Does earning 8% on your DAI stablecoin holdings sound too good to be true? Let’s take a look at how Spark Protocol is offering this APR using MarkerDAO’s Enhanced Dai Savings Rate system.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Spark Protocol at time of writing. Do your own research, not investment advice.

How sDAI Works

The DAI stablecoin is minted by MakerDAO using USDC, ETH & other digital assets as collateral. The Dai Savings Rate (DSR) enables any DAI holder to earn savings. To activate the DSR, users must interact with the DSR contract transferring DAI from their wallets to the contract. There is no lock up and DAI can be redeemed immediately.

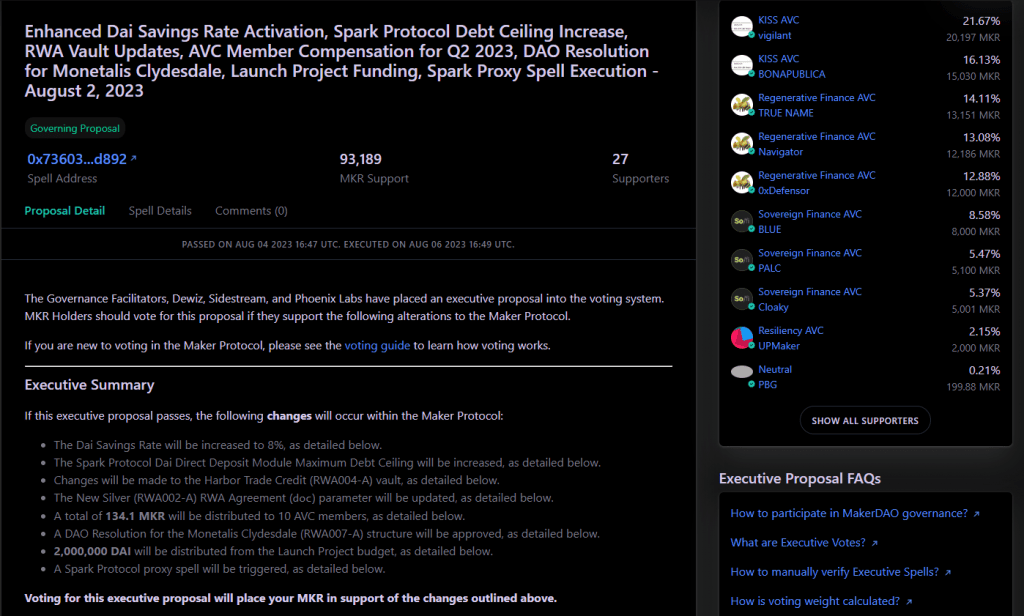

On August 4th 2023 this governance proposal was passed and was implemented on the 6th August.

The Enhanced Dai Savings Rate (EDSR) is a system designed to temporarily increase the DSR for early adopters during the early bootstrapping stage. EDSR decreases over time as the utilization rate increases.

