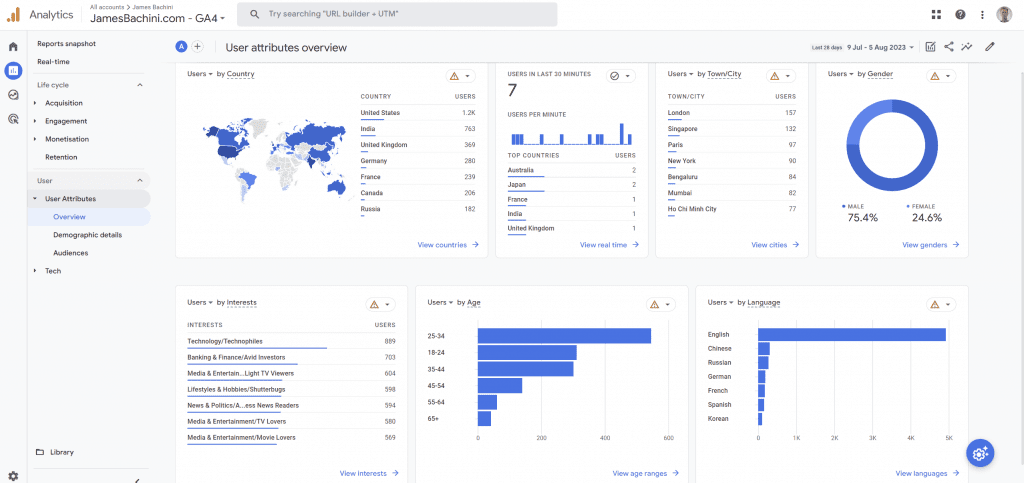

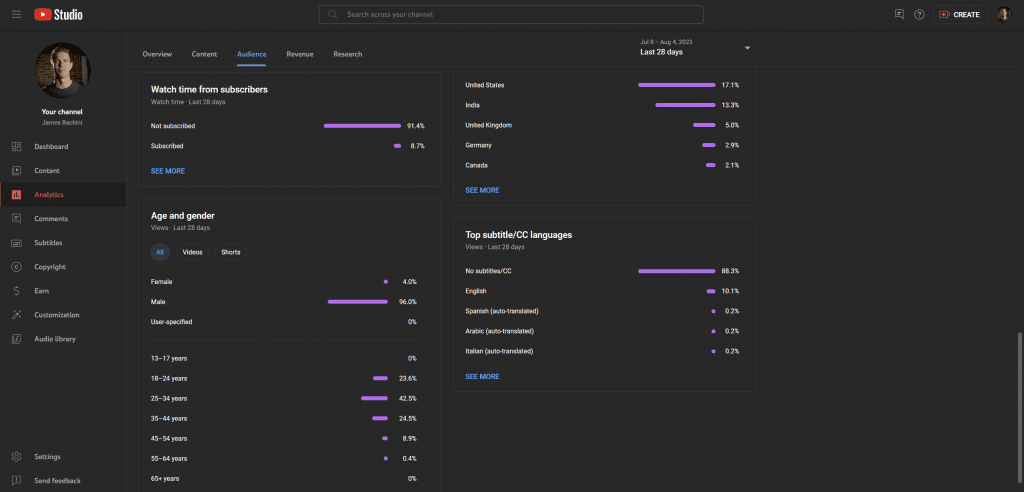

Due to my blog and YouTube channel I get detailed analytics on crypto user demographics. In this article I’ve compared my own data with other accounts, studies and published demographic information.

tl;dr

- Target demographic is millennial men with disposable income

- Gender: Male 79%, Female 21%

- Age: 18-25 23%, 25-35 40%, 35-45 23%, 45-55 9%

My Demographic Data

Here are some screenshots from Google Analytics and YouTube. My content is almost solely focused on blockchain, web3, crypto.

This data is skewed because I’m a millennial English speaking man and my channels tend to lean towards more technical information, decentralized finance and blockchain development content.

