ETHx from Stader Labs is a solution committed to decentralization and keeping Ethereum accessible, reliable, and rewarding.

Having just launched ETH stakers earn 1.5x staking rewards and $800,000 in DeFi incentives across various protocols for the first month.

This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Strader Labs products or tokens. Do your own research, not investment advice.

Why Stake With Stader Labs?

Liquid staking tokens on Ethereum is a competitive market. Stader’s ETHx is going up against projects like Lido Finance’s stETH and Rocketpool’s rETH which have billions of dollars in TVL.

Stader is backed by notable funds including Coinbase Ventures, Pantera & Jump Crypto. The ETHx product has been audited by Sigma Prime and Halborn.

During the launch month, Stader Labs are offering a staggering 1.5x staking rewards. This translated to a boosted staking return of 6.5% APR in ETH. To sweeten the pot even further, Stader Labs earmarked an astounding $800K in incentives specifically for DeFi protocols in the first quarter.

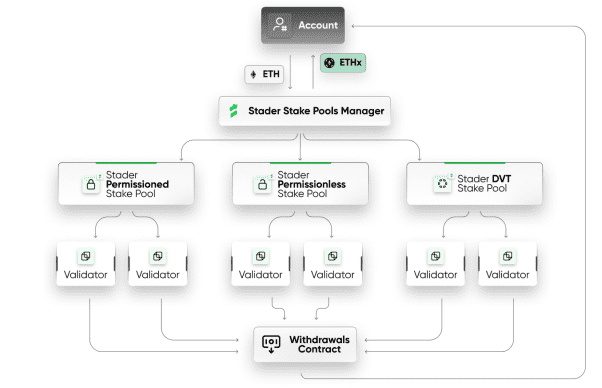

The product works by combining permissionless and curated permissioned staking pools for validators. Permissionless pools open the protocol up to home stakers while the permissioned side enables rapid scalability.

The permissionless stake pool is built for independent node operators to form an integral pillar of their validator operations. Stader have set the lowest bond requirement seen in the current ecosystem, just 4 ETH plus 0.4 ETH in the SD governance token. After detailed simulations conducted with SSV Network, Stader ensured even this minimal bond offers strong protection to user’s staked funds against key tail risks, such as poor validator performance or adverse network conditions.

During the initial phase, achieving complete decentralization and supporting billions of dollars in staked assets can be challenging. The system needs to scale gradually to avoid compromising user demand, an issue seen with other decentralized staking solutions. To mitigate this, Stader plans to augment the permissionless operator pool with a handpicked collection of permissioned operators. These entities would have a strong prior track record of high performance and non-malicious intent.

With the ETHx<>ETH liquidity pool going live across prominent platforms such as Balancer, Curve, and Uniswap, the earning potential for early liquidity providers appears quite promising. There are also plans to leverage the existing partnership with Aave to have it accepted as a collateral asset for borrowing and lending.

Stader Labs commitment to community engagement also shines through in its exclusive offers for Decentralized Autonomous Organizations (DAOs) and community members. Starting with their partner DAOs Dewhales and Uniwhales, they’ve pioneered an initiative that paves the way for broader community involvement while simultaneously maximizing members rewards.

Long Term Market Share

Lido Finance has $15 billion dollars in TVL alone for it’s stETH product earning 10% of the 4% staking rewards. That equates to $60m a year in fee revenue and I’d expect that to grow in USD terms significantly over the next few years.

It’s a lucrative market that Stader Labs are trying to break into with ETHx. The question is what happens once the incentives run out?

There is value in diversification both for individual users and the Ethereum network as a whole. Lido’s domination of the liquid staking market is seen as a negative for the community and more competition is regarded a good thing. That being said Lido has the Lindy effect where it is more trusted because it has been around the longest.

Most stakers are relying on liquid staking tokens and the underlying protocols for a significant amount of their digital asset portfolios. To allocate ETH exposure to a new product is brave, it’s quite a different proposition to apeing 0.1% of your portfolio into a trending memecoin.

The incentives, audits and prominent VC backers will help alleviate some of the fear among early adopters. This will help Stader get a foot in the door and build some initial TVL to prove the system in production.

The fees on staking rewards are half that of Lido’s stETH with only 5% taken from the incoming staking rewards for token holders. This is competitive but could signal the start of a race to the bottom and destruction of margins across the sub-sector.

The SD Governance Token

Stader Labs has a governance token SD which is used as part of the deposit put up by permissionless validators. A undiscolsed percentage share of the staking revenues will be redirected to SD holders.

SD holders also have the option to lend SD to stakers who don’t want exposure to anything other than ETH.

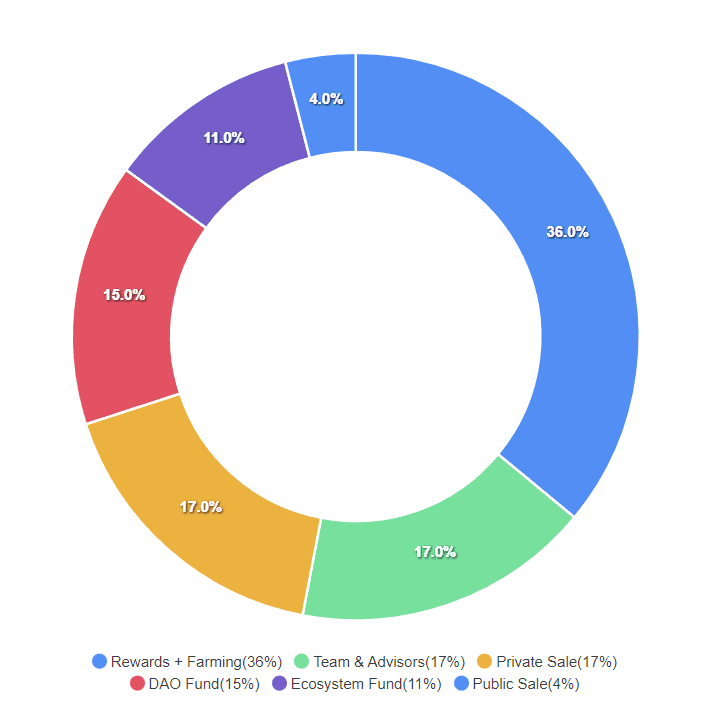

The token distribution was split between various entities with only 4% going on public sale.

The project has a 150m SD total supply with 28.2m circulating. The token price at time of writing is $0.9066 and the market cap is just over $25m (Lido’s LDO governance token has a $2B market cap for comparison).

The team and a number of VCs voluntarily postponed the beginning of the vesting of their tokens from Oct 2022 to June 2023. Tokens will be vested to linearly for 36 months from June.

There is a large supply of tokens coming into circulation which could create selling pressure on exchange over the next 3 years. If Stader can break into the LST market and create long term products and fee revenues then it has the potential to do well but these things are by no means guaranteed.