This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ATOM at time of writing. Do your own research, not investment advice.

What Is Cosmos

Cosmos is a decentralized layer zero network of independent blockchains, designed to enable scalability and interoperability between them. Founded by Jae Kwon and Ethan Buchman in 2014, Cosmos raised $17 million through funding rounds and its ATOM token ICO.

Cosmos enables diverse blockchains to communicate and transact via its three main components:

- The Tendermint consensus engine

Tendermint provides a robust proof-of-stake (PoS) consensus mechanism, powering the Cosmos Hub and other interconnected blockchains, or ‘Zones’. - The IBC Protocol

The Inter-Blockchain Communication protocol facilitates secure and trustless exchange of data and tokens, read more - The Cosmos SDK

The Cosmos Software Development Kit is a modular framework, enabling developers to build their own simple and customizable PoS blockchains using pre-built components

The Cosmos ecosystem is built around the concept of application-specific blockchains, allowing each to maintain sovereignty and optimize user experiences. These blockchains can smoothly collaborate and transfer assets safely through IBC, leading to innovative blockchain use cases and potential scalability improvements.

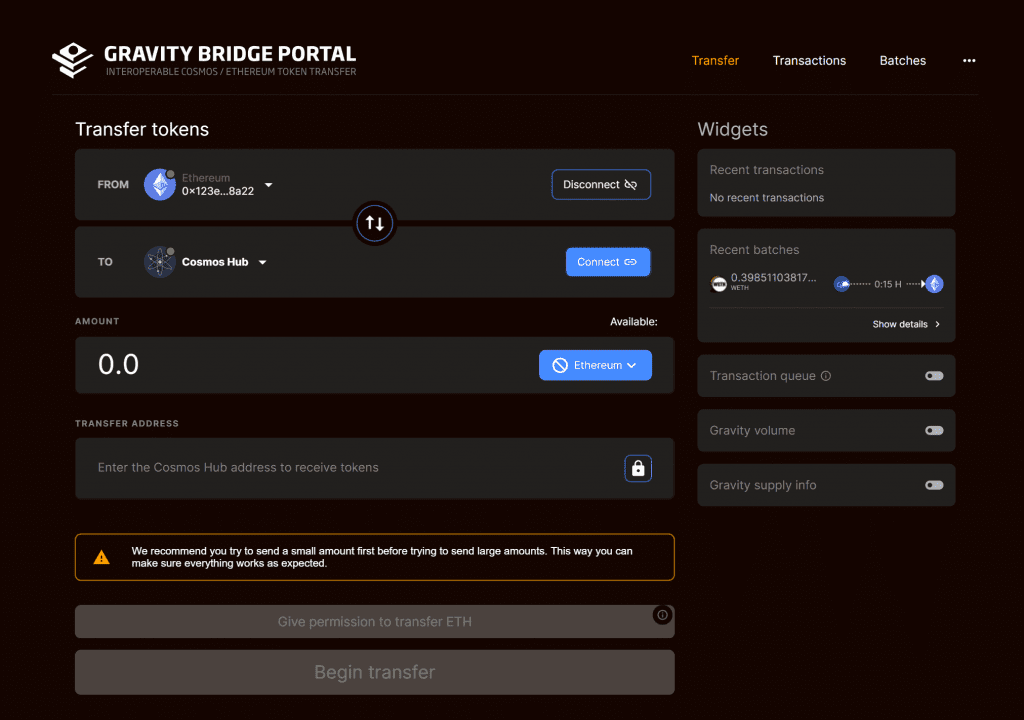

IBC Interchain Communications

IBC facilitates the transfer of data and assets (like tokens or NFTs) between different blockchains within the Cosmos ecosystem. This allows for a decentralized, interconnected network of independent blockchains, each with its own unique features and use cases.

It operates with the principle that each blockchain in the Cosmos network is sovereign, maintaining its consensus mechanism and governance model.

How Does IBC Work?

- Connection Establishment: Two Cosmos blockchains wishing to communicate first establish a connection, acknowledging each other’s existence and agreeing to communicate.

- Channel Creation: After a connection is established, they create a specific communication channel within this connection. This channel dictates the type of data or assets that can be transferred.

