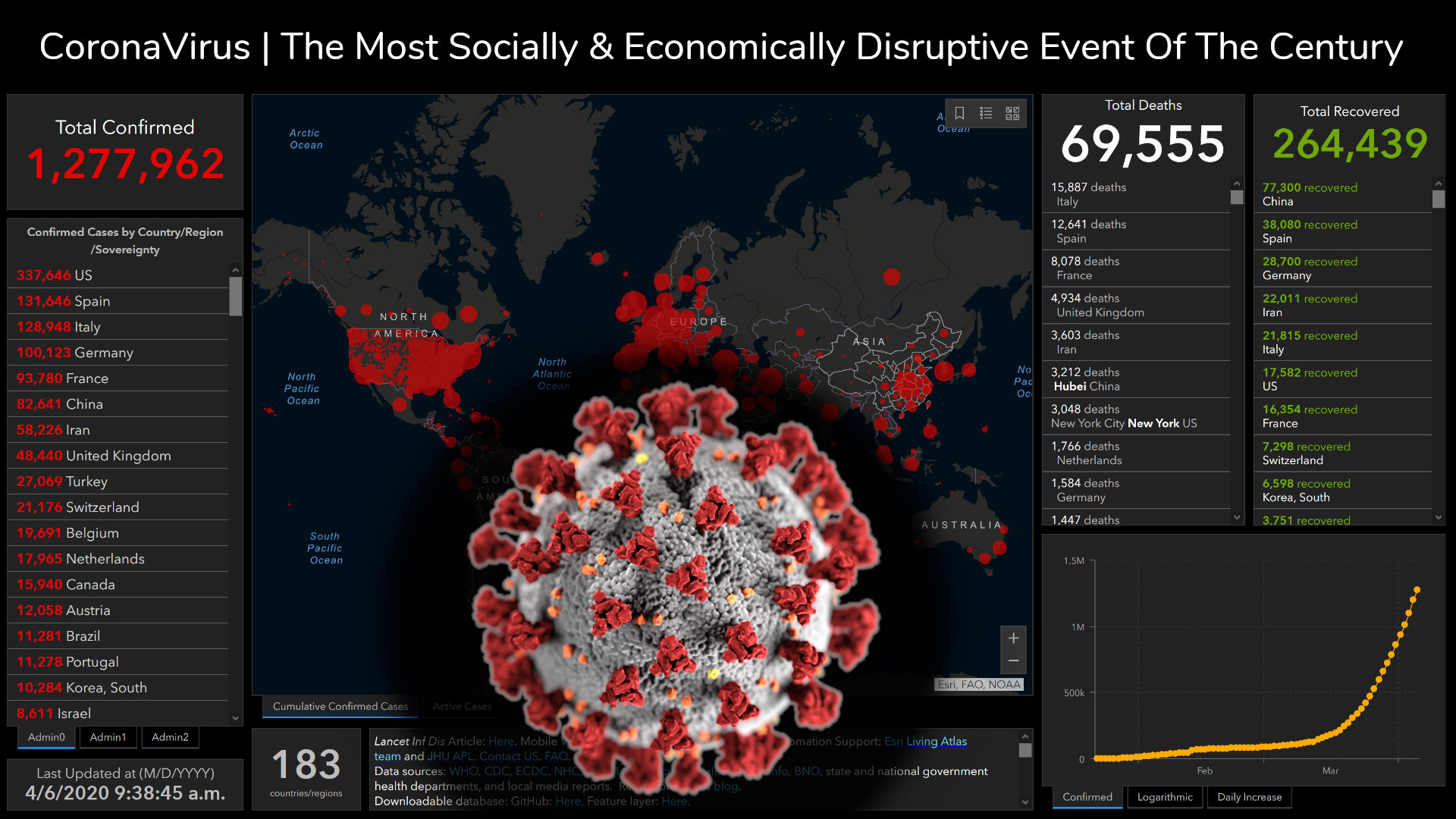

The coronavirus pandemic is the most socially and economically disruptive event of the 21st century. What will the world look like once we come out of lockdown and can we return to some level of normality?

The lockdown period is expected to last 2-6 months in western economies. There is going to be political pressure to get everyone back to work as soon as possible. The most extreme measures are likely to be lifted between May and July 2020.

