In this article I’m going to share how to track developer activity for crypto projects for fundamental analysis.

- Understanding the Crypto Development Ecosystem

- Developer Influence in Crypto Communities

- Tracking Developer Activity in Crypto Projects

- Case Study: Tracking Developer Activity On Solana

- Quantifying Developer Activity in Fundamental Analysis

Understanding the Crypto Development Ecosystem

Cryptocurrencies like Bitcoin and Ethereum as well as the majority of blockchain projects are fundamentally software. They are applications that run on a decentralized network of nodes. Hence why the developer ecosystem around the sector is so important.

By tracking the ebbs and flows of developers we can look at what is being built where and how the industry is evolving as new products are built.

Developer Influence in Crypto Communities

We have a bad habit of building developers up as superheros in bull markets only to cancel them in bear markets. We’ve seen this time and time again with developers becoming the public face of a project and getting attacked whenever price goes down.

It’s common for crypto projects to have technical leads who act in a combined role as the CEO and CTO. The technical merit and potential for a project largely comes down to these individuals and their team of developers.

For foundation level blockchain’s there are also the secondary developer communities who build smart contracts on top of what the core team are building.

For example if we can accurately track the number of developers building on top of L2 rollups we can potentially predict the future market leaders.

Tracking Developer Activity in Crypto Projects

99.9% of opensource projects are hosted on Github which provides transparent developer metrics.

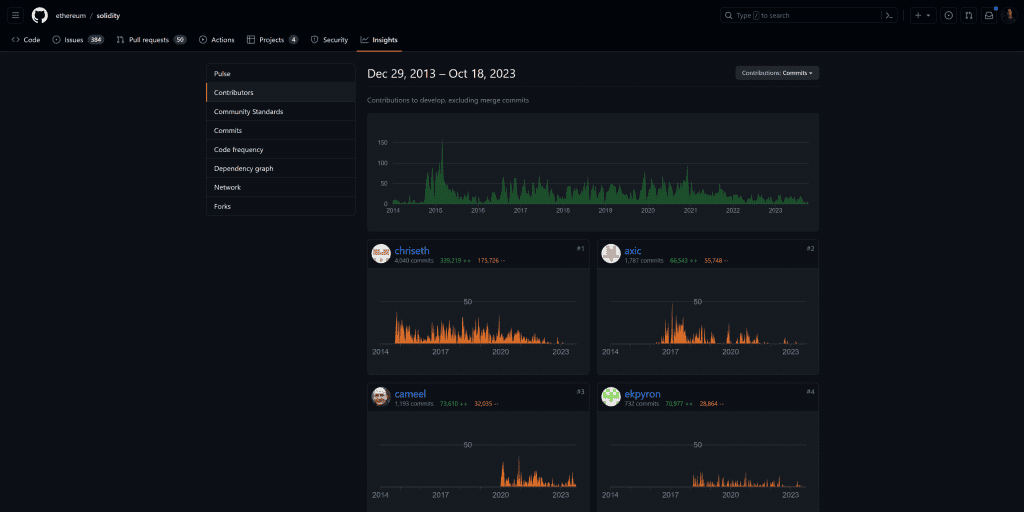

If we open up the “insights” tab for a repository and then select “contributors” from the left menu we get charts showing who is working on the project past and present.

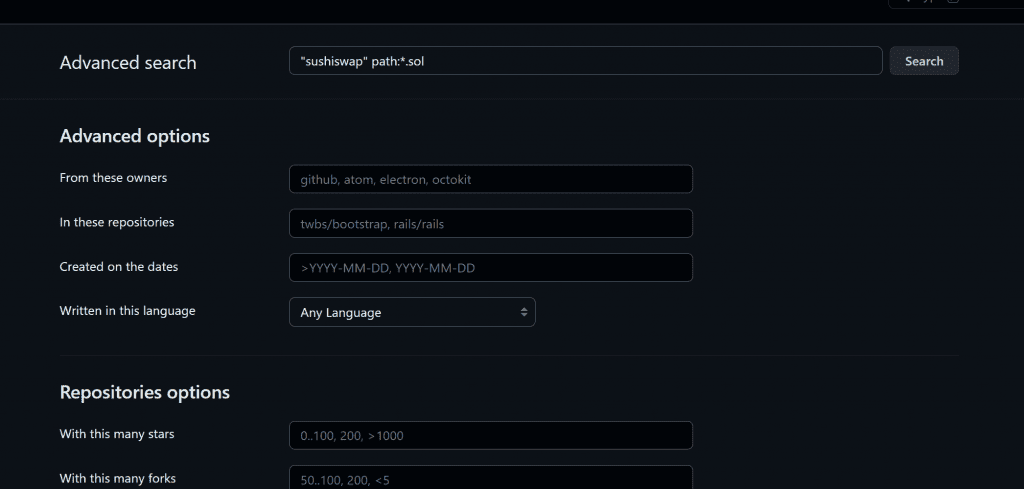

To take this further we can use the advanced search feature to craft queries. For example we can look at how many times a DeX is mentioned in Solidity code to see how many developers are integrating and building on top of it.

