In crypto we live and die by the four year market cycle and I read this with the ambition to learn from someone who has decades of experience and seen cycles play out across multiple markets.

Here is a write up of my notes from the book which is available on Amazon.

tl;dr Mastering The Market Cycle TakeAways

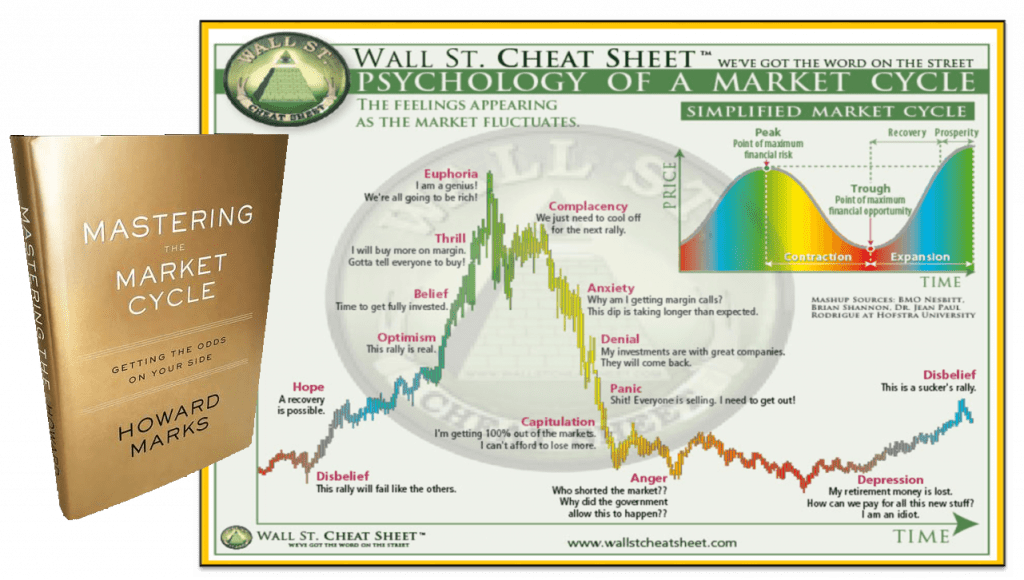

- Market cycles are like a pendulum, constantly moving from overly optimistic to overly pessimistic.

- Studying market cycles is not about predicting the future but estimating where you are currently in the cycle and positioning portfolios accordingly.

- Bad investments are often made during good times as investor sentiment breeds fomo and over confidence. We see this a lot in crypto as people discover crypto at the heights of a bull market and get rekt.

- Bubbles can collapse under their own weight or external factors can trigger a market crash.

- After experiencing losses, investors often become excessively risk averse, selling off assets at the worse possible time and leading to further market volatility.

- When everyone else has lost hope and it feels like things will never get better there is a margin of safety in the pessimism.

- A contrarian approach to investing can offer great profits as the outcome is not priced in.

- Portfolio management should include choosing investments with higher or lower correlation (beta) to markets depending on investor’s risk appetite.

- Being too far ahead of a market cycle is the same as being wrong

Mastering The Market Cycle Book Notes

Market cycles arc much like a pendulum, the movement is constant and in a perpetual state of flux, from optimism to pessimism, bull to bear markets. Contrary to common belief, cycles do not need to end where they started, as they can follow an underlying secular uptrend or downtrend.

Studying market cycles does not give us the ability to tell the future but gives us a better understanding of the current market conditions. Estimating where we are in the market cycle allows us to tailor our portfolio either aggressively or defensively.

In the complex ebb and flow of market dynamics, the pendulum spends little time at the midpoint of its arc. Instead, it is usually swinging towards one extreme or the other, oscillating in its perpetual motion.

This pendulum characterization of market cycles helps us understand why more unwise investments are made during good times rather than bad ones. Encouraging circumstances, fomo and bullish trends often lure investors into taking on risk at the worse possible time, often ignoring inherent risks and potential downturns.

Investors tend to associate risk with pain, especially after experiencing losses in a market downturn. This association often leads them to become excessively risk averse, causing a decline in their participation or even exiting the markets entirely. This action consequently leads to a further drop in prices, pushing the market to even further extremes.

