Short selling the best asset class of the the last 10 years is a risky venture at the best of times. However there are situations where it can be profitable to get the shorts in while markets or individual token valuations are crashing. In this article I’ll be explaining how to short sell crypto such as Bitcoin, Doge and Shiba Inu.

- Short selling crypto video

- What is short selling

- Market timing and invalidation

- How to place a short position

- Risk management

- Conclusion

Short selling crypto video

What is short selling

Short selling is where a trader takes a position to basically bet on the price of an asset going down. To do this they will post collateral to their exchange account. They can then take out a short position either by borrowing spot holdings or by shorting a futures contract.

In crypto markets perpetual futures contracts provide the most widely traded method of shorting assets. The contract will follow the price of an asset and balance the weight of shorts and longs via a funding rate mechanism.

So a common example will be to place USD stablecoins as collateral and then short an individual token that has got out of line or is expected to fall in value. Leverage can be used to increase the position size exceeding the value of the funds in account. For example if you place $10 on account and use 10x leverage you can short sell $100 worth of Bitcoin.

If the asset price goes down the trader will make money and their collateral will be increased on account. If the asset increases in price then the trader will lose money and collateral. Liquidation occurs when the losses on a position come close to exceeding the collateral at which point the exchange closes the position automatically.

Market timing and invalidation

The main concept that is important to understand is that markets go up slowly and down fast, “up the stairs and down the elevator”. If you can get the timing right it’s possible to find highly profitable trades in volatile markets such as the crypto sector.

There are two obvious trades that are commonly taken by active traders.

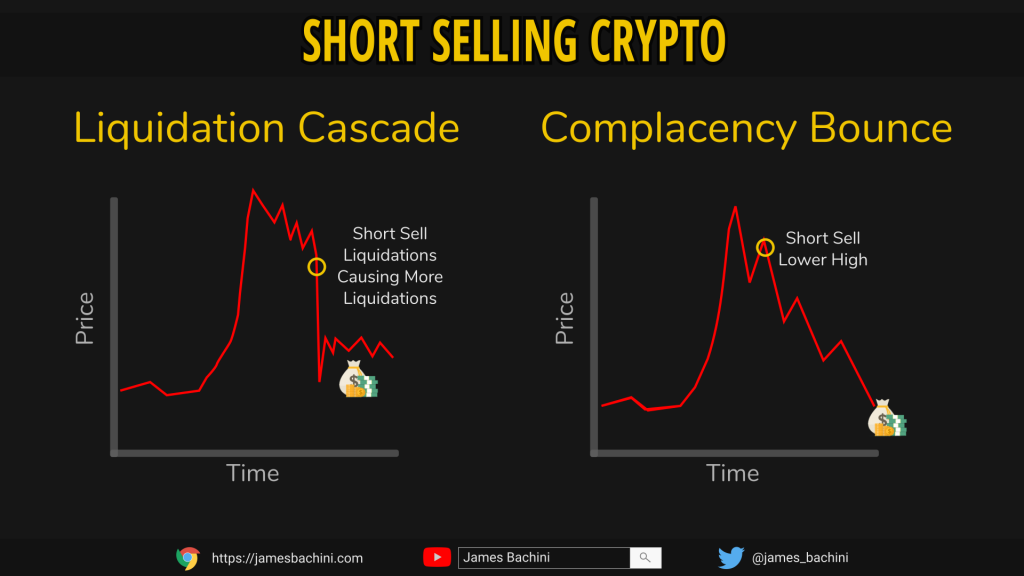

Short Sell Liquidation Cascade

A liquidation cascade is when a number of stops and liquidations all happen together causing the price to drop further as the market sells off positions. This drops the price further causing more long liquidations and further sell offs. This all happens quite quickly often causing a deep wick down into the order book before bouncing back and finding a middle ground after the liquidations are over.

Liquidation cascades are relatively easy to invalidate in that they’ll either happen or they wont. If the market starts to recover or goes sideways then the stops and liquidations wont happen.

10x leverage is the default on most exchanges and is widely used. At 10x with a standard 3% margin requirement the liquidation price is around 11.5% off the mark price where the position was entered. This means if there’s a failed break out or a lot of trading volume followed by a decline in price down towards those levels it’s worth watching out for a liquidation cascade.

Most crypto exchanges will also provide data on liquidations in real time via their API’s which can be used along with price and volume data to create models.

