Aevo is a hybrid decentralized options protocol running an off-chain orderbook with trades routed through a dedicated EVM appChain and settled on Ethereum mainnet. The exchange is built by the Ribbon Finance team who plan to migrate Ribbons products to Aevo options.

For traders and market makers it offers a decentralized alternative to Deribit.

How Aevo Options Work

Aevo operates using a custom EVM roll-up and employs an off-chain order book, but utilizes on-chain settlements. Transactions are executed and settled via smart contracts once orders are successfully paired.

Aevo uses European options (as opposed to American style options). These can only be settled at the expiration date. European options will payout, granted they are In The Money (ITM) at expiry.

In comparison to Deribit’s inverse options, Aevo’s options are linear and settled in USDC. Besides simplifying access and organization of tools and positions, this also eliminates the need to manage the volatility of buying price and price movement, a requirement present in Deribit’s system as you pay and receive the premium in the base asset, BTC or ETH.

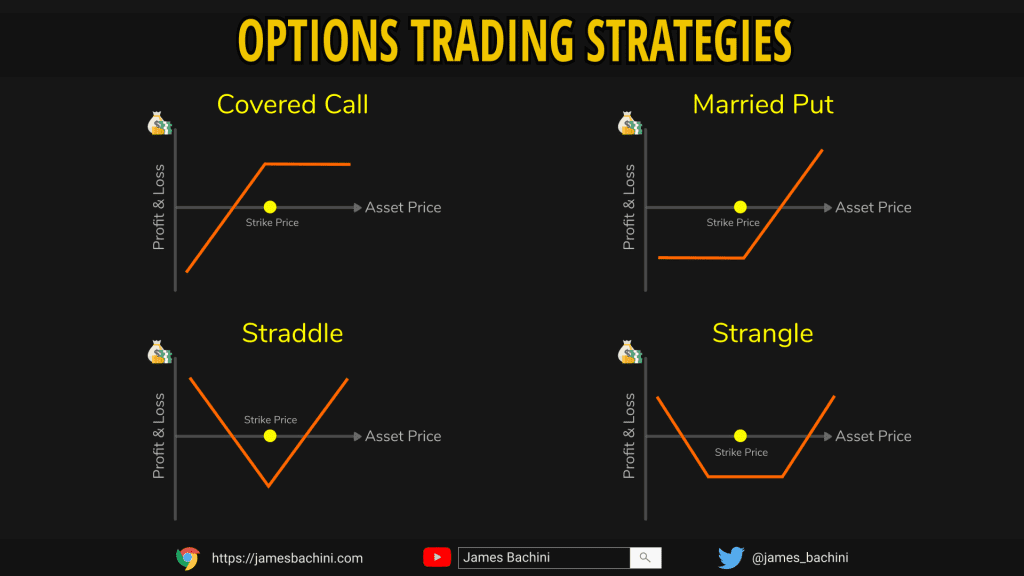

Traders will use options to express opinions on the markets. Aevo enables users to deposit USDC and bet that the price of ETH, BTC, BNB, MATIC, SOL, WLD, XRP will go up or down by a set date in the future. They can also be used to setup more complex strategies like covered calls to create yield strategies when the holder expects limited upside in the near term.

Aevo’s smart contracts function on the Aevo Rollup and gas fees are currently paid for by Aevo so the user doesn’t have transactional costs. Users will however need to pay a gas fee when they deposit funds, currently USDC from ETH mainnet.

Aevo uses a proprietary internal oracle to relay the respective value of asset prices to the exchange, and concurrently constructs an Index based on the spot price across various centralized exchanges. Aevo identifies the median of all data sources, eliminating pairs that have not responded or deviated more than 0.5% from the median. The ultimate Index price is calculated by taking a mean of the verified exchange prices.

When a match has been made in the off-chain order book it is sent to Aevo’s smart contracts, which are stationed on the L2 roll-up. An internal risk management application verifies margin requirements for an account, ensuring that it possesses adequate margin to manifest that order. All the while, user funds and positions remain securely within Aevo’s smart contracts on-chain.

Unfortunately I wasn’t able to find any code for the smart contracts or risk management system in Aevo’s Github Repository at this time.