Human psychology searches for explanations to make sense of events. During market crises, we tend to be more worried about blame and losses than the opportunity cost of not seizing potential buying opportunities. It takes a lot of conviction and never feels comfortable getting aggressive and making big contrarian moves even for seasoned investors.

There is a tendency towards excessive risk aversion in a negative market environment, which often prompts investors to subject their investments to unreasonable scrutiny and endless negative assumptions. In these moods of despair and gloom, investors forget that the safest time to buy is when everyone has lost all hope.

When cycles rise to extremes, they cannot stay there forever. Sometimes an overcrowded exuberance triggers their collapse, other times external factors create sharp and sudden declines.

Superior investing is not merely about buying high quality assets, it is about buying when the price is right. This requires a clear understanding of the amount of optimism factored into the price. During market exuberances, investors hope and optimism is usually priced ahead of potential future developments. “No price is too high for x”

Investor behavior and market psychology interact with historic and anticipated future events to determine asset prices. Investor rationality is the exception rather than the rule. Mr Market is a bi-polar lunatic who’s mood swings and perceived reality stretch far from the actual market conditions and possible future outcomes.

The contrarian approach to investing offers the greatest potential for profit, because if the crowd’s judgment is incorrect, the outcome is less priced in. The trade is less crowded and likely to produce handsome returns if correct. Fear of loss often forces investors to opt-out of “knife catching” during steep market declines, leaving them deprived of the bargains once the uncertainty and fear dissipate.

The cardinal sin in investing is to sell or be forced to sell at the bottom, thereby missing out on the subsequent rally. Portfolio management is not all about timing buys and sells, it is also about choosing investments with higher beta to the market when an investor wishes to take on more risk, or choosing assets with less correlation to markets when the investor wishes to lower risk.

Being too far ahead of time is the the same as being wrong. Market cycles can go on long past the 9th innings and last longer than short sellers can stay solvent.

Determining the market cycle’s phase and adjusting one’s investment strategy accordingly is easier during the extremes. However, there are potential risks attached to extremes.

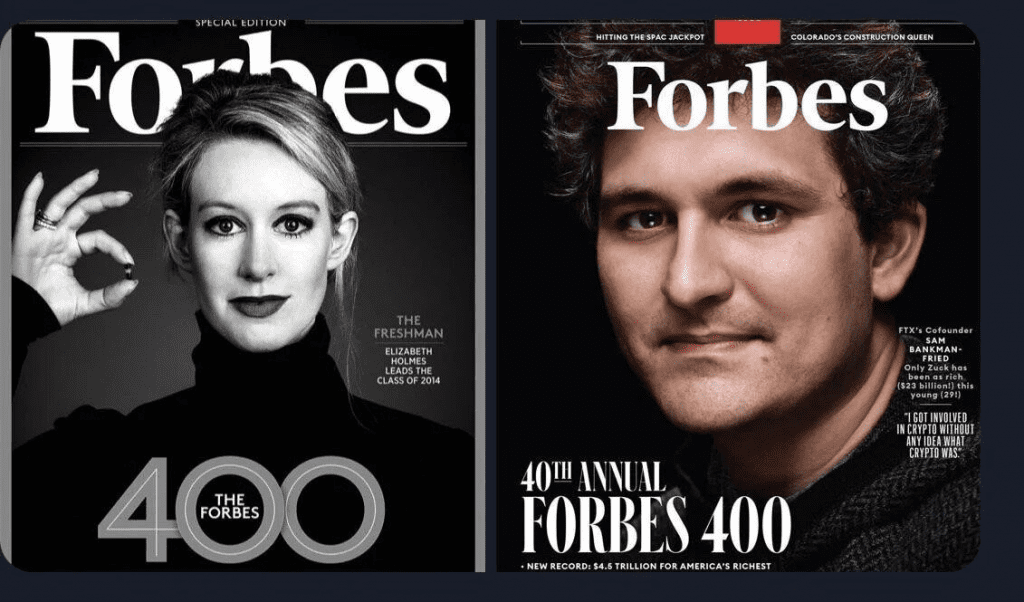

Market cycles exist outside of finance as well. The author describes the success cycle and the “Forbes jinx” suggesting that success breeds overconfidence and lack of discipline, which can steer one away from the hard work that created the original success.

If you found this useful there are more book reviews, summaries and notes here: https://jamesbachini.com/category/business/book-reviews/