3rd Party Crypto Demo Data

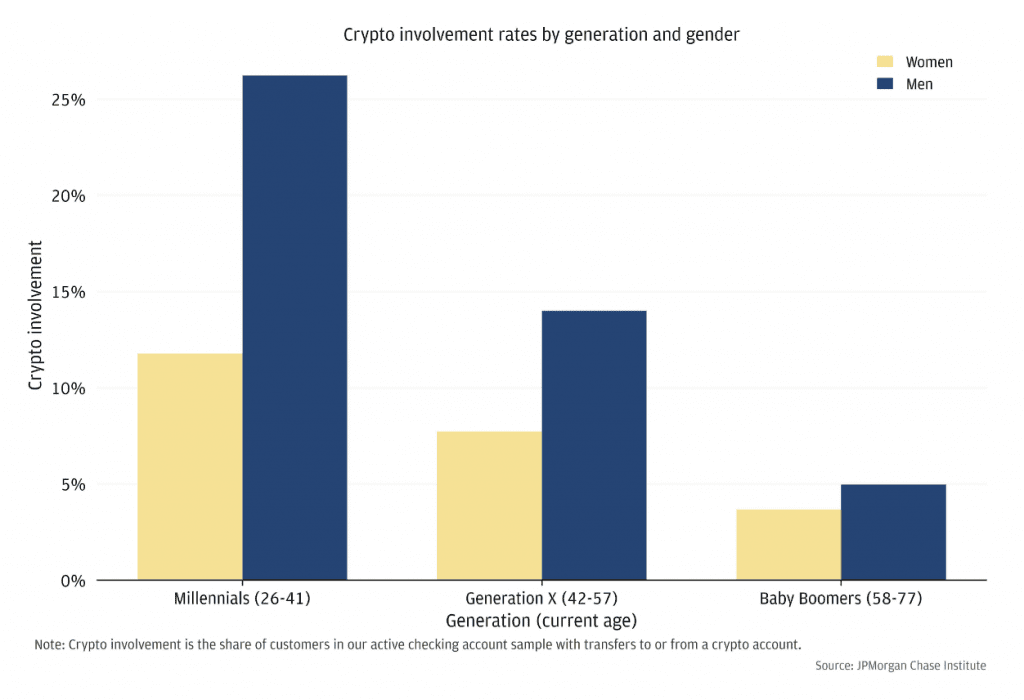

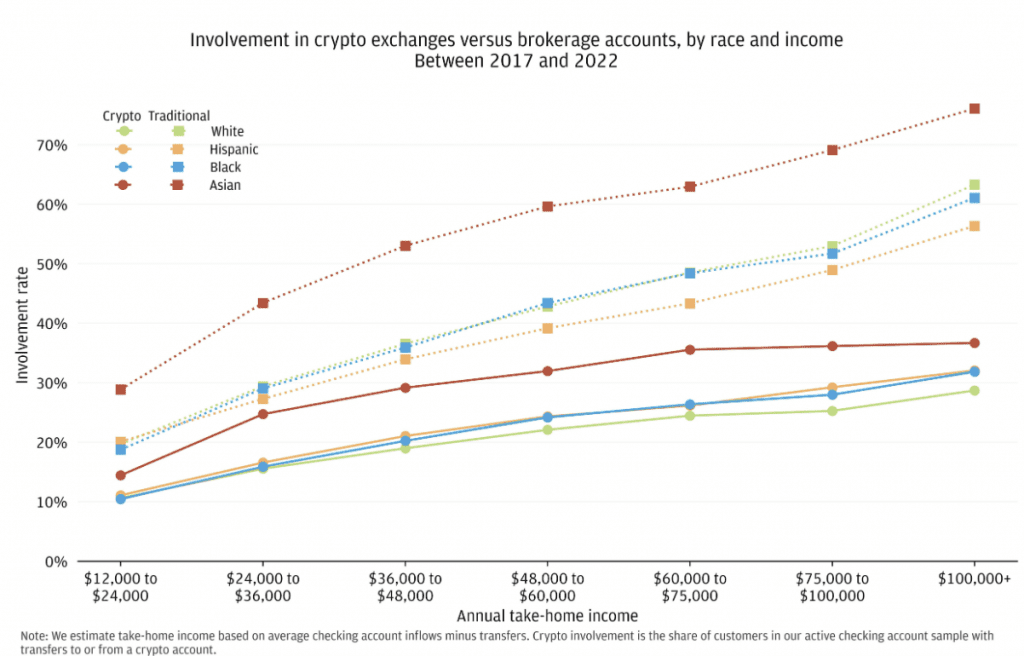

The most credible study I could find was one published by US finance giant JP Morgan Chase: https://www.jpmorganchase.com/institute/research/financial-markets/dynamics-demographics-us-household-crypto-asset-cryptocurrency-use