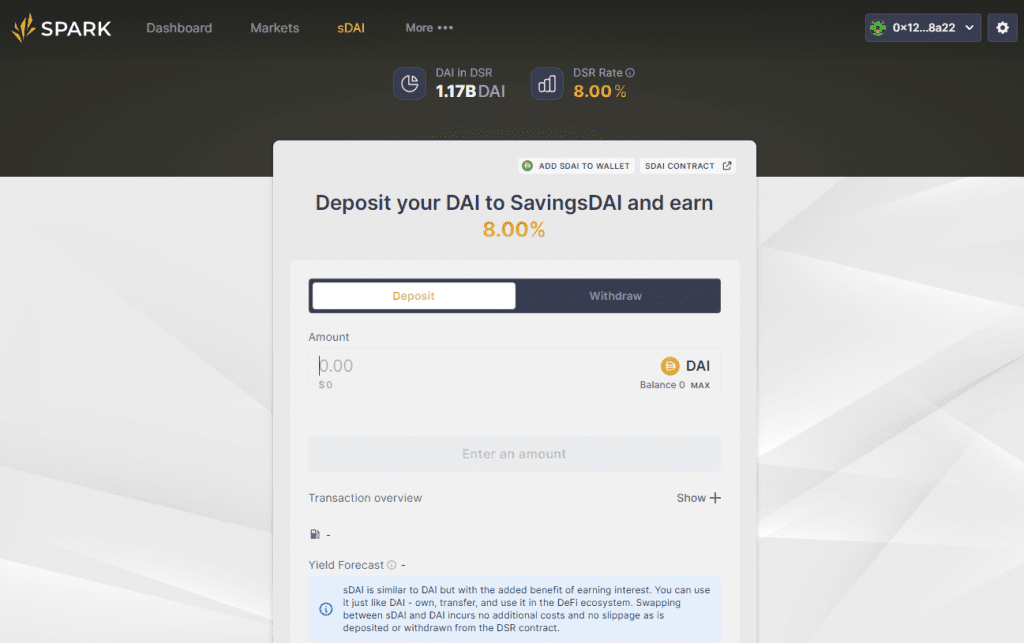

Spark Protocol are taking advatage of this product and have created an ERC4626 vault token called sDAI (Savings Dai) which represents a position of DAI in the DSR module.

By depositing DAI, users can earn yield generated by the Maker protocol and simultaneously retain the ability to transfer, stake, lend, and use sDAI in any way they see fit. Interchanging between DAI and sDAI can be accomplished by depositing and withdrawing from the DSR token contract via the app at https://app.sparkprotocol.io/sdai/

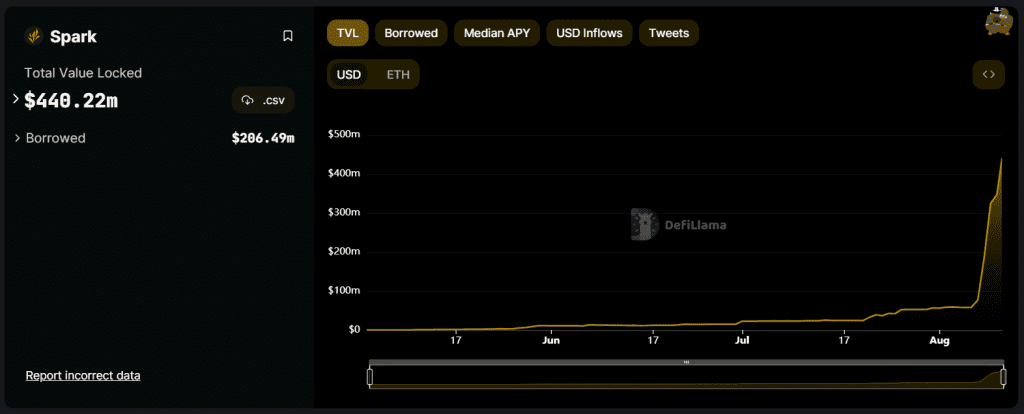

This has proven vastly popular as the protocol has sky rocketed to $440m in TVL in less than a week.

This is likely to be a temporary opportunity as the APR rate will drop as more funds flow into the vault.

| Utilization | Multiplier | Effective DSR |

|---|---|---|

| 0% – 20% | 3x | 8% |

| 20% – 35% | 1.75x | 5.81% |

| 35% – 50% | 1.3x | 4.32% |

| >50% | 1x | 3.19% |

Spark Protocol offer additional products such as borrowing and lending which incorporates sDAI directly into their internal DeFi ecosystem. More interestingly 3rd party platforms such as Aave are looking to accept sDAI as collateral.

Leveraging Aave GHO & sDAI

When Aave’s sDAI proposal goes through (and it almost certainly will) users will be able to borrow the Aave stablecoin GHO at a fixed 1.5% APR interest rate using sDAI as collateral.

The user could then swap the GHO for more sDAI, repeat the loop a few times to leverage up a position to double digit APR’s.

This is going to be a popular yield farming position which I expect will boost Spark’s TVL well into the billions of dollars.

Enjoyed this DeFi analysis report? Check out some other DeFi Protocols and sign up to the newsletter to stay connected with emerging tech and opportunities in decentralized finance.