Finally we have the Github API which can be used to programmatically create systems to monitor queries and log historical data.

Documentation for the API is here: https://docs.github.com/en/rest

In the next section we will be building a bot to monitor 3rd party developer activity on Solana.

Case Study: Tracking Developer Activity On Solana

Let’s look at a simple Github API query which will log the number of mentions of a phrase in code published to Github.

We will be looking for the phrase solana_program which is widely used in Solana smart contracts.

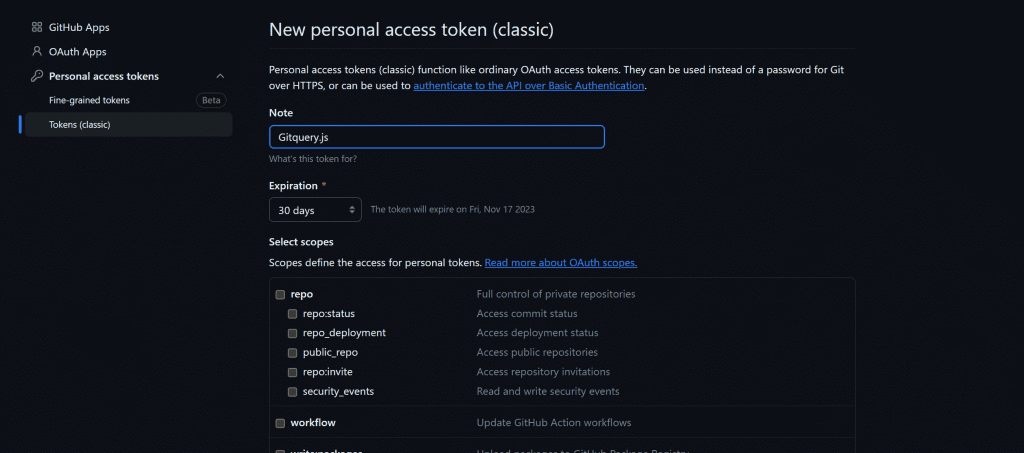

We will need a personal access token to use as the API key which can be generated here: https://github.com/settings/tokens/new

Github API Code

const GITHUB_API_URL = 'https://api.github.com/search/code?q=solana_program';

const GITHUB_API_KEY = '';

const gitQuery = async () => {

try {

const response = await fetch(GITHUB_API_URL, {

method: "GET",

headers: {

"Authorization": `token ${GITHUB_API_KEY}`,

"Accept": "application/vnd.github.v3+json",

}

});

const data = await response.json();

console.log(`Query 'solana_program' was mentioned in ${data.total_count} smart contracts`);

} catch (error) {

console.error(error);

}

};

gitQuery();To run this code make sure you have NodeJS installed, save it to a file called gitquery.js and then run the following from a command line:

node ./gitquery.jsWe can then store this data or plot it into a chart to gain insights into how many 3rd party developers are creating smart contracts on Solana.

This is a very simple example but the API query can be expanded to provide more complex data extraction using the documentation here and here.

Quantifying Developer Activity in Fundamental Analysis

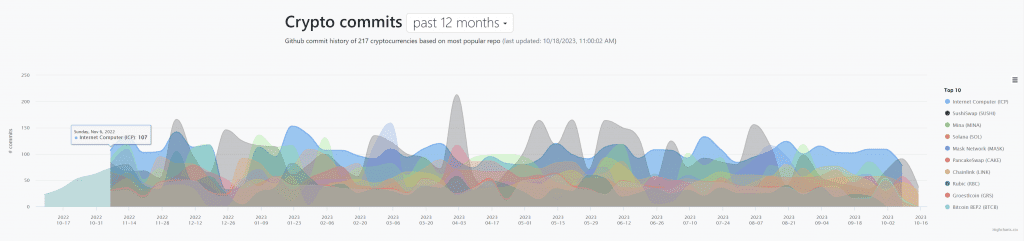

Note that the data can be manipulated and I suspect some projects are already spoofing commits and dev activity to simulate traction. If we look at the top 10 projects by dev activity we can see that it is no indicator to project quality.

However when looking at a new project the dev activity can provide an important data point to provide insights in to not only the code base but the organizational structure within that project.

If there is a single developer contributing the majority of the code then the project is obviously early and any investment should consider the risk factor of that developer having an SBF moment or getting hit by a bus.

Likewise if a project has a hundred developers actively working on the protocol you can assume it’s VC funded and at a later stage of maturity where perhaps there isn’t the same upside potential.

Jeff Bezos said “We try to create teams that are no larger than can be fed by two pizzas” and somewhere in the 3-8 range is a good middle ground for most early stage emerging web3 projects in my opinion.

If something is getting used and built on top of within the DeFi sector then this is a good indicator that 3rd party devs either find it useful or there are incentives in place such as grants and hackathons to attract developer activity.

Ultimately the blockchain sector is built on code and understanding who is writing that code and insights into what they are building can lead to better investment decisions.