In this article I’m going to discuss where I think the industry is going over the next decade and how emerging developments will affect the following:

Bitcoin

Bitcoin, the pioneer and household name of crypto, has not evolved significantly from its origins as a digital currency. It is becoming increasingly recognized as a mainstream financial asset, albeit with characteristics more akin to a risk asset than a diversified hedge. As traditional currencies like the pound and dollar face inflationary pressures, Bitcoin’s appeal as a store of value will continue to grow. However, its future as the market leading digital asset may be challenged by platforms offering broader utility.

Bitcoin’s underlying technology, its blockchain, is unlikely to undergo radical changes. The Bitcoin community treats its code with a near religious reverence, viewing it as dogma that should remain stable and backwards compatible. This conservatism has allowed Bitcoin to maintain its position as the flagship cryptocurrency, with its price often serving as a barometer for the entire crypto economy.

Can Bitcoin maintain its dominance in the long term? It’s possible that Bitcoin may one day become the second or third largest digital asset, surpassed by smart contract platforms. These networks offer more than just a store of value; they provide the infrastructure for decentralized applications, which have the potential to disrupt multiple industries and create new economic models.

Ethereum

Unlike Bitcoin, Ethereum was designed not just as a currency, but as a global computer for 3rd party decentralized applications. Its application layer allows developers to host both code and data directly on a peer to peer network, bypassing the need for traditional client/server infrastructure.

In the next decade, smart contract platforms like Ethereum could pose a serious challenge to cloud computing. Instead of relying on centralized servers and databases, web developers could deploy immutable code on decentralized p2p networks.

However, Ethereum’s current state is far from perfect. The user experience is often clunky, transactions can be prohibitively expensive and data storage is limited. These challenges suggest that it may take another decade for Ethereum to become viable alternatives to traditional ifrastrucure. In that time we may see something else emerge which makes things simpler.

Updating Ethereum has been likened to replacing parts on a airplane engine while it’s in mid-flight. The network has billions of dollars worth of digital assets on it so changes need to be rolled out slowly and carefully. A build fast and break things approach is not possible. This opens up the potential for a competitor to launch a competing network which captures developers and end users attention and becomes the leading smart contract platform. The risk is that Ethereum becomes the netscape of the blockchain industry.

In my opinion no serious competitor exists today and Solana, Cardano, Near and all other smart contract platforms are unlikely to be significantly competitive.

If Ethereum can fend off competition it will evolve into an interconnected network of zkEVM enshrined rollups, functioning as a cohesive system. This would enable a more scalable and efficient platform, capable of supporting a broader range of applications.

DeFi

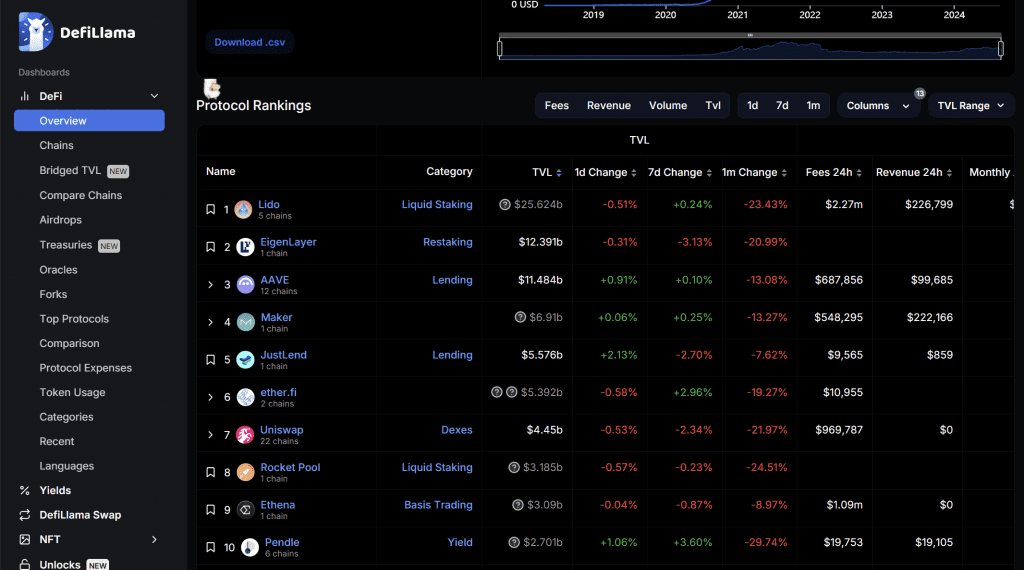

Decentralized Finance represents one of the most promising areas of growth within the blockchain sector. Developers love programmable money and the protocols they can build on a network already incorporating various digital assets.

