The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing.

In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV manner.

- Evolving Landscape Of Crypto Narratives

- A Summary Of The Hype Cycle

- Ride The Wave Or Avoid The FOMO

- Early Indicators For The Next Narrative

- Swing Trading Crypto Narratives

Evolving Landscape Of Crypto Narratives

In this section I’ll explore some notable crypto narratives from my time in the crypto industry to examine their rise, impact and eventual outcomes.

2017 The ICO Boom

During the ICO (Initial Coin Offering) boom, which reached its peak in late 2017, countless projects raised funds by issuing their own ERC20 tokens on Ethereum. This narrative promised a new era of decentralized investing and disrupted traditional fundraising methods. Valuations were astronomical with projects like EOS raising billions of dollars. The ICO boom ended abruptly at the start of 2018 as crypto markets collapsed.

2020 Summer of DeFi

The Summer of DeFi in 2020 was characterized by the rapid growth of decentralized finance applications. This narrative built around the vision of creating an open and permissionless financial ecosystem. More importantly it was built around the distribution of governance tokens as incentives. Compound was the first to really capture attention with their release of the COMP token which lead to a surge in yield farming and liquidity mining as DeFi scaled up to a multi-billion dollar industry.

2021 Alt Layer 1 Rotations

The rise of Layer 1 protocols such as Solana, Avalanche (Avax), and Terra (Luna) marked a significant narrative shift in the crypto landscape. These projects aimed to provide scalable and high-performance blockchain solutions, challenging the dominance of Ethereum. Each alternate layer 1 blockchain had an ecosystem of protocols building on it, all of which had their own governance tokens. Rotating from one ecosystem to the next big thing was very profitable in 2021 as attention and TVL inflows shifted rapidly.

2021 NFTs Go Mainstream

NFT’s (Non-Fungible Tokens) took the crypto world by storm, reaching mainstream awareness in 2021. The NFT scene saw explosive growth and utilization in digital art, collectible and PFP’s (profile pictures like punks & apes). At the height of the narrative it was impossible to order a coffee without hearing someone launching a NFT project.

2023 Memecoin Mania

The emergence of memecoins dates back a long way, perhaps the release of DOGE as a light hearted fork of Bitcoin in 2013. This year we have seen a massive shift in attention towards tokens inspired by internet memes. The jewel in the crown has been Pepe which captured widespread attention and speculation.

There have been other noteworthy narratives in between these main events with things like the recent layer 2 Arbitrum airdrop which boosted that ecosystem for a short time.

In the next section we will look at how these narratives all follow a common hype cycle where opportunity leads to greed and eventual collapse.

A Summary Of The Hype Cycle

Crypto narrative hype cycles are driven by a pattern of increasing attention and price growth, followed by a excessive speculation which eventually pops the bubble.

The initial stages of the cycle are fuelled by a narrative that promises innovation, disruption and opportunity for financial gains. This narrative grows through social media and the hype of early adopters. Early adopters are invested which incentivises them to add to the growing hype. We talk about the things we are excited about and in the early stages of a narrative there is excitement about the unrealised potential for a particular technology or asset.

As more people become aware of the opportunity, demand rises and prices increase. This has a self-fulfilling component where it gains further attention because of the rising prices. A strong narrative will induce people learning about the opportunity for the first time to allocate funds which further increases prices.

As the hype cycle continues, investors become increasingly motivated by the fear of missing out (FOMO) and the potential for significant financial gains. As asset prices become overvalued investors disregard any for of valuation or risk assessment to get in on the action.

When digital assets appreciate rapidly perceived risk reduces while real risk increases due to flaws in our human psychology

As assets get listed on centralised exchanges their perpetual future contracts enable leverage to be applied. Traders can now take 10-100x positions risking minimal collateral while creating massive purchasing power.

Prices can’t go up forever and the markets become unsustainable. Eventually a market corrections occurs which creates a liquidation cascade wiping out all the leverage.

These corrections are often sharp and significant, leading to the collapse of overvalued assets. The result is a rapid decline in value, leaving many investors with significant losses.

Ride The Wave Or Avoid The FOMO

To judge investment decisions we need to understand where we are in the current hype cycle and understanding the risk at that time. At the earliest stages of a narrative emerging the risk is that it will never take off. At the later stages there is a risk we are the sheep following the herd providing exit liquidity for the early adopters.

George Soros has an interesting quote on investing in financial bubbles “When I see a bubble forming, I rush in to buy, adding fuel to the fire“

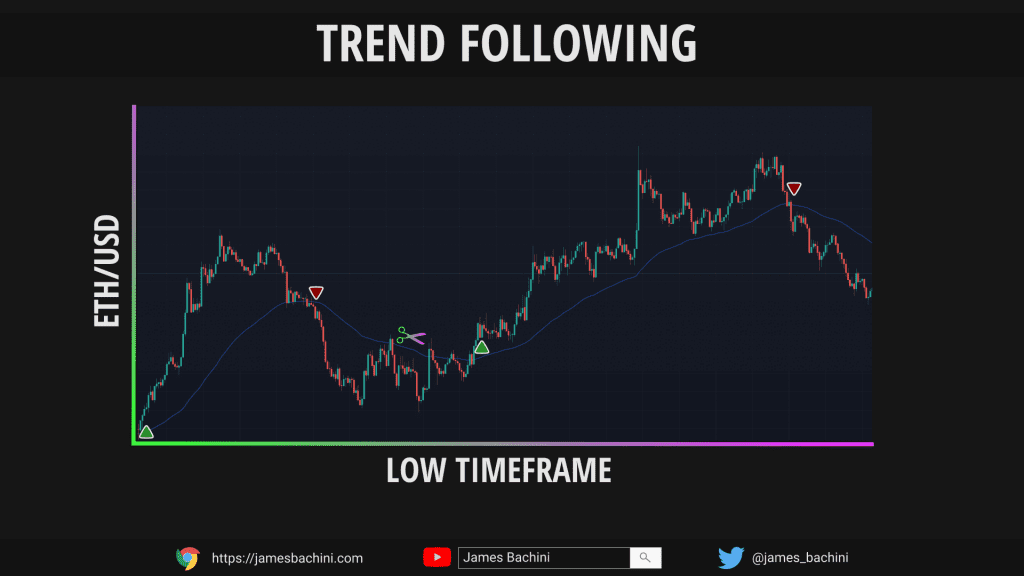

To carry out this kind of trend following strategy you need two things:

