In this tutorial, we will create a Rust script that:

- Connects to the Binance API to retrieve historical Bitcoin price data in hourly format.

- Calculates the current price, 24-hour moving average, and 7-day moving average of Bitcoin.

- Estimates a fair value for Bitcoin based on the average of the current price, 24-hour moving average, and 7-day moving average.

Instructions

- Clone the repository:

git clone https://github.com/jamesbachini/Bitcoin-Fair-Value.git- Navigate to the project directory:

cd Bitcoin-Fair-Value/- Ensure you have Rust installed.

- Build the project:

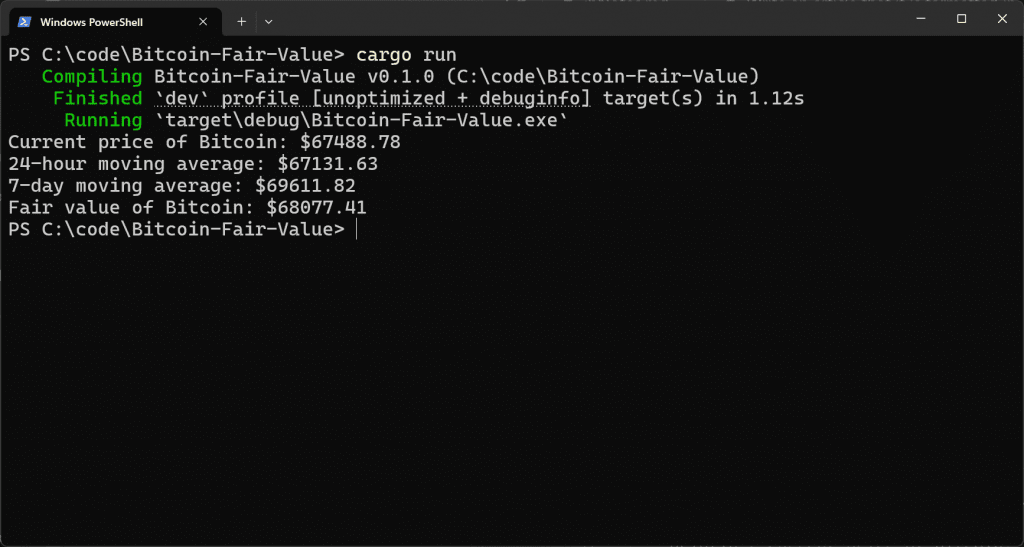

cargo build- Run the script using:

cargo runRust Code

The code is open source and available on Github: https://github.com/jamesbachini/Bitcoin-Fair-Value

use reqwest::Client;

use serde::Deserialize;

use std::error::Error;

#[derive(Deserialize, Debug)]

struct Kline {

close: String, #[allow(dead_code)]

open_time: u64, #[allow(dead_code)]

open: String, #[allow(dead_code)]

high: String, #[allow(dead_code)]

low: String, #[allow(dead_code)]

volume: String, #[allow(dead_code)]

close_time: u64, #[allow(dead_code)]

quote_asset_volume: String, #[allow(dead_code)]

number_of_trades: u64, #[allow(dead_code)]

taker_buy_base_asset_volume: String, #[allow(dead_code)]

taker_buy_quote_asset_volume: String, #[allow(dead_code)]

ignore: String,

}

async fn fetch_klines(client: &Client, symbol: &str, interval: &str) -> Result<Vec<Kline>, Box<dyn Error>> {

let url = format!(

"https://api.binance.com/api/v3/klines?symbol={}&interval={}",

symbol, interval

);

let response = client.get(&url).send().await?;

let data: Vec<Vec<serde_json::Value>> = response.json().await?;

let klines: Vec<Kline> = data.into_iter().map(|kline| Kline {

open_time: kline[0].as_u64().unwrap(),

open: kline[1].as_str().unwrap().to_string(),

high: kline[2].as_str().unwrap().to_string(),

low: kline[3].as_str().unwrap().to_string(),

close: kline[4].as_str().unwrap().to_string(),

volume: kline[5].as_str().unwrap().to_string(),

close_time: kline[6].as_u64().unwrap(),

quote_asset_volume: kline[7].as_str().unwrap().to_string(),

number_of_trades: kline[8].as_u64().unwrap(),

taker_buy_base_asset_volume: kline[9].as_str().unwrap().to_string(),

taker_buy_quote_asset_volume: kline[10].as_str().unwrap().to_string(),

ignore: kline[11].as_str().unwrap().to_string(),

}).collect();

Ok(klines)

}

fn calculate_moving_average(klines: &[Kline]) -> f64 {

let sum: f64 = klines.iter().map(|kline| kline.close.parse::<f64>().unwrap()).sum();

sum / klines.len() as f64

}

#[tokio::main]

async fn main() -> Result<(), Box<dyn Error>> {

let client = Client::new();

let symbol = "BTCUSDT";

let interval = "1h";

let klines = fetch_klines(&client, symbol, interval).await?;

let current_price: f64 = klines.last().unwrap().close.parse().unwrap();

// Calculate 24-hour sma

let ma_24h = if klines.len() >= 24 {

calculate_moving_average(&klines[klines.len() - 24..])

} else {

calculate_moving_average(&klines)

};

// Calculate 7-day sma

let ma_7d = if klines.len() >= 168 {

calculate_moving_average(&klines[klines.len() - 168..])

} else {

calculate_moving_average(&klines)

};

let fair_value = (current_price + ma_24h + ma_7d) / 3.0;

println!("Current price of Bitcoin: ${:.2}", current_price);

println!("24-hour moving average: ${:.2}", ma_24h);

println!("7-day moving average: ${:.2}", ma_7d);

println!("Fair value of Bitcoin: ${:.2}", fair_value);

Ok(())

}We’ll start with the async fetch_klines function to fetch Bitcoin price data from the Binance API. The Binance API provides various endpoints for accessing market data, and we’ll use the /api/v3/klines endpoint to get the historical price data.

Once we have the price data, we need to calculate the 24-hour and 7-day simple moving averages. Moving averages help smooth out price data over a specified period, making it easier to identify trends.

Finally, we’ll determine the fair value of Bitcoin by averaging the current price, 24-hour moving average, and 7-day moving average. This fair value provides a balanced view of Bitcoin’s price based on short-term and long-term trends.

I hope this code is of interest, if you want to learn more about blockchain development and decentralized finance then I have a free newsletter here: https://bachini.substack.com