DeFi projects, which offer financial services without intermediaries, are likely to continue expanding, driving the evolution of the crypto ecosystem. Governance tokens, which give holders a stake in these projects, may fluctuate in popularity as market narratives shift. However, the projects that establish themselves as leaders will likely create long term value, akin to the S&P 500 for traditional companies. Out of the thousands of tokens in existence, perhaps only 10-50 will demonstrate lasting potential.

NFTs

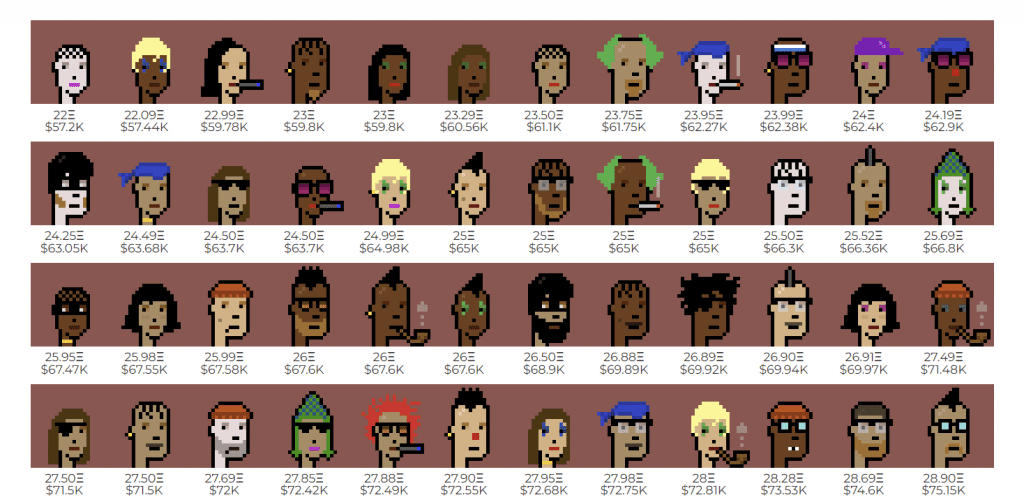

Non-fungible tokens captured the imagination of both the art world and the broader public, leading to a speculative frenzy around 2021. The underlying technology is too significant to dismiss as a passing trend.

NFTs represent digital ownership and unique digital assets, making them crucial for the future of online commerce, art, and even identity. In the future, today’s NFTs, whether they be CryptoPunks, Bored Apes, or Beeples may be regarded as laying the foundation for a new era of creativity and ownership.

If this period is looked at as a renaissance period in the future then the blue chip NFT’s from the era will become truly valuable.

Web3

As Ethereum smart contract networks continue to evolve, they will become more user friendly, unlocking new use cases. The development of decentralized applications will challenge the status quo and will be as intuitive and accessible as today’s apps, but without the privacy concerns associated with centralized services.

Imagine games built around digital assets or social networks that don’t monetize your personal data. This is the promise of Web3, a decentralized internet that empowers users rather than exploiting them.

In the coming years, we can expect dApps to offer a user experience comparable to traditional email and password based services, but with enhanced privacy and security. As the technology matures, it will attract more developers, leading to an explosion of innovative applications that could redefine how we interact with the digital world.

The future of the blockchain sector is filled with potential and uncertainty. Bitcoin may continue to lead the market, but its position as the dominant digital asset could be challenged by more versatile platforms offering greater utility.

DeFi, NFTs, and Web3 represent just a few of the exciting developments on the horizon. As these technologies mature, they will likely usher in a new digital era, one that transforms not only finance but also the very structure of the internet itself.

The biggest developments and disruption will be in new emerging technology which we are yet to imagine. If you want to stay up to date with the latest in blockchain, subscribe to my free weekly newsletter: https://bachini.substack.com