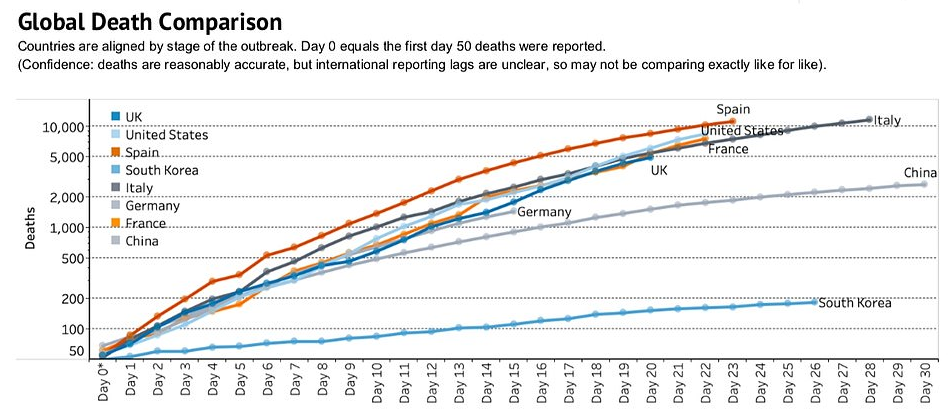

While death rates are increasing and testing is restricted it’s hard to see how or when the government could remove or lighten the lockdown period. The UK/US is some way behind Italy and it doesn’t seem likely that they will relax measures any time soon.

Political pressure to get everyone back to work and revive the economy is strong. Trump’s reelection campaign prior to Coronavirus was based around a booming economy. Much discussion of the “cure being worse than the problem” is already being projected. The public will remain very risk averse with the perspective that preventable death in society is intolerable.

Johnathan Sumption highlights what could become an alternative narrative in months to come. In an article published in the Times he uses the analogy of cars which kill thousands every year but society accepts that risk due to the benefits of independent travel. Could a similar argument be made that not destroying the economy, jobs and society is a price worth paying?

Covid-19 isn’t going away, it will continue to spread and mutate for some time. It’s critical that we reduce the pressure on hospitals to save lives, however flattening the curve may lengthen the long tail of the outbreak. Official figures have now exceeded one million cases, even if we factor in a 10x multiple for unreported cases we are still an incomprehensible way off achieving the 50-80% of the population required for herd immunity. Masks, hand-sanitizer and bans on large events could be part of the new normal years to come.

Politicians can’t declare the lockdown over and everything will go back to normal. As a society we are going to have to reframe our definition of normal over the coming years rather than months. Certain industries are going to find recovery very difficult if not impossible. Under what circumstances could you foresee someone booking a cruise in 2020… or 2021?

Once lockdown is lifted or partially lifted we are likely to see second and third waves of outbreaks. As testing becomes more prevalent we could see more localised social distancing enforcement to aid containment. It’s unlikely, for example, that we will see the same measures in rural areas as we do in urban environments due to higher social risk.

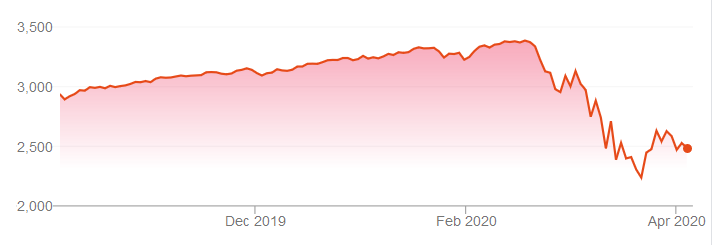

Governments are set to print money in an attempt to create a fiscal stimulus and encourage a prompt recovery in the markets and underlying economic conditions. In 2008 the banks were seen as too big to fail, now every employer in the SP500 is going to be too big to fail as unemployment is a key factor in the potential recovery. The corporate bond markets are being propped up by government purchasing and at this stage the US has already passed a $2 trillion USD relief bill. There are roughly 130 million households in the US which equates to $15,000 per household.

Never before have we seen a coordinated global economic shutdown while central bankers carry out the greatest fiscal experiment of all time. Negative interest rates, excessive national debt and unprecedented quantitative easing combines to set the stage for a game of Russian roulette with the global economy and monetary system. Could this be the final blow for a financial system built on a house of cards?

Analysis

The short and medium term effects of the pandemic have been analysed and broken down into the following sections.

- Economy

- Social

- Entertainment

- Commerce

- Environment

Economy

Already stock markets are down around 30%, the US has received over 10 million unemployment claims and comparisons are being drawn to the 1929 depression. National, corporate and consumer debt levels are inflating at alarming rates.