The Aevo Platform

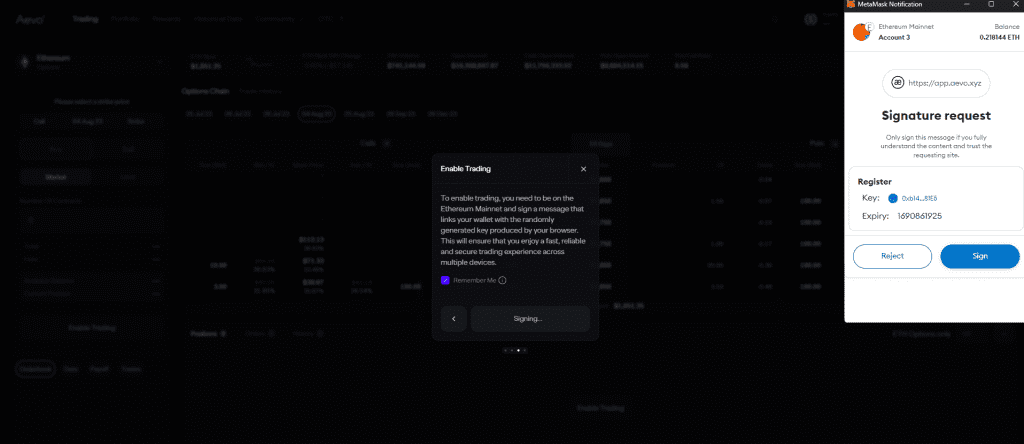

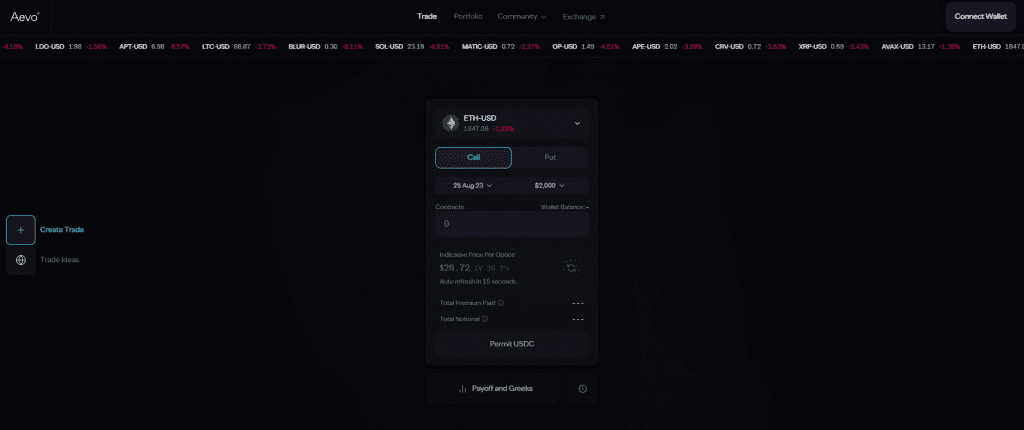

When first logging in you need to sign a transaction from your wallet to verify the account.

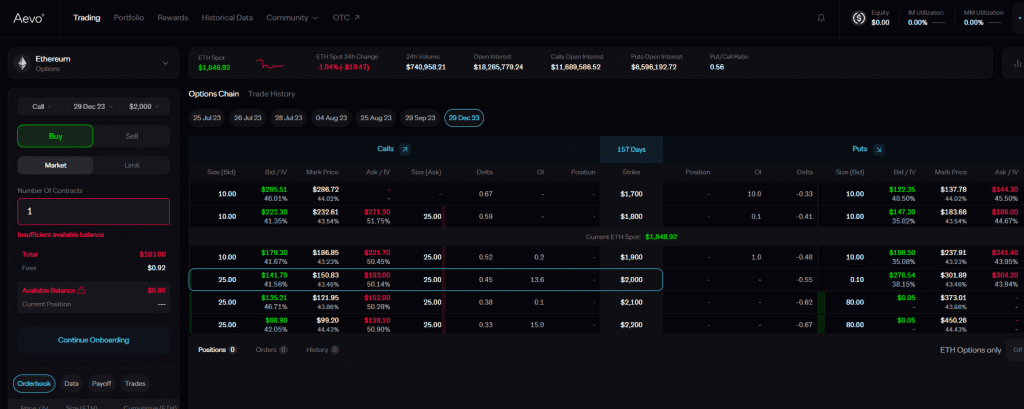

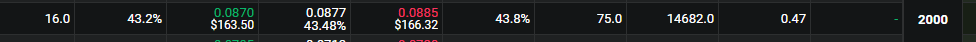

We then get the familiar (if you’ve traded options before) tables with strike price down the center and various call and put options available for purchase.

The call option is a bet that price will appreciate above a certain level by the settlement/expiry date. When you buy the option you are essentially provided with the option but not obligation to buy that asset at that price at that date. In reality you just get paid out the difference if price does go up above the strike price.