- Data Verification: When a blockchain sends data or assets to another, the receiving blockchain verifies the data’s authenticity using the sending blockchain’s consensus state. This ensures that only valid and agreed-upon data is transferred.

- Packet Transfer: Data or assets are encapsulated in packets, which are sent through the established channel. These packets contain information about the origin, destination, and the data itself.

- Receipts and Acknowledgments: The receiving blockchain sends back a receipt or acknowledgment once the packet is processed. This ensures reliability in communication.

- Security: IBC maintains high security by isolating each blockchain. A failure in one blockchain doesn’t compromise others in the network.

IBC is perhaps the biggest moat that Cosmos has enabling easy bridging of assets into your newly deployed blockchain. It also allows cross chain communications in a similar way to what we experimented with on LayerZero in the past but rather than an external network carrying the message it is delivered by the underlying IBC Protocol which runs on the same Cosmos nodes.

B2B Traction

Cosmos has something rarer than Unicorn poop, enterprise traction. IBM has been searching for an enterprise product for over a decade and still hasn’t found a use case for blockchains.

Cosmos has gained significant traction in this area due to its unique approach to scalability and interoperability. They have made it simple, quick and affordable to roll out a EVM blockchain, appChain or novel custom product using the SDK.

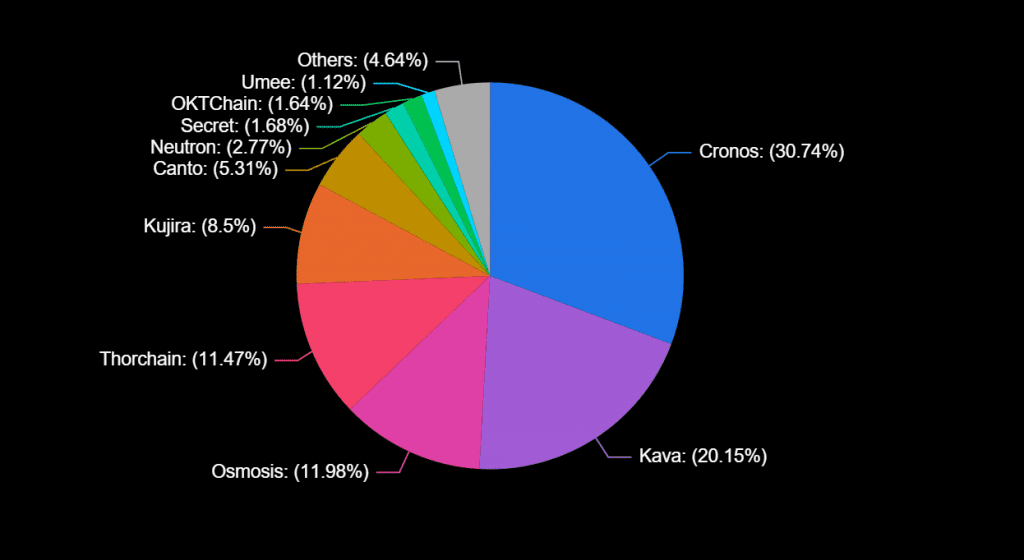

All the following projects are built on the Cosmos ecosystem:-

- dYdX – a futures trading platform and appchain read more

- BNBchain – Binance’s internal EVM blockchain

- Cronos – Crypto.com’s internal blockchain

- Thorchain – is integrated with IBC

- Kava – a DeFi platform offering collateralized loans and stablecoins

- Canto – Taiki’s favourite EVM blockchain

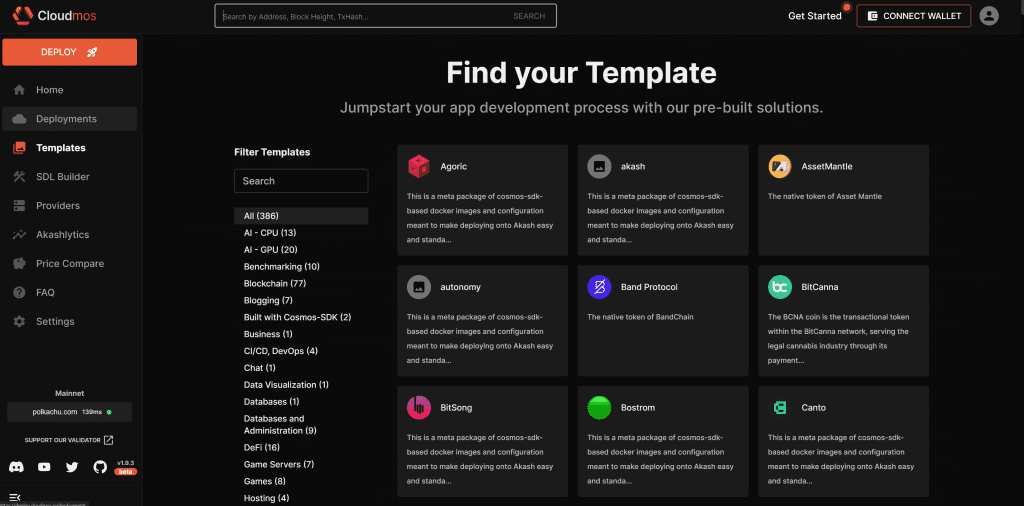

- Cloudmos – bought out Akash to build AWS for blockchains

There is a full list here: https://cosmos.network/ecosystem/apps

These projects demonstrate the versatility of the Cosmos ecosystem. From decentralized finance and cloud computing to private smart contracts and stablecoin platforms, Cosmos’ ability to enable cross-chain communication and transaction has positioned it as a go to solution for a wide range of decentralized applications. This diversity in use cases is a testament to Cosmos’ growing traction and influence in the blockchain space.

Atom Tokenomics

ATOM functions similarly to other Layer 1 utility tokens, enabling network stakeholders to engage in various activities. These include paying network fees for asset transfers or application interactions, staking ATOM to earn block rewards while bolstering network security, and participating in governance decisions through voting on proposals.