Inflation / Deflation

Western economies have targeted a 2% inflation rate for decades and more or less achieved it. The increase in supply from QE (quantitative easing) would be expected to decrease the real value of fiat currencies like the USD/EUR/GBP. This could in theory lead to high levels of inflation or even hyper-inflation in western economies. It’s likely that poorer economies will be hit first and act as an early indicator to what we might see in major economic regions.

The USD has long been the reserve currency for the international community but that is a market choice and not dogma. China interestingly has been reserved in their fiscal policy and they could benefit greatly. Perhaps we will look back at this historically as the moment where China overtook the US as the world’s dominant economy.

Work

The lockdown has introduced a generation to remote work & video conferencing. Apps like Zoom and LoopUp should benefit directly from more people working from home. More remote work could lead to more geographically diverse businesses. Outsourcing and VA’s could benefit as businesses move from the office to online. Coworking spaces like wework and workspace will be hard hit initially but there’s likely to be increased demand once the lockdown is lifted and some normality returns.

We could see an increase in startups and entrepreneurship from the lockdown and type A individuals having too much time on their hands. If you’ve always thought about running your own business or pursuing some form of passive income then there is no time like the present to make a start, even if you can’t execute until the lockdown is over.

Real Estate

Commercial real estate may be hit hardest from shop closures, remote working and a general downturn in the economy and it’s knock on effect with manufacturing and distribution.

Domestic real estate hangs on a finely balanced edge. Demand has fallen to zero in the UK as estate agents aren’t showing people around and no one is buying. Supply is at least the same level if not higher as landlords rush to sell property. Buy2Rent and AirBnB superhosts are going to be hit hard by a complete drop off in income, many of whom won’t be able to keep up mortgage payments.

These factors combined suggest a decline in prices is likely however how much is key. If prices drop 25% or more it will put the vast majority of property owners into negative equity. In the UK a professional landlord will almost always leverage the portfolio with 25% equity buy to let mortgages.

Banking

The vast majority of UK wealth is tied up in property. If the property markets crash alongside the stock markets then banks are going to be hit hard. We haven’t seen much talk of defaults or foreclosures at this stage but it’s still early days. Lenders are being encouraged to offer “mortgage holidays” but this is only a temporary fix.

We are now in a recession and are likely to see bankruptcies across various industries over the coming months. This will have a knock on effect as banks have to write off bad debt.

A liquidity crunch could make the problem worse and governments are currently trying hard to keep money flowing to firms that need it. This is causing central banks to develop huge balance sheets as they prop up bond markets. It’s even been suggested that the Federal Reserve could start purchasing risk assets such as stock ETF’s (exchange traded funds) to artificially recover the stock market.

Social

Academics will be writing about the social impact and the isolation of lockdown for years to come. The longer it goes on the more pronounced the effects will be on adults and a generation of children that have lived through this.

Nationalism

With everyone returning home, travel banned and countries shutting up borders it’s possible we will see an uptick in nationalist sentiment. No one has mentioned BREXIT for months but it’s still happening in theory. Could we see a breakdown of the EU, especially if economies go further downhill? Spain and Italy are two of the worst affected regions and are also two of the most unstable economically. Both may require bailouts in the near future which could lead to discontent from other struggling EU member states.

Unemployment

The Guardian released an article about unemployment reaching levels not seen since the 1929 depression. In the UK they are predicting 6 million unemployed which equates to 21% of the workforce. The government has guaranteed to back 80% of wages up to £2500/month for firms affected by Coronavirus otherwise it would have been much worse. We haven’t seen high levels of unemployment here for decades and the idea of not being able to get a job or earn money to provide for the family is going to be a shock to many families that live paycheck to paycheck.

Social Unrest

If unemployment alongside a decline in the economic and social environment gets out of control then we could see social unrest. This provides a strong argument for the “cure can’t be worse than the problem” with regards to an extended lockdown. However even after the lockdown is lifted we are likely to see secondary effects to the economy which could create a perfect storm for social unrest. It’s hard to imagine violent protests and rioting as we’ve never seen it at scale in our lifetimes. If we consider a worse case scenario for coronavirus’s impact on society and the economy it’s highly likely there will be some form of push back.

Entertainment

Since lockdown, have noticed your phone is running out of battery much more frequently? We are turning to our personal devices for entertainment and to fill the gap in social interaction.