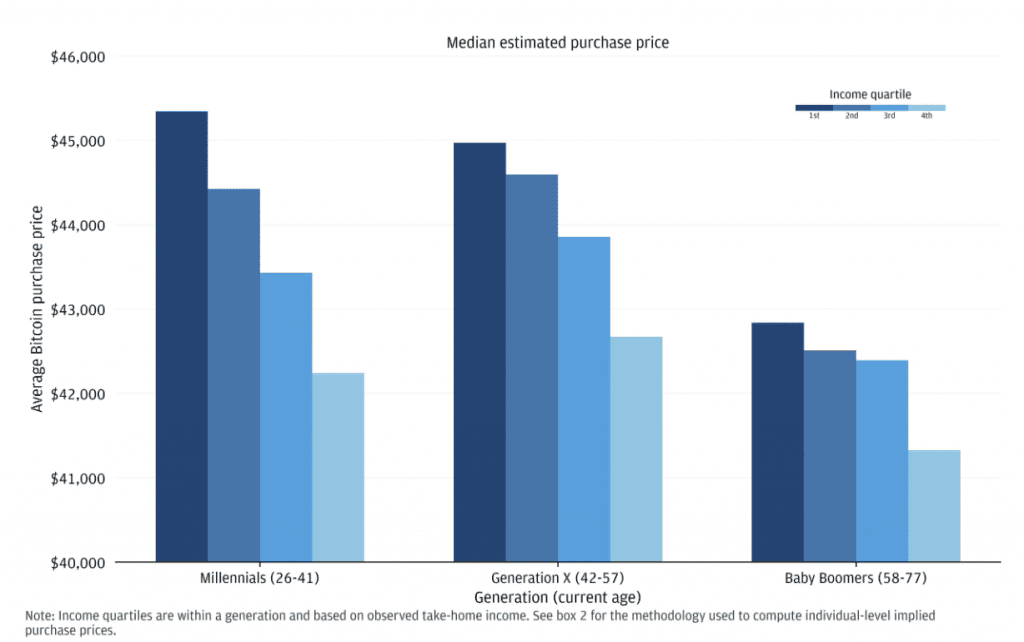

Another stat from the document states that Bitcoin buyers with a graduate degree bought in at a 3.8% discount to those with no degree. Quite an accolade for the US schooling system.

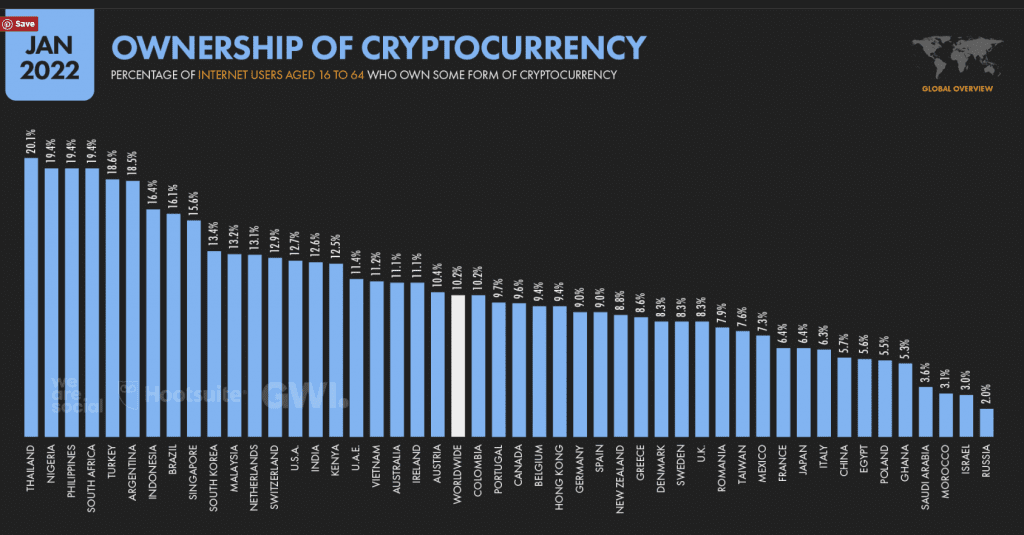

Another study published originally by GWI analyzed crypto holders as a percentage of internet users by country: https://datareportal.com/reports/digital-2022-big-rise-in-cryptocurrency-ownership

