The Bitcoin market cycle is volatile and emotionally challenging for investors but both Bitcoin and the wider crypto sector follow familiar cycle dynamics to other markets.

- Prophecy Was Given To Fools

- Advice From Wall Street

- Four Year Halving Cycle

- The Super-Cycle Hypothesis

- Controlling Emotions

- Market Cycle Strategies 📺

- Conclusion

Prophecy Was Given To Fools

While I’ve never found a way to predict what the market will do next it’s both useful and fairly easy to understand where you are in the current market cycle.

When you are looking at super car prices, checking stats 20 times a day while creating spreadsheets to project future wealth then the top is probably getting close. If the world is crashing down around you, organisations are breaking and there’s no interest from retail then the bottom might be approaching.

Advice From Wall Street

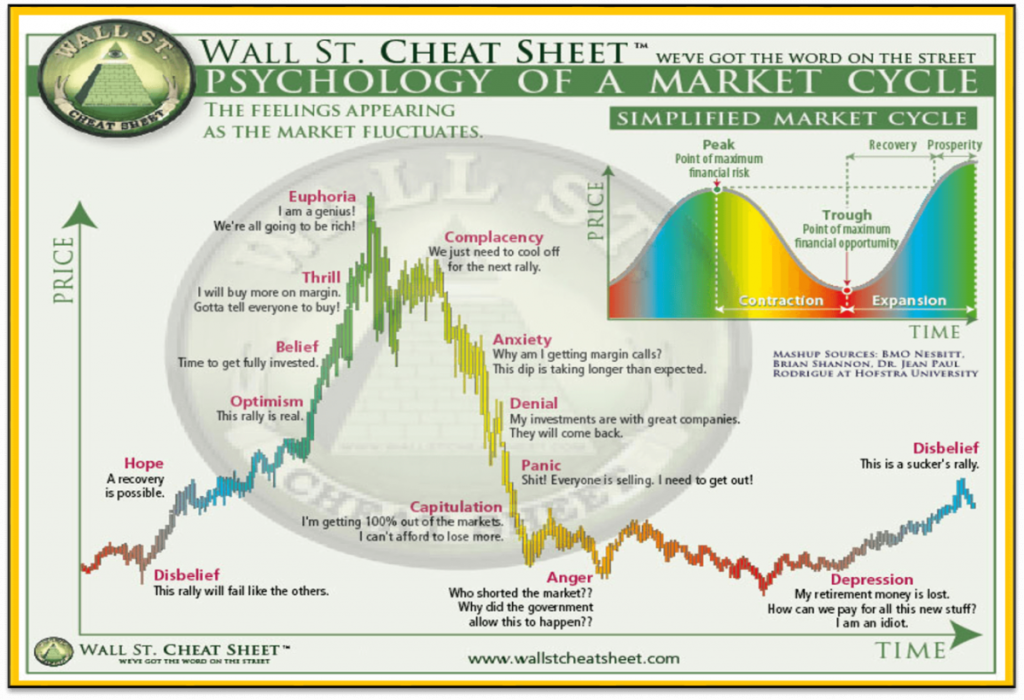

The Wall Street Cheat Sheet has been doing the rounds on social media long before Bitcoin was conceived. It does a really good job of explaining how sentiment shifts through a market cycle.

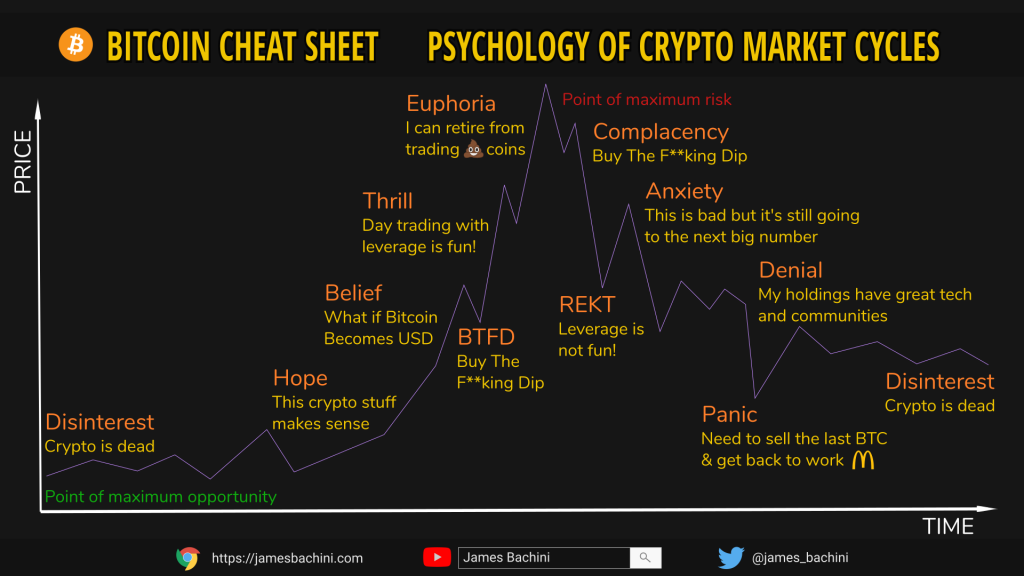

Here is an updated version I mocked up for the crypto markets.