Social media

Twitter, Facebook, SnapChat, TikTok will be seeing increased usage and time spent in-app. However the economic decline will likely lead to decreased advertiser budgets. One media buyer said last week CPM prices on Facebook had already halved. Increased ad inventory and lower prices provides an opportunity for media buyers, performance marketers and affiliates. New opportunities for remote social interactions like HouseParty app which could be an acquisition target. After lockdown we will see a drop off in usage but advertising spend won’t immediately return.

Streaming

Streaming services such as Netflix and Disney should benefit from more people at home looking for entertainment. Netflix has become a staple in the UK but secondary platforms like Amazon Prime and Disney could particularly benefit once people run out of things to watch on Netflix.

Travel

The travel industry is going to be one of the hardest hit. When will confidence return to a point where consumers might start looking at overseas holidays? If there’s isolated outbreaks and second, third, fourth waves etc then lockdown measures will follow and this could go on for some time. Travel restrictions, grounded flights and localised outbreaks seem likely in the short-term which could prevent the travel industry recovering.

Countries and regions that rely on tourism are going to be particularly hard hit. The travel industry won’t be destroyed but it may need to adapt to less movement of people and less social travel. Staycations could gain popularity and last minute bookings are likely to be more popular than booking a trip months in advance in uncertain circumstances.

Gaming

Gaming industry should benefit from increased free time for gamers. Companies like Twitch will see an immediate increase in app usage and will need to scale fast to maintain their high quality, high frame rate USP. EGaming events could gain a more mainstream audience from the lack of sport on TV.

Education

Skillshare, Udemy and other online education platforms have an opportunity to expand while the lockdown is in place. With both teachers and potential students having more time to create and consume courses. Clickbank type info products and eBooks could do well from a short term boost to sales as well. Post lockdown businesses that have a subscription model will see the most benefit.

Gambling

Bookmakers like Ladbrokes and Coral will see an immediate negative effect from the closure of stores. This could however prompt older clientele to start using online services more frequently and lead to long-term benefits. The industry is probably going to be moving completely online eventually and the bookie store closures could accelerate that. Poker sites could gain more new users and increased demand from existing players.

Commerce

The Amazon effect was already having a huge impact on the retail industry. With the world in lockdown and all non-essential physical stores closed the only option that remains is e-commerce.

Groceries

Tesco/Sainsbury’s have seen a short-term increase in demand due to panic buying. Delivery slots in the UK are currently maxed out and this should increase long-term demand for grocery deliveries. Food Kits, and subscription delivery products like HelloFresh were running high volume ads prior to this and this is a huge opportunity for those companies to scale quickly if they can meet demand. Takeaways could also gain market share over restaurants if people are hesitant to go back to social situations in the medium term.

E-Commerce

All shops are closed so companies from ASOS to Amazon should gain market share in areas like clothing and electronics. If Coronavirus goes on long enough it’s plausible that it will lead to a “death of the high street” narrative and UK shops will never recover. This will lead to a repurposing of the commercial high street properties for service based companies like coffee shops, hairdressers. It’s possible that stores that sell “Amazon goods” won’t ever be able to compete as all consumers discover online shopping as a necessity. Couriers and Royal Mail should get a knock on boost to sales due to increased deliveries.

Imports

Dropshipping has become a no-go industry for performance marketers this year due to unreliable deliveries. While Chinese industry is recovering it still seems very likely that we will see a large drop in imports for 2020. Shortages of medical equipment have highlighted our dependence on overseas manufacturing.

Environment

Perhaps one key positive from the shutdown is the reduction in emissions. Industry, cars, planes are all at a standstill and cities are seeing cleaner air as a result. In a prolonged scenario it will provide an interesting case study for how drastically reducing carbon emissions will affect the climate and environment.

Rob Jackson from the Global Carbon Project is quoted as suggesting we could see a 5% decline in carbon emissions which hasn’t been seen since the second world war.

This might be able to give some clues to the potential for an improvement to climate change or if we’ve already created too much of a snowball effect to recover from.

Conclusion

The coronavirus pandemic is having a disruptive effect on society and the economy. We are only at the very start of this situation and the long-term effects are yet to be seen. It’s hard to see many positives and the potential downside is terrifying. Hope is for the stimulus packages to work, people to go back to work in due course and the doom and gloom to subside for a swift recovery.

Covid-19 is the black swan event of a generation and while the world will go on it’s effects are going to be long lasting and challenging.