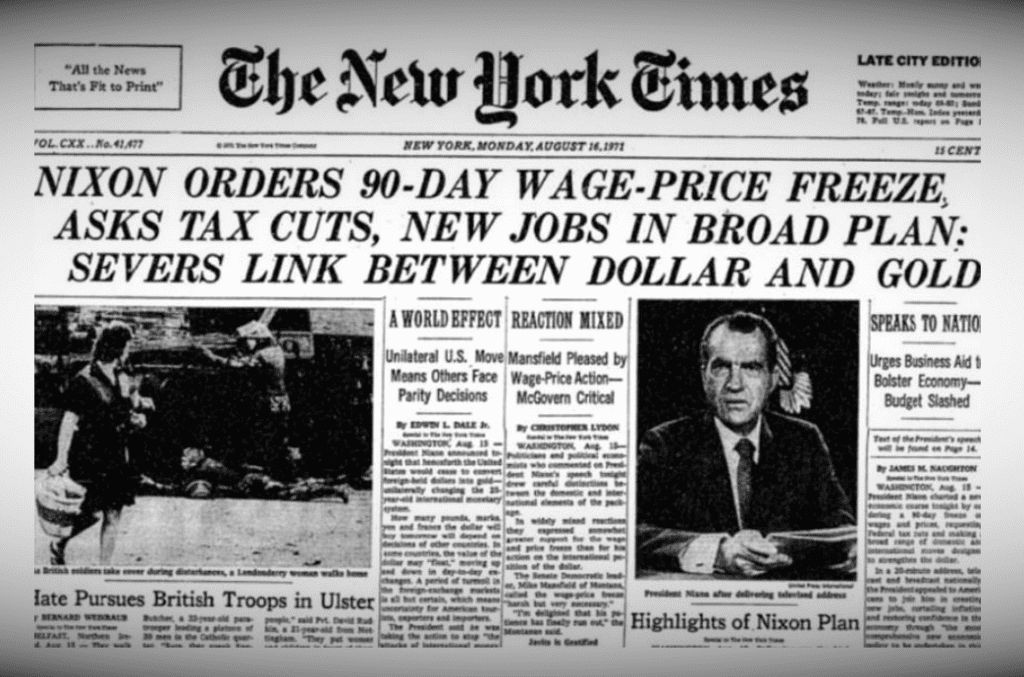

In a bold and controversial move in 1971, U.S. President Richard Nixon instigated what is now known as the “Nixon Shock“

Faced with soaring inflation, Nixon implemented drastic measures including wage and price controls, import surcharges, and ending the U.S. dollar’s gold convertibility. This move effectively dismantled the Bretton Woods system, an international monetary framework established post-World War II.

The Bretton Woods system, operational since 1958, anchored global currencies to the U.S. dollar, which was convertible to gold at $35 per ounce. Initially successful, the system began to falter as the U.S.’s share of global economic output dropped and its gold reserves dwindled, strained by the Vietnam War expenses and domestic monetary inflation.

The climax came in 1971, when several countries, wary of the overvalued dollar, began demanding gold for their dollar reserves. Nixon’s response, cutting the gold dollar tie, shocked the world. It led to the devaluation of the US dollar and the transition to a regime of floating fiat currencies.

This seismic shift in global finance had long-term effects. The U.S. dollar’s dominance was challenged, and the era of fiat currencies ushered in new economic dynamics.

