This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice.

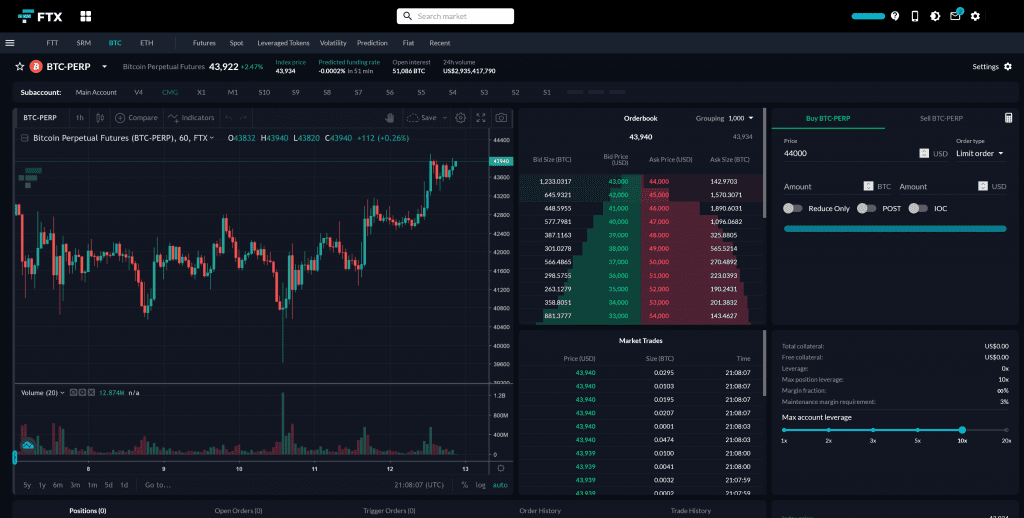

The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged trading of futures markets.

There is an updated comparison of the two market leading exchanges here:

Binance vs FTX | Which Crypto Exchange Is Right For You

Understanding Leverage And Why You Shouldn’t Use It (To Start With)

Most crypto traders will either trade spot markets where they actually buy Bitcoin on exchange or they’ll trade futures markets where the temptations of leverage await.

When a trader makes a trade with leverage they are effectively borrowing money to place that trade. If the trade goes against them they risk being liquidated if the loss comes close to exceeding their collateral position. For example a user can deposit $10 to an exchange, purchase a Bitcoin futures position worth $200 with 20x leverage but if the price of Bitcoin drops close to 5% they risk getting liquidated and losing their deposit.

When using leverage it’s important for the protocol or exchange to prevent losses exceeding the collateral posted. For this reason a liquidation engine will sell positions to recap funds automatically if a margin requirement is not met. Liquidation engines work differently across the industry but many place market orders to sell assets which can cause liquidation cascades and highly volatile price action.

Leverage is a hard thing to manage because it requires precise timing of the markets. Novice traders often try to predict what will happen next in a binary fashion and then get rekt when the market goes in the other direction.

Crypto is not a zero sum game and even bad traders can make money being in the right place at the right time however if you denominate in Ethereum rather than USD it becomes much harder to beat the market. Money tends to flow from discretionary leveraged day traders to sophisticated well funded market makers.

There is an often quoted metric that 95% of day traders lose money and I would guess 90%+ of quants and systems traders make money because it’s data driven and non-performing strategies just get paused. This should give you an idea of which side you want to be on in the markets if you have the ability to code.

If you are new to trading and don’t have any interest in taking short positions then trading spot markets on well researched long to mid term swing trades will stand more chance of being profitable than day trading perpetual futures with 10x leverage.

Good risk management to ensure you don’t get rekt and put out of the game should always be the priority.

Rule number one “Don’t lose money”, rule number two “Don’t forget rule one”.

Understanding Risk And Where We Are In The Market Cycle

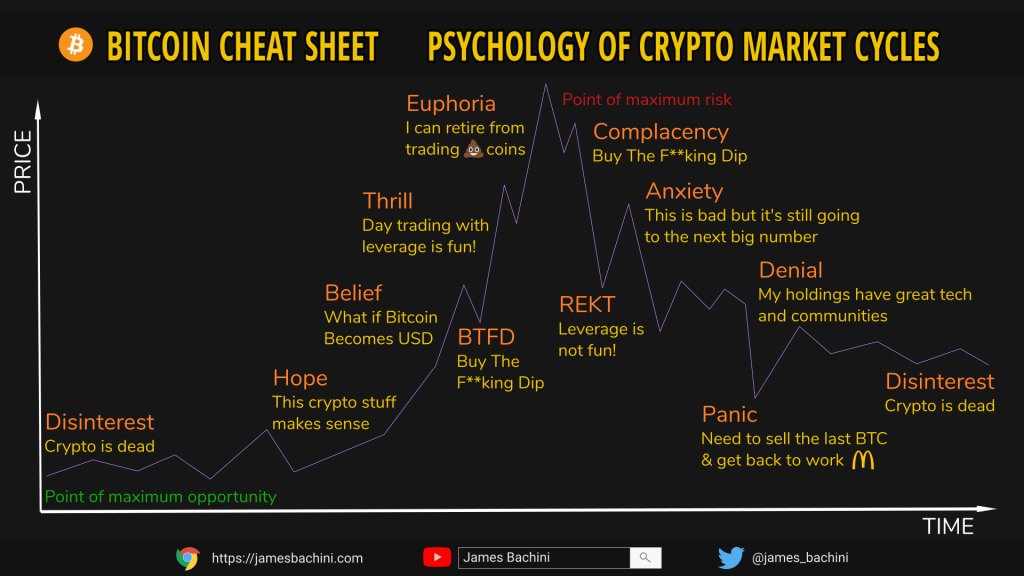

This is a conversion of the Wall Street Cheat Sheet which does the rounds every time the markets get frothy.

