Yield farming stablecoin strategies provide high returns on low volatility digital assets. In this article I explore three ways to generate yield on USD stablecoin holdings.

For an introduction on what stablecoins are and the different stablecoins compared see this article: https://jamesbachini.com/stablecoins/

Note that stablecoin farming strategies are changing all the time and this article was last updated on 19th November 2022. I’ve tried to keep the strategies as generic as possible to give you a starting point rather than list individual farms and liquidity pools.

Curve Finance

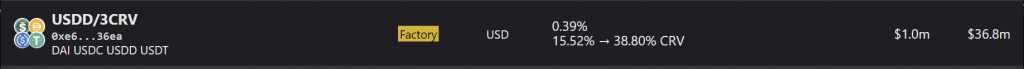

Curve is still the go to place for stablecoin liquidity and for new stablecoins to bootstrap liquidity. For this reason there’s always a high return pool that you can get a high yield on. At time of writing there’s this one which combines 3 reputable stablecoins with USDD which is one that would need some due diligence.

Check out the current pools at https://curve.fi/

These newly launched stable coins can gain liquidity by bribing holders of the CRV governance token for votes. This increases their gauge weighting and they get more rewards relative to the size of the pool which causes the APR to go sky high incentivising liquidity providers to add more collateral until it stabilises. Learn more about the curve wars.

This is a fast moving, active strategy which will take some time to manage and put risk frameworks in place.

MultiFarm

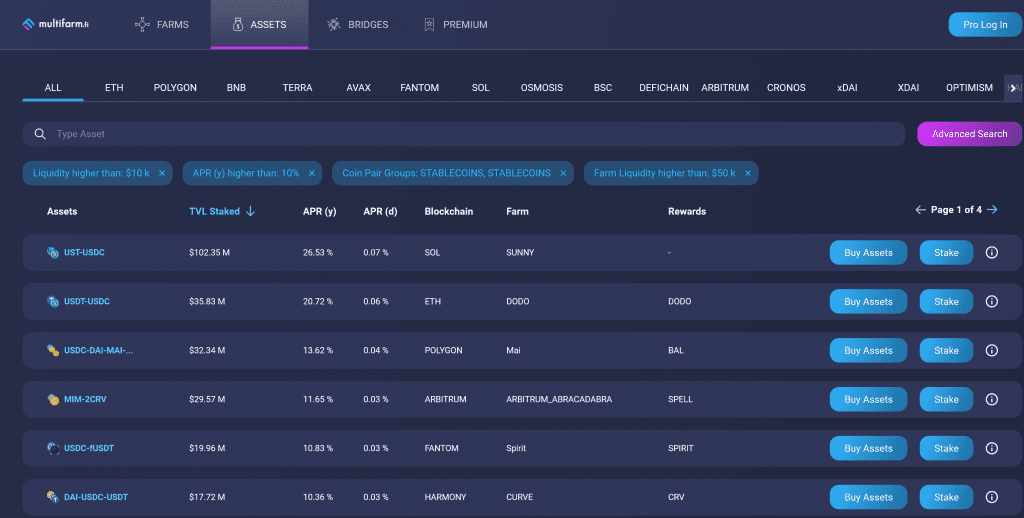

Multifarm is an application which collects market data on liquidity pools across different blockchains. Yield farming opportunities come and go, if you want to get the very best APR’s, especially from a risk/reward perspective you’ll need to be moving funds around a lot.

Sites like Multifarm provide a good starting point for researching different pools and looking for the best EV farms.

Rotating funds to the latest high yielding pools can be done on a opportunistic time frame or it can be scheduled quarterly for example.

Origin USD

Origin has been around since 2017 and offer a novel way to earn yield in a risk-averse way through leading DeFi protocols using DAI, USDC, and USDT. The token distributes rewards from yield farming automatically so holders of the OUSD token can see their balance increasing similar to how stETH works on lido finance.

There is more information at https://ousd.com/ and in the docs https://docs.ousd.com/

Conclusion

Stablecoins offer a low volatility digital asset which can be staked to earn high yield. With the lack of basis trading and lending demand currently across crypto markets these pools fill up quickly diluting the rewards.

In an ideal world funds would be diversified over the top few pools at any given time. Risk should always be calculated and assessed to discount the returns and rank opportunities accordingly.

I hope this serves as a good introduction to yield farming stablecoins.