The token generation event for ATOM began in 2017, with the Interchain Foundation (ICF) conducting several private sales, followed by a public sale that raised approximately $17.6 million. Initially, token distribution allocated 5% to ICF’s initial donors, 10% each to the ICF and All in Bits, Inc. (the organization behind Tendermint), and the remaining 75% distributed through private and public fundraisers.

| Price @ 2023-11-13 | $9.87 |

| Circulating Supply (entire supply is in circulation) | 374m |

| Fully diluted valuation | $3.7B |

The bull case for Cosmos hinges on its successful realization as the “AWS of Blockchains,” connecting diverse crypto networks and thereby driving its growth and value. It would need to achieve this to justify and provide significant returns on the $3.7B valuation.

ATOM’s value accrues through several mechanisms. The Cosmos SDK facilitates the creation of PoS blockchains and their connection via IBC. However, each blockchain needs robust security, which is directly linked to the economic value of staked tokens. The Cosmos Hub, backed by the substantial value of staked ATOM tokens, provides this essential security, offering its validator set to safeguard emerging blockchains. This security service, termed “Interchain Security” presents a revenue opportunity for Cosmos through transaction fees and inflationary rewards from the hosted blockchains. As the network evolves, the Cosmos could become a pivotal element in cross-chain interactions, potentially accruing additional value from these engagements.

The current inflation rate of the ATOM token, targeted at around 13%, poses a challenge for long-term price appreciation. However in September Cosmos Hub introduced liquid staking, providing an easy way for Atom holders to gain a yield on their holdings. This has proved popular and driven some life back into the atom token valuation.

Conclusion

While the future of Cosmos and it’s ATOM token is promising, there are reservations concerning its tokenomics, competition, and internal developer disputes. Governance dynamics, marked by disagreements among key entities contribute to execution delays and strategic uncertainties.

Nevertheless, under optimistic assumptions about the crypto market’s growth, the Cosmos Ecosystem could potentially see a substantial increase in TVL and valuation over the coming years.

If the independent teams can come together and capture value from the enterprise traction and moat they are building with IBC and the SDK, then direct that value towards ATOM token holders there could be significant upside.