Risk is directly proportionate to where we are in a market cycle at various time frames. Crypto markets follow the usual patter of slowly ascending and then fast paced sell-offs. “Up the staircase and down the escalator”. This market principle alone should be enough to highlight the importance of strong risk management.

Markets also rotate from Bitcoin to Ethereum to Altcoins to Sh*tcoins. As markets go up speculators take on more and more risky investments in search of the next pump.

The two indicators that I find very helpful to keep an eye on are BTC/ETH and BTC.D (Bitcoin dominance). These both show how Bitcoin is trading relative to the rest of the crypto market and can be used as an indicator to when #altseason may be approaching which is like Christmas for crypto traders.

One final thing worth noting is the spectacular liquidation cascades which force leveraged longs to sell off their positions causing deep wicks in to the order books. Often these wicks will mark the end of one micro-cycle and the wick will slowly fill back in before bottoming and starting back up towards the next level.

Fundamentals

Project fundamentals do matter in crypto but perhaps not as much as other markets. I remember someone on the UpOnly podcast stated that “having a product is bearish” and it’s true that a lot of hype is built on what could happen rather than what is actually gaining traction in the space.

Money rotates in and out of different sectors based on the leading narrative at any given time. One week it could be alternate layer 1’s, the next it’s metaverse tokens followed by cross-chain bridges the week after that. Getting ahead of the narrative can be very profitable for traders and investors alike.

Technical Analysis

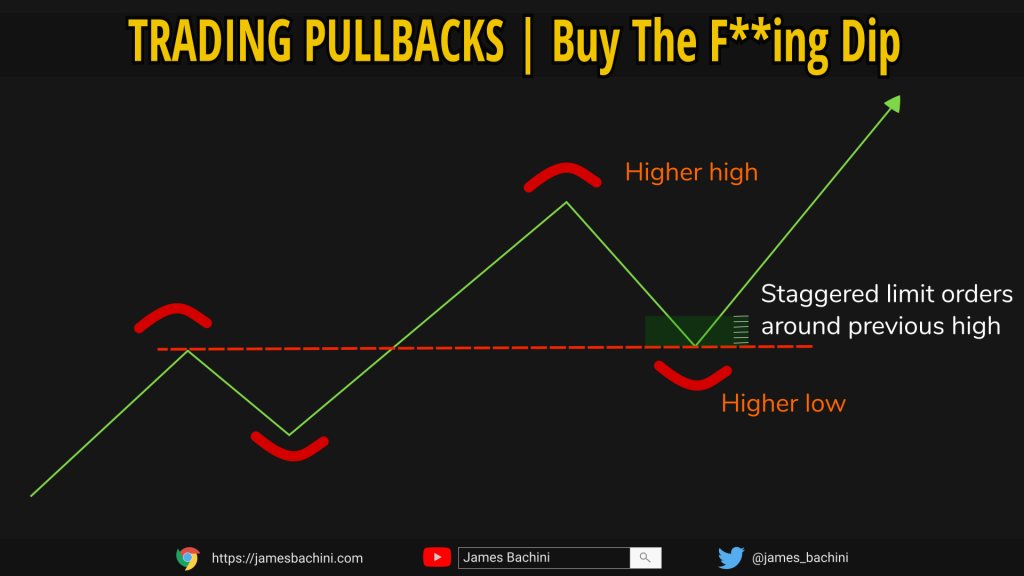

Technical analysis is the study of charts to observe past price and volume action in an attempt to predict future price movements and reactions to key price levels.

It’s very useful to have a basic understanding of technical analysis to create entry points and exit points for your trades.

Support and resistance levels are regions where people will likely buy and sell the asset respectively. These may be in line with previous highs and lows, based on diagonal trend lines, moving averages or higher time frame closing prices.

If all else fails buy the dip.

Limit Orders vs Market Orders

When trading it’s important to understand the difference between limit orders and market orders. When buying an asset a limit order places your bid in the orderbook at or below the current market price. A market order executes at the lowest ask price that someone else has placed in the order book.

Exchange fees are generally much lower for limit orders as they add liquidity to the order book rather than removing it. Market orders execute immediately however limit orders will only get filled if and when the price moves through your bid in the orderbook.

Large orders can cause the price to move which is called slippage. When an asset is traded on exchange the quoted price is often the midpoint between the leading bid and leading ask price. However when a market order is placed it can take out more than just the leading price eating into the order book and removing liquidity and moving the price.

There is a more in-depth study on order execution strategies using trading bots here:

Order Execution Strategy | Testing The Best Way To Execute Bitcoin Trades

DeFi Trading

Trading on decentralized exchanges can also cause slippage as the price you get will become worse as you increase the volume or quantity of the assets being traded. This is because it has a greater effect of adjusting the balance of the liquidity pool. This becomes even more of an issue in small liquidity pools for new or unknown tokens where even modest orders can create significant price swings.

However trading on automated market makers has the advantage of often being able to work with lower market cap assets that haven’t been listed on a centralised exchange yet. When markets get frothy it’s not uncommon to see small Uniswap Gems double in price over a 24hr period. Just don’t be the bag holder when everyone moves on to the next thing as liquidity dries up very quickly.

Learn more about DeFi technologies here: DeFi Demystified | An Introduction To Decentralized Finance