Put options are the opposite and a bet that price will be below a certain figure by a certain date.

One thing of note is that the spread is quite significant currently. A December ETH/USD option @ $2000 (at time of writing $1850 July 2023) has a bid of $141.70 and a ask of $183.00

The same equivalent option on Deribit has a spread of just a few dollars 😞

Hopefully over time more market makers will start using Aevo and it will become more competitive. I haven’t actually tried trading there so it might be possible to get filled at prices tighter than the advertised spreads.

Seems like there might be an opportunity for someone to step in and offer liquidity while hedging on CEX.

Aevo Fee Structure

The fee arrangement for Aevo is pretty straightforward and is broken down into three main categories:

- Trading Fees are based on whether you’re a ‘maker’ or a ‘taker’. If you initiate the trade, you’re the ‘maker’ and you pay a fee of 0.03% of the total transaction amount. If you’re the one taking someone else’s existing trade, you’re the ‘taker’ and your fee is slightly higher, at 0.05%. But no matter the scenario, you will never pay more than 12.5% of the option’s price in trading fees.

- Settlement fees apply when options expire in the money, meaning the option has value at expiration. Here, Aevo charges a fee of 0.015% on the total amount of the option that expired in the money. However, if you’re dealing with daily options, you can relax – there are no settlement fees for these. And just like trading fees, settlement fees can never exceed 12.5% of the option’s value.

- Liquidation fees apply when positions are liquidated, that is, when you need to sell off your position. In such a situation, a liquidation fee of 0.5% of the total amount of the transaction is charged to the user.

All the fees collected by Aevo are stored in Aevo’s treasury. There is no governance token or fee distribution implemented.

Aevo OTC

Aevo OTC (Over The Counter) is a platform leveraging an RFQ (Request for Quote) system to facilitate the sale of options. Whenever a user issues a trade request, for example, “buy 1000x ETH $2000 Call Options”, this request is sent to multiple market makers.

These market makers return a price and a signature as their response. The signature makes their response binding, preventing them from backing out. Behind the scenes, Aevo OTC picks out the most competitive price and executes the trade on behalf of the user.

The market maker participating in the transaction is required to post an initial margin, equivalent to roughly 20-30% of the trade’s total size. If the option’s value appreciates over time (and the market maker is short on the option), they must deposit additional collateral into the smart contract.

Aevo currently collaborates with multiple institutional grade market makers, including esteemed entities like Galaxy, Orbit, and Genesis Trading.

In the event that the market maker refrains from depositing additional margin while the trade goes against them, the initial collateral posted by the market maker can be seized and transferred to the option holder, which effectively liquidates the market maker.

In the current version of Aevo OTC users cannot exit their positions prematurely and must hold the options until expiry.

The Aevo website has a nice user interface for the OTC desk which provides a clean UX. Connect wallet > Approve USDC spend on ETH mainnet > Degen

In terms of fee structure, ETH and BTC options come with a modest fee of 0.04% of the total size of the trade. For altcoin options, the fee rate is slightly higher at 0.10% of the total trade size.

Crypto Options Market

In the traditional finance world of stocks there has been a significant surge in retail demand for options, thanks to platforms like Robinhood and phenomena like GameStop and WallStreetBets. Options trading in the cryptocurrency sector has not experienced a similar wave.

The complexity of options trading itself is perhaps too advanced for many investors. Unlike straightforward buying, hodling and selling, options trading introduces market timing and added nuances which many traders may not have the patience or time to navigate.

As we move forward, however, the potential of decentralized options in the cryptocurrency market is promising. DeFi platforms are increasingly reducing the barriers to entry for the average user. They provide competitive features such as zero fees, transparency and censorship resistance, opening ways for retail investors to engage with complex financial instruments such as options.

Platforms like Aevo are pioneering this shift with an intuitive, user-friendly approach to decentralized options trading. As the crypto market continues to mature and innovation in user-friendly DeFi platforms increases, we can expect a gradual shift in the retail demand.

These platforms are also uniquely empowered to offer more innovative products tailored to the decentralized economy. Ribbon Finance is in a very good position here and is building an entire ecosystem around structured products and derivatives.

While the wave of retail investors trading options in crypto hasn’t arrived yet, the tides may change over the next decade. The rise of decentralized options could revolutionize how retail investors speculate on the latest memecoins, dissolving barriers to entry and setting the stage for a landscape where everyone can participate in trading options, just as we’ve seen happen recently in the stock market.