Short Sell Complacency Bounce

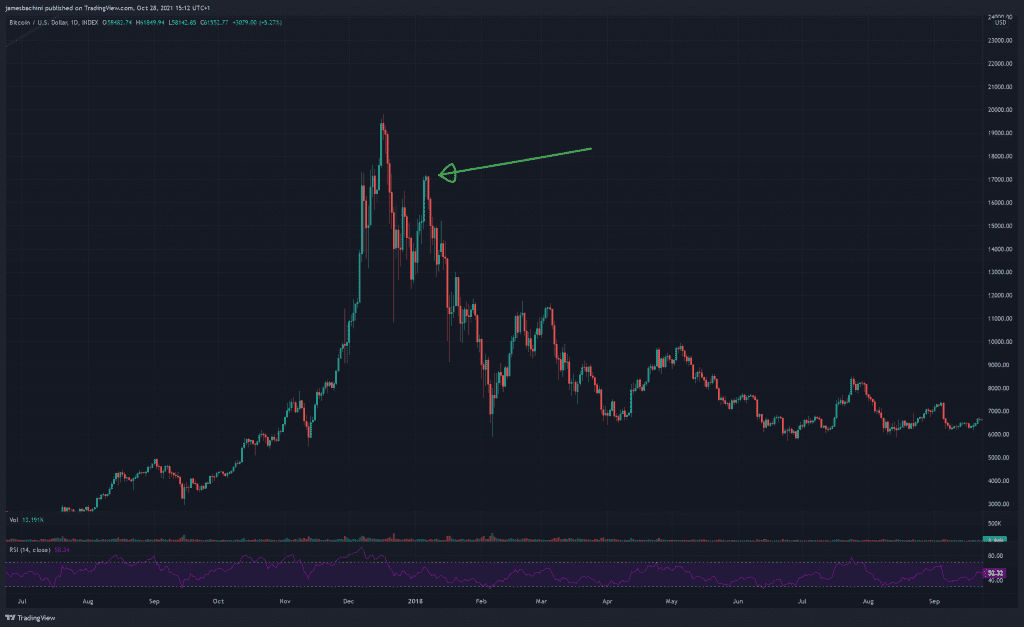

The complacency bounce is the first lower high after a big move. It works best on a high time frame when analysing low time frame intraday moves for signs of weakness to catch the failed attempt at a higher high. This type of trade can take days or weeks to play out as it’s not as aggressive as a liquidation cascade and prices can drop slowly over a longer period.

Complacency bounces can be sold into either for Bitcoin and the entire market or for individual tokens against their Bitcoin pairs. Here’s an example of a complacency bounce in early 2018 that took the entire market with it.

Complacency bounces can be easily invalidated when the market makes a higher high.

There are other reasons to short crypto as well such as cash and carry trades to collect funding premiums. There’s also the option to hedge a long position by shorting an asset which has got out of line with the market after a big run up. Longer term hodlers will often rebalance their portfolios in the days following a big move causing a reversal.

How to place a short position

All the major centralised exchanges provide perpetual futures contracts for trading long and short on numerous digital assets. The two I’d recommend would be Binance (because it’s the biggest) and FTX (because it’s arguably the best for active traders).

Once you have an account set up you’ll need some collateral. Both exchanges accept USD stablecoins and major crypto assets as collateral. This is quite useful if you want to use a short futures position to hedge against a long spot position. For example you could hold Bitcoin in your account as collateral and short the BSV futures contract.