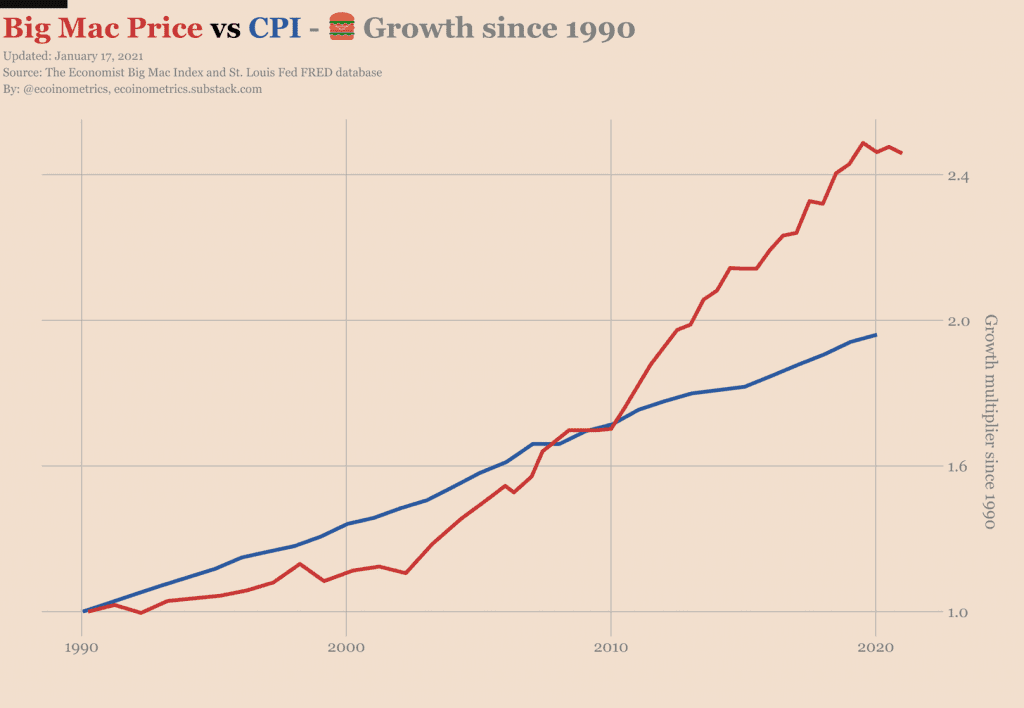

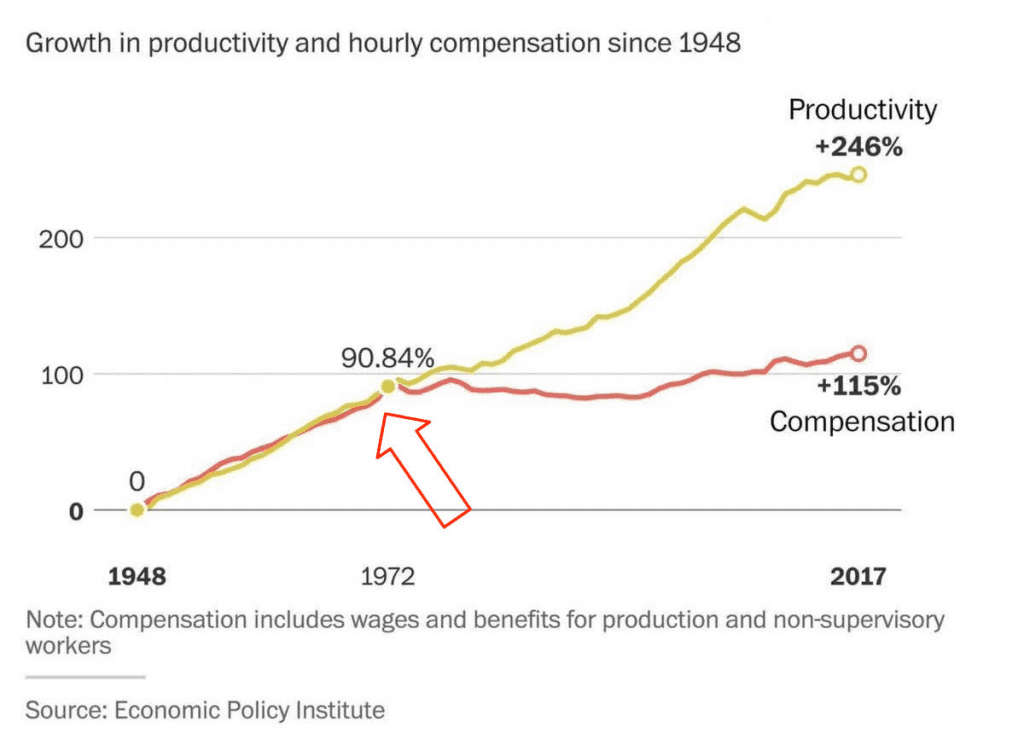

It gave the US the ability to print dollars at will expanding the monetary supply to subsidize public spending. Since the Nixon shock employee compensation has stagnated relative to productivity in real terms adjusted for inflation.

Fast forward to the present, these economic conditions have made cryptocurrencies an appealing alternative. Offering open, transparent economics, digital assets provide the opportunity to separate state and finance.

The money supply is expanding, the government prints it, the fractional banking system inflates it, the “debt burden” grows ever bigger. By devaluing the currency central governments reduce their liabilities at the cost of the middle classes who hold cash savings.

The reneging of the dollar-gold exchange was the beginning of the end for an economic system that now descends further towards unsustainability. Digital assets, stocks and real estate can all provide a hedge against further devaluation of our purchasing power.