And a useful table of warning signs

| Top Signals | Bottom Signals |

|---|---|

| Refreshing portfolio or CMC 20x+ a day | Haven’t checked the crypto portfolio in weeks |

| Doing future projections of wealth spreadsheets | Crypto twitter is angry but not sure who at |

| Bragging to the girlfriend how much you money you made | Coinbase starts issuing profit warnings |

| Thinking you will become the next Buffett, Soros or SBF | @AlamedaTrabucco is writing post-mortem threads |

| Got a call from an ex asking if she should buy Ada or Doge | Ran out of stablecoins to buy the capitulation |

| The latest ponzi 💩coin just raised $x billion | Consensys laying off employees |

| Planning when to give up the day job | Gold bugs and BTC maxis seek attention |

| Bitcoin and Coinbase are blowing up in Google Trends | China isn’t even bothering to release FUD news |

| Where can I get 100x leverage on low cap tokens? | Bitcoin is going to zero |

Four Year Halving Cycle

Bitcoin is distributed to miners and their rewards get cut in half every four years. The next halving event is due in spring/summer of 2024. In the past this has created a four year cycle where Bitcoin rallies and price explodes after the halving.

This is best seen on a logarithmic chart:-

It’s worth considering that in the early years mining rewards were larger, circulating supply was smaller and trading volumes were nothing like what they are today. Just because we’ve followed a 4 year cycle up to this point doesn’t mean it will last forever.

The Super-Cycle Hypothesis

A super-cycle is a term used to describe an asset that appreciates in price over a long period of time. The last 20 years of Amazon stock price is a good example. There are dips along the way of course but the trend is #UpOnly

I first heard the term in relation to Bitcoin from Zhu Su of Three Arrows Capital. The general idea is that for the next 20 years fiat money (USD) is going to be continuously devalued through inflation at the same time as institutional funds are flowing into digital assets.

When you look back at a chart you’ve lived through, the dips along the way look insignificant, it’s hard to remember how stressful and concerning they were at the time. There’s definitely a case to be made that as the Bitcoin market matures and grows to a multi-trillion asset class, volatility will decrease and market crashes will become less severe in percentage terms.

Controlling Emotions

If we can understand where we are in the market cycle then it should be easy to buy low and sell high. So why do so many retail investors do the exact opposite?

Our natural human tendencies and emotions lead us to behave irrationally. When markets are down and the media says they are going to zero fear stops us from entering the market at the most opportune time. When we are making more money than we ever thought possible and our balance is growing daily greed takes over. It’s like a drug and getting out of the game at that moment is almost impossible, taking profits is perhaps the hardest thing to get right.

Often we hear about a new investment opportunity at the worse possible time. When the Uber driver is telling you about how much money he’s made from the latest ICO it’s likely not the best time to enter the market. Our inclination is to get that dopamine hit and buy in as soon as possible due to FOMO (fear of missing out). This is where having time available to research new technologies is hugely valuable.

If you can identify these emotions both in yourself and other market participants then you’ll have the best chance of counteracting them. Experience helps too, I’ve done stupid things often enough that I’ve started to recognise the patterns.

While not entirely related, some of the biggest financial mistakes I’ve made in my life have been passing on investment opportunities because “they’ve gone up too much already“. Bitcoin @ $300, Tesla @ $20, Shopify @ $40 all exceptional opportunities that I somewhat understood but turned away because they were too expensive. If something is great and has high growth potential then there is likely asymmetrical risk at almost any price when investing for the long term.

Market Cycle Strategies

In this section I’ll be discussing some of the strategies you can use to navigate Bitcoin market cycles.

Dollar Cost Averaging

DCA is the process of setting up automated buying at regular intervals. The idea is to balance out your entry price across market cycles.

It’s an excellent way to build a position in a new asset or investment vehicle. There is a win win situation where if the price goes up you make money and if it goes down you get to buy it cheaper.

This only works when you have high conviction on a trade. If the asset goes down in price 80% will you cancel the weekly buy? Because that will be the most important time to be buying more.

Rebalancing | Automating Buy Low Sell High

By having a portfolio with multiple assets such as a 60/40 crypto portfolio, or even better would be a mix of index funds, real estate and digital assets. You can then rebalance to keep the allocations in line with target percentages.

This automates the process and forces the holder to sell after price has gone up and buy when price goes down. It still requires emotional control to sell an asset that is outperforming the rest of the portfolio.

