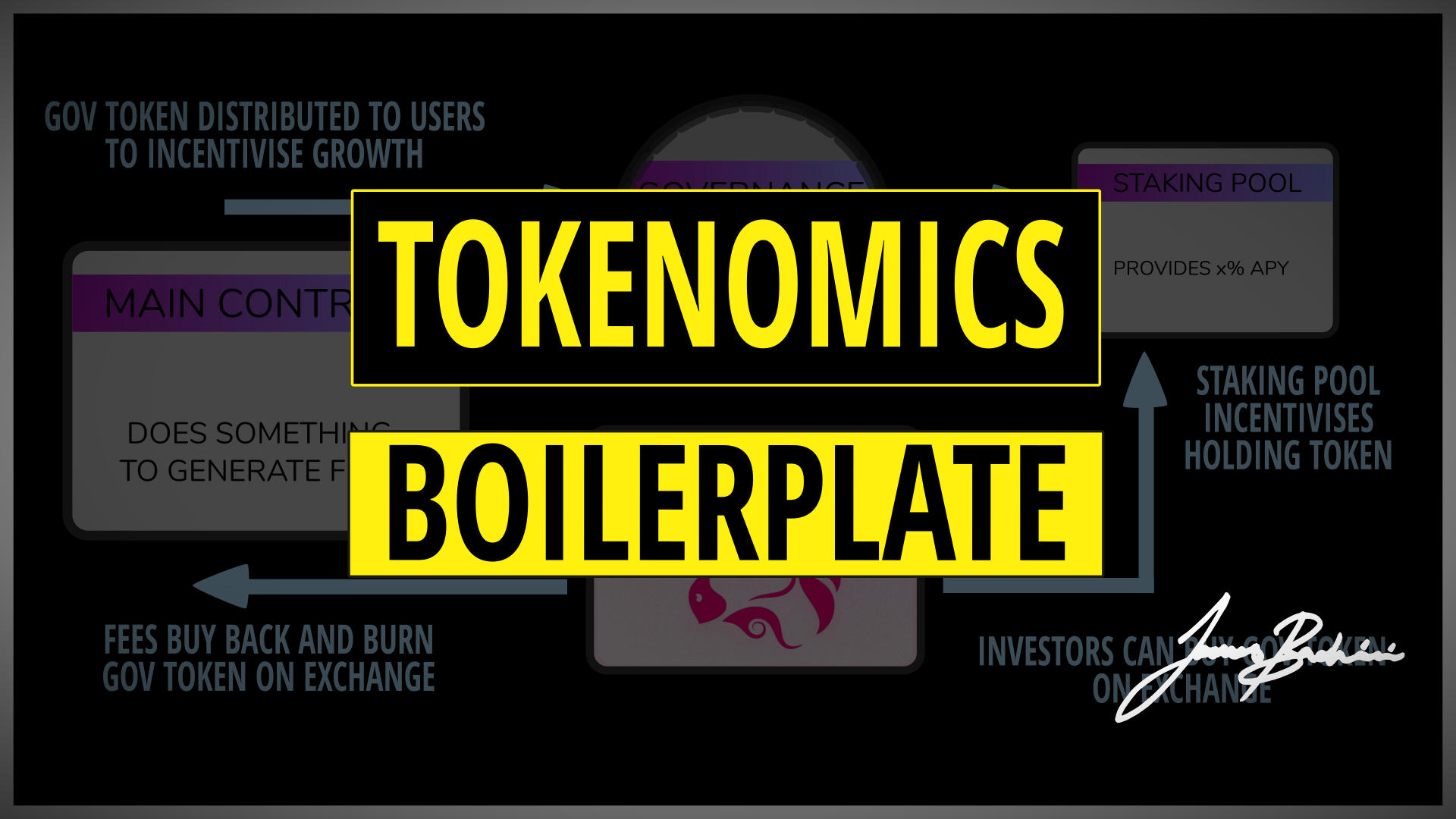

Tokenomics Boilerplate | Governance Tokens, Uniswap Buy-Backs and Staking in Solidity

In DeFi a projects success is greatly tied to the effectiveness of the tokenomics. Governance tokens can be distributed to the users to incentivise growth and fees can be used to buy these back on exchange. In this Solidity tutorial we are going to deploy a governance token, a Uniswap v3 liquidity pool, a buy…

-

EthGlobal Hackathon | Winning $4300 And Advice For Future Participants

EthGlobal hackathons are the largest and most prestigious in the blockchain developer space. The February 2022 “Road To Web3” event was focused on the migration from web2 social networks to web3 technologies. Over the weekend around 400 teams built projects using sponsors technology including Polygon, Uniswap, Moralis and Web3Auth. This video talks about the experience…

-

The Rise Of DyDx And Decentralized Trading

In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets. DyDx took this concept and packaged it in to a decentralized trading…