Ethena Labs has introduced USDe, a synthetic dollar on the Ethereum blockchain. USDe is designed to be crypto native, stable and censorship resistant.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Ethena or USDe at time of writing. Do your own research, not investment advice.

USDe achieves stability and scalability through a cash and carry type mechanism where they create a delta neutral hedged position using staked Ethereum as collateral.

To promote growth Ethena offers the ‘Internet Bond’, an onchain bond offering dollar denominated savings of over 60% currently. This is made up by combining yield from staked Ethereum and returns from derivatives markets. The short positions used to hedge the spot stETH collateral earn a funding fee because of the current demand for leverage.

This is along the same theme as things I’ve discussed before including the demo from 2022 usETH which used a similar delta neutral strategy to create a stablecoin from ETH collateral. The problem with my implementation was that it didn’t scale…

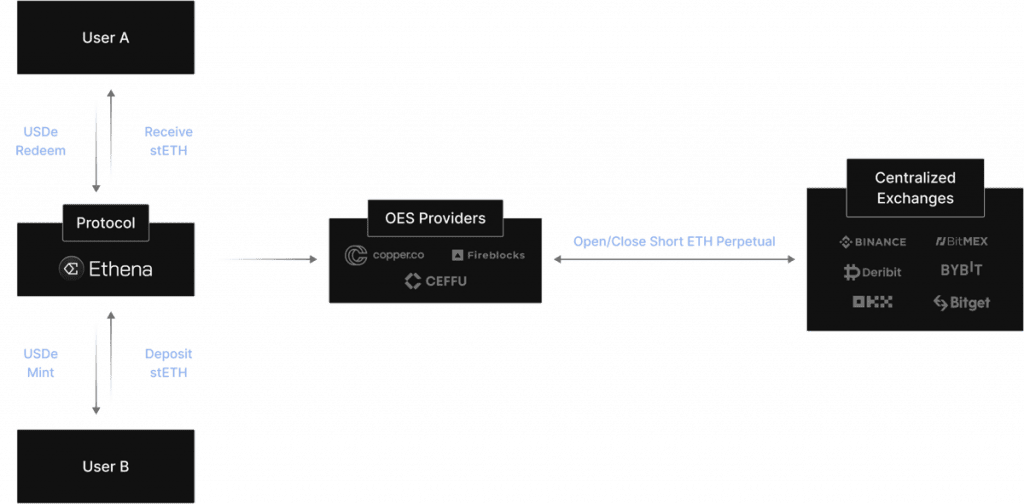

Ethena handles scaling by introducing some centralization around handling the futures side of the trade. These 3rd parties are called OES handlers who will short the futures contracts on centralized exchanges where more volume is available to scale.

There is mention in the docs of using zero knowledge proofs for positions in the future but this seems unlikely in the short term and I couldn’t find any evidence it’s actually being worked on.

The compromise here for scalability is centralization around the “regulated & licensed custodians and MPC wallet providers”.

Ethena has found product market fit with a high APR on stablecoin holdings. There is proven demand for this in DeFi and the protocol is enjoying fast growth.