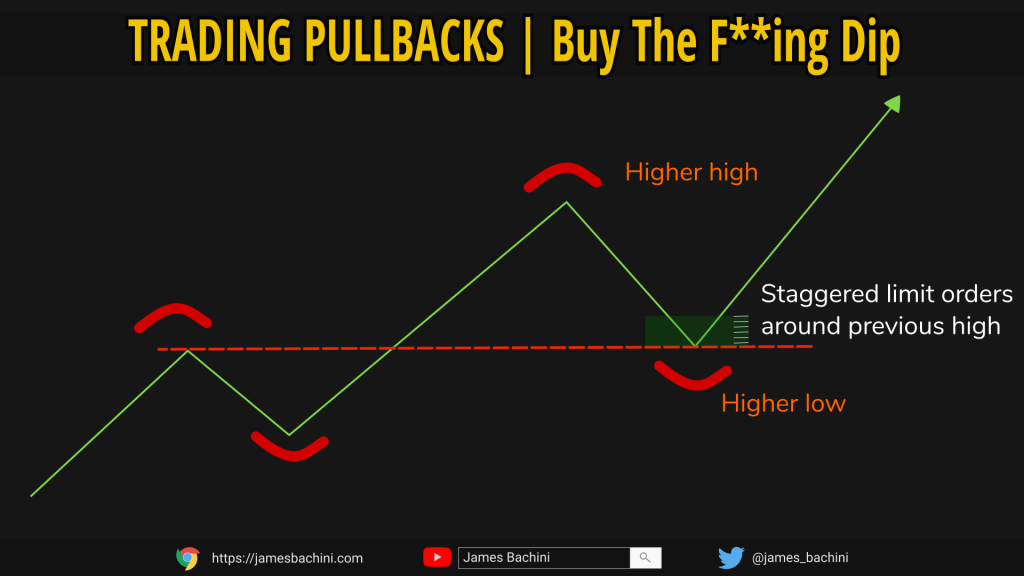

BTFD | Buy The F**king Dip

This is a more active and challenging method than something like dollar cost averaging. A trader or investor will often bid on the pull back to a previous high. It’s a very hard thing to get right and you never know when the next dip will turn in to a bear market.

This is overly simplified and it’s worth learning about support/resistance levels and Fibonacci retracements if this is a strategy that you are considering.

You can combine pull-back entries with other strategies to buy short time frame dips to establish a long term position. On a higher time frame there can be an opportunity cost to wait for a significant pull-back that never comes.

Trend Following Moving Averages

The general idea is to use a trend following strategy to capture the gains and risk off at the first sign of trouble.

A simple moving average is just the average of the last x price points. So a 30 day SMA is just the average closing price for the last 30 days. When the current price is above this markets are trending up. When price is below it markets are trending down.

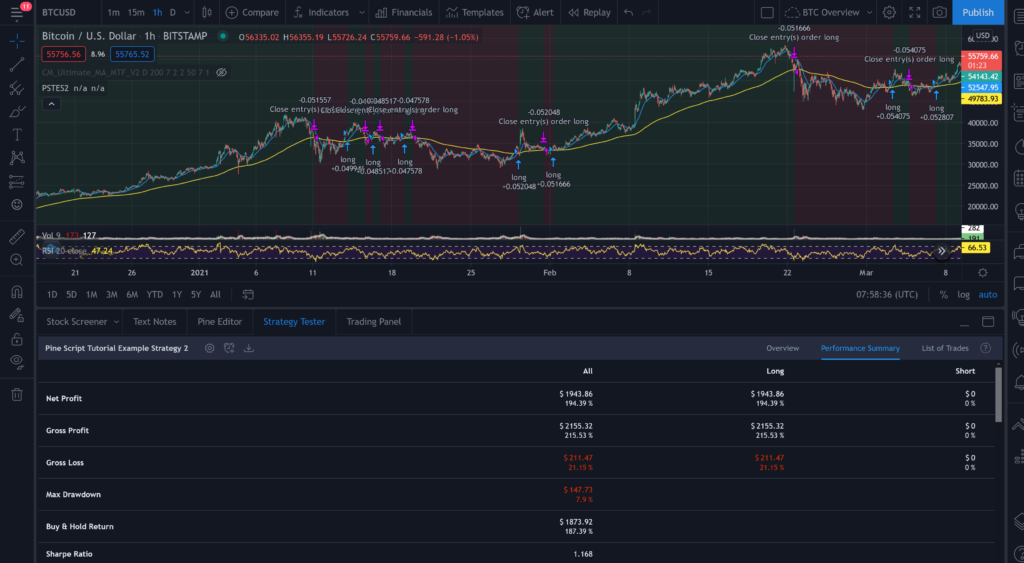

There’s a good example of this in the Trading View Pine Script Tutorial where I fitted a moving average to the Bitcoin chart.

When markets are choppy or ranging trend following strategies don’t work so it’s important to know what the current market conditions are like.

Conclusion

If it was easy to time markets and buy low to sell high then everyone would be doing it successfully. There’s a often quoted and unchecked stat that 95% of day traders lose all their funds.

Human psychology works against us in the form of fear, greed and fomo. Controlling our emotions and understanding the current position in the market cycle can help but it still isn’t easy to get right.

There are strategies such as dollar cost averaging that can automate processes and to an extent, take timing mistakes out of the equation.

Hopefully this information about Bitcoin market cycles has been of interest and helps someone navigate the crypto markets with a little less stress than the game requires.