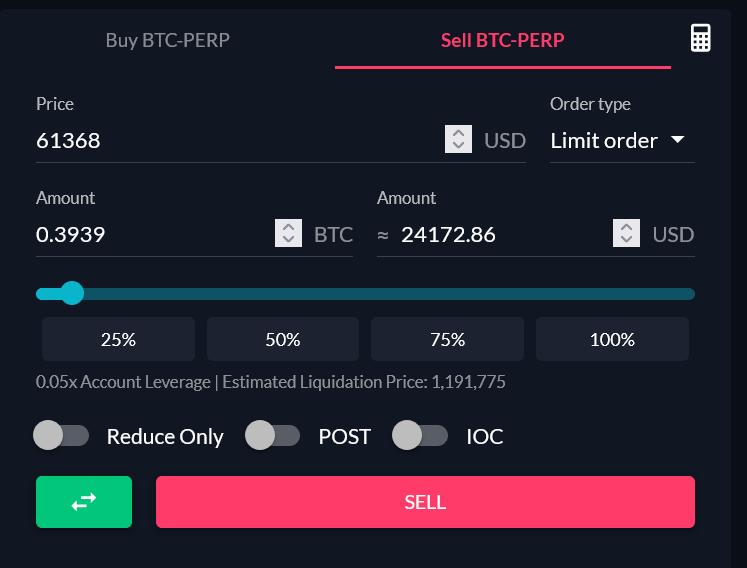

To place a short go to the perpetual futures market for the asset, for example DOGE-PERP on FTX. From there you can select SELL and place your limit order price and volume to execute the trade.

To close a short position a trader needs to buy back the asset or futures contracts, hopefully at a lower price in the future. To do this click BUY and tick the Reduce Only tab.

Risk management

Short selling is highly risky and very rarely profitable in crypto markets that tend to trend “up only”. It’s therefore critical to set up strong risk management systems to limit losses and manage positions.

The first thing we can do is separate some funds into a separate sub account. This will mean they are isolated from our main balance and we have a specified pot of funds at risk.

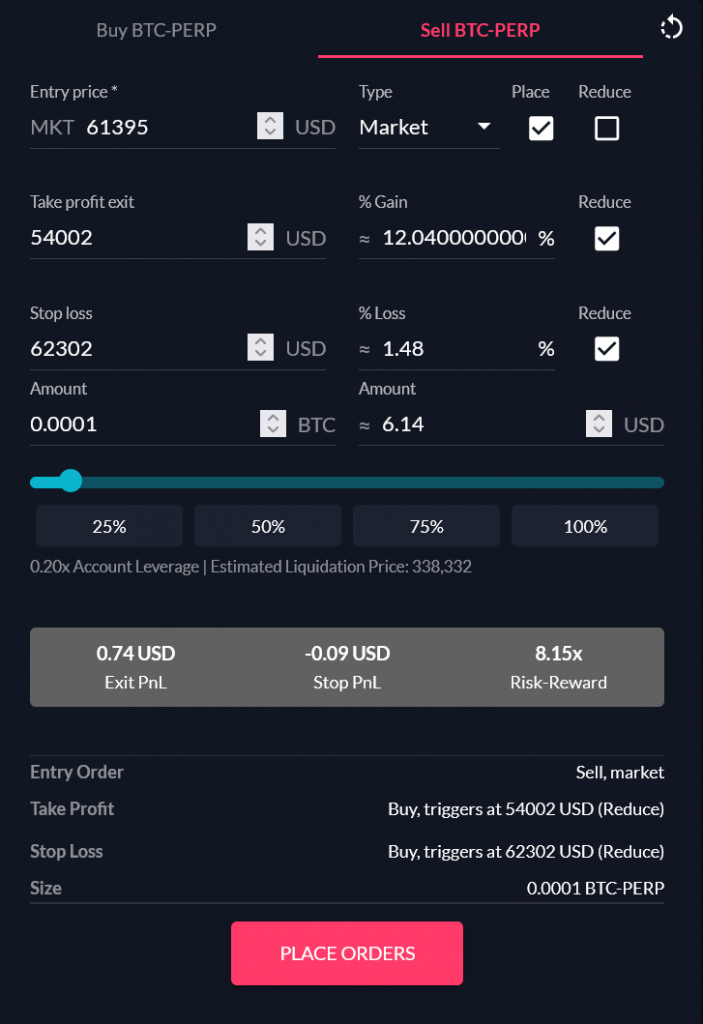

When placing an order it’s possible to set take profit and stop loss levels. A stop loss will market buy the position size to exit the position if the market moves against you to a predetermined level.

On FTX we can set this up when placing a trade by clicking on the little calculator in the top right of the order box to bring up the advanced menu.

Conclusion

Short selling in crypto markets is a high risk opportunity that can be used to take advantage of market volatility. The markets tend to trend upwards but come crashing down with 30%+ pullbacks on Bitcoin and more on altcoins happening frequently.

Market timing is difficult and essential to making any strategy profitable. Models can be created using price, volume and liquidation data provided by Exchange API’s.

Shorts can also be used to hedge positions and collect funding premiums on markets that are generally net long with positive funding rates.