- Early indicators for the next narrative

- Good risk management to get you out at the first sign of trouble

Early indicators we will cover in the next section. Risk management is key and there are a few different methods for making sure you aren’t left holding a bag which we will look at in the final section on swing trading.

Early Indicators For The Next Narrative

Here is a brainstormed list of things that I have seen in the past as narratives have started to form.

Developer Discussions

Most disruptive emerging tech brings opportunities and the first people to see those opportunities are the developers working at the cutting edge of the industry.

There is always buzz around certain technologies which are in development. At the moment that might be account abstraction, zkRollups and real world assets. Not everything takes off but if you think back to where you first heard about x, it’s usually from a discussion or tweet from a developer or someone working in the industry.

This is perhaps the earliest and most unreliable indicator but its worth keeping an eye on the latest emerging tech that devs are getting excited about.

Social Media

Searching for emerging crypto narratives on social media platforms like Twitter, Telegram and Discord can pay off dividends if you are in the right communities. Protocols will announce new developments to their social channels first. The problem is 99% of the announcements are pointless partnerships and content for the sake of content. Finding the signal through the noise on social channels is a skill in itself which deserves a separate blog post.

Social media can be broken down into categories for KOL’s, Founders, Devs, Influencers, VC’s, Investors, Traders. Each of these individuals can provide insights into what they are looking at and where they see the opportunities emerging.

Thought leaders within the crypto space have the ability to shape narratives. If you notice influential figures expressing enthusiasm or support for a particular project or technology, always form your own opinion based on the fundamentals.

Technical Analysis

Significant price increases or spikes in trading volume for a specific cryptocurrency or token can suggest growing interest and allocations. There are a number of screening platforms available which allow you to compare assets relative to other similar digital assets to see what is outperforming.

Monitoring market data in terms of price and volume can provide a lagging indicator which is still plenty good enough to get you in ahead of the trend.

There’s a degenerates guide to TA here:

VC Investment Activities

VC’s and crypto native funds are, for the most part, the smart money in crypto markets. They have teams of researchers and better systems in place to value assets effectively.

Certain crypto native funds are particularly good at frontrunning narratives. Outlier Ventures for example was doing talks about NFT’s long before anyone had heard of Beeple. Multicoin rode the Solana rollercoaster all the way up and down, investing heavily across the ecosystem. A16Z has more experience in early stage investment than anyone and they now have a crypto division and are employing an army of extremely smart people as analysts.

Many funding rounds are now completely private which removes the opportunity for individuals to invest in the earliest stages of a projects token lifecycle. The VC’s are pitched and get familiar with the latest projects long before their tokens reach Uniswap.

While not all VC’s are created equally, looking at what the leaders in the space are doing and how they are allocating capital can be an effective way of getting a feel for where the industry is going.

Community Growth & Network Fees

Crypto narratives are often built around increased adoption. As a new technology starts to gain traction it will achieve product market fit. This often leads to the hockey stick style growth curve as everything compounds rapidly in a fast paced industry.

A growing community of supporters, developers and users rallying around a project or concept can be an early indicator of a narrative gaining traction. Look for signs of active participation, community-driven initiatives, and engagement.

Blockchains are transparent, you can see what is getting used and how much it’s getting used compared to last week by looking at the volume of transactions, fees and revenues.

Swing Trading Crypto Narratives

Once I have built a thesis around a new narrative that I think might be emerging I need a way to allocate funds and ride the wave without getting rekt in the process.

The process I use for allocating capital could be described as trend following swing trading. This is a small part of my digital asset portfolio and for new projects I would generally only allocate 1-3% depending on the conviction.

I generally look for the best in class digital asset. That might mean the project that has a first move advantage or the biggest TVL (total value locked) or simply the best tokenomics.

I would then form an entry plan and an exit plan to allocate funds and manage my risk on the trade.

For the entry I generally look for pull backs to obvious levels and then dollar cost average holding the bid price (on CEX) over a period of time. This might be spaced out over a few hours in a fast paced market or spread thinly over a few days to get filled gradually around a good support level.

For the exit there is the simple method of setting a trailing stop loss. This can be set at x% off the current market price. I use these sparingly and always as a plan B in case the market moves before I can react.

Plan A for the exit is to use a fitted moving average. This is a trailing indicator which plots the average of past prices over a period of time. For example a 30 day simple moving average will be calculated as the average price over the last 30 days.

Generally I use a exponential moving average and set the period to a setting where it’s not going to get wicked in a general pull back and any close below that level indicates a strong change of momentum. I believe in giving a trade room to breathe and not panic selling a position until there is a close below the pre-determined level.

In crypto markets you often get strong wicks which take out the stops before price reverts back up sharply. By trading closes you avoid this wiping out your position at the cost of seeing further losses if a liquidation cascade causes prices to fall further.

If markets get frothy and I feel an asset has become overvalued I have been known to sell too early based on a belief that the crypto markets can’t get any more irrational. They always can.