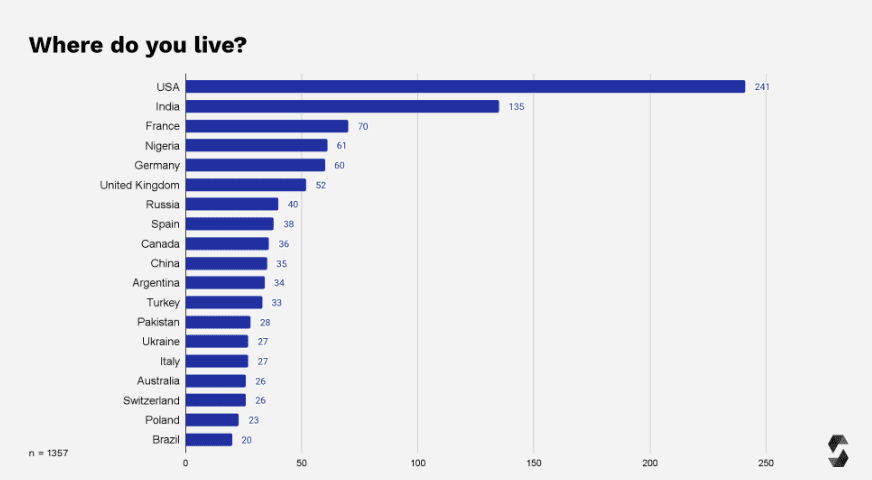

The annual Solidity (leading blockchain programming language) developer survey (conducted only in English) is published here: https://soliditylang.org/blog/2023/03/10/solidity-developer-survey-2022-results/

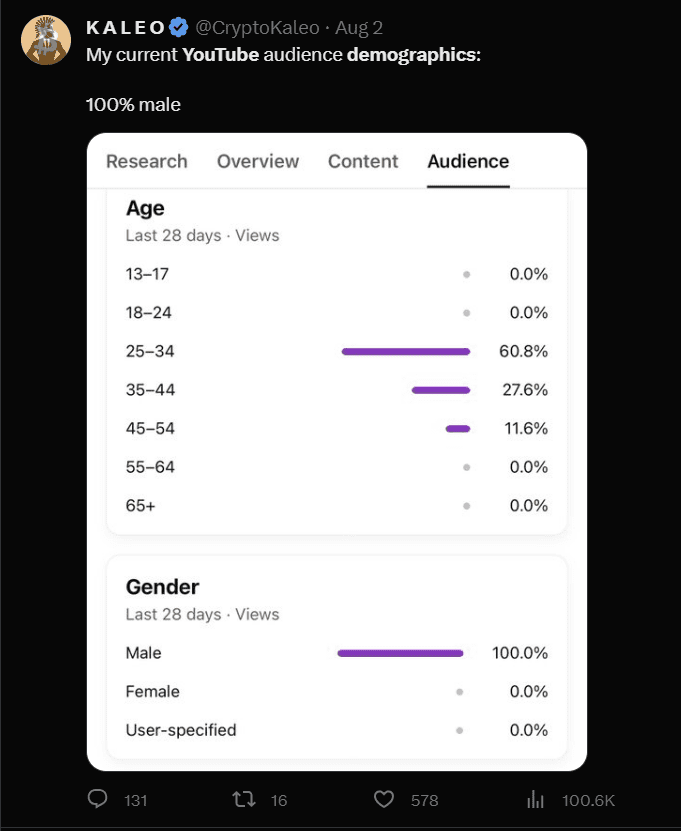

Some users have also published demographic data such as crypto swing trader @CryptoKaleo.

Crypto User Demographic Takeaways

If we remove the CryptoKaleo data as an outlier and average the rest of the studies and my own data we get the following demographic information.

- Gender: Male 79%, Female 21%

- Age: 18-25 23%, 25-35 40%, 35-45 23%, 45-55 9%

I believe there might be a concentration of wealth in the older demographics due to earlier investment at lower prices and access to more funds to invest. Most whales I’ve met in person tend to be in the 35-55 age bracket.

High net-worth and better educated segments of the population are both more invested in crypto and invest at lower prices.

If you want a Solidity developer then US and India are the places to look.

Geographic distribution varies greatly from country to country with Russia being the lowest percentage of holders 2% and Thailand being the highest 20%. Asian demographic in the US also more likely to use crypto exchanges.

Findings from JP Morgan study:

- Most crypto users made their first transactions during spikes in crypto-asset prices

- Usage of crypto is broader and deeper for men, Asian individuals, and younger individuals with higher incomes

- Crypto holdings for most individuals are relatively small—as median flows equal less than one week’s worth of take-home pay—but almost 15 percent of users have net transfers of over one month’s worth of pay to crypto accounts.

- Most individuals who transferred money to crypto accounts did so when crypto-asset prices were significantly higher than recent levels, and those with lower incomes likely made purchases at elevated prices relative to higher earners.

I hope this has been of interest and provides some useful demographic data